Previously, we talked about how the implied volatility (IV) of a long option will drop in value immediately after an earnings announcement — a phenomenon known as IV crush.

Let’s take a look at some examples over the 2021 earning season.

Contents

-

-

-

-

-

- IV Chart

- Buying Puts On Stock Before Earnings

- Married Puts Across Earnings

- Long Call Over Earnings

- Buying Straddle Over Earnings

- Selling A Straddle

- Iron Condors Over Earnings

- Time Spreads Over Earnings

- Price Moves After Earnings

- Summary

-

-

-

-

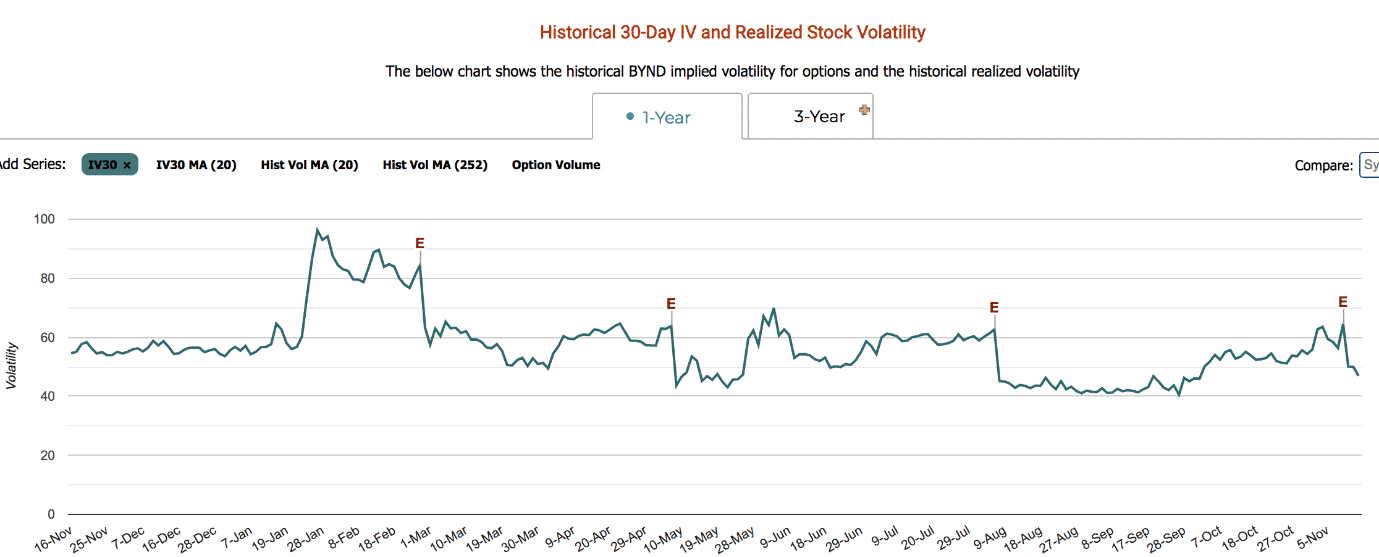

IV Chart

Looking at the IV chart of Beyond Meat (BYND) during its four earnings report in 2021, we notice that the chart falls off a cliff right after earnings, as marked by the “E” symbol…

source: marketchameleon.com

The largest drop happens in the trading session immediately following the announcement. Sometimes it will still drop some more on subsequent days.

Here’s how much the IV dropped:

Feb 25 to Feb 26: IV drop from 84.4 to 63.2

May 6 to May 7: IV drop from 63.9 to 43.7

Aug 5 to Aug 6: IV drop from 62.6 to 45.1

Nov 10 to Nov 11: IV drop from 64.5 to 50.1

For more granular IV data on the strikes of the individual options, we look at the historical data in OptionNet Explorer.

For BYND on Feb 25, the implied volatility value of the Feb 26 at-the-money $144 put is 280. Right after the earnings announcement on the next day, the value of this put option dropped to 135.

Before the earnings announcement, the demand for protective puts is high, which drives up the IV (which is correlated to option price).

Right after earnings, the demand is less and IV drops.

Buying Puts On Stock Before Earnings

An investor who already owns 100 shares of Peloton (PTON) sees the uncertainty of the earnings announcement coming up on November 4th, 2021.

