Finchat is an investment research startup incorporating Large Language Models (think ChatGPT) into its platform.

This capability allows you to interact with hundreds of thousands of data points and performance metrics across thousands of companies worldwide.

In addition to this, they also have tons of features for financial modeling, stock screening, and analysis, but with all these tools, is the platform worth your time, or is it just marketing hype?

That is what you can find out below.

Contents

-

-

-

-

-

-

- Platform

- Analytics

- Charting

- Screener

- Investors/Earnings

- Ask Finchat

- Pricing

- Verdict

-

-

-

-

-

Platform

This platform is completely web-based, as is normal now with cloud software.

It is incredibly easy to use and navigate, and even the free plan gives you access to the most important services and tools.

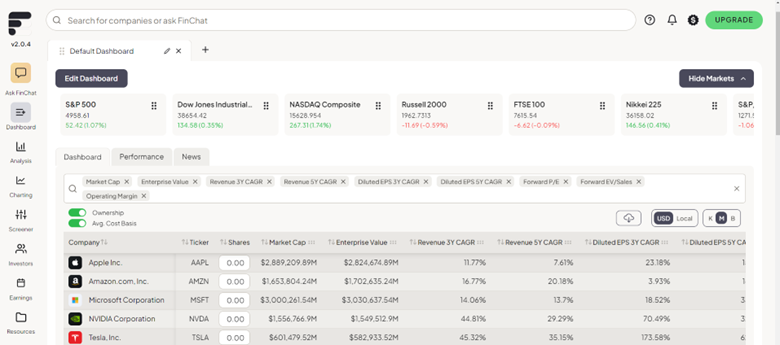

When you open the app for the first time, it drops you onto a customizable dashboard showing you information about your favorite traded companies.

One of the paid tools is integration with your broker (if supported), so you can manage your entire portfolio from this dashboard screen.

Analytics

The next section is the analysis section, and this is where a lot of the magic currently happens.

If you can think of a metric, they probably have it here.

You can look at the financial statements, ratios, filings, ownership and dividend metrics, and many other Performance Indicators.

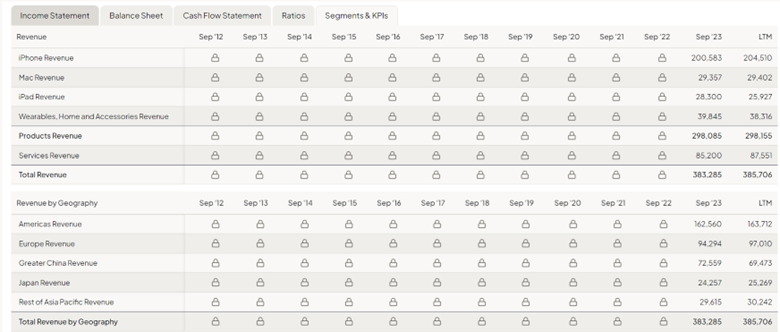

The screenshot below is one example of Apple Stock, where you can see the breakdown by market segment all laid out in front of you.

For the free version, you are limited to the most recent quarter, but more on what each version allows you below.

One of the more impressive areas on this tab is the Modeling table.

This shows you the present, past, and future financial data, but it also lets you change key metrics like the cost of debt, revenue projections, and market risk premium to see how the numbers will change in real-time.

This completely removes the need for a lot of manual forecasting and the use of Excel for financial modeling.

Lastly, you can do industry comparisons from this section as well.

Let’s say you want to see how Microsoft matched against its peers.

You can view all of the data here.

The program automatically selects what it views as industry peers, but if you want to add or subject companies, you are free to do so.

This makes industry research a breeze as everything is interactive.

Charting

The charting tab is next on the menu, which goes beyond normal price charting.

This tab lets you visualize hundreds of metrics and ratios across their universe of stocks.

You can also chart multiple companies at once so you can visually compare the metrics between them.

You can also plot multiple metrics for single companies, allowing you to create your own dashboard for company research.

Lastly, you can alter the time scale of the data so you can compare it on a timeframe you want to look at, be it quarterly or annually.

Screener

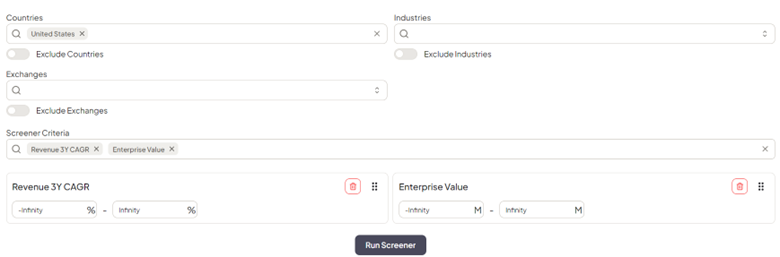

The screener is another excellent tool created on the FinChat platform.

