Most people associate “insider trading” with secret tips and federal agents busting into a dirty hedge fund like Showtime’s Billions.

That’s insider trading based on material non-public information (MNPI).

We will cover the illegal side briefly, but today’s article is mainly about the legal open market activities of company insiders.

When an “insider” of a company performs a transaction within their company’s stock, they have to publicly report that transaction to the SEC.

The publication of insider trades is written into US federal law, under the Securities Exchange Act of 1934, which forced company insiders to disclose their company stakes and transactions.

This means that we can see things like when Mark Zuckerberg buys and sells Facebook (FB) stock.

Common sense tells us that company insiders have a better understanding of a company’s performance than your average investor, so insider trading data is potentially profitable data if harnessed correctly.

Many utilize insider transactions as a type of sentiment indicator, where lots of insider buys may indicate a future earnings beat.

Before we get into the fun stuff like how to profit from this information, we should actually define a few things.

Illegal Insider Trading

Illegal insider trading is when a person places a trade based off of material non-public information.

This can include the purchase of another company, a company preparing to file for bankruptcy, strong earnings that haven’t been announced yet, among many other things that can change the value of the company.

Whether you profit from it or not, it is still illegal.

The “tippee” or person providing the information can also be prosecuted.

The best thing to do if provided with material non-public information is to not trade on it and to keep it to yourself.

Hefty fees, fines and even jail time are typical punishments for trading on insider information.

What is an Insider?

The insiders we will talk about in this article is company insiders.

The law is pretty broad on whom it considers a company insider, which is both a good and bad thing. It’s good because more information is better.

However, larger companies can have hundreds of “insiders” who report their transactions, making it difficult to sort through the muddle.

We can categorize insiders into four categories:

- Large shareholders (own more than 10% of the company’s equity)

- Board of directors members

- Executives

- Top executives

All of the above insiders must report their transactions to the SEC for the public to view.

As a general rule, we can glean the least information from large shareholders’ activities, because they’re not involved in the company’s daily activities, and the most information from top executives, who are privy to each significant company decision.

Where to Find Insider Trading Data?

The primary source for insider trading in the US markets is the SEC. Insiders must report their transactions through three SEC forms:

- Form 3: Filed when a shareholder owns 10% or more of a company’s equity

- Form 4: Filed when an insider makes a transaction in their company

- Form 5: Filed when an insider fails to file a form 4 on time.

When analyzing insider trading filings, you’ll generally only focus on the form 4, which has to be filed within two days of the transaction.

How To Find a Form 4

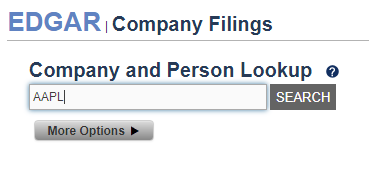

Navigating the SEC website is pretty simple. Let’s use an example with Apple stock.

First, navigate to the SEC company filings page and type in a ticker symbol.

Once you’ve navigated to the specific company’s filing page, find the “Filing Type” box and type in “4” and click enter.

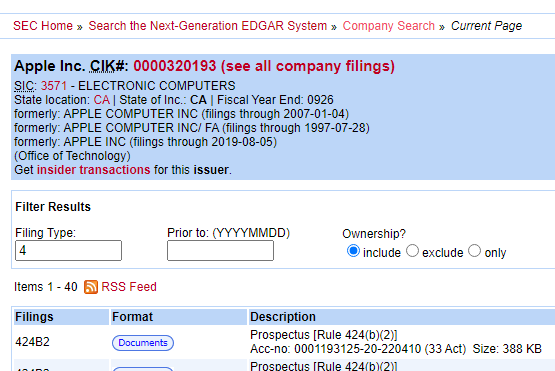

You’ll then see a list of Form 4s filed by company insiders. Here’s a typical form 4 looks like:

As I said, the SEC website is the primary source of this information. But, unless you’re looking for insider transactions within a specific company, there’s not a practical way of sorting through recently filed form 4s to find the really juicy ones.

That’s where tools like OpenInsider come in.

OpenInisder is one of many tools that scrapes the SEC’s website for form 4s and organizes them in an easy-to-read format.

