Contents

-

-

-

-

-

-

-

-

-

- Example

- Run Over By A Steamroller

- Add Risk Management

- Conclusion

-

-

-

-

-

-

-

-

The image of picking up pennies in front of a steamroller is a scary image, and rightfully so.

It refers to trade setups with a high risk compared to their reward.

Is it as risky as the theory suggests?

Can it be done responsibly?

Yes, it can.

Some investors do pick up pennies in front of a steam roller.

However, they always keep an eye on the steam roller.

How far away is it?

How fast is it going?

At a certain point, they get out of the way.

Example

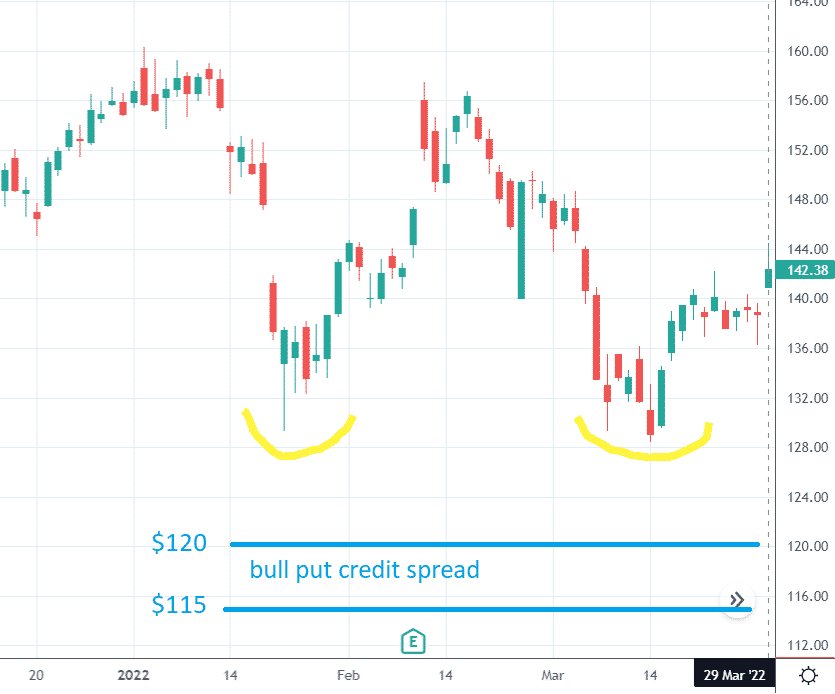

On March 29, 2022, Disney appears to be going up after making a double-bottom.

An investor wants to collect $90 worth of premiums by selling ten put credit spreads on Disney (DIS).

Date: March 29, 2022

Price: DIS @ $142.54

Sell ten Apr 29 DIS $120 put @ $0.25

Buy ten Apr 29 DIS $115 put @ $0.16

Total Credits: $90

Max Risk: $4910

Risk to Reward ratio: 55

The short strike at $120 is at the 4-delta.

So, in theory, the trade has only a four percent chance of being in the money at expiration.

That means a 96% chance of profit if held to expiration.

Run Over By A Steamroller

Since there is good chance of keeping the $90 premium, one might be tempted to just hold to expiry, which is one month away.

The only problem is that we are risking 55 times more than what we are making.

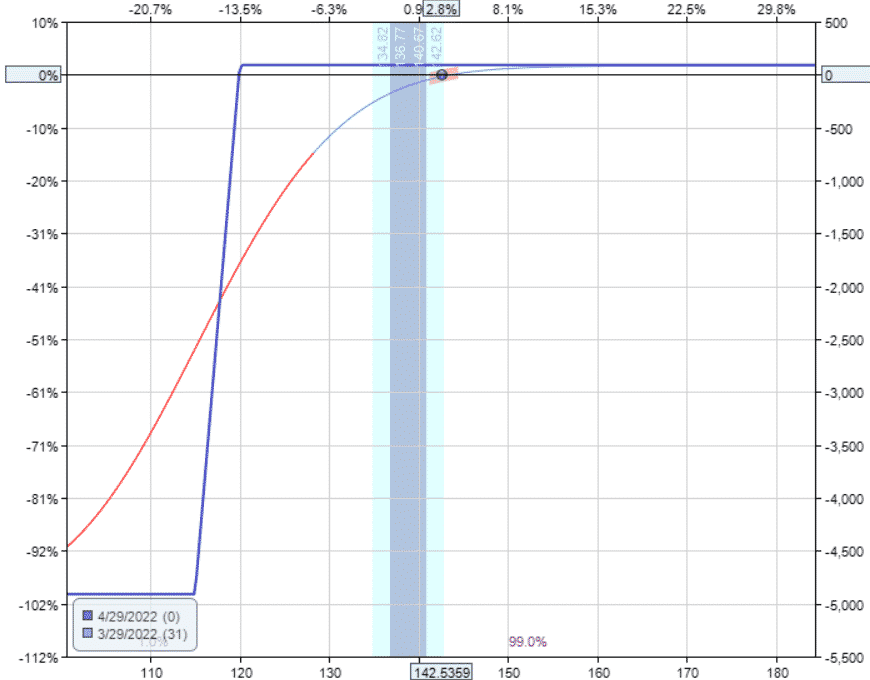

You can see this on the payoff diagram.