The investor buys an at-the-money put option to protect the stock position.

Date: Nov 4, 2021 @ 2 hours after the open

Price: PTON at $86.29

Buy one Nov 5 PTON $86 put @ $4.78

The investor buys the $86 strike put option expiring on November 5, which costs $478 for one contract.

This option gives the investor the right to sell 100 shares at the price of $86 at expiration on November 5th, regardless of how far down in price the stock might drop during earnings.

The next day after the earnings, the stock opens at $56.85, about a 34% drop.

The investor holding 100 shares lost $2944 on the stock position.

However, the put option soared to a value of $2918.

Since the investor paid $478 for the option, the option profit is $2440.

This profit is not quite enough to offset the stock loss, but it is close.

The investor continues to hold the put option thru to expiration on November 5.

The option is in the money at expiration and is automatically exercised.

The 100 shares are sold at $86 per share, and the option is removed.

The net loss to investor is only $507 = $478 + $29.

An investor without the put option would have lost $2944.

Yes, the put option was expensive at the time that it was purchased.

But in this case, it was well worth it.

Married Puts Across Earnings

Some investors might buy stock and put options just before earnings hoping to catch a gap up on earnings.

The combination of stock plus put options is known as a “married put”.

Let’s look at the case of Home Depot (HD):

Date: Nov 15, 2021 @ 2 hours after the open

Buy 100 shares of HD @ $371.74

Buy one Nov 19 HD $372.5 put @ $6.63 [IV=40.17]

Total investment: $37,837.

The next day before the market opens, earnings are announced.

When the market opens on November 16, Home Depot stock is up at $383.92 and climbing.

The put option lost value due to IV crush and due to the price moving up.

The value of the put option is at $1.07, down from $6.63. And its IV is 34.73, down from 40.17.

The investor continues to hold till the end of the day and sells both the stock and put option.

Date: Nov 16, 2021 @ market close

Sell 100 shares of HD @ $392.33 Sell one Nov 19 HD $372.5 put @ $0.24

Credit: $39,257

The investor made a net profit of $1420, or 3.8% of the initial investment.

Not too bad for a day’s work.

A stock investor who had owned only the 100 shares without the put option would have made more in this case: $2059.

However, that investor would not have had the downside protection that the put option offered.

Long Call Over Earnings

An investor who did not have $38000 to invest in Home Depot might buy a long call instead.

Date: Nov 15, 2021 @ 2 hours after the open

Buy one Nov 19 HD $372.5 call @ $5.93 [IV=40.52]

Initial investment: $593.

The next day, after the earnings report, the call option rose to $12.48 due to the price gap up, even though the IV had dropped from 40.52 to 34.52.

The investor continues holding the call until the end of the day, where its value is up more at $19.95 and its IV is down more to 30.

Selling the call option at the end of the day on Nov 16 would give this investor a profit of $1995-$593 = $1402, or 236% of the initial investment.

It is not a coincidence that this investor made about the same dollar amount as the married put investor.

The long call and married put are synthetic of each other (assuming the same strike price for the put and the call).

Their payoff diagrams are nearly identical.

Buying Straddle Over Earnings

The long call and married put bullish strategies would only be used by an investor who believes that the stock would gap up on earnings.

If the guess on the direction is wrong, the trades would lose money.

If an investor does not have any clue as to which direction, what would happen if an investor buys a straddle just before earnings?

A straddle consists of a long call and a long put to be directionally neutral.

Date: Nov 15, 2021 @ 2 hours after the open

Buy one Nov 19 HD $372.5 call @ $5.93

Buy one Nov 19 HD $372.5 put @ $6.63

Initial Investment: $1256

And if the investor sells the straddle the next trading day, the profit would be $99.50, or 7.9% of the initial investment.

It worked out in this case because Home Depot made a significant price move.

But quite often, it would not work out, as in the case of Walmart (WMT):

Date: Aug 16, 2021 @ 2 hours after the open

Buy one Aug 20 WMT $152.5 call @ $1.89 [IV=37.67]

Buy one Aug 20 WMT $152.5 put @ $2.96 [IV=37.57]

Initial Investment: $485

On the open the next day after earnings have been announced, the profit and loss (P&L) are showing –$126.5.

