Today, we are looking at the key differences in a long call vs short call.

We will first define long calls and short calls and look at the differences such as probability, theta and purpose.

Lastly, we will look at some examples and answer some frequently asked questions.

Contents

- Introduction

- What is a Long Call?

- What is a Short Call?

- Long Call vs. Short Call: The Key Differences

- Key Difference #1 – Purpose of the position:

- Key Difference #2 – Profit and Loss profile:

- Key Difference #3 – Theta usage:

- Key Difference #4 – Probability of Success:

- Long call example

- Short Call Example

- FAQ:

Introduction

There are several key and distinct differences between being long vs short a call option.

Long and short, when used in reference to equities, means either buying and looking to sell higher or short-selling and looking to rebuy at a lower price.

In options, it means something similar, but the differences greatly impact the risk profile of the position.

What is a Long Call?

A long call option is when you purchase the option to buy a security on a future date at a set price.

It is strictly a bullish strategy on the underlying instrument.

Being long a call option will allow you to participate in an upward move without having to own the actual equity, and it is also highly leveraged, so your profit and loss will reflect on any price movement on the underlying.

With a long call, your risk is completely defined by the purchase price of the call.

Your profit has unlimited upside potential, and your breakeven price is the Strike Price + premium paid.

The only potential concern would be auto-exercise if the option expires in the money (the price of the underlying is higher than the strike price of the option), but the options can get closed at any point up until expiration.

When long a call it is important to note some of the Greeks involved with the contract.

You will want to pay special attention to Delta and Theta.

All the Greeks are important in their own right, but Delta will tell you how much you can expect the option price to increase in relation to a 1-point move in the underlying.

Theta will tell you how much the option depreciates with time if the underlying does not move.

This is also called time decay and works against you in a long position.

What is a Short Call?

A short call option is when you sell the option to purchase an underlying instrument in order to collect the premium.

This can be both a neutral and bearish options strategy.

When shorting a call, you are hoping the stock price stays stable or declines so that you can collect the maximum amount of the premium.

By going short on a call, you now have the obligation to sell the underlying instrument should the option get exercised.

There are two potential scenarios where that would happen.

The first is if the stock rises above the contract strike price, the second is if the contract owner exercises the option early (very, very rare).

With a short call, your profit is locked in on the premium you received for selling the option, and your theoretical loss is unlimited (stocks never run to infinity, though).

The breakeven price is the contract price + the premium you received.

Just like a long call, the option can be closed at any point up to the expiration date.

With a short call, you are looking for the price of the option to go to zero.

The closer to zero you can buy it back/let it expire, the more of the premium you can collect.

In a short call, the same two Greeks are important but for the opposite reasons.

Delta still shows how much the option price should increase with a 1-point move in the underlying, but now you are on the other side of the trade, which means that the price is going against you.

And Theta is now your friend; as the option price goes to zero, you continue to improve your profit on the position.

Long Call vs. Short Call: The Key Differences

There are many differences between a long and short call, from how the risk is handled all the way up to the basic purpose of the strategy.

Key Difference #1 – Purpose of the position:

Being long a call is a very bullish position.

You are expecting a price move in the underlying stock that will overcome the negative effects of time decay on the option.

You often see long calls posted with astronomical gains because the larger the move in your favor, the more the leverage works in your favor.

By contrast, a short call is a neutral to bearish position.

You want the stock price to remain the same or fall so you can collect the maximum premium amount.

Key Difference #2 – Profit and Loss profile:

The second key difference between long and short calls is the risk profile of the trade.

You have a capped max loss and unlimited profit potential with a long call.

With a short call trade, you have a capped profit of the premium you collect, and the maximum loss is theoretically unlimited.

Key Difference #3 – Theta usage:

Theta will be used as a marker on both a long call and short call, but the meaning is very different on both.

On a long call, Theta will work against you and slowly chip away at the profit on your position.

On a short call, Theta will work for you and slowly lower the premium price of the option, making your position move valuable every day, provided the stock price does not move against you.

Key Difference #4 – Probability of Success:

Something not covered yet here is the probability of success.

Since trading and investing is just a function of probabilities, it is always helpful to stack them on your side.

