What is a good delta for options?

This is a common question.

One that I had asked myself when I was first getting started with options.

So, I did what any rational investor would do.

Open up my browser and asked my search engine.

Answers from reputable option educators range all over the place.

The truth is that any delta between 45 to 15 delta will work fine.

These represent the extreme ends of the spectrum where the correct delta for you depends on your trading style, risk tolerance, and directional conviction on the stock.

This article will look at the pros and cons and the trade-offs that you will make as you move from one end to the other end of the spectrum.

Contents

-

-

-

-

- Bull Put Spread Example

- Selling Close To The Money

- Selling Further Away From The Money

- Risk Profiles

- What Delta To Avoid

- Adding Trading Rules

- Delta

- Theta

- Vega

- Conclusion

-

-

-

Bull Put Spread Example

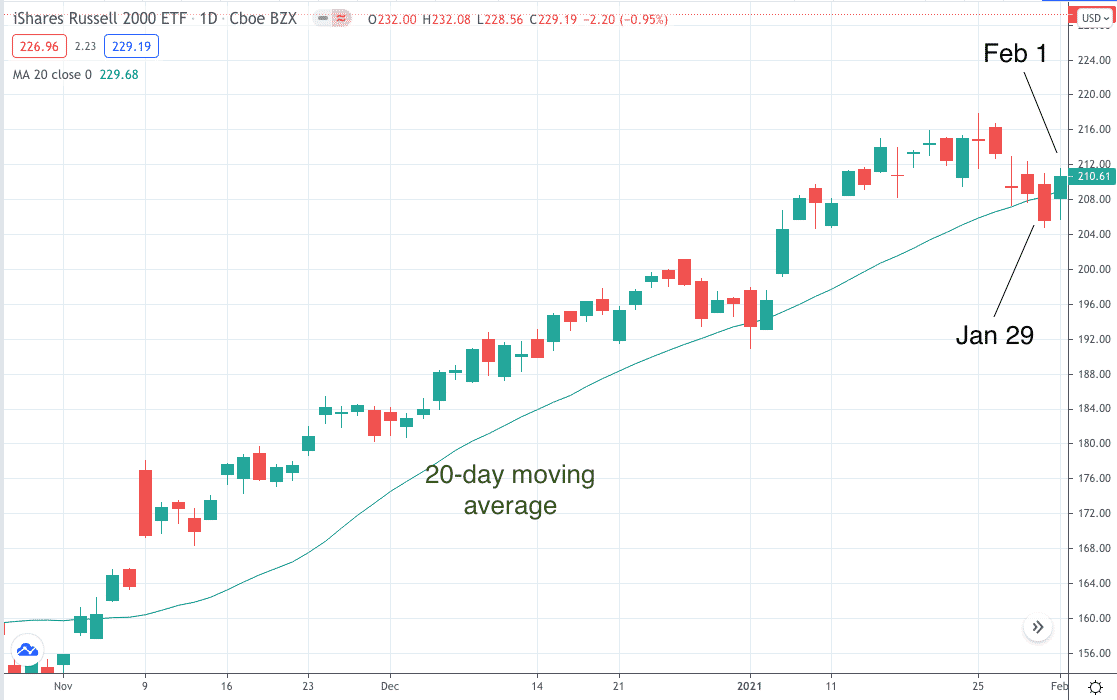

In early 2021, we see that the Russell 2000 ETF (ticker IWM) is in an uptrend where it pulls back to the 20-day moving average and rallies up from there.

On January 29th, 2021, it pulled back to the moving average again.

In the next trading session on February 1st, IWM trades above the high of the previous session.

Suppose two investors initiate a bull put spread on the close of February 1st.

Investor A sells close to the money at the 45 delta.

Investor B sells further out-of-the-money at 15 delta.

We have adjusted the contract size so that both investors receive an initial credit of about $450, which is their maximum potential profit on the trade.