The value of the call option: $0.55 [IV=27.04]

The value of the put option: $3.03 [IV=26.66]

Note the drop in IV, which deflates the value of the options.

Here the “IV Crush” is working against us doubly because there are two long options.

The negative theta of the long options also erodes the value of the options.

In addition, we had bought the option when their prices were high, just prior to earnings.

In fact, the price of the straddle is often used to determine the expected price move of the stock.

In other words, the price of the straddle is priced in such a way that most of the time, the expected move of the stock does not move enough to overcome the price of the straddle.

Because of all these negatives, this is not a common strategy to do over earnings, nor is it recommended.

Selling A Straddle

Instead, some investors may sell straddles over earnings.

In that case, we would win on WMT trade and lose on the HD trade, because all the negatives have now become positives.

WMT Trade:

Date: Aug 16, 2021 @ 2 hours after the open

Sell one Aug 20 WMT $152.5 call @ $1.89

Sell one Aug 20 WMT $152.5 put @ $2.96

Initial Credit: $485

Profit on Nov 17 at market close: $126.50

HD Trade: Date: Nov 15, 2021 @ 2 hours after the open

Sell one Nov 19 HD $372.5 call @ $5.93

Sell one Nov 19 HD $372.5 put @ $6.63

Initial Credit: $1256

Profit on Nov 16 at market close: –$99.5

Selling options is the way to capitalize on the IV crush effect seen over earnings.

We sell options when the price is high and profit when the option price drops.

The drop in IV helps deflate the price of the option.

The wildcard is the price movement that can increase or decrease the price of the option dramatically and can often overcome the effects of implied volatility.

When selling options, we want IV to drop but for the price to not move much.

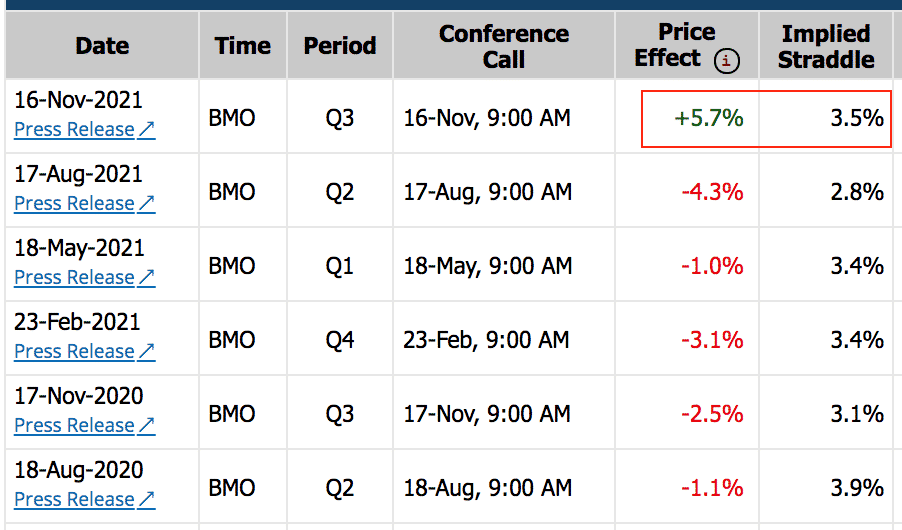

Let’s see the history of Home Depot’s earnings price moves.

source: marketchameleon.com

Note that the price percent move is greater than the percent move that is implied by the price of the straddle.

That is why we lost on the HD trade when selling the straddle.

Below shows that the price move was less than the implied straddle for WMT.

And hence that is why WMT was profitable when selling a straddle.

Iron Condors Over Earnings

Selling a straddle over earnings is a bit risky because it is an undefined risk strategy.

To limit our risk, iron condors can be used instead.

Suppose an investor sells an iron condor on Netflix (NFLX):

Date: Oct 19, 2021 @ 2 hour after open

Price: $634.57

Buy one Oct 22 NFLX $595 put @ $4.00 [IV=76.12]

Sell one Oct 22 NFLX $610 put @ $7.68 [IV=76.70]

Sell one Oct 22 NFLX $660 call @ $8.68 [IV=79.93]

Buy one Oct 22 NFLX $675 call @ $5.25 [IV=80.30]

Credit: $710

The next day after earnings on Oct 20, the investor buys back the condor to close the trade for a profit of $558.

