Today we are looking at why traders would sell a put option out of the money. We will explain what a put option is and why people sell puts and look at some examples.

Let’s get started.

Contents

-

-

- What Is A Put Option?

- Why Sell Put Options?

- What Is Out of The Money (OTM)?

- Selling A Put Option Out Of The Money

- Selling A Put Option Out Of The Money – Example 2

- Things To Know About Selling Out Of The Money Puts

- What Are The Risks Of Selling Puts Out Of The Money?

- FAQ

- Conclusion

-

What Is A Put Option?

A put option is a contract giving the option buyer the right, but not the obligation, to sell a specified amount of an underlying security at a predetermined price within a specified time frame.

The “predetermined” price is known as the strike price.

Put options are available on various assets, including stocks, indexes, commodities, and currencies.

Put options gain value as the price of the underlying security drops.

Investors often buy put options as a risk management technique to limit losses on a long stock position.

But what about taking the other side of the trade?

Why Sell Put Options?

The trader who sells the put option is looking to generate an income and potentially acquire a stock below the current market price.

By selling puts, an investor can:

- Achieve above average returns while waiting for the stock to come down to a price at which they are happy to buy.

- Gain some downside protection if the stock drops. A 20% drop in a stock may see the put seller suffer only a 10% loss due to the premium received.

- Make effective use of spare cash while waiting to get in to the market.

- Take advantage of high volatility during market corrections. Taking a contrarian approach when there is a lot of fear in the market can see put sellers handsomely rewarded.

What Is Out of The Money (OTM)?

The degree to which an option does or doesn’t have intrinsic value is referred to as moneyness.

When it comes to option moneyness, we have three possible scenarios:

- In the money

- At the money

- Out of the money

In the money options contain intrinsic value.

Taking call options as an example, if a stock is trading at $50, any call option strike below $50 would contain intrinsic value and be in the money.

The call option with a strike of $50 would be at the money.

Any call options above $50 would not contain any intrinsic value and are out of the money.

The prices for these call options would be entirely made up of extrinsic value, or time value.

In the case of put options, an out of the money put option would be any strike price below the stock’s current price.

Take our example of a stock trading at $50.

Any put option below $50 would be out of the money.

Selling A Put Option Out Of The Money

We now know what a put option is, and we know what out of the money is.

Let’s combine the two and look at an example of selling a put option out of the money.

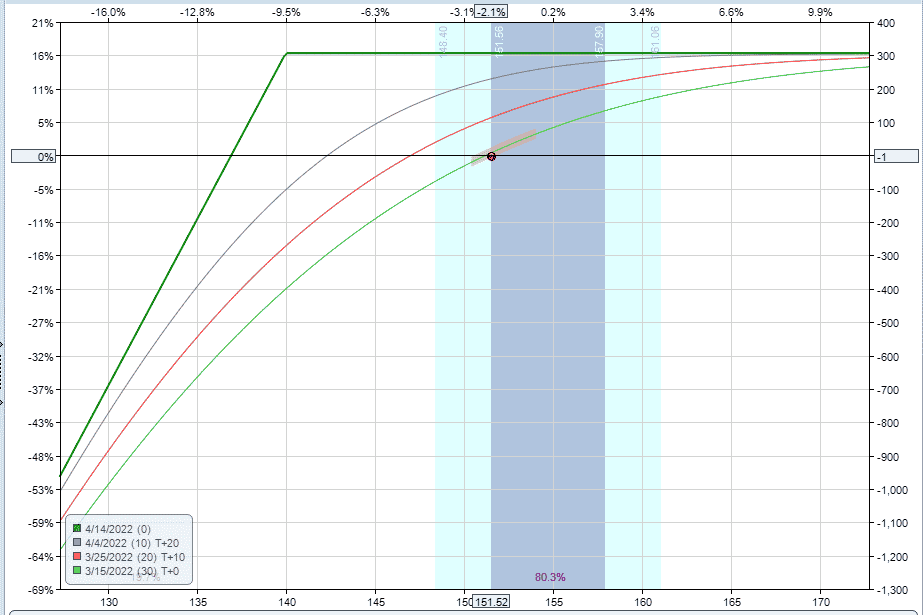

Trade Date: March 14th, 2022

Stock: AAPL @ 151.52

Trade Details:

Sell one AAPL April 14, 2022 140 put @ 3.05

Credit Received: $305

Capital Required: $13,695

Delta: 24.81

Potential Return: 2.23% in 31 days or 26.25% annualized

This trade involves selling an out of the money put option on AAPL with 31 days to expiry.

