As a review, an iron condor is an out-of-the-money put spread plus an out-of-the-money call spread.

Contents

-

-

-

- Iron Condor Adjustment: Rolling Tested Spread Away

- Iron Condor Adjustment: Rolling Un-tested Spread In

- Iron Condor Adjustment: Delta Hedge

- Iron Condor Adjustment: Rolling Out InTime

- Summary

-

-

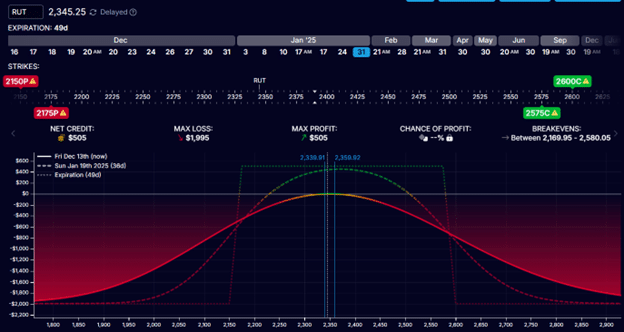

Here is a typical iron condor on the RUT index with the short put and short call at around 15-delta.

It started out with 49 days till expiration.

Put spread:

Sell one contract 2175 put

Buy one contract 2150 put

Call spread:

Sell one contract 2575 call

Buy one contract 2600 call

With a credit received of $505 and a max risk of $1995, its potential return is 25% of capital at risk.

From a different perspective, this iron condor has a risk-to-reward of 4-to-1.

This assumes that it is held to expiration.

Many investors may not hold it to expiration due to high gamma exposure, thereby capturing smaller rewards and taking a smaller risk.

To be profitable with iron condors, we have a strategy for what to do when either spread gets tested.

By that, we mean when the price of the underlying approaches one of the spreads and causes that spread to take on losses.

While there are many techniques to adjust the iron condor, we present four of my favorite ways today.

- Rolling the tested spread away from the price

- Rolling the untested spread closer to the price

- Delta hedging with stock

- Rolling the condor out in time

Iron Condor Adjustment: Rolling Tested Spread Away

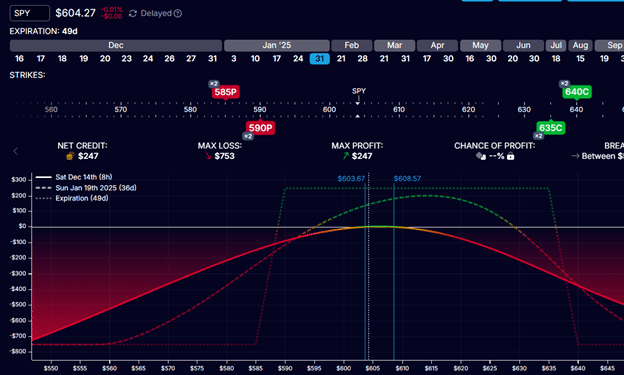

Here is an example of a two-contract iron condor on SPY where the put spread is being tested:

The current price of SPY is $604.

The white vertical line indicates it has approached the put spread.

The short put started out at the 15-delta and is now at the 28-delta.

This is a good time to adjust.

In fact, one can place an alert to signal the investor when the price gets to that price point.

We never want the underlying price to reach the short strike at $590.

Because waiting till then to adjust is usually too late.

We will make a defensive adjustment by rolling the put spread down away from the price.

First, we close the existing spread:

Buy to close two contracts of the $590 put

Sell to close two contracts of the $585 put

Net debit: -$170

In this case, we have to pay $85 to close each spread.

So, a net debit of $170 will be used to close two contracts.

Next, we sell two put spreads further away (at the 15-delta).

Sell to open two contracts of the $570 put

Buy to open two contracts of the $565 put

Net credit: $76

We get a net credit of $76 for two contracts.

Therefore, we had to pay $94 to perform this roll.