The probability of profit is high, but the risk-to-reward is terrible.

What if we do this same type of trade 100 times?

Doing a rough estimate of the theoretical expectancy.

In 96 cases, we would win $90.

And in 4 instances, we would lose $4910.

The wins would amount to $8,640.

The losses would total $19,640.

In the long run, it would not work out.

One loss would wipe out 55 wins.

In any case, let’s see what happens to this Disney trade.

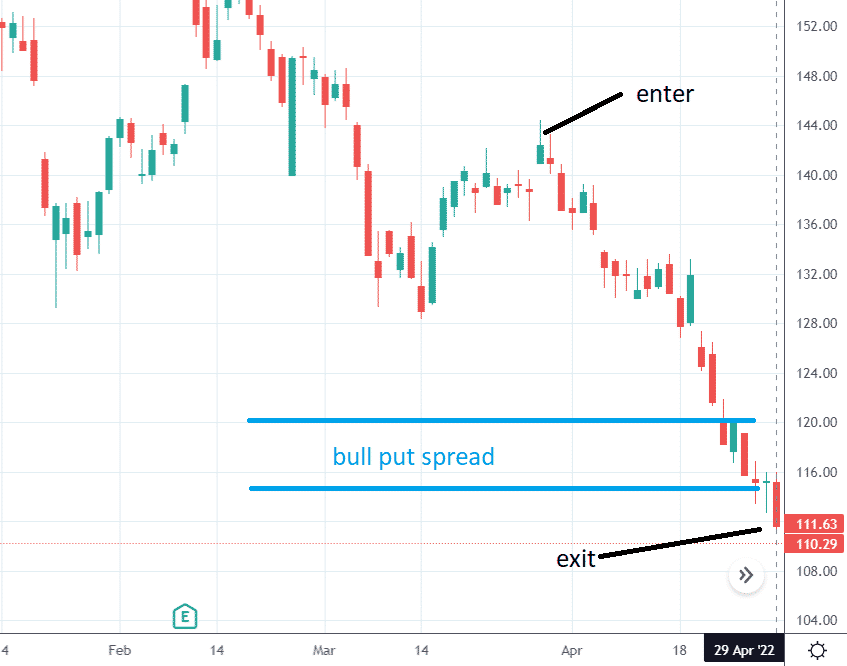

On expiration April 29, Disney closed at $111.63.

The price dropped right through the put spread.

The 4% chance of happening did in fact happen.

The investor lost $4910 in this trade.

This is calculated by:

Investor is assigned 1000 shares at $120: –$120,000

Investor long put exercised at $115: +$115,000

initial credit: $90

Net loss: –$4910

You cannot take a “set-and-forget” approach to these high risk-to-reward trades.

Add Risk Management

You need to monitor the trade and have an exit plan in place.

A reasonable exit plan is to exit the trade if the losses exceed two times the credit received.

Some will call this a “2X loss”.

Some investors may choose a 1X, 3X, or 4X loss stop.

That’s up to the individual investor.

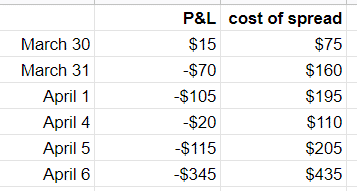

Let’s rerun the same trade with the 2X mental stop in place, checking the price chart and P&L once a day.

If the P&L exceeds a loss of $180, we exit.

This is the same as saying that we would exit if the spread price increases three folds.

If the price to buy back the spread exceeds $270, we exit.

If we buy back the spread at $270 after collecting a premium of $90, that equates to the same $180 loss.

Suppose the investor is checking the account two hours after the open each day and sees the following P&L for each day in the trade.

On April 6th, the trade is at a loss of –$345.

The investor closes the trade by buying back the spread.

Date: April 6

Sell to close ten Apr 29 DIS $115 put @ $0.56

Buy to close ten Apr 29 DIS $120 put @ $0.99

Total debit: –$435

Since the investor sold the spread for $90 and has to buy back the spread at $435, the net loss in this trade is $345.

Conclusion

Some investors may say that risking $4910 to make $90 is dangerous, as implied by the expression “picking up pennies in front of a steam roller”.

It is if there is no risk management plan or monitoring plan in place.

As we saw in the first example, the put spread was completely run over.

However, it can be done responsibly if one has a solid risk management plan that is followed religiously.

As seen in the second example, exiting the trade at a certain stop level will alter the risk-to-reward of the trade.

In theory, a 2X stop means that one loss would only wipe out two wins.

In practice, the loss can be greater than this, depending on how frequently the account is checked.

The loss can be greater than 2X by the time the investor puts in order to exit.

Trade safe!

Disclaimer: The information above is for educational purposes only and should not be treated as investment advice. The strategy presented would not be suitable for investors who are not familiar with exchange traded options. Any readers interested in this strategy should do their own research and seek advice from a licensed financial adviser.

Original source: https://optionstradingiq.com/picking-up-pennies-in-front-of-a-steamroller/