You can narrow your stock scans using almost any imaginable metric and filter it by exchange, country, sector, and more.

What sets this apart from other more basic stock screeners is its interface.

Instead of selecting pre-set scans or dropdown boxes, Finchat allows you to just type in what you are looking for, and it will populate the closest metric it has.

You can continue drilling by setting upper and lower limits on any selected metric.

Investors/Earnings

These are technically two separate sections, but I am grouping them simply.

First up is the Investors tab; here, you can select a fund or investor and see how they are investing, which companies they are in, basic stats of the fund, and any filings they have on record.

This is an incredibly powerful tool if you plan to trade with any of these larger funds.

In the same section, they also have Hedge Fund Letters.

This collection of all of the Fund letters as they are available will allow an investor insight into what some of these funds are looking at.

While they seldom contain research, you can often get a feel for how they view the economy, what they are planning for, and any large investment thesis they have.

Finally, there is the earnings tab, which is just a standard earnings calendar.

You can view by date or search for a specific company.

This will then let you view estimates for the different metrics.

Ask Finchat

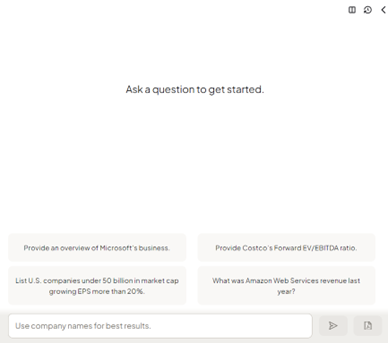

The best was definitely saved for last in this review, and that is the Ask FInchat feature.

Set up to look very similar to the ChatGPT interface; this allows you to ask questions directly about Finchat’s data.

This interaction is what sets this platform apart from others in the research space.

You can ask for specific metrics or larger company overviews, and the model will find the answer and display it for you.

It will also show you any related graphics, create graphs, and show how it compares to previous data. It tries to “think” ahead and show you a complete data set for what you might be looking for.

You can also upload your PDF documents and add them to the dataset the model searches for you.

This is basically training the model on your own dataset; something that used to require special knowledge can now be done simply by uploading a PDF.

Pricing

So, now that you have seen all of the power this platform offers, let’s talk about what it costs.

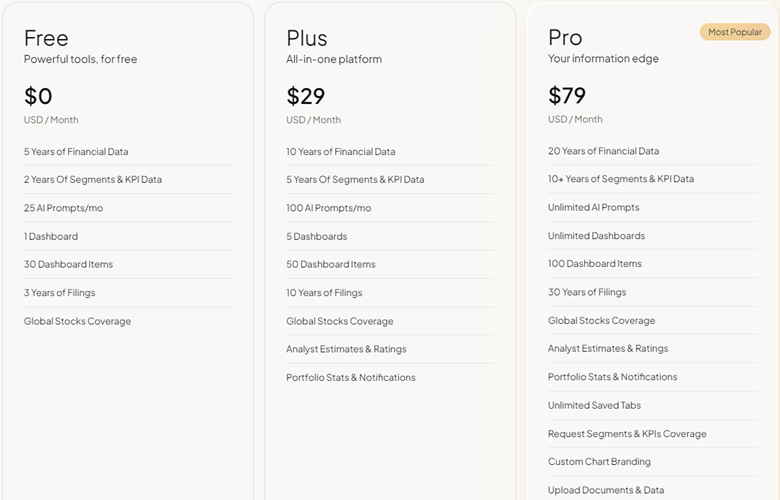

There are three different pricing levels: Free, Plus, and Pro.

The free version gives limited access to the Ask FInChat AI, historical data, financial modeling, and other toolsets.

The Plus, available for $29/month, includes the same features with more historical data, analyst estimates, and portfolio information.

Finally, the Pro is $79/month and contains all of the previous features plus significantly more historical data, less restricted use of the FinChat AI, and more customization and branding of charts.

It also allows you to save layouts and make special requests for Metrics to be added to the dashboard. For complete details of the differences, see the image below.

Verdict

Having looked at all of the information and possibilities of the Finchat.io platform and the pricing, the question now becomes, is it worth it?

For this particular platform, the answer is yes, regardless of your investing style.

They offer a free version with plenty of power for the casual or retail investor, giving you access to more than enough data for your research.

If you are a serious investor or require more advanced research and longer data sets, this platform is still worth $29 or $79 per month, depending on your budget.

The FInchat AI really makes this a super-powered platform, and with the free tier available, there is no reason not to sign up and try it out for yourself.

We hope you enjoyed this article on Finchat.io.

If you have any questions, please send an email or leave a comment below.

Trade safe!

Disclaimer: The information above is for educational purposes only and should not be treated as investment advice. The strategy presented would not be suitable for investors who are not familiar with exchange traded options. Any readers interested in this strategy should do their own research and seek advice from a licensed financial adviser.

Original source: https://optionstradingiq.com/finchat-review/