With a long call, you have a low probability of success IF you do not close the option early.

Something like 70+% of options expire worthless.

This puts you at a disadvantage as a call buyer but at a huge advantage as a call seller.

Selling calls has a large probabilistic advantage over call buying.

Long call example

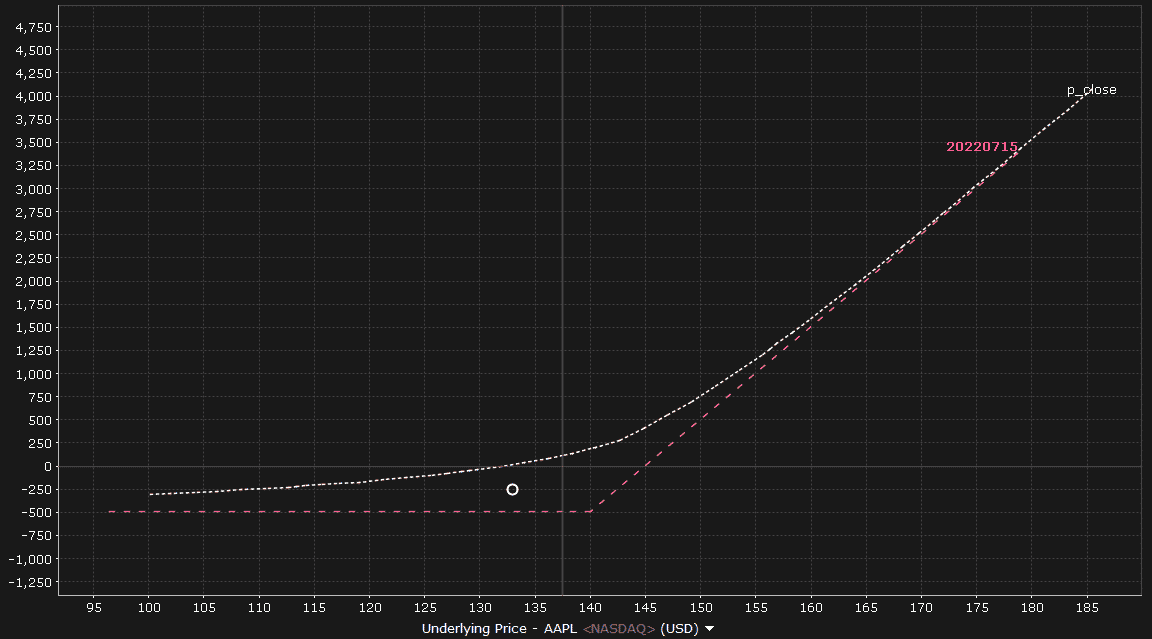

The underlying stock is AAPL.

Current price: $138.00

Exp Date: 7/15/2022

Strike: $140

Premium Paid: $5.36

Breakeven price: $145.36

Max Profit: Theoretically Infinite

Max Loss: $536

Potential Rationale for the Trade: Given the stock’s recent sell-off, I think a relief rally is due in the next month.

I think this sees a market leader like AAPL see the lower $150’s by mid-July, where I can take profits on the position.