The resulting risk graph at expiration looks like this:

See how the price is now recentered on the iron condor.

Also, compare the max loss and max profit shown in the modeling software before and after the adjustment.

Because we paid money to perform the adjustment, our max risk increased by approximately $94, and our max profit decreased by $94.

We say approximately to account for a dollar or two off due to non-optimal fill prices from the differences between the bid and ask prices.

We call this slippage.

The larger our starting credit, the more credit we had to spend to make these defensive adjustments when needed.

Iron Condor Adjustment: Rolling Un-tested Spread In

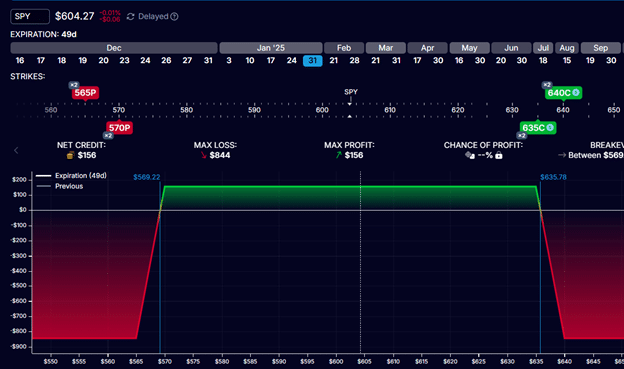

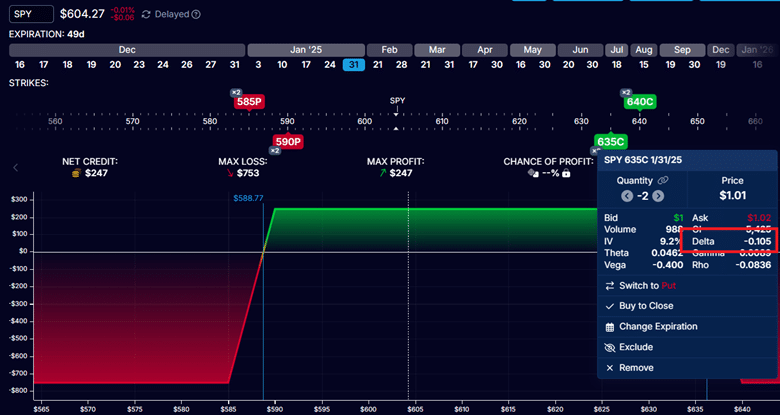

Returning to our original SPY condor where the put spread is being tested:

Because the price moved away from the call spread, the short 635 call, originally at around 15-delta, is now showing at 10-delta.

For this second adjustment technique, we will roll the untested call spread in:

Buy to close two contracts of the $635 call

Sell to close two contracts of the $640 call

Net debit: -$80

Sell to open two contracts of the $630 call

Buy to open two contracts of the $635 call

Net credit: $122

By being aggressive and rolling the call spread, we get a net credit of $42 in this offensive adjustment.

This is reflected in the resulting risk graph:

With a higher max potential profit – an increase from $247 to $290 (which is equal to the credit received for the roll)

The max loss is also reduced by that amount, from $753 to $710.

One problem with this adjustment is that if the market reverses, it can test our call spread, which we had moved closer to.

However, one can argue that since we were willing to set our call spread at the 15-delta initially, why wouldn’t we set it back to the 15-delta now?

It is also possible to perform both adjustments simultaneously: rolling the put spread out and rolling the call spread in.

