Since trading began, there has always been the desire to predict where prices are going.

This is a Holy Grail of trading strategies because it would allow the person who holds the power to print money on demand.

Many ” tools ” have been released that have boasted this ability and failed, but now, with the advent of AI and large language models, are we finally able to predict future price movements?

That is what Tradespoon aims to potentially find out.

Using a proprietary set of tools, members can access trade picks, model portfolios, and, most notably, the Forecasting tools they created.

Contents

-

-

-

-

-

- Trade Picks

- Screeners and Research

- Forecasting

- Pricing

- Wrapping It Up

-

-

-

-

Trade Picks

Let’s start by looking at the trading services they offer. Tradespoon’s “Picks” section is one of the services its clients offer.

They offer several types depending on price point, account size, and trade style. Below are the types, instruments, and holding times.

Active Trader – Offered in both stocks and options, these are short-term trades usually held intraday or at max two days.

Weekly Trader – Also offered in both stocks and options, the weekly trader is for more of a swing trading approach, with hold times ranging from 2 to 5 trading days.

Monthly Trader – Next up is the longer-term time frame, with these trades holding times from 5 days out to 30. Monthly picks are also offered on both stock and options.

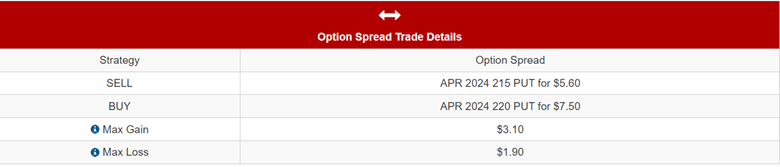

Spread Trader – These picks are solely options-based and are credit or debit spreads with entry and exit signals. A sample trade is seen below.

Shadow Trader – Lastly, there is their shadow trading service. This is based on the daily trades of their Head Trader, Vlad (who also happens to be their CEO). You get updates in real time when he opens or closes a position. It should be noted here that Tradespoon recommends you have a max of 4 positions open at a time while you get accustomed to the platform and the trades.

Screeners and Research

In addition to its AI-assisted stock and options picks, Tradespoon also provides proprietary screeners and research to its members.

First, we will look at what they offer as their screener.

The Tradespoon screener is unlike most standard screeners that use technicals and fundamentals to narrow down a list of stocks for you to potentially trade this week/month/year.

The Tradespoon screener uses AI and some advanced mathematical models to look at trends, volume, qualitative data, and other factors to determine if a stock will beat or lag the S&P (the SPX in their model) over the coming weeks.

They assume a 10-day to 2-month holding window, so all these trades should be considered swing trades.

One cool feature about their screeners is that they have both bullish and bearish recommendations, and they let you use these stocks in their “Trade Ideas” tool that analyzes the probable range, likelihood of finishing above or below the price envelope, and probable support and resistance levels.

These tools can help a trader plan a trade on an expert level.

The other feature they offer is research.

Tradespoon research goes beyond traditional earnings and financial research; it utilizes math and seasonality to look for a potential edge in a stock.

The probability analysis on their researched stock list is the same as mentioned above, looking at probable ranges.

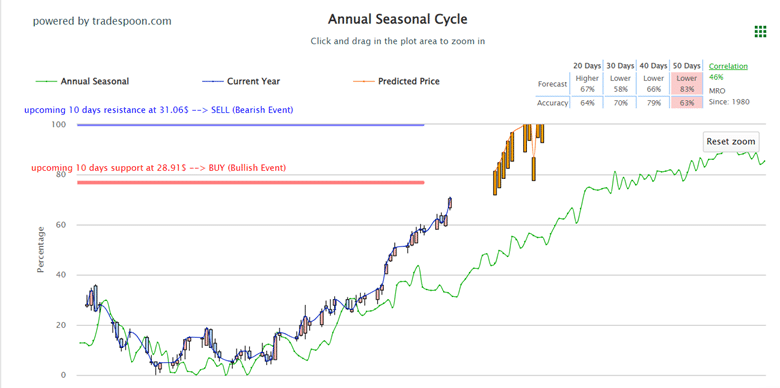

The seasonality chart looks at the historical movement over the year and plots the current prices against its average location by this point in the year.