Sell one Oct 22 NFLX $595 put @ $0.38 [IV=46.55]

Buy one Oct 22 NFLX $610 put @ $1.24 [IV=41.05]

Buy one Oct 22 NFLX $660 call @ $1.05 [IV=46.90]

Sell one Oct 22 NFLX $675 call @ $0.40 [IV=51.64]

The price happened not to have moved much while the volatility dropped (look at the IV values shown above).

The is the best case scenario for iron condors.

To make a directional play, an investor could do an unbalanced condor or even a broken wing butterfly.

If an investor is bullish and is willing to take ownership of the stock when wrong, then one can do a Jade Lizard.

All these strategies take advantage of the IV crush effect by selling options.

When you sell options, you want the value of the option to drop.

Time Spreads Over Earnings

Trading calendars over earnings takes advantage of volatility skew due to earnings.

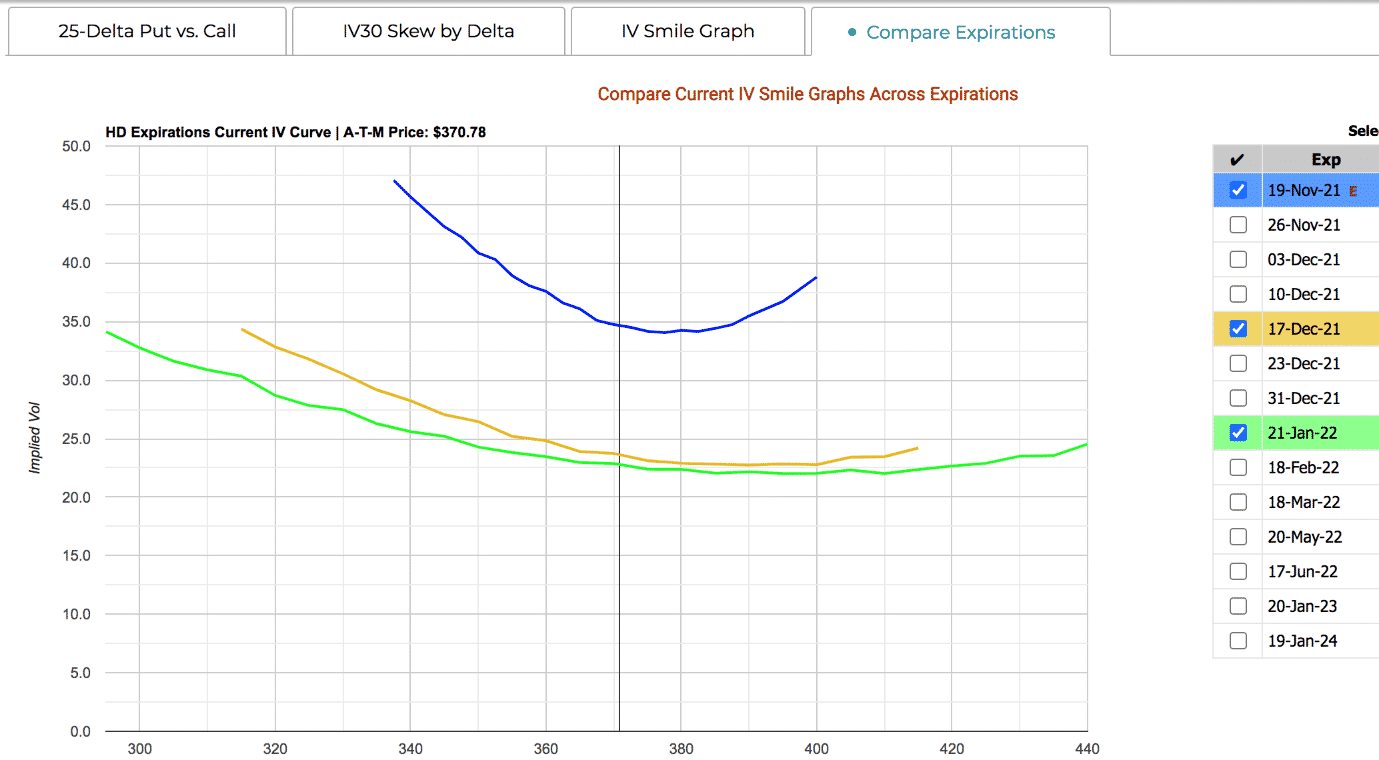

To visualize the IV across options strikes and across different option expirations, we can look at the IV curve.