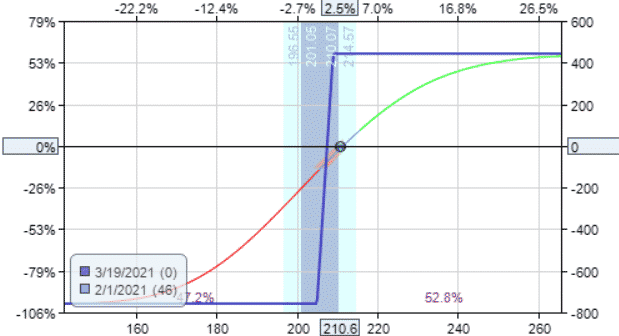

Selling Close To The Money

Date: Feb 1st

Price: $210.60

Sell three Mar 19 IWM $209 put @$8.83

Buy three Mar 19 IWM $205 put @$7.35

Credit Received: $443

Max Risk: $1200 – $443 = $757

Risk to Reward Ratio: 1.7 (if held to expiration)

Breakeven: $207.52 (1.5% down from current price)

Delta: 18.93

Theta: -0.09

Vega: -2.93

Gamma: 0.12

The payoff diagram looks like this:

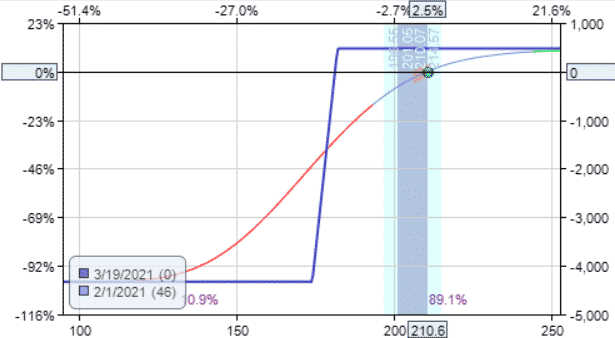

Selling Further Away From The Money

Now let’s look at investor B:

Trade Details:

Sell six Mar 19 IWM $182 puts @$2.44

Buy six Mar 19 IWM $174 puts @$1.65

Credit Received: $474

Max Risk: $4800 – $474 = $4326

Risk to Reward Ratio: 9.1 (if held to expiration)

Breakeven: $181.21 (14% down from current price)

Delta: 26.31

Theta: 7.76

Vega: -23.21

Gamma: -1.96

Risk Profiles

The one big difference that you can see from the graph and the numbers is the risk profile.

Selling further of the money means a higher max risk and margin requirement — a max risk of $4326 versus $757.

Selling further out of the money has a higher risk to reward of 9.1. Whereas selling closer to the money has a lower risk to reward of 1.7.

The trade-off is that a lower risk to reward has a lower probability of profit — assuming all other things being equal.

It is just the way it is. You can see that by looking at the delta as a proxy for the probability of price being in the money at expiration.

Selling at the 45-delta implies a 45% chance that the price will be below the strike price at expiration.

Selling at the 15-delta implies only a 15% chance that the price will be below the strike price at expiration.

4 Tips for Better Iron Condor Trading

If both investors were to hold their position till expiration, Investor B would have a higher chance of being profitable.

This makes intuitive sense because investor B is selling further away from the current price, and the breakeven point is 14% below the current price.

In contrast, Investor A’s breakeven point is only 1.5% away from the current price.

But on those occasions when Investor B is not profitable, the losses will be greater than that of Investor A.

And if, upon assignment, Investor B would be forced to buy 600 shares of IWM.

In comparison, investor A would be forced to buy only 300 shares.

So, it all balances out at the end.

This is why there are successful investors that sell at the 45-delta.

And some equally successful investors sell at the 15-delta.

What Delta to Avoid

Avoid deltas that are in the low single digits. They are too far out of the money.

The risk to reward ratio ends up going above 10, which you don’t want.

This is when the credit you receive is too low for the risk you are taking — known in the industry as “picking up pennies in front of a steam roller.”

Also, liquidity starts to thin out, and the bid-ask spread gets wider, not something you want when trading options.

Adding Trading Rules

Following our trading rules of credit spreads, both investors use a stop loss of 1.5 times the credit received.

Investors will take profit if 50% of the income potential has been achieved in less than 50% of the time. Otherwise, hold to expiry.

