Today, we are looking at the long call condor strategy.

Many of you will be familiar with regular iron condors, which use both puts and calls.

The long call condor uses calls only.

This trade can be entered as a neutral trade, but that would carry assignment risk with one of the short calls being in-the-money.

Typically traders will use a long call condor as a bullish trade and place all four legs out-of-the-money.

Contents

-

-

-

-

-

- What Is A Long Call Condor

- Maximum Loss

- Maximum Gain

- Breakeven Price

- Payoff Diagram

- Risk of Early Assignment

- How Volatility Impacts Long Call Condors

- How Time Decay Impacts Long Call Condors

- Risks

- Long Call Condor Example

- Summary

-

-

-

-

What Is A Long Call Condor

A long call condor is typically used as a bullish trade where the trader believes the stock price will move up into the profit zone, but not higher.

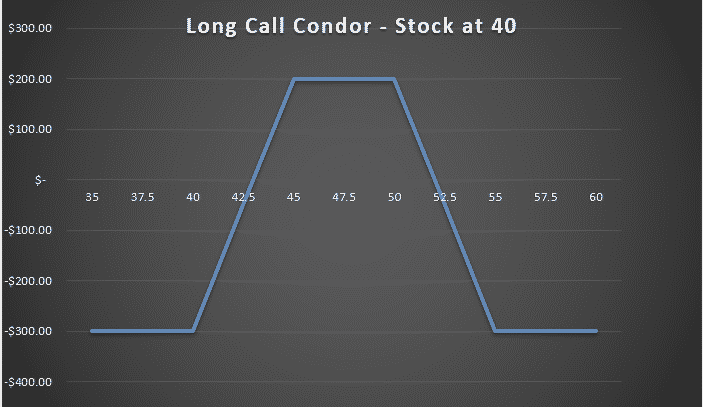

To execute the strategy, the trader would place the following trade as an example on a stock trading at $40.

Long 1 XYZ 40 Call

Short 1 XYZ 45 Call

Short 1 XYZ 50 Call

Long 1 XYZ 55 Call

You can also think of this as a combination of a bull call spread (debit spread) and a bear call spread (credit spread).

Maximum Loss

The maximum loss will occur when the stock finishes below the lowest call or above the highest call on the expiration date.

To calculate the maximum loss, use the following formula:

Maximum Loss = Width of the strikes x 100 – credit received.

In the above example, if we received $200 for the long call condor with 5 point wide strikes, the maximum loss would be 5 x 100 – 200 = $300.

Maximum Gain

Like an iron condor, the maximum gain is limited to the premium received, in this case, $200.

The maximum gain occurs when the underlying stock price closes between the short calls on the expiration date.

When this occurs, the lower long call and the lower short call will be in-the-money and subject to assignment risk, so please be aware of this!

Placing the strikes further closer together results in a higher premium received and a narrower profit zone.

Breakeven Price

The lower breakeven price can be calculated by taking the lower short strike and subtracting the premium received.

In this case:

Lower breakeven = 45 – 2 = 43

The upper breakeven can be calculated by taking the upper short strike and adding the premium received:

Upper breakeven = 50 + 2 = 52

Payoff Diagram

Looking at the payoff diagram above, we see that all four call options are out-of-the-money.

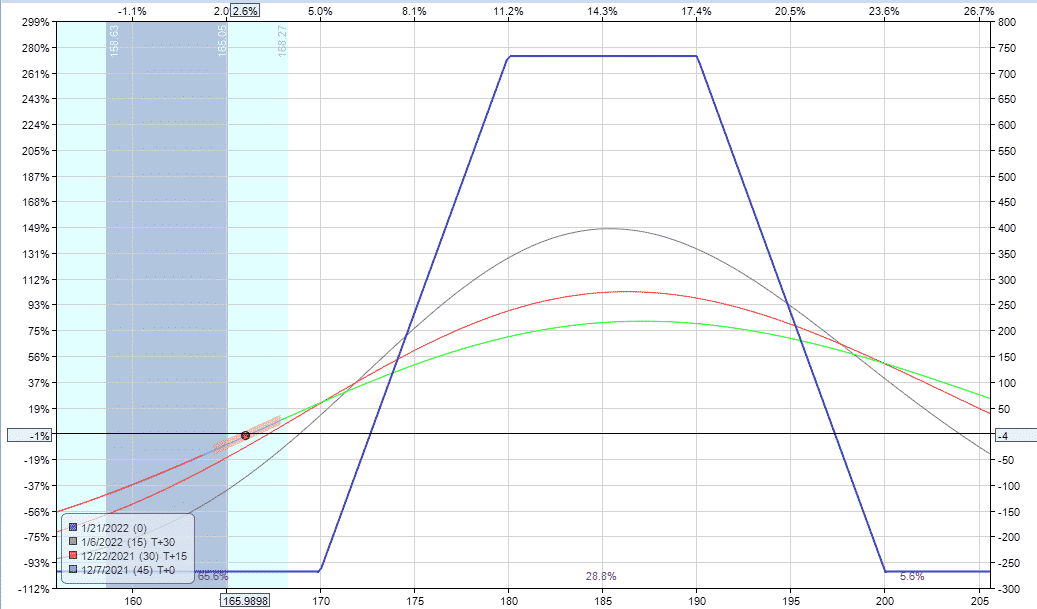

Let’s look at another real example so we can also see the T+0 line.

Placing the long call condor with a directional bias gives it a favorable risk to reward ratio.