Short Call Example

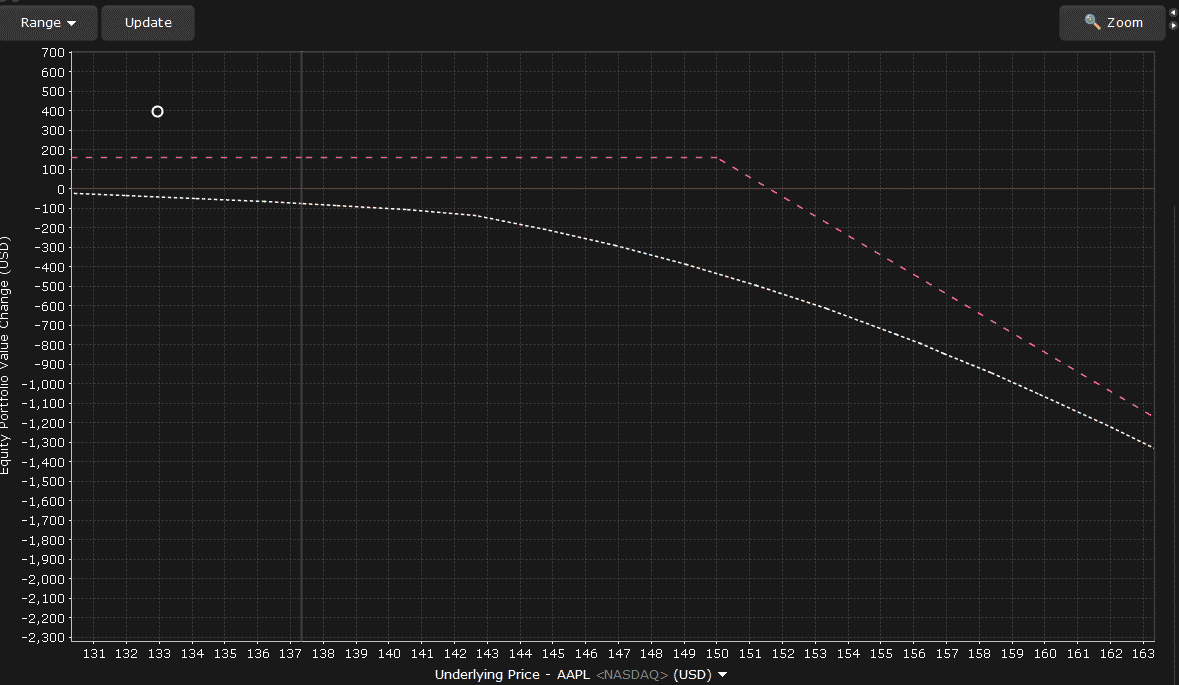

This is an example of a short call position.

The underlying stock is AAPL again.

Current price: $138

Exp Date: 7/15/2022

Strike: $150

Premium Collected: $1.77

Breakeven price: $151.77

Max Profit: $177 minus fees

Max Loss: Theoretically Infinite

Potential Rationale for the Trade: Given the current market themes, it makes sense that any upside potential is at least temporarily capped on AAPL.

I believe that the stock price will remain under $150/share until at least July 15, but I am not sure that it will fall substantially, so I sold the call to try and capitalize on the stagnant to decreasing price.

FAQ:

Are long calls worth it?

The short answer is yes!

The long answer is it can be complicated.

A long call is a fantastic way to participate in the upward price movement.

With a capped risk and unlimited profit potential, you can make a great return on investment if you have the right direction and timing.

This is one of my go-to strategies for trading and investing, given its risk-reward profile.

Are long calls safe?

Yes, long calls are very safe.

Your maximum risk is capped at the price you paid for the option.

The only risk associated with it is auto-exercise on expiration date, but this is easily avoidable by manually closing the trade either early with a profit or an hour before market close on the day of expiration.

What does short and long mean in options?

In options, Long/Short has a slightly different meaning compared to equities or futures.

When you are long an option, your maximum risk is defined by what you paid, and your profit potential is based on the underlying price action and is theoretically infinite.

Both of these are extremely similar to being long equity.

Being short an option has an additional difference from equity.

When you are short an option, you still want the price to fall, but your potential gain is capped at the premium you received for the option.

Like being short an equity your max loss is still theoretically infinite.

Are they good strategies?

Yes, both are fantastic strategies.

Being long a call is a great speculative play on a security you are bullish on.

It requires far less capital, has much less risk, and has a greatly outsized potential profit comparatively.

Being short a call is also a great strategy for a security you are neutral or bearish on.

It is a more advanced strategy, though it requires more starting capital and trade management to maintain profitability.

Where the short call really can shine, though, is as a hedge against a long position.

On equities it’s called a covered call, and on an existing long call it’s a calendar spread or vertical(depending on the contract specifics.)

We hope you enjoyed this article on long call vs short call.

If you have any questions, please send an email or leave a comment below.

Trade safe!

Disclaimer: The information above is for educational purposes only and should not be treated as investment advice. The strategy presented would not be suitable for investors who are not familiar with exchange traded options. Any readers interested in this strategy should do their own research and seek advice from a licensed financial adviser.

Original source: https://optionstradingiq.com/long-call-vs-short-call/