What is a bull call spread exit strategy?

When and why do we exit this type of trade?

Today, we will answer these questions and more.

Contents

-

-

-

- Introduction

- Bull Call Spread Overview

- What View Do I Express When I Place this Trade?

- Why Is A Bull Call Spread Easier To Exit Than Short Options?

- When Do I Exit The Trade?

- Can I Hold my Bull Put Spread Till Expiration?

- Concluding Remarks

-

-

Introduction

Bull call spreads allow investors to place a directional view on a stock while customizing it to fit their risk and return preferences.

As such, bull call spreads a very versatile trading tool.

Though entering the trade is only half the battle. We need to know when to exit.

This article will take an overview of the bull call spread and talk about different exit strategies.

Bull Call Spread Overview

A bull call spread consists of buying a call option while also selling a higher strike call option on the same expiry.

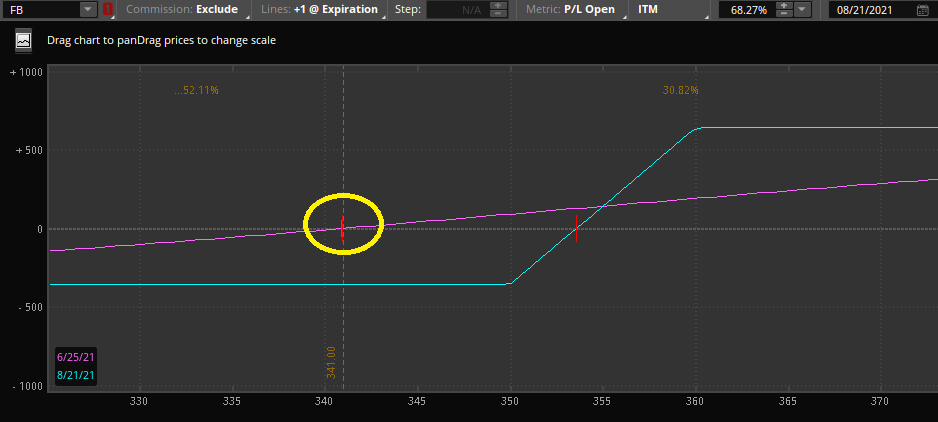

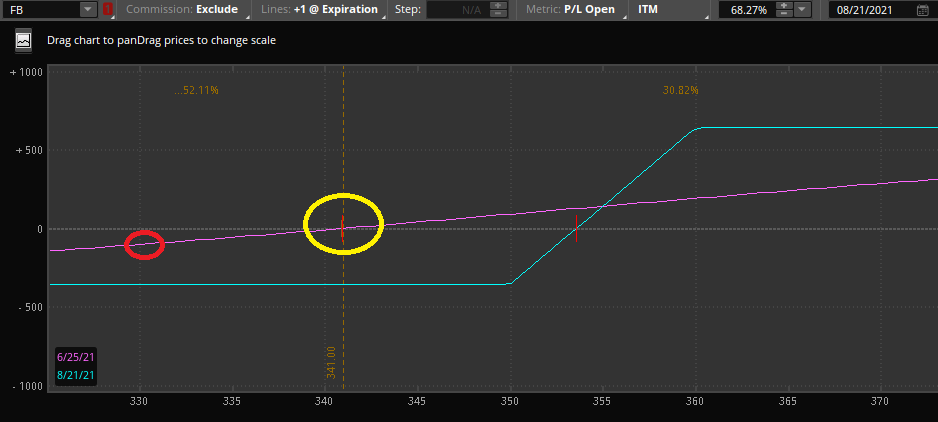

Let’s look at an example of a bull call spread on Facebook.

Here the stock is trading at $341.

We have created a bull call vertical by buying a 350 call and selling a 360 call.

To place this trade, we have paid a debt of $360.

This debt also corresponds to the maximum loss on our trade.

Keep this point in mind when we discuss exiting our position later.

On the other side, our maximum gain is the difference between our long and short strikes and the debt paid. In this case it is (10 X 100 = $1,000) – ($360) = $640.

What View Do I Express When I Place This Trade?