This is implied volatility of Home Depot (HD) on November 15, 2021, just before earning announcement.

Source: marketchameleon.com

Notice that the blue IV curve of the expiration containing the earnings event is elevated.

The further out expirations are less affected by the earnings event and have normal non-elevated IVs.

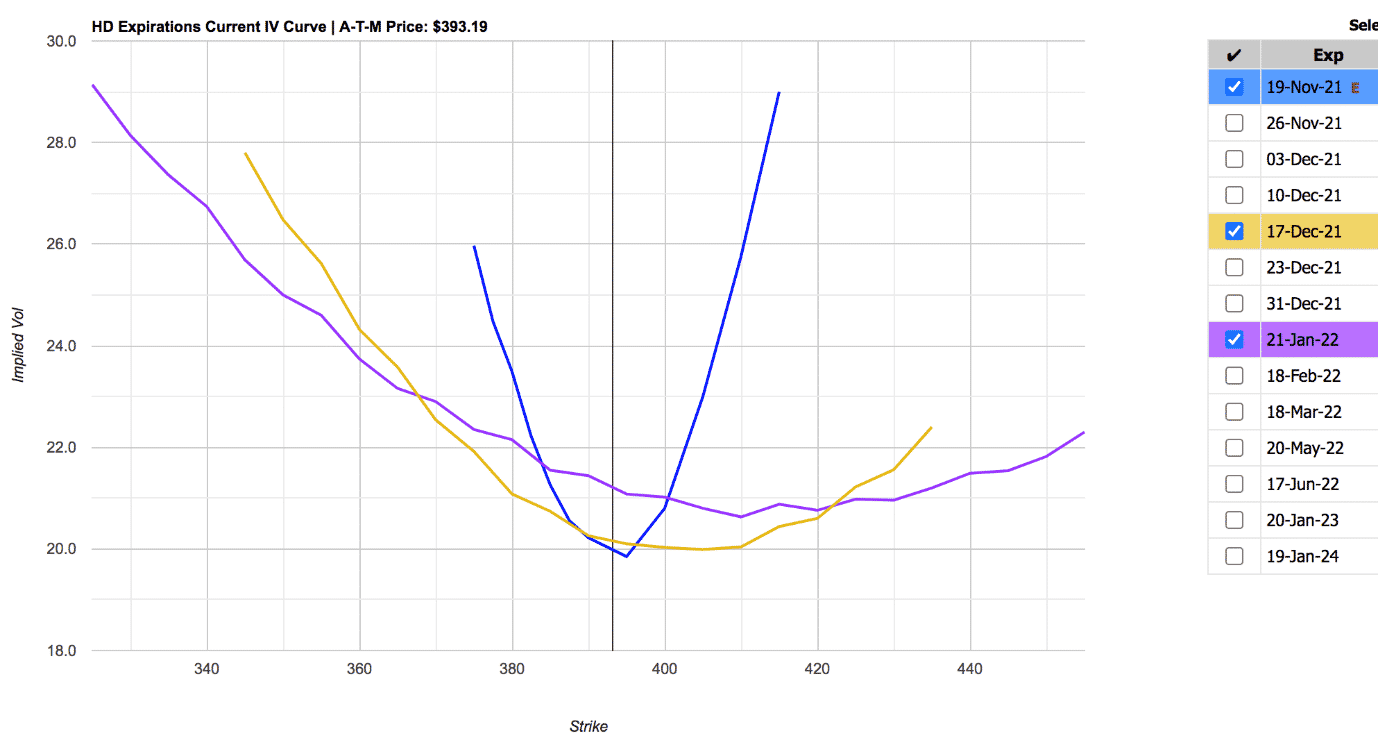

This is HD on November 16 after earnings.

Source: marketchameleon.com

The implied volatility curve drops back to normal right after earnings.