The premium received for selling the put is $305, which is also the maximum profit.

If AAPL stays above 140 at expiration, the put option will expire worthless, leaving the trader with a profit of $305.

If AAPL closes below 140 at expiration, the put option will be assigned, and the trader will be required to purchase 100 shares of AAPL stock at 140.

The net purchase price would be 136.95, which can be calculated by taking the strike price of 140 less the 3.05 option premium received.

On the expiration date of April 14, AAPL was trading at 165.29, and the put option expired worthless for a full profit.

Selling A Put Option Out Of The Money – Example 2

Let’s look at another example of selling a put option out of the money.

This time, we will look at a stock that drops through the out of the money put strike.

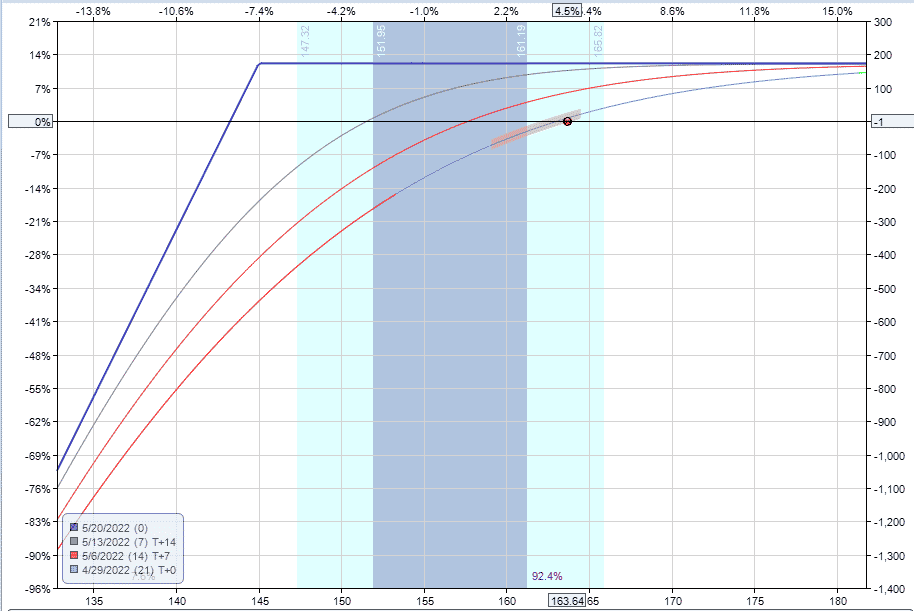

Trade Date: April 28th, 2022

Stock: AAPL @ 156.57

Trade Details:

Sell one AAPL May 20, 2022 145 put @ 1.75

Credit Received: $175

Capital Required: $14,325

Delta: 15.30

Potential Return: 1.22% in 23 days or 20.27% annualized

This trade involves selling an out of the money put option on AAPL with 23 days to expiry.

The premium received for selling the put is $175, which is also the maximum profit.

If AAPL stays above 145 at expiration, the put option will expire worthless, leaving the trader with a profit of $175.

If AAPL closes below 145 at expiration, the put option will be assigned, and the trader will be required to purchase 100 shares of AAPL stock at 145.

The net purchase price would be 143.25, which can be calculated by taking the strike price of 145 less the 1.75 option premium received.

On May 20th, AAPL closed at 137.59, which was below the strike price of 145.

The put option would be assigned, and the investor would be forced to buy 100 shares at 145.

However, their net purchase price would be 143.25, thanks to the 1.75 option premium.

At this point, the trader has lost around $566.

This loss I calculated by taking the current stock price minus the breakeven price from the sold put trade:

137.59 – 143.25 x 100 = -$566

However, if the trader had bought 100 AAPL shares on April 28th, they would be showing a larger loss.

137.59 – 157.56 x 100 = -1,997

Even though the put seller has lost money, they have lost less than someone that bought the stock outright on the same day.

Things To Know About Selling Out Of The Money Puts

Like any investment strategy, you need to know some basics, and it’s the same when it comes to selling out of the money puts.

To sell put options, you need to have collateral.

Collateral is usually in the form of cash in your brokerage account.

In the examples above, using AAPL, the trade would need at least $14,325 cash in their account to conduct this strategy.

AAPL is an expensive stock.

Selling a put option out of the money would be much more affordable on a stock like Ford.

At the time of writing, Ford was trading around $13.50.

Therefore, to sell an out of the money put on Ford stock would only require around $1,300 in capital.