In the example above, we are long delta (we want the stock to go up) and long volatility (if the stock does not move by expiration, we lose money).

Depending on where we placed our strikes, we can be neutral to volatility or even short volatility.

For example, if we choose an in-the-money bull call spread, we are short volatility.

Despite this, one universal thing when buying a call spread is the bullish directional view on the underlying.

Bullish price action is always our primary view with a bull call spread.

***Note: If an investor wants to take a pure directional bet in a risk-defined manner, a very narrow bull put spread, also known as a digital, can be placed. These almost act as binary options. It will most likely either end at full profit or full loss at expiration. Just like betting on the outcome of a sports match.

Why Is A Bull Call Spread Easier To Exit Than Short Options?

With options strategies that have undefined risk, managing and exiting trades needs to proactive.

A small loss can quickly balloon into a significant loss, especially when an investor is short gamma near expiration.

Sometimes, this can involve exiting trades even when an investor feels as though they are still correct.

A painful move, but the right one to preserve capital.

A bull call spread does not face this problem.

The reason is that the maximum loss on the trade is simply the debt paid.

Setting your debt paid as your maximum loss allows you to stay in the position longer and allow time for your view to play out.

The risk-defined nature of bull put spreads makes them easy to manage.

Despite this, it is not an excuse to leave trades that no longer make sense.

Access the Top 7 Tools for Option Traders

When Do I Exit The Trade?

When we place a trade, we express a specific view.

If that view holds, then we should stay in that position.

If our view changes, then exiting the position makes sense instead of simply holding on and hoping. Let us go back to our trade example of Facebook.

At the outset of the trade, we expressed a bullish view that Facebook will appreciate moderately over the next few months.

The next day rumor comes out that the U.S administration is considering significant accountability measures for big tech.

Facebook’s price drops from $341 to $340.

At this point, we have lost $100.

Should we hold on and hope for the best?

It depends on our view.

If we think that the rumor will quickly blow over and then go back to the status quo, we could leave the position.

If the overhanging cloud of regulation changes or dampens our view, it is better off exiting the position.

A good question to ask yourself is if you did not have the position today, would you put it on? If not, then it is better to close it out.

After all, losing $100 is a lot better than being stubborn and losing $360.

In summation, we exit the trade when our reasons for placing the trade are no longer valid. Win, lose, or draw.

Can I Hold My Bull Put Spread Till Expiration?

If an investor’s view does not change, there are no issues continually holding a bull put spread to expiration.

This contrasts with naked short strategies, which take on a lot of short gamma and potential tail risk as they near expiration.

While these naked strategies require active management, we can only lose our debt paid on a bull call spread.

If we size appropriately, there is no need for concern.

Letting a bull put spread expire is simple if both legs are either out-of-the-money (OTM) or in-the-money (ITM) on expiration.

If both legs are OTM, the spread expires worthless.

If the spread ends ITM, they are both exercised, and the investor receives their full profit.

A quick warning, some brokers charge for exercising options; in this case, it may make more sense to close the position and pay commissions instead of paying the assignment fees.

A third scenario occurs when the long leg of the spread ends ITM while the short leg finished OTM. If this is the case, the position should be closed out unless the investor desires to hold long stock after the trade.

Closing the trade be done by either selling the ITM call back to the market or shorting the number of shares assigned at expiration.

Concluding Remarks

Bull put spreads offer investors a great vehicle to trade direction while still having defined risk.

This allows traders to weigh the benefits and costs of a trade before the trade is entered.

Exiting a position can be a lot easier if the position is sized appropriately on inception.

Leaving bull put spreads to expiry is usually not an issue though trades should be closed out early if a person’s view changes or the spread finishes partially in-the-money.

Trade safe!

Gav.

Disclaimer: The information above is for educational purposes only and should not be treated as investment advice. The strategy presented would not be suitable for investors who are not familiar with exchange traded options. Any readers interested in this strategy should do their own research and seek advice from a licensed financial adviser.

The post Blog first appeared on Options Trading IQ.

Original source: https://optionstradingiq.com/bull-call-spread-exit-strategy/