To keep the examples simple, we will not make any adjustments here, but you probably will want to add that to your trading plan.

Playing out the hypothetical trade in OptionNet Explorer, Investor A took a profit of $263 on February 8th.

Investor B hits the profit target in a shorter amount of time on February 4th with $255.

There is not much difference in P&L because we have adjusted both trades to have the same potential max profit of around $450, and both took profits at 50% of that.

However, due to the smaller credit received from selling further out of the money, Investor B had to sell twice as many contracts to achieve this — six contracts instead of three.

The max loss of a credit spread should never be reached because both investors would be stopped out at 1.5 times credit received — or roughly around $675.

By adding in the take profit and stop-loss rules, we have altered the risk profile of both trades.

The risk to reward of both trades is now 3.

You can see this more easily with round numbers.

Suppose both investors receive an initial credit of $450.

Then their profit target is $225, and their stop loss is $675.

That is a risk to reward of $675/$225 = 3.

Delta

Now we look at the differences in the options Greeks.

The bull put spread is a directional trade, and delta is a measure of that directionality.

It measures the amount of P&L change per unit change in the price.

Intuitively, the delta is the slope of the T+0 line of the above payoff graphs.

A flat slope means a lower magnitude delta. A steep slope means a larger magnitude of delta.

When selling at the 45 delta, the slope at the start of the trade is at the steeper portion of the curve (middle of the S-curve).

Selling at the 15 delta has a much gentler slope since it is closer to the edge of the S-curve.

The 45 delta is more directional. It has a larger delta.

But wait.

Then how come the delta of Investor B at 26.31 is larger than the delta of Investor A at 18.93?

That is because those are total deltas of six contracts versus three contracts of Investor A. The delta gets multiplied by the number of contracts.

To avoid the effects of position size, we look at the Greeks on a per contract basis and see the following:

At the 45 delta:

Delta/contract: 6.31

Theta/contract: -0.03

Vega/contract: -0.98

Gamma/contract: 0.04

Delta/Theta ratio: 210

Theta/Vega ratio: 0.03

At the 15 delta:

Delta/contract: 4.39

Theta/contract: 1.29

Vega/contract: -3.87

Gamma/contract: -0.33

Delta/Theta ratio: 3.4

Theta/Vega ratio: 0.33

Yes, indeed, selling closer to the money has a higher delta on a per-contract basis.

Another notable point is that selling close to the current price gives you small theta, vega, and gamma.

That leaves the major driving factor of Investor A’s P&L to be the delta.

It is almost a pure directional play.

The Delta/Theta ratio is high.

Theta

Selling further out-of-the-money, you will get some good positive theta.

This puts time on your side.

Investor B’s out-of-the-money credit spread will gain value with each passing day, even if all other things are held constant.

So, if you want to get the benefit of time-decay in your credit spreads, you need to sell them further out-of-the-money.

Vega

As you sell further out-of-the-money, you will start getting volatility exposures in vega.

That means changes in implied volatility of the options will begin to affect the P&L.

Option investors tend to like to have large theta, but they don’t want significant vega exposure.

The theta/vega ratio measures this relationship.

As detailed in another article, selling further away from the money results in better theta/vega ratios.

Conclusion

Sorry to not be able to give you a definitive strike selection for selling options.

Any delta from 45 and 15 is good. It depends on all the trade-off factors mentions.

You don’t need to sell at the same delta consistently.

You can move and adjust where you want that short strike based on the market price structure.

When selling put options, place that short strike below a support zone.

When selling call options, place that short strike above a resistance zone.

If you see a good setup and are confident of your direction, sell at deltas closer to the money for a more pure directional play.

When the setup is not very bullish nor bearish, sell further out-of-the-money to give you a better probability of profit and let time decay work in your favor.

Trade safe!

Gav.

Disclaimer: The information above is for educational purposes only and should not be treated as investment advice. The strategy presented would not be suitable for investors who are not familiar with exchange traded options. Any readers interested in this strategy should do their own research and seek advice from a licensed financial adviser.

The post Blog first appeared on Options Trading IQ.

Original source: https://optionstradingiq.com/what-is-a-good-delta-for-options/