Put Option Strike Price

The strike price is the price at which the option seller will be required to purchase the shares.

In our examples above, this was 140 and 145.

Placing the sold puts further out of the money gives the trade a higher probability of success, but a lower return potential.

Delta

Delta is the option’s sensitivity to changes in the underlying stock price.

It measures the expected price change of the option given a $1 change in the underlying.

Call options have a delta between 0 and 1.

Put options have a delta between 0 and -1.

In our first AAPL example, the trade has a delta of 24.81.

A delta of 24.81 means the sold put is roughly equivalent to being long 25 shares of AAPL stock, although this delta will change as the trade progresses.

The second example had a delta of 15.30, roughly equivalent to being long 15 shares of AAPL stock.

Delta can also be used as a rough guide to the probability of success.

A put option with delta 25 has a roughly 25% chance of expiring in the money.

A put option with delta 15 has a roughly 15% chance of expiring in the money.

Volatility

Volatility is a crucial component when it comes to option trading.

When implied volatility is high, option prices are high.

Conversely, when implied volatility is low, option prices are low.

Selling out of the money puts when implied volatility is high will result in higher premiums and potentially higher profits.

A good way to measure the current level of implied volatility is by the implied volatility percentile.

IV Percentile is a measure of implied volatility where the current level is compared to the twelve month range.

This video shows the best way to scan for high volatility stocks:

What Are The Risks Of Selling Puts Out Of The Money?

Selling puts out of the money comes with similar risks to outright stock ownership.

If the stock price suffers a significant fall, the trade will be in a losing position.

If the stock price drops below the breakeven price, the trader may have to buy the stock for less than it is worth.

The premium received helps offset the cost basis somewhat.

However, as we saw in the second AAPL example above, the trader had a cost basis of 143.25 on a stock trading at 137.59.

Traders should only sell puts on stocks they are willing to buy at the strike price.

We like to focus on quality blue-chip companies and ETFs.

If you get assigned on a put sale, you can hold on to the stock and collect the dividends while waiting for the price to bounce back.

You can also turn the position into a wheel trade by selling covered calls to generate additional income!

FAQ

Can you get rich selling puts?

Selling out of the money put options can form part of an overall investment strategy.

You can earn anywhere between 1 and 5% per month selling puts.

However, it depends on the choice of the underlying stock, the strike price, and the days to expiration.

More volatile stocks can earn higher returns but come with higher risk.

In the first AAPL example above, the return was 2.23% in 31 days, or 26.25% annualized.

If we had chosen a more high volatility stock like TSLA, the potential return would have been 4.31% in 31 days, or 50.78% annualized.

We aim to sell out of the money puts on blue-chip companies that have the potential to generate a minimum of 15% per annum.

The main parameter should be to sell puts on stocks you are willing to take ownership of and hold for the long term.

Does Warren Buffett sell puts?

Yes, Warren Buffett sells puts.

It is one of his favorite strategies, particularly when quality companies have suffered a large price drop.

Buffett once said, “Indeed, at Berkshire, I sometimes engage in large-scale derivatives transactions to facilitate certain investment strategies.”

What is the downside of selling put options out of money?

The downside of selling put options out of the money is that you can be sitting on large unrealized losses if the stock continues to drop.

Also, if a company goes bankrupt, you can be left with nothing.

This risk is the same as owning stock.

Think about investors that sold out of the money puts on Lehman Brothers or Bear Stearns.

The other downside of selling out of the money puts is that the potential gains are limited.

Investors who sold out of the money puts on TSLA in 2020 would have made handsome returns, but not nearly as much had they invested directly in the stock.

Does selling put options work?

Yes, selling put options works and is a great way to generate an income on stocks you are willing to own.

You can achieve a high return or take ownership of the stock for less than the current price.

Conclusion

Selling put options out of the money can be a great way to generate extra income from the stock market.

However, it is essential to focus on high quality companies and ETFs that you are willing to hold for the long term.

All investment strategies contain risk and selling out of the money puts is no different.

The risk is similar to stock ownership, and losses can occur if the stock suffers a large drop.

We hope you learned something from this article, and if you have any questions, please send us an email or post a comment below.

Trade safe!

Disclaimer: The information above is for educational purposes only and should not be treated as investment advice. The strategy presented would not be suitable for investors who are not familiar with exchange traded options. Any readers interested in this strategy should do their own research and seek advice from a licensed financial adviser.

Original source: https://optionstradingiq.com/put-option-out-of-the-money/