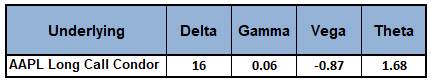

The trade has positive delta, as seen from the T+0 line and the greeks. This example on AAPL has a profit zone between 172.50 and 195.50.

Risk of Early Assignment

There is always a risk of early assignment when having a short option position in an individual stock or ETF. You can mitigate this risk by trading Index options, but they are more expensive.

Usually, early assignment only occurs on call options when there is an upcoming dividend payment. Traders will exercise the call to take ownership of the shares before the ex-date and receive the dividend.

For this reason, traders need to be careful of early assignment if the stock is above the first short call and it is close to expiration or an ex-dividend date.

How Volatility Impacts Long Call Condors

Vega is the greek that measures a position’s exposure to changes in implied volatility. If a position has negative Vega overall, it will benefit from falling volatility.

If the position has positive Vega, it will benefit from rising volatility. You can read more about implied volatility and Vega in detail here.

The trade will have negative Vega when the stock price is within the profit zone and positive Vega when the stock price is outside the profit zone.

How Time Decay Impacts Long Call Condors

Like volatility, time decay will vary depending on where the stock is trading. When the stock is trading in the profit zone, theta will be positive, meaning the trade will make money each day through time decay.

When the stock is outside the profit zone, the trade will have negative theta and lose money through time decay.

Risks

If the long call condor is structured as a bullish trade, we have a risk that the price of the underlying will fall, causing an unrealized loss or a realized loss if we close the trade.

Some other risks associated with long call condors:

ASSIGNMENT RISK

Another risk of the trade is the risk of early assignment. While this doesn’t happen often, it can theoretically happen at any point during the trade. The risk is most acute when a stock trades ex-dividend.

The risk is highest if the stock is short put is in-the-money. There is also assignment risk if the short call goes in-the-money, particularly when it is close to expiration.

One way to avoid assignment risk is to trade stocks that don’t pay dividends or trade indexes that are European style and cannot be exercised early. However, this should not be the primary factor when determining which underlying instrument to trade.

Otherwise, think about closing your bull put spreads if they are close to being in-the-money.

EXPIRATION RISK

Leading into expiration, if the stock is trading near either of the short options, the trader has expiration risk.

The risk here is that the trader might get assigned, and then the stock makes an adverse movement before he has had a chance to cover the assignment.

In this case, the best way to avoid this risk is to simply close out the spread before expiry.

While it might be tempting to hold the condor and hope that the stock moves away from the short strike, the risks are high that things end badly.

Sure, the trader might get lucky, but do you really want to expose your account to those risks?

Long Call Condor Example

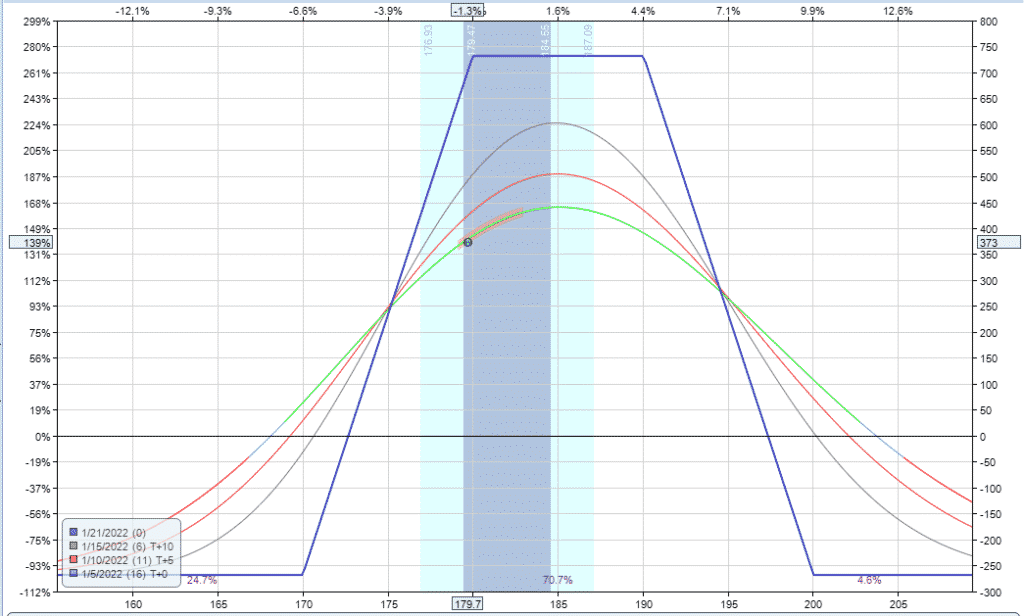

Here is an update from the above long call condor example on AAPL. On January 4th, with AAPL trading at 179.70, the long call condor was up $373 or around 139%.

Summary

Long call condors are usually structured as bullish trades, with all strikes being out-of-the-money. They are a bullish trade with the trader looking for the stock to end inside the profit zone at or near expiration.

Delta is the main driver of profits in the trade.

Trade safe!

Disclaimer: The information above is for educational purposes only and should not be treated as investment advice. The strategy presented would not be suitable for investors who are not familiar with exchange traded options. Any readers interested in this strategy should do their own research and seek advice from a licensed financial adviser.

The post Long Call Condor first appeared on Options Trading IQ.

Original source: https://optionstradingiq.com/long-call-condor/