Right on the front page of their website, QuantConnect claims to be the “world’s leading algorithmic trading platform.”

What does that mean?

An algorithmic trading platform is a software-based solution that allows traders to develop, test, and execute trading strategies using their own specific algorithms.

Contents

-

-

-

-

-

- Cloud-Based

- Sign Up

- QuantConnect Community

- Quantitative Analysts

- Extensive Documentation

- Conclusion

-

-

-

-

The typical workflow of someone using QuantConnect might be:

- Write a trading algorithm using Python and C# programming language.

- Backtest the algorithm by running it on historical market data.

- Forward test the algorithm by simulating runs on live data.

- Analyze results and refine the algorithm.

- Repeat steps 1 to 4 until you are satisfied with the algorithm

- Integrate with various brokerages such as Interactive Brokers, Oanda, Tradier, and others to execute the algorithm with live money.

Cloud-Based

In the case of QuantConnect, the software platform is cloud-based, which means that once you sign up and log in, you can use the software via your web browser.

Nothing to download.

Nothing to install.

Sign Up

The sign-up is free.

The free plan includes unlimited backtesting.

However, anything live and automatic trading will require a paid plan whose pricing depends on the number of users, features, and resources used.

Resources used in the cloud are priced by the number of compute nodes you use.

You can customize the number of backtesting, research, and live trading nodes.

QuantConnect Community

QuantConnect allows community sharing of algorithms.

You can browse various strategies that other members have created.

And if you find one that you like, you can close that strategy and modify it to make it your own.

The QuantConnect Team created many strategies.

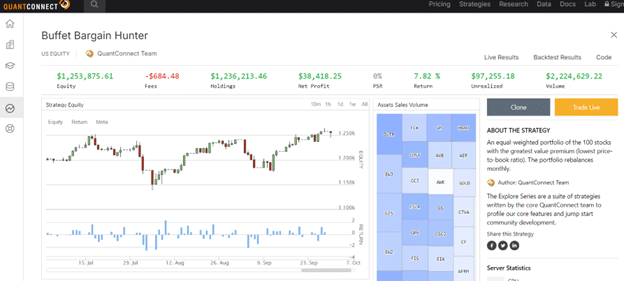

Here is an example that I found in the Strategy Explorer:

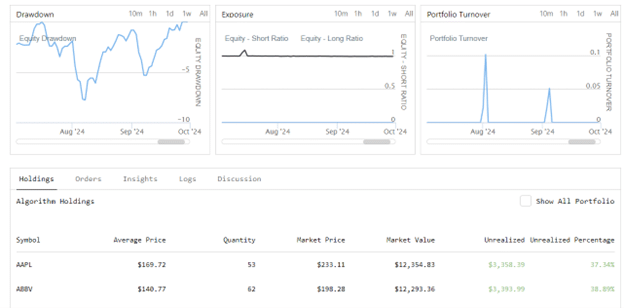

Knowing the drawdown of a strategy is important, and you can see a chart of it:

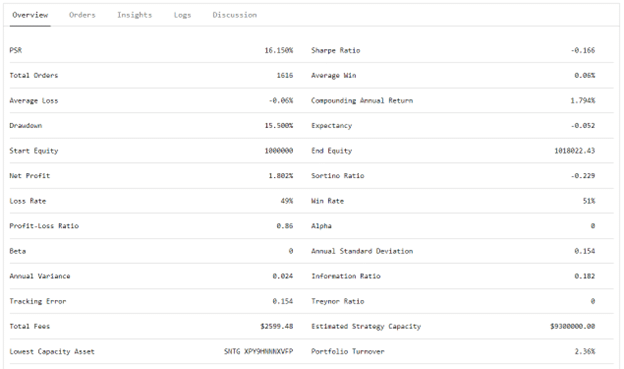

Looking at the backtest results of this strategy, you can see valuable statistics like the Sharpe Ratio, etc:

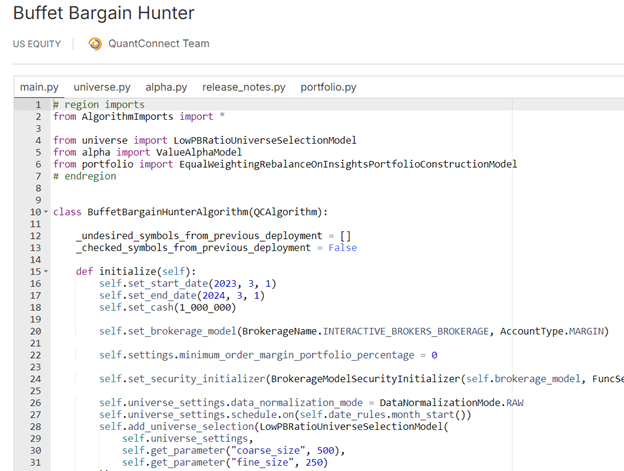

The code for this algorithm looks like this:

If you are not a programmer familiar with the Python programming language, then this might be a bit difficult to understand.

Quantitative Analysts

QuantConnect is designed for quantitative analysts (quants) in the trading industry, and it can write strategies in Python and C#.

I guess that’s why the average salary of a quantitative analyst in the United States is around $150,000 per year.

A computer science student with a summer internship with a trading firm can earn between $75 and $100 per hour [YouTube reference].

This is not to say that a motivated retail trader can not learn the subject matter and take advantage of the power and dataset available in the QuantConnect platform.

But the learning curve and time commitment would be steep, in my humble opinion.

Extensive Documentation

However, for those willing to devote the time to learn, QuantConnect has extensive documentation that is very good.

Just within the “Writing Algorithms” section, it has a dozen sub-sections…

The documentation is not for the casual user.

You really should already know how to program before attempting to read this.

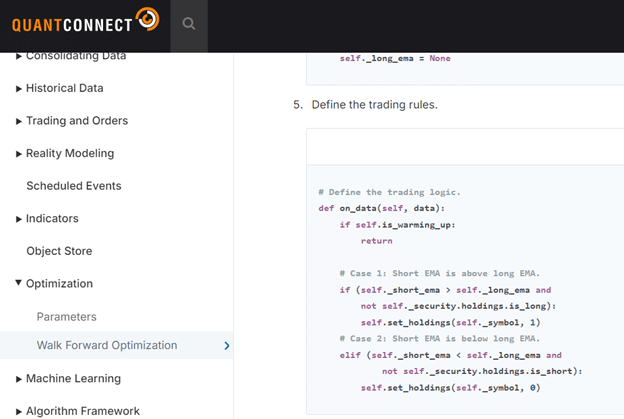

Here is an example from their documentation on implementing a walk-forward optimization for an exponential moving average (EMA) crossover strategy.

This is just step 5 out of 11 and is written in Python.

However, some examples exist in the C# (pronounced C-sharp) programming language.

Python and C# are the two programming languages you can use in the QuantConnect platform.

Conclusion

Those who are skilled enough to code up and test their own algorithms can potentially find a profitable strategy in that they can have QuantConnect execute live trades automatically via a connection with their brokerage account.

QuantConnect would indeed be a valuable tool in that case.

It may even be, as they say, “the world’s leading algorithmic trading platform.”

I can not substantiate this claim one way or the other, as I am neither a quantitative analyst nor a programmer.

I have no reason to doubt that claim from what I have seen.

We hope you enjoyed this article on QuantConnect.

If you have any questions, please send an email or leave a comment below.

Trade safe!

Disclaimer: The information above is for educational purposes only and should not be treated as investment advice. The strategy presented would not be suitable for investors who are not familiar with exchange traded options. Any readers interested in this strategy should do their own research and seek advice from a licensed financial adviser.

Original source: https://optionstradingiq.com/quantconnect-review/