They also take the probability models and overlay the “predicted price” on the chart; see an example with an explanation below.

The above chart is for MRO, an oil and gas name.

The green line is how the seasonality of the name is expected to look.

Based on this, a trader could expect MRO prices to increase through the first half of the year, which is what is happening based on the candlesticks that you can see overlaid on the chart.

Next, you have the yellow candles, which Tradespoon estimates will be the next several candles in the series.

Finally, in the upper right corner, you have a table showing where Tradespoon predicts the price in the next 10 – 50 days and a grade of how accurate they believe the model is.

**As a side note, you should never see 100% accuracy in a model.

Any form of statistics or analysis will always risk being incorrect, especially in anything market-related, as there are hundreds of thousands of market participants and possible news outcomes. **

Forecasting

Let us look at Tradespoons’ flagship tool and stock forecasting application.

Their stock forecasting model considers trends, volatility, and a large range of other factors to predict where prices will be in the coming weeks and months.

There are three main timeframes they focus on Intraday (5-minute intervals), Short-term (Out to 10 days), and Long-term (out to 6 months).

The rest of this section will focus on the long-term section, but the data structure is the same across all their timeframes.

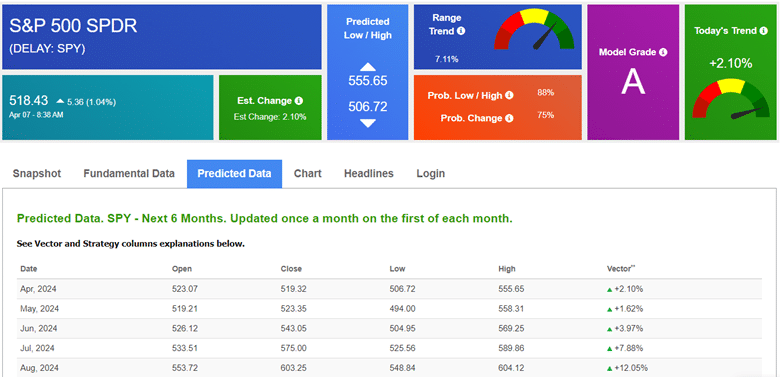

The above is a sample of the long-term predictions for the SPY.

The first thing to look at is the tiles across the top of the screen.

These tiles are a quick glance at the basic trend, direction, and volatility over the next few sessions and the trend’s strength and momentum.

Range Trend and Today’s Trend

The Range Trend and Today’s Trend show how strong the stock’s momentum is and the overall price trend.

The Predicted high and low are similar to the predictive statistics mentioned above and are a price envelope that Tradespoon expects the price to stay within.

The Model Grade is how confident they are in their model, and the probability of Low/High and Probability of Change show the odds of the price staying in the envelope and the odds that the Estimated Change block is accurate.

These numbers and grades are based on how the models performed historically against live data.

Finally, the predicted values at the bottom are the returns the model expects over the coming six months.

Based on this model, we are in for a great rest of the year, returning an additional 15% over the coming months in the SPY.

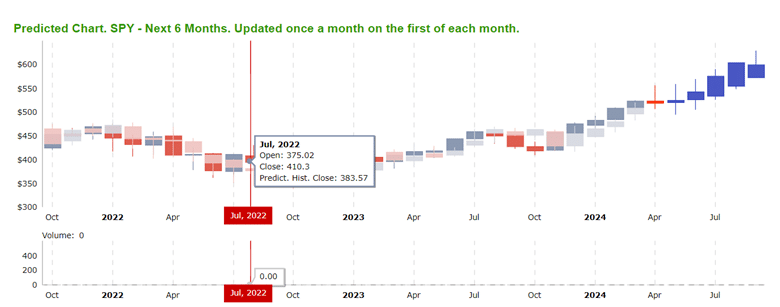

All of these values can also be seen in a chart format, as referenced below, where you can see how the past predictions played out with actual data and where the future predictions place us on a chart.