Calendar spreads take advantage of this effect.

Because of possible large price moves, we need to use double calendars in order to create a wider range for the stock to move within the breakeven points.

Date: November 15, 2021

Price: HD @ $371.73

Buy one Dec 17 HD $360 put @ $6.40 [IV=26.26]

Sell one Nov 19 HD $360 put @ $2.32 [IV=43.18]

Sell one Nov 19 HD $385 call @ $1.86 [IV=40.69]

Buy one Dec 17 HD $385 call @ $4.50 [IV=21.72]

Debit: $672

We are selling the front-month expiration that contains the earnings event.

It has an elevated IV in the 40s.

And we are buying options that have a normal IV in the 20s.

This is a condition known as positive horizontal skew.

Thinking of high IV as expensive options and low IV as cheap options, we are, in effect selling high and buying low.

The next day after earnings on November 16, we close the trade:

Date: November 16, 2021

Price: HD @ $393.69

Sell one Dec 17 HD $360 put @ $1.70 [IV=26.22]

Buy one Nov 19 HD $360 put @ $0.12 [IV=48.05]

Buy one Nov 19 HD $385 call @ $9.88 [IV=29.53]

Sell one Dec 17 HD $385 call @ $14.00 [IV=19.76]

Total Credit: $570.50

Net P&L: –$101.50

This trade lost $102.

This is because the price of HD gapped up outside of the breakeven points of the calendars.

The IV normalizes and converges for the calls.

But the Nov 19 $360 put had a slight increase in its IV — not what we want.

This is because that option had gone so far out of the money due to the price move, that its IV had increased.

From the graphs above, you see that far out-of-the-money options on the lower strikes are much more elevated than at-the-money options.

Price Moves After Earnings

Not only can IV change dramatically after earnings, but the price of the stock can jump dramatically as well.

The big worry is that price makes a big move that can hurt these types of earnings trades.

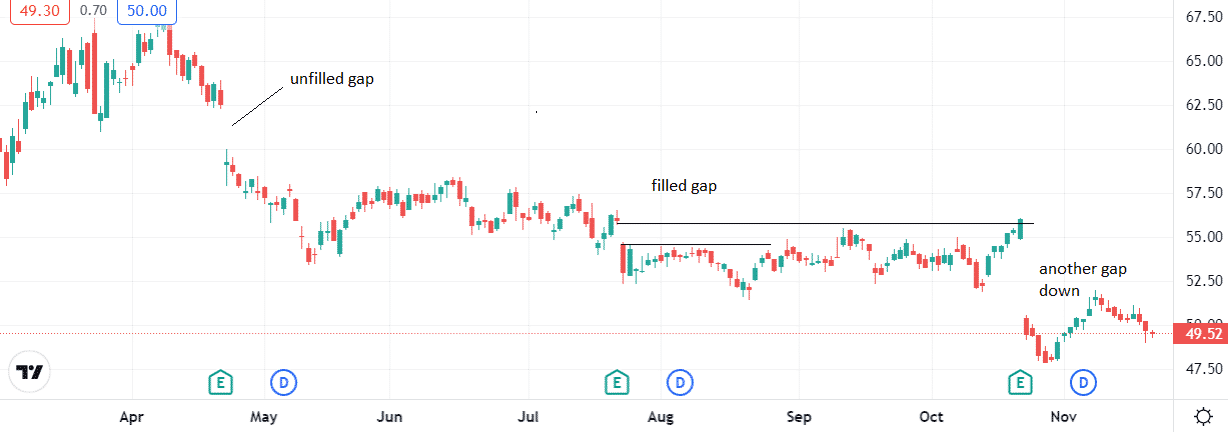

Take a look at Intel (INTC) when it gapped down on earnings on April 22nd, 2021 — a gap that still has not been filled six months later.

The stock price went from $62.57 at the close to $59.16 the next morning, a 5% change.

Then it made a smaller gap on earnings on July 22nd.

Then on October 21, it made a 10% gap down on third-quarter earnings.