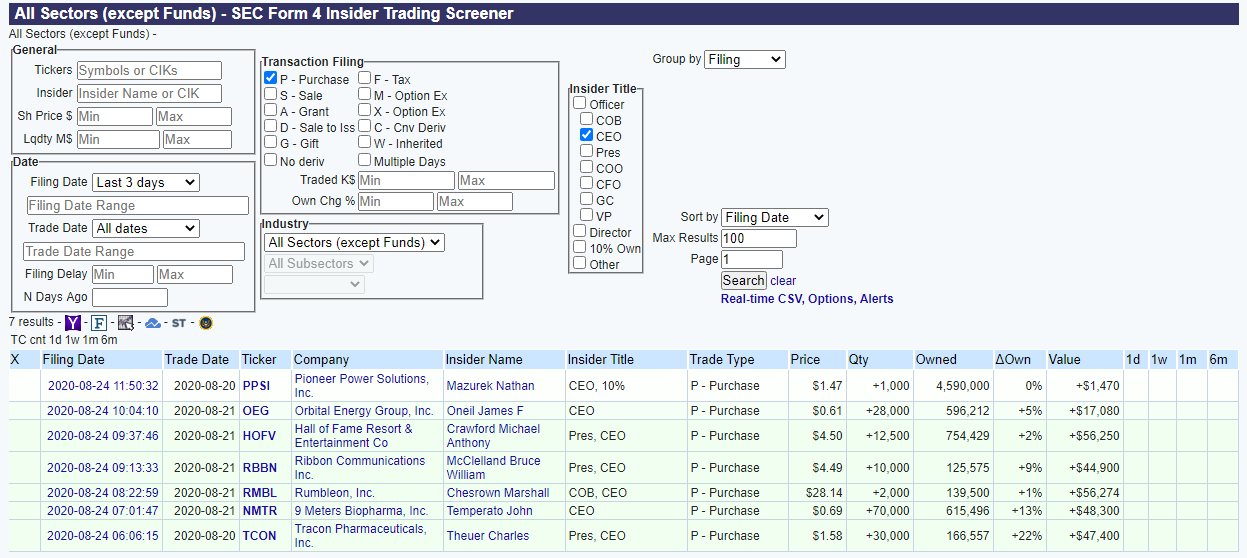

For example, here’s an OpenInsider search for CEO purchases within the last three days. As you can see on the list, the largest purchase is for just $56,250, which is pretty insignificant.

Does Following Insider Transactions Work?

Most academics and traders alike would agree that there is at least some signal in the noise that is insider trading data. You find alpha in deciphering and filtering down the info to find the most important transactions.

One of the best sources of research on the profitability of insider trading is H. Nejat Seyhun and his book Investment Intelligence from Insider Trading. His book essentially serves as a 442-page academic study on the subject.

The first thing we should settle is the pure profitability of buying baskets of stocks with bullish insider activity and selling a basket of those with bearish insider activity.

If a strategy/dataset can’t pass this basic test, it’s typically just a rabbit hole to continue searching for profitable results within that dataset.

