When we trade options, we trade two things, price and volatility.

Often traders only use options only as a price tool.

This can lead to distress when they are right on price but wrong on volatility.

“Why did the price go up, and I lost money on my calls?”

It is an all too common remark.

Being right on price but wrong on volatility can still mean being wrong, or at the very least, missing out on a better trade opportunity.

Contents

-

-

-

-

- Trading Implied Volatility

- Benefits of Using an Implied Volatility Calculator

-

-

-

Trading Implied Volatility

The first step in understanding how to trade volatility and price is understanding what level of volatility you are trading.

As volatility is embedded in the value of an option, the exact level of volatility in the options price is not visually apparent.

Thankfully for us, we can find the level of implied volatility in any options strike for any expiry simply with the price of the option and the details of the contract.

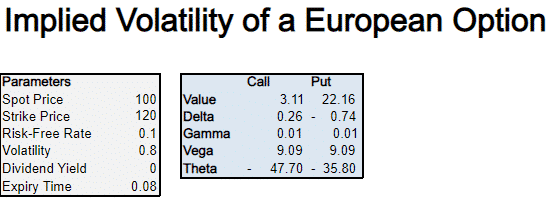

Introducing the options calculator.

Benefits of Using an Implied Volatility Calculator

Aside from finding the implied volatility of any strike, there are more benefits to using an options calculator.

We can calculate various theoretical situations.

Simply by adjusting the underlying price and implied volatility, we can develop new prices for an option.

This can be an intricate tool in risk management as we can prepare beforehand to approximate what we will make if we are right and lose if we are wrong.

To do this, we can adjust the price in the calculator, change the volatility or adjust the days to expiry.

From a risk management perspective, we have the added benefit of using a calculator to see our exposures to greeks such as delta, theta, gamma and vega.

This helps allow us to manage these exposures and risks.

Whenever I place an options trade, I will always use an options calculator beforehand, even if I can see the volatility on my brokerage.

This is because the volatility mark that your brokerage gives can sometimes be slightly off.

Using the calculator will show the exact volatility of the price you choose to trade at.

Sound interesting?

If so, you can try it out as well.

Put your email below and receive a free copy of the calculator to try it out for yourself!

Trade safe!

Disclaimer: The information above is for educational purposes only and should not be treated as investment advice. The strategy presented would not be suitable for investors who are not familiar with exchange traded options. Any readers interested in this strategy should do their own research and seek advice from a licensed financial adviser.

The post Blog first appeared on Options Trading IQ.

Original source: https://optionstradingiq.com/implied-volatility-calculator/