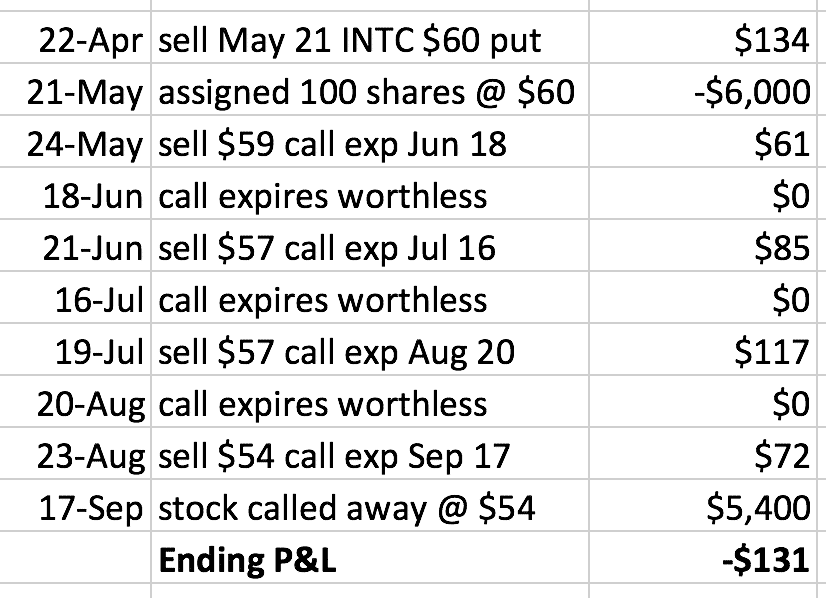

Let’s say that an investor is doing the wheel strategy on INTC.

Do you want to be holding a short put on April 22nd before earnings?

Maybe or maybe not.

That is for the investor to decide only after considering all possible consequences.

One can consider.

“Okay, there will be an IV crush during earnings.

So that will be beneficial to me when I sell a put option because the put option loses value due to a drop in implied volatility.

If price gaps up, does not move or moves down slightly, I will win on the trade.

However, there is the possibility that the price may gap down by an unknown amount.

If the price drops past the short strike, the put option will become in the money, and the value of the option will go up, possibly go up more than the IV crush.

I will lose money on the put option.

But what if I’m willing to hold the put option to expiration and to take ownership of the shares?

In that case, I will lose only the difference between the strike price and the current stock price and then less the premium received.

I’ll plan to make up the loss by selling covered calls.”

Sounds like a plan.

But do you know how many covered calls it would take? How long to recover?

Let’s use historical options data from OptionNet Explorer and do some math.

Suppose an investor sells a cash-secured put with the intention of taking ownership if Intel has a bad earnings report.

Date: April 22, 2021

Price: INTC @ $62.90

Sell on May 21 INTC $60 put @ $1.34 [IV=36.68]

The next day after earnings, INTC is at $58.59.

The put option value had gone up in price to $2.76 due to the price move, even though the IV had dropped to 30.16.

The price move had a greater effect on the option price than did the change in implied volatility.

The investor continues to hold the put option until expiration, hoping that the stock will recover.

It did not.

On May 21st expiration, the put option is in-the-money, and the investor is assigned 100 shares of stock at $60 per share — while the market price is at $56.08

After selling four months of covered calls, the stock got called away on September 17.

But the covered calls were not able to make up for the loss in the stock.

Summary

By using our knowledge of IV crush and price changes due to an earnings event, we can protect our position or capitalize on its effects.

Stock investors can buy puts over earnings to protect stock positions.

Speculators can buy calls or married puts if bullish on the stock.

Non-directional traders can capitalize on the IV crush by selling straddles, selling iron condors, or buying double calendars.

However, non-directional players need to be wary of large price moves, which can damage their trades.

Trading these strategies on stocks that you don’t mind owning is a good idea.

In the event that you have to take assignment, at least you can sell covered calls on it.

Just keep in mind that it might require quite a bit of time to bring enough income from selling covered calls to offset the loss in the stock if the stock decides to continue dropping.

Trade safe!

Disclaimer: The information above is for educational purposes only and should not be treated as investment advice. The strategy presented would not be suitable for investors who are not familiar with exchange traded options. Any readers interested in this strategy should do their own research and seek advice from a licensed financial adviser.

The post Blog first appeared on Options Trading IQ.

Original source: https://optionstradingiq.com/iv-crush/