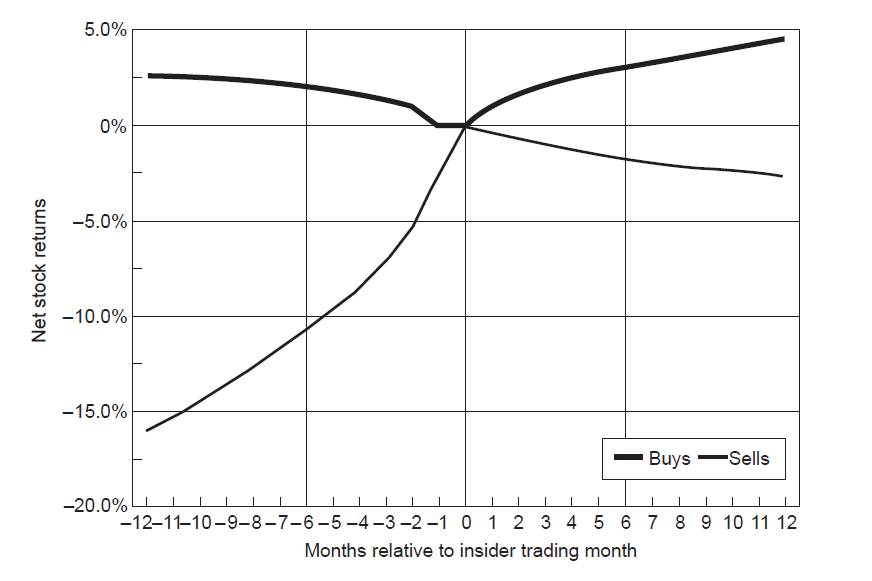

This measure was one of the first issues addressed in Seyhun’s book. He tracked the net stock returns (excess returns above the broad stock market) of insider buys and sells 12 months prior to, and after the transactions. The dataset had over 300,000 months of data.

As you can see, on the whole, both insider purchases and insider buys are both profitable signals on their own.

The above graph didn’t distinguish between the size, date, or specific insider making the transaction, and yet the signals still prove to be profitable.

The logical next step is to examine if we can filter down to the metrics that have true significance and see even better returns. This means only looking for large purchases by highly informed insiders like top executives, preferably before a catalyst like an analyst day or earnings.

There are a few factors observed by Seyhun which improve the profitability of following insider transactions:

- Following buys instead of sells.

- Excess returns of insider purchases are almost double those of insider sales. Keep the Peter Lynch quote in mind: “insiders might sell their shares for any number of reasons, but they buy them for only one: they think the price will rise.”

- Size of the transaction (in dollars)

- Identity of the insider

- Firm size

- Insider consensus

Seyhun goes into much deeper detail, exploring the profitability of each of these factors in the book.

Insiders Can Predict the Broad Market

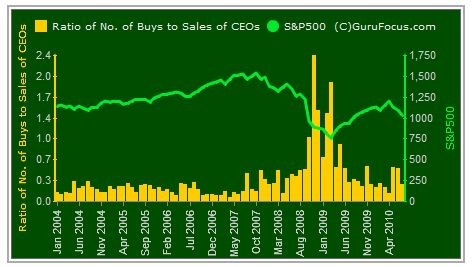

Another study performed by the stock research platform GuruFocus found that insiders are “smart money.” While studying similar data points, the GuruFocus study focused more on insider trading as a broad market indicator.

The study found that simply tracking the number of stock sales and purchases by CEOs can serve as an accurate indicator for spotting intermediate-term market tops and bottoms.

This finding further develops Seyhun’s results, which were talked about in the previous passage. Seyhun concluded that top executives are the best insiders at predicting their future stock price.

GuruFocus used a ratio of CEO buys-to-sells plotted against the S&P 500. As you can see, their buying activity spikes around market bottoms.

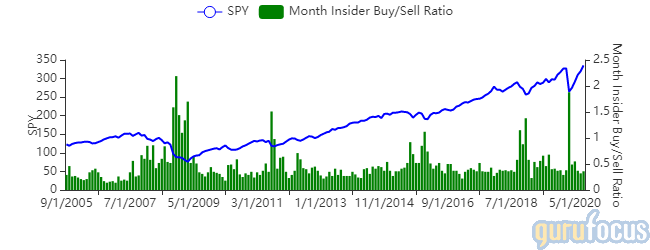

The markets went into absolute panic mode around February and March of 2020. Things looked quite bleak to most investors between the coronavirus beginning to spread and crude oil plummeting quickly.

Corporate insiders, however, were buying their stock in droves.

Looking at the graph below, it’s clear how confident insiders were, with 1.8x more stock purchases than sales, a ratio high last reached in 2008.

Bottom Line

There’s significant evidence that corporate insiders are accurate at predicting their future stock price. Many quants actively trade strategies using these transactions as a dominant factor.

With the ease of acquiring large data sets for free or cheaply nowadays, there’s no excuse not to do your own work on this strategy if it intrigues you.

The great thing about following corporate insiders is that it seems to be an area with an edge that has yet to be eroded by algorithmic investors.

According to research by GuruFocus, they haven’t seen the performance of the strategy reduce over time.

The post Insider Trading – How to Folllow Insider Trades appeared first on Warrior Trading.