5 Top Penny Stock Trading Lessons From The Weekly Challenge Webinar: Key Points

- The ILUS and KBLB charts look almost identical, but ONLY if you know penny stock history. See “5 More Lessons From My Challenge Webinar” below…

- When’s the time for fun and games? When you’ve earned it, you’ll get it. See lesson 3.

- Fully refreshed is the perfect way to start the trading day, right? Don’t be so sure! Lesson 4 can save you from a BIG (but common) mistake.

Shocking Demo Shows How Proprietary Algorithm Can Predict Social Media’s Next Big Bet

5 Top Penny Stock Trading Lessons

document.write(new Date().getFullYear()); Millionaire Media, LLCEvery week I give a Trading Challenge webinar. Some are Q&A sessions. Others are live-trading webinars.

Webinars are a GREAT way to grow your knowledge account. Over time, the lessons stack up. So come along, ask questions, and work to get better at trading penny stocks under $1.

This week we focused on a counterintuitive strategy to prepare for the next hot market. Here are five trading lessons from the webinar…

Lesson 1: When There’s No Great Trade, Do This

Everyone wants to hear that trading is fun and that we make money all the time. It’s not like that. 90% of traders lose money.

For example, I’m not doing great right now. Morning panics haven’t been working lately. We’re not seeing the max panic and big bounce I like. When you take out my favorite pattern, it hurts my confidence.

And I’m chasing a little.

So I either trade less or take small positions. That’s fine. It’s OK to not trade. If you screw up on trade executions or lose a little, that’s OK, too. You have to be realistic.

Even if you’re off your game, you still have to be responsible. Don’t throw away weeks or months of earnings because things aren’t working. Take a day off.

Lesson 2: What Trades Are Working Now?

document.write(new Date().getFullYear()); Millionaire Media, LLCRight now, higher-priced plays are working better. I’m not the best at those. Again, that’s OK.

One example is Society Pass Incorporated (NASDAQ: SOPA). It’s an unreal IPO that just kept going. There are a lot of crazy high-priced runners that keep uptrending. And we’re seeing volatility halts on the way up before consolidation on the way down.

There’s opportunity there, but it’s not my kind of pattern. Recognize what’s working and what’s not. More importantly, recognize what’s working and not working for you. It’s OK if it’s different from me…

Millionaire Challenge trader and mentor Mark Croock figured out how to apply my strategies and patterns to higher-priced stocks.

Lesson 3: Test Penny Stock Patterns & Position Sizes

document.write(new Date().getFullYear()); Millionaire Media, LLCYou have to test different patterns and position sizes. Early on, your priority is collecting data. Some people enjoy it. But even if you don’t, you have to do it.

Everyone wants an ‘easy’ button. Or to focus on one or two indicators. It doesn’t work that way. (I use these seven penny stock trading indicators.)

Want success? Get to work! Have fun later with the results of your hard work.

Lesson 4: The Truth About Taking Time Off to Refresh

It’s a good idea to do whatever you need to do to rest up and refresh. But there’s a common misconception. People think that once they’re refreshed, they can “get back into trading.”

Wrong mindset.

You should NOT look forward to trading. Ever. Trading is stressful, frustrating, and annoying. Don’t look forward to it.

Here’s a BIG tip…

Once you look forward to trading there’s a risk of betting too big and making irresponsible choices.

I know it’s fun when there are big wins. But you have to think of big wins as just part of doing business. If you start to cherish big wins like a degenerate gambler, you’ll start trying to do different things to get them. Big wins give you a rush. Never chase that feeling.

By all means, rest up. Just not to get back into trading. What counts as getting refreshed? It’s different for different people…

8 Ways to Refresh

- Work out. Matt, Roland, and Bryce are on workout kicks.