Tradespoon additionally offers headlines, fundamental data, and a snapshot of the company in its predictive model pages.

Pricing

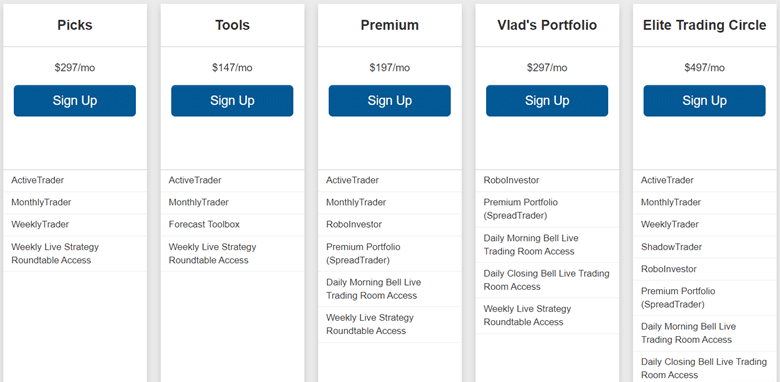

So far, all of the tools Tradespoon offers are simple to use and implement in your trading. Pricing is where things can get a little complicated, though.

They offer both packages and stand-alone services that you can mix and match to customize your subscription.

The packages range in price from $150/month to $500/month, depending on your preferences.

The complete list of packages and what they include are seen below.

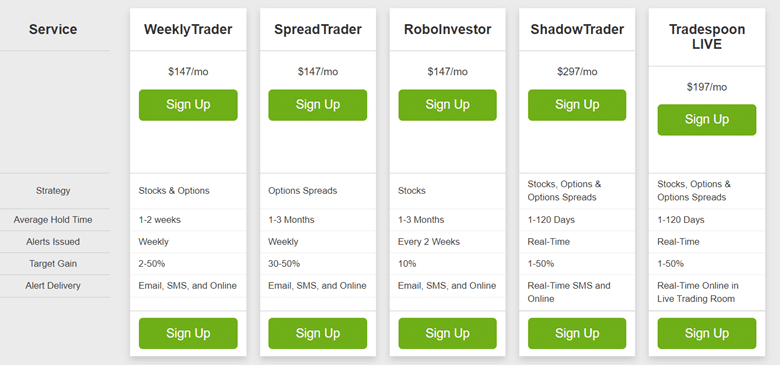

Next up are the add-ons/stand-alone pricing.

Most of these are in the $150/month range, with the more in-depth ones (Tradespoon Live and Shadowtrader) topping out at $200 and $300 monthly, respectively.

The rest of the details for the stand-alone services can be seen in the image below, which are unique to each service.

Another thing to bring up is substantial discounts for purchasing all these packages or services yearly.

Still, there is a significant upfront expenditure for these options.

Wrapping It Up

Now that we have gone through many of the tools and services that Tradespoon offers let’s see if there is actual value in these services.

The largest downside to Tradespoon is the cost associated with it.

If you want to purchase one of the higher packages, expect to spend at least $200/month. If you purchase several packages and add-ons, the monthly bill can extend well over the $500 mark.

That said, there is a lot of potential value here for larger traders who can afford the associated monthly costs.

The average return per trade on the live trading is over 30%, according to their performance reports.

This has led to a pretty remarkable hypothetical gain over the past four years.

So, with all of this in mind, is Tradespoon worth it?

The answer is potentially.

It is worth the cost if you can afford the services and are looking for the tools they offer.

These AI tools are always improving, and at some point, we could possibly predict market movement.

We hope you enjoyed this Tradespoon review.

If you have any questions, please send an email or leave a comment below.

Trade safe!

Disclaimer: The information above is for educational purposes only and should not be treated as investment advice. The strategy presented would not be suitable for investors who are not familiar with exchange traded options. Any readers interested in this strategy should do their own research and seek advice from a licensed financial adviser.

Original source: https://optionstradingiq.com/tradespoon-review/