Let me be more specific on what ratio spread I’m talking about.

Because there are many types of ratio spreads.

Contents

-

-

-

-

- Price Of Stock Greater Than Strike Prices

- Price Of Stock Between The Strike Prices

- Price Of Stock Below The Short Strikes

- Conclusion

-

-

-

We will use the following ratio spread on Salesforce (CRM) as an example.

Date: Jul 1, 2024

Price: CRM @ $256.45

Sell two contracts Aug 9 CRM $240 put @ $2.40

Buy one contract Aug 9 CRM $245 put @ $3.43

Net credit: $136

We are using all put options.

These options are all out-of-the-money to begin with.

That means that the strike prices are below the stock’s current price.

It is important to note that this ratio spread receives a credit at the start of the trade.

Depending on what strike price is selected, it is possible that a ratio spread of this type may require a debit.

Today, we are only looking at the ones that receive a credit, as they behave somewhat similar to a credit spread.

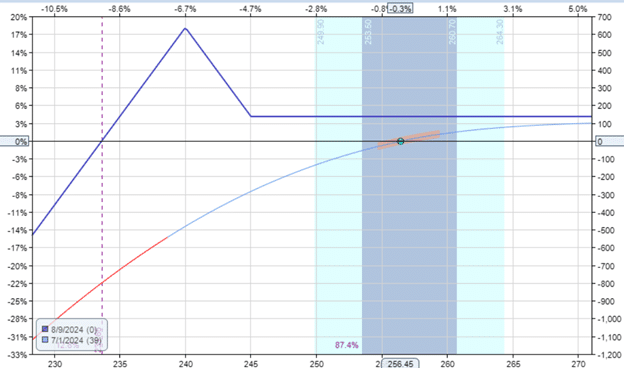

The bottom horizontal axis of this payoff diagram shows the CRM price.

It is currently at $256.45

The right vertical axis shows the profit and loss of the stock (P&L).

The solid blue line indicates the P&L at expiration on Aug 9, which is 39 days from when the trade is initiated.

This line is called the expiration line.

The curved line represents the P&L at the current time.

There are four possibilities at option expiration.

- The stock price of CRM is greater than $245

- The stock price of CRM is between $240 and $245

- The stock price of CRM is between $240 and $233.64

- The stock price of CRM is below $233.64

The prices of $240 and $245 are the strike prices of the ratio spread.

This is also where the solid blue expiration graph pivots and changes direction.

Price Of Stock Greater Than Strike Prices

If CRM is greater than $245, then all of the put options remain out-of-the-money.

If put options are out-of-the-money at expiration, they become worthless.

No money changes hands.

No assignment of options.

Nothing happens.

The options disappear.

The investor keeps the initial $136 they received at the start of the trade.

You can see from the expiration graph that the trade’s profit is $136 if CRM is above $245 at expiration.

Price Of Stock Between The Strike Prices

If CRM is between $240 and $245 at expiration, the price is within the debit spread of the ratio spread.

What do I mean?

You can think of the ratio spread as a put debit combined with a short put option.

Put Debit Spread:

Sell one contract Aug 9 CRM $240 put @ $2.40

Buy one contract Aug 9 CRM $245 put @ $3.43

Short Put:

Sell one contract Aug 9 CRM $240 put @ $2.40

Considering the short put option, CRM is above the short strike of $240.

Therefore, the short put is out-of-the-money and expires worthless.

Considering the put debit spread, CRM is above the short put option strike price of $240.

Therefore, this second short put also expires worthless.

CRM market price is below the long put option with a strike of $245.

The put option holder has the right to sell CRM at $245.

If the investor had 100 shares of CRM, that would be what the investor would do since it is of financial benefit for the investor to do so.

Many brokers will automatically do this for the investor at expiration.

However, if the investor did not have 100 shares of CRM to sell, the investor would see cash coming into the account instead.

It would be as if the broker purchased 100 shares of CRM at the current market price and then sold it at $245.

Depending on how far the market price is below the strike price, that cash could be as little as a penny or as much as $500.

The max profit of the debit spread is $500 because if one were to buy at $240 and sell at $245.

This is in addition to the initial credit of $136 at the start of the trade.

So max profit on the ratio spread is $136 + 500 = $636.

And this is what you see in the profit graph.

It peaks at $636 when the price of CRM is at $240 at expiration.

An easy way to remember is that the max profit of a ratio spread of this type is the credit received plus the width of the strikes.

Remember to multiply the width of the strikes by 100, though.

Price Of Stock Below The Short Strikes

The two short puts have strikes at $240. We say that the short strikes are at $240.

If CRM is below the short strikes, does the investor get assigned the stock?

Yes, they do.

But only on one of the short puts.

Again, we must break the ratio spread into a debit spread and a short put.

Put Debit Spread:

Sell one contract Aug 9 CRM $240 put @ $2.40

Buy one contract Aug 9 CRM $245 put @ $3.43

Short Put:

Sell one contract Aug 9 CRM $240 put @ $2.40

With CRM below $240, the debit spread is at a maximum profit, and the investor gains $500 cash from it.

The investor is assigned 100 shares of stock at $240 per share on that second short put option.

At expiration, there is no more ratio spread, and the investor is left holding 100 shares of CRM stock.

Did the investor profit overall or not?

That depends on how far below $240 the price of CRM was at expiration.

The net cash received is $636 due to the initial credit of $136 plus $500 from the debit spread.

That means CRM can go below the strike price by $6.36 and remain profitable.

So $240 – $6.36 = $233.64.

That is the breakeven price.

You can confirm in the above graph that this is the CRM price where the expiration P&L crosses the zero profit horizontal.

If CRM is between $240 and $233.64, the trade is profitable even though 100 shares of stock are assigned.

If CRM is below $233.64, the trade is at a loss with 100 shares of stock assigned.

Conclusion

A few other points of note for this put credit ratio spread.

It is possible for such a spread to be initiated for a credit and to be closed for another credit.

Just because the trade structure has two short put options does not mean you will get assigned 200 shares of stocks.

At most, you can only be assigned 100 shares.

Therefore, an investor needs to have cash available to purchase 100 shares if the investor plans to hold the trade to expiration.

Some investors may want to hold to expiration with the plan to transition to the option wheel strategy when shares are assigned.

We hope you enjoyed this article on what happens in an options ratio spread at expiration.

If you have any questions, please send an email or leave a comment below.

Trade safe!

Disclaimer: The information above is for educational purposes only and should not be treated as investment advice. The strategy presented would not be suitable for investors who are not familiar with exchange traded options. Any readers interested in this strategy should do their own research and seek advice from a licensed financial adviser.

Original source: https://optionstradingiq.com/ratio-spread-at-expiration/