Iron Condor Adjustment: Delta Hedge

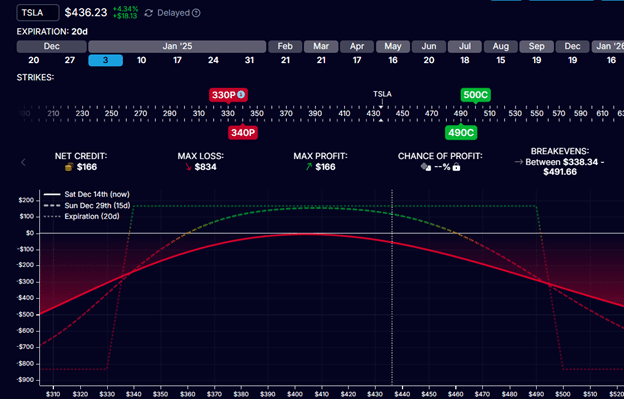

In this example, we use Tesla’s (TSLA) stock iron condor with 20 days left until expiration.

Its call spread is under pressure due to the price moving up to $436 per share.

Its short call has risen from the 15-delta to the 26-delta.

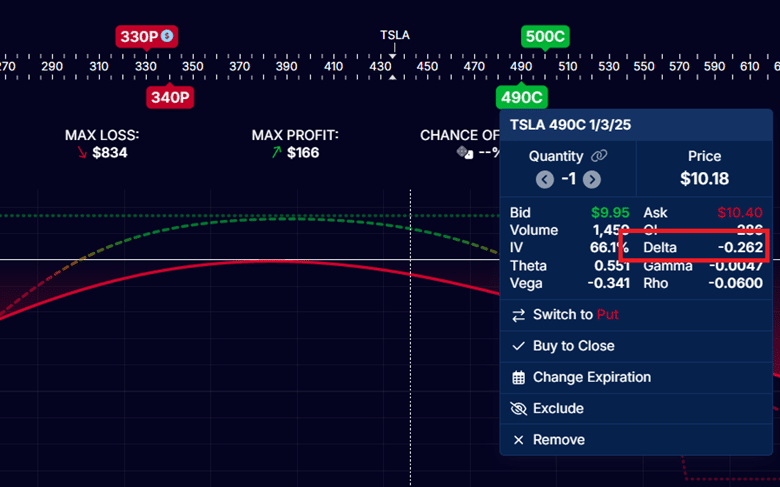

We say “26-delta” loosely. More precisely, it is a negative -0.26 delta:

The short call has a negative delta because it benefits when the underlying price goes down.

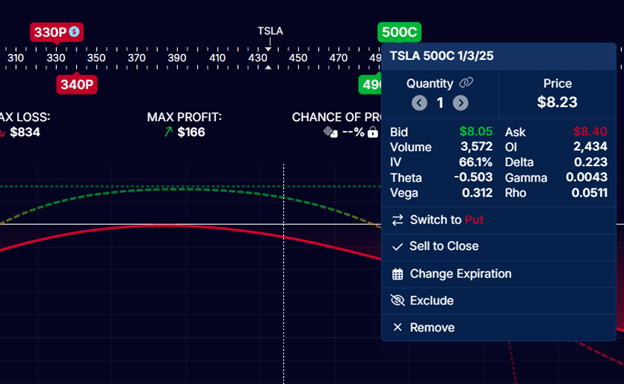

The long call has a positive delta of 0.22 because it benefits when the price goes up:

Reading from the modeling software or trading platform, we can see that the short put has a 0.05 delta per contract, and the long put has a -0.04 delta per contract.

Note that the signs of the deltas for puts are opposite to the calls.

If we add up all the deltas, we have a net -0.03 deltas for a one-contract iron condor.

If you have two contracts, double the deltas accordingly.

Overall, a negative delta means that the trade benefits if the price of TSLA goes down.

This makes sense because it has negative deltas.

Our current profit and loss line (the T+0 curve line) is slanting downwards, indicating that this trade would lose money if the price continued up.

