The week of the 2024 United States Presidential Election had the potential to move the prices of equities up or down quite a bit.

This was not only due to the election but also the FOMC press conference and some notable corporate earnings reports that were coming out the same week.

Contents

-

-

-

-

- Post Election Results

- Nov 7

- Waited Too Long To Close

- Summary

-

-

-

The ratio backspread benefits from large price moves.

They come in various sizes and flavors.

The one that we will show here is the two-by-three call ratio backspread.

When you hear the word “ratio backspread,” it means the trade buys more options than it sells.

A two-by-three means that it sells two options and buys three options.

The options have to be of the same type (meaning all calls or all put options).

In this case, we are using call options.

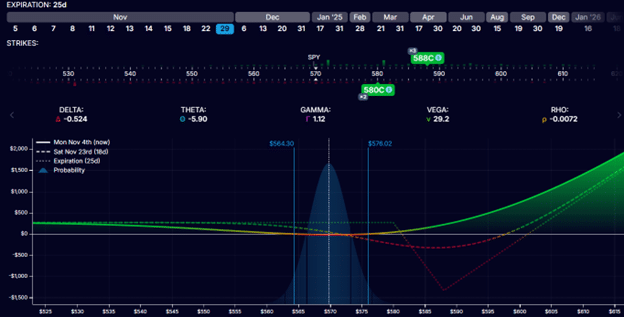

Here is the risk graph of a call ratio backspread on SPY (the S&P 500 ETF).

The following trade is initiated before the election, hoping to profit from a large price move post-election.

Date: Nov 4, 2024

Price: SPY @ $570

Sell two Nov 29 SPY $580 call @ $7.56

Buy three Nov 29 SPY $588 call @ $4.15

Net Credit: $267

This is place as one single order with option expirations 25 days away.

The strikes are selected so that the trades start relatively delta-neutral. Delta is -0.5.

Trades that start as delta-neutral are not necessarily range-bound trades where we want the price to be in a narrow range.

Our graph shows that this trade benefits if the price of SPY makes a large move, either up or down.

The white vertical line is where the current price of SPY is.

It is at the bottom of the T+0 profit and loss (P&L) curve.

As the price moves up or down, the P&L curve goes up with greater profits.

Suppose it makes this large move earlier, the better.

This is because this trade has a negative theta.

The more days the trade sits around without the price moving, the more money this trade will lose.

The vega is positive. So we say this is a long vega trade.

Theoretically speaking, it benefits if volatility increases.

Before the uncertain events, the volatility was high.

If it turns out that the uncertain events resolve themselves without causing a large move in the market, then volatility is likely to drop, and this trade could lose.

How much can this trade lose?

Well, it can lose up to $1300.

But only if we hold the trade to expiration and SPY is at $588 at expiration.

From the above graph, the call strike price of $588 forms the lowest point of the expiration graph.

Therefore, we don’t want to hold this trade until its expiration.

The earlier we get out of the trade, the better.

Post Election Results

The day after the election, on the morning of Nov 6, the American Press announced the election results.

Uncertainty resolved.

Volatility dropped. And SPY gapped up from the close of $576.70 the previous day to open at $589.20 – over a 2% move.

Source: tradingview.com

With this large of a move, the ratio spread profits.

The price of SPY (the white vertical line) is in the green area of the graph.

If the trader decides to take the profit, the trade can be exited with one single order like this.

Date: Nov 6, 2024

Price: SPY @ $588.95

Buy to close two Nov 29th SPY $580 call @ $14.38

Sell to close three Nov 29th SPY $588 call @ $8.82

Debit: -$230

An initial credit of $267 and paying $230 to close gives a net profit of $37.

Out of a max risk of $1300, that is a 3% return.

To some traders, that may not be such a spectacular return.

This is because there was a drop in volatility as the VIX went down from 20.50 to 16.06, which is unfavorable for the trade due to its positive vega.

However, the delta Greek here is more significant than the vega, and the large price move was enough to make the trade net profitable.

Nov 7

What happens if the trader decides to hold the trade for one more day?

Nov 7 is another rally day.

This is good for the trade because it continued moving in the same direction it had moved the day before.

This means the trade profits more and would cost even less to close.

In fact, it only costs $45 to close the trade on this day.

Buy to close two Nov 29th SPY $580 call

Sell to close three Nov 29th SPY $588 call

Debit: -$45

Closing the trade at this time would result in a profit of $267 – $45 = $222, or a $222/$1300 = 17% return on risk.

Nov 11

On Nov 11, SPY was up again, reaching for the 600 mark.

To avoid the risk of a pullback, the trader closes the trade.

Date: Nov 11

Price: SPY @ $599

Buy to close two Nov 29 SPY 580 call @ $22.11

Sell to close three Nov 29 SPY 588 call @ $14.99

Credit: $75

With an initial credit at the start of the trade of $267 plus $75 credit to close the trade, the net profit is $342, a 26% return on risk.

A point worth noting is that this time, we are closing the trade for a credit instead of for a debit, as we did the previous two times.

Ratio spreads have the characteristic that initiating the trade for a credit and closing the trade for an additional credit is possible.

Waited Too Long To Close

If the trader waited too long to take profit, all the gains were taken away on Nov 15 when the SPY pulled back down to 585.

The price indicated the white vertical line now landed at the low point of the T+0 profit curve:

To close the spread now requires a debit of -$535.

With an initial credit of $267, that would be a loss of -$268 in the trade, a 20% loss.

Summary

See how the price gapped up post-election, continued to its peak at $600, and then came back down.

That top where SPY was at the price of $600 would be when the ratio backspread would be the most profitable as it is where the price had moved the farthest.

Of course, picking the top is not always easy.

Picking when to exit the ratio spread is an art.

The trader has to stay in long enough for a large move.

However, staying too long means that time is working against the trade and the possibility that volatility and price will go against the trade.

Because one is always buying more options than selling, the backspread is a limited risk strategy.

As in our example, the ratio between buying and selling does not always have to be three to two.

The ratio can simply be two to one.

We hope you enjoyed this article on how the two-by-three ratio backspread over the election.

If you have any questions, please send an email or leave a comment below.

Trade safe!

Disclaimer: The information above is for educational purposes only and should not be treated as investment advice. The strategy presented would not be suitable for investors who are not familiar with exchange traded options. Any readers interested in this strategy should do their own research and seek advice from a licensed financial adviser.

Original source: https://optionstradingiq.com/two-by-three-ratio-backspread/