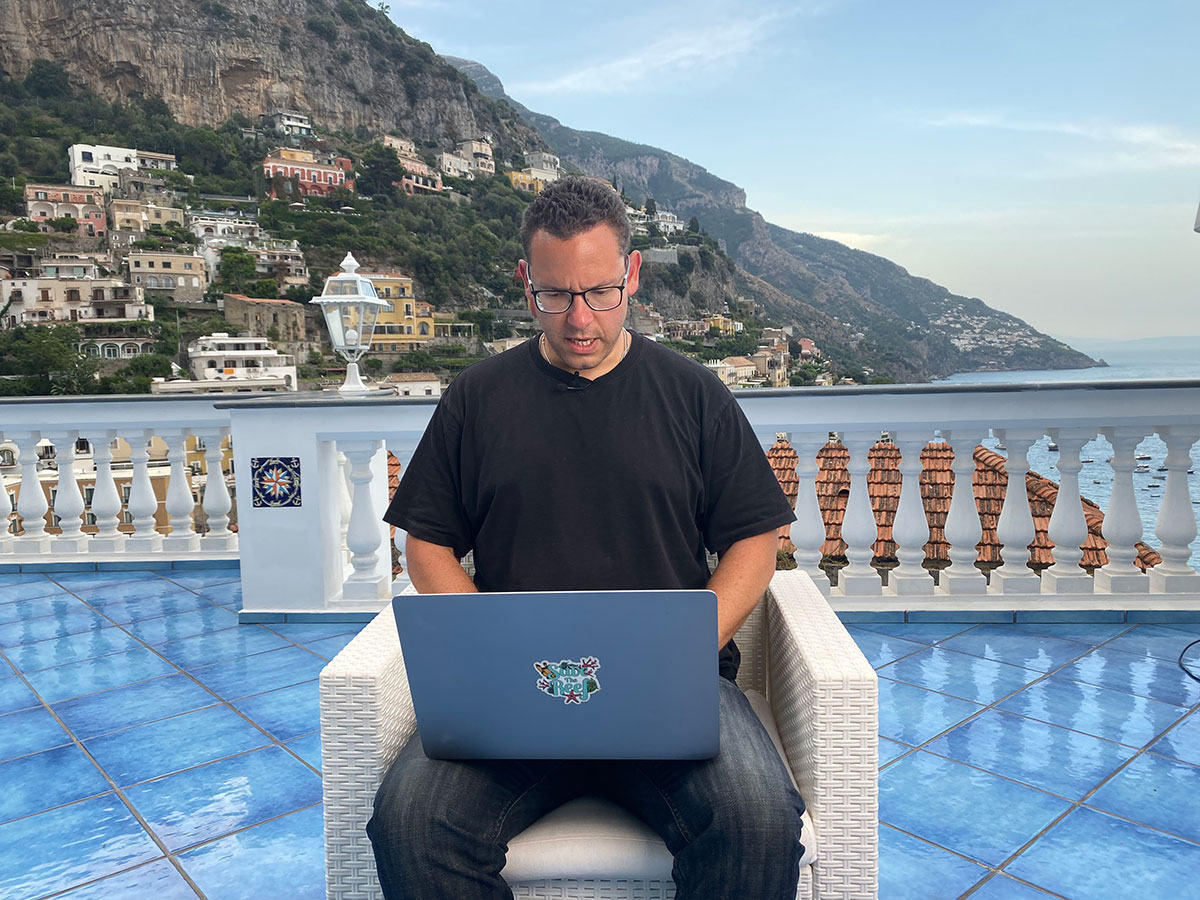

- Travel is my personal favorite.

- Spend time with friends & family.

- Go out to eat at a nice restaurant

- Watch a movie like Jack & Mariana did in Italy to avoid the open in a slow market.

- Do yoga to reduce stress.

- Learn to meditate.

- Find a hobby like collecting Pokémon cards.

Really, do anything that doesn’t involve screen time. We spend too much time in front of laptops or with smartphones in our faces.

Lesson 5: Don’t Focus On How MUCH You Study

document.write(new Date().getFullYear()); Millionaire Media, LLCThis might seem strange because I constantly tweet #nodaysoff. And it’s true, you need to put in as much time as possible in the beginning.

But understand it’s the quality of study time that matters.

We sometimes get suggestions about gamifying Profit.ly. Some students want a leaderboard to see who’s studying the most.

If we did, people would write scripts to make it look like they’re studying. Or they’d play webinars in the background while doing something else. I can’t judge how focused you are. You could be taking notes. But you could also be watching Netflix at the same time.

I can’t study for you. And I can’t promise that after x number of hours you’ll get it. It doesn’t work that way. I’d take one hour of focused study over multitasking with webinars in the background 15 hours per day.

Also, people learn differently. Which brings me to…

Penny Stock Trading Fails

document.write(new Date().getFullYear()); Millionaire Media, LLCThose five lessons barely scratched the surface. Here are 5 more lessons to look for when you watch the webinar. If you missed it live, watch the replay. If you’re not a Trading Challenge member yet, apply here.

5 More Lessons From My Challenge Webinar

Here’s what you missed and what you’ll learn when you watch the replay…

- The mistake most newbies make that dooms them. Hint: Study This FREE Guide. Then, use THIS free tool. (Ironically, most people reading this won’t watch this 11-hour guide OR use the tool. For those who do, it’s almost always a BIG eye-opener.)

- Counterintuitive! Why trying to make money your first year of trading is the wrong mindset.

- What I maximize to NOT overtrade. (REVEALED: The sneaky mindset trick that can help you focus on only the best setups.)

- What to remove from the ‘trading equation’ to get the most out of your first year.

- PLUS: A penny stock history lesson. The Kraig Biocraft Labs (OTCQB: KBLB) chart from mid-2019 looks a LOT like the Ilustrato Pictures International (OTCPK: ILUS) chart now. It’s a perfect example of why you need to study the past.

The weekly Trading Challenge webinars have SO MUCH information. (There were at least 10 more important lessons not mentioned here.) But you have to show up, pay attention, and bring solid questions. Coming up next week…

How to come prepared for webinars with the best questions that benefit the most students.

And if you’re not a student, now’s the time to take the…

Trading Challenge

document.write(new Date().getFullYear()); Millionaire Media, LLCWeekly webinars separate the Trading Challenge from our stand-alone products and newsletters. And it’s not just my webinars and lessons.

Every week there are two to four live webinars from mentors like Tim Lento, Mark Croock, and Matt Monaco.

Ready to take your trading to the next level? Want access to our weekly live webinars and hundreds of archived webinars?

Take the Trading Challenge

Want more weekly lessons from Trading Challenge webinars? Comment below, I love to hear from all my readers!

The post 5 Top Penny Stock Trading Lessons From The Weekly Challenge Webinar appeared first on Timothy Sykes.

Original source: https://www.timothysykes.com/blog/top-penny-stock-trading-lessons/