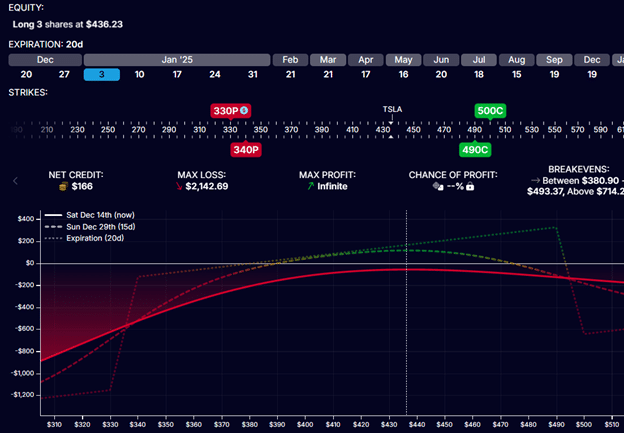

To hedge off the loss if the price continues up, we buy TSLA stock.

How much stock should we buy?

Because we have a net -0.03 deltas on the iron condor, we need to buy three shares of TSLA stock.

Just remember that 1.0 delta is equivalent to 100 shares of stock.

Look how our T+0 line has flattened after buying three TSLA shares at $436 per share:

This does increase our max risk by $1308 (equivalent to 3 x $436).

So, we need to have enough capital in our account to accommodate this.

We also would sell the shares if the price of TSLA goes back to the center of the condor and when the hedge is no longer needed.

Again, set a price alert for this.

Because stock only affects the Greek delta, there is no effect on theta and vega.

This adjustment does not cause the iron condor to lose theta decay.

The adjustment technique works best on stocks and ETFs you can buy directly.

We can not buy the indices like the RUT and SPX.

However, we can buy their ETF equivalent.

If a RUT iron condor shows a -0.03 delta, one would like to buy three shares of the RUT.

But since we can not, we can buy 30 shares of the IWM instead.

The IWM tracks the movement of the RUT but is 10 times smaller.

Similarly, SPY is the ETF equivalent of SPX, which is 10 times smaller.

Iron Condor Adjustment: Rolling Out In Time

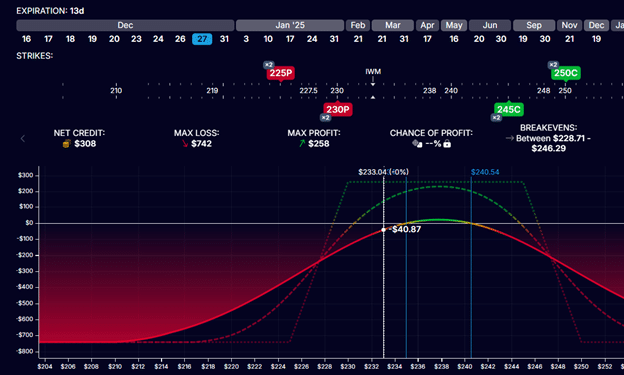

For our last example, suppose we have a two-contract iron condor in IWM.

After a few adjustments to counteract the wild up-and-down price movements of IWM, we ended up with the following iron condor at a $41 loss, with pressure on the put spread and only 13 days left until expiration.

Preferably, we like to get out before the expiration date approaches 14 days because price swings can start to make large changes in our P&L at this point.

We give this condor more time by rolling all four legs to a later expiration to see if we can get back to breakeven.

Close existing condor:

Sell to close two contracts Dec 27th, 2024 IWM $250 call @ $0.13 each

Buy to close two contracts Dec 27th, 2024 IWM $245 call @ $0.33 each

Buy to close two contracts Dec 27th, 2024 IWM $230 put @ $2.28 each

Sell to close two contracts Dec 27th, 2024 IWM $225 put @ $0.93 each

Net debit: -$310

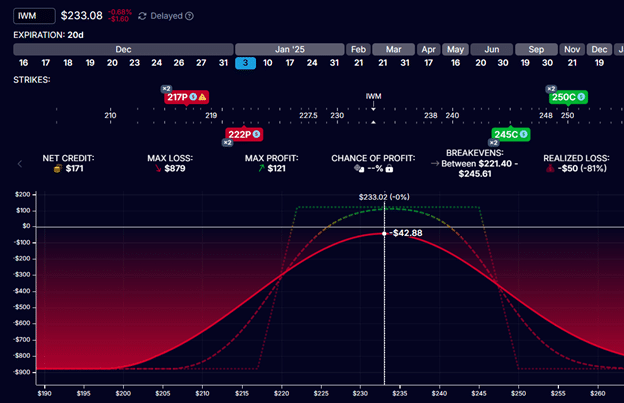

Open a new condor one week further out, keeping the contract size and wing widths the same:

Buy to open two contracts Jan 3rd, 2025 IWM $250 call @ $0.32 each

Sell to open two contracts Jan 3rd, 2025 IWM $245 call @ $0.71 each

Sell to open two contracts Jan 3rd, 2025 IWM $222 put @ $0.96 each

Buy to open two contracts Jan 3rd, 2025 IWM $217 put @ $0.50 each

Net credit: $170

In the process, we recentered the new condor’s strikes so that the short strikes are around the 15-delta.

The resulting risk graph looks like this:

With the condor centered and now with 20 days till expiration.

In theory, our trade P&L should not change with this adjustment.

In practice, you will lose some money due to slippage when opening and closing so many option legs.

This is why we see a P&L of -$43 instead of -$41.

Because our credit for the new condor could not cover the cost of closing the old condor, this adjustment requires a debit of $140.

Note the high of the expiration graph.

Originally, we had a maximum potential profit of $258.

Now, it has decreased to $121.

This is because we had used up $140 of that “credit” to pay for rolling out in time.

This is also why our max risk has increased by approximately $140.

But that’s okay, as we need to gain only $45 to come back to breakeven.

If we want to reduce the cost of the roll, we could roll it even further out in time, such as to the Jan 10th expiration, giving us 27 days till expiration.

Let’s see:

Close existing condor:

Sell to close two contracts Dec 27th, 2024 IWM $250 call @ $0.13 each

Buy to close two contracts Dec 27th, 2024 IWM $245 call @ $0.33 each

Buy to close two contracts Dec 27th, 2024 IWM $230 put @ $2.28 each

Sell to close two contracts Dec 27th, 2024 IWM $225 put @ $0.93 each

Net debit: -$310

Open new condor:

Buy to open two contracts Jan 10th, 2025 IWM $253 call @ $0.46 each

Sell to open two contracts Jan 10th, 2025 IWM $248 call @ $0.88 each

Sell to open two contracts Jan 10th, 2025 IWM $220 put @ $1.23 each

Buy to open two contracts Jan 10th, 2025 IWM $215 put @ $0.73 each

Net credit: $184

The net cost for the roll is now -$126 instead of $140.

We had to roll the strikes of the new condor further away because as we went further out in time, the 15-delta was further away.

Nevertheless, we collected more premium for this new condor because it had more time value.

This new condor has more extrinsic value.

(The condor has no intrinsic value because all its strikes are out-of-the-money.)

Summary

Adjusting iron condors is a balancing act.

In the early stages of the iron condor, we like to either roll the tested spread away and/or roll the untested spread closer.

The former uses up our initial credit.

The latter replenishes our initial credit.

By doing so, we keep the height of our expiration graph above zero.

As the condor gets closer to expiration, we like to utilize the delta hedge technique.

When the condor gets closer to 14 days till expiration and is still not profitable, we can give it more time by rolling the whole condor to a later expiration.

For additional details, watch my video How to Adjust Iron Condors When Tested.

We hope you enjoyed this article on iron condor adjustment strategies.

If you have any questions, please send an email or leave a comment below.

Trade safe!

Disclaimer: The information above is for educational purposes only and should not be treated as investment advice. The strategy presented would not be suitable for investors who are not familiar with exchange traded options. Any readers interested in this strategy should do their own research and seek advice from a licensed financial adviser.

Original source: https://optionstradingiq.com/condor-adjustment-strategies/