Contents

-

-

-

-

-

- The Platform

- The Options Flow

- Historical Flow

- Flow Overview

- Dark Pool Levels and Chart Analysis

- Alerts/Unusual Flow

- Pricing

- Verdict

-

-

-

-

Many tools are available to today’s retail options trader, but few are as important as one that can let you see the markets under the hood.

That is exactly what Cheddar Flow markets itself to do.

CheddarFlow is an options order flow platform specializing in catching unusual options trades, dark pool prints, and a powerful AI alert system, but is it worth the money?

That’s what we aim to find out in this review.

The Platform

First up is the platform itself; it is completely web-based, so you can view it from anywhere you have an internet connection.

The platform is clean, easy to use, and provides all the information you want from an order flow tool.

Down the left side of the welcome screen is your menu.

Here, you can view the current options order flow, historical Flow, dark pool levels and prints, education, and their AI alerts.

The Options Flow

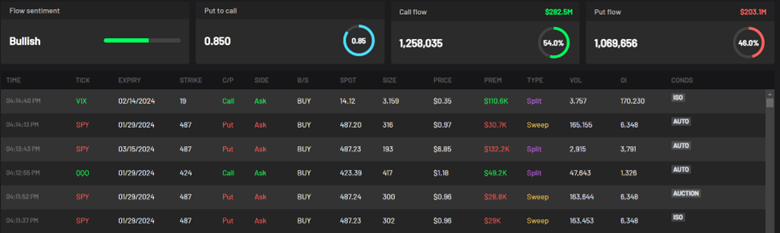

The main page you will see when logging in is the Options Flow Dashboard.

This is a fancy way to say the spot that shows what’s going on in the market.

If you want to just see an overview of the entire market, you can leave all of the filters blank, and it will show you the Put and Call flow, sentiment, and put/call ratio for the entire market.

Of course, this is only the tip of the iceberg of what this platform can offer.

Some of the real power comes from the ability to drill down into a specific ticker for further investigation. Let’s say you wanted to see all the Apple (AAPL) options flow.

You could enter it into the search bar, and now all that data is specific to the ticker you entered.

It offers a window into what is going on with the tickers you want to see.

Finally, there are the filters for the data itself.

You can continue to drill down based on a lot of different criteria.

If you have a watchlist of tickers that you consistently trade, you can have it only show Flow on those tickers.

What about if you want to see all the market data coming through but only want to see opening trades?

You can set that as a filter as well.

There are almost limitless ways to divide up and filter the data to get the exact look and feel you are going for.

These filters make this an extremely powerful platform.

Historical Flow

Next up is the Historical Flow tab.

As the name implies, this lets you view the options flow for tickers in the past.

This has the potential to be incredibly powerful for a few reasons; perhaps the most important reason is that it lets you backtest options strategies using options flow.

Let’s say you are looking to trade the MACD cross strategy and want some extra confirmation before you enter a trade.

This could be an excellent way to go back and look and see what happens when you get a cross and options flow at the same time.

Additionally, you can filter the historical data, so if you want to look back and see what tickers had sweeps yesterday, you can do that.

This helps a trader dial in their technique and their entries.

Flow Overview

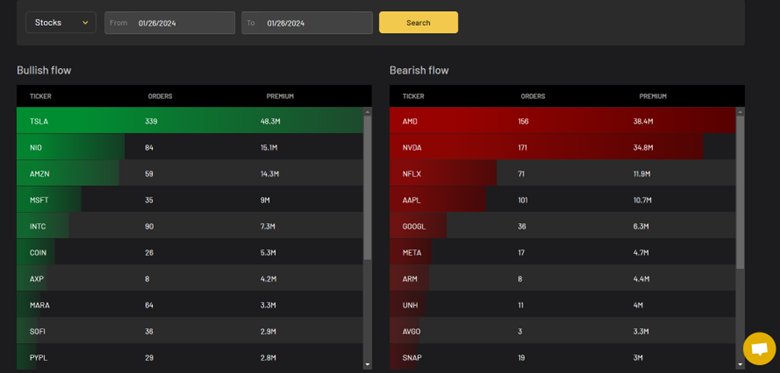

The Flow Overview tab is the third on the list of tools that Cheddarflow offers.

The Flow Overview is one of the more interesting tools available to you as a trader because it aggregates all of the data and shows what stocks had the highest bullish and bearish Flow.

This tool also lets you aggregate data over longer periods with the ability to select the dates.

So, if you wanted to see which stocks had the largest bullish Flow over the past week, you could set that up and see where possible trades exist.

The above screenshot is set to one day with all the stocks as the universe.

As you can see, Tesla had the most bullish Flow, with over 300 orders and over 48 million in notional value.

One way to use this tool is to scan for bullish and bearish Flow and then drill down on tickers that you find that you like.

Dark Pool Levels and Chart Analysis

One of the more interesting tools available through Cheddarflow is the dark pool levels.

This tool tracks large dark pool trades and shows the price at which they happened.

A theory states that these levels could be potential market pivot points, so this information could be useful to some traders.

In addition to the dark pool data, you can access charts through Tradingview with a subscription.

These charts are not through Tradingview but embedded into the CheddarFlow website.

These charts give you many of the most common indicators and time frames.

This is a solid add-on for looking quickly at a ticker chart you are interested in.

Alerts/Unusual Flow

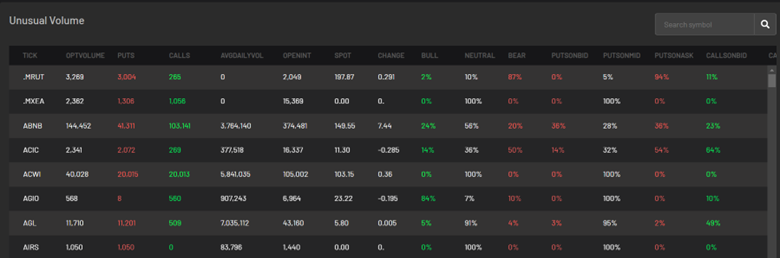

Finally, there are the unusual volume alerts.

This section picks specific data from the overall market flow that meets certain criteria to be considered “unusual” and a possible signal for something to come.

This tool is separated by ticker and shows the options volume and other information on a ticker level.

Think of this tool as more of a scan than a direct options signal.

If a ticker has been flagged for unusual volume, it might be worth further investigation.

Pricing

So now that you know all of the interesting tools that Cheddar Flow has to offer, what does it cost?

They offer three different pricing levels: Standard, Professional, and Yearly.

Standard: The standard subscription comes in at $85/month, and this includes real-time flow options, charting, unusual volume, all of the filtering capabilities, and historical flow data. It’s not a bad price for all of the tools.

Professional: The professional plan is $99/Month and includes all of the standard features plus the addition of the dark pool data, the ability to create custom watchlists, and Cheddarflows AI-powered alerts.

Yearly: The yearly contract has all the professional features, but because it’s paid upfront, it comes with a 25% discount. This decreases the per-month cost to $75, cheaper than the standard option. Because this is paid upfront, you should be sure you like the product and use the order flow tools.

Verdict

Now that you have seen all of the interesting tools that Cheddarflow has to offer, along with what it costs to start using these tools, the question becomes: is it worth it?

As with all tools around trading, there isn’t a cut-and-dry yes or no answer.

If you rely on options flow or dark pool prints to trade, then the answer is yes.

The data quality is fantastic, and there are plenty of ways to help you filter it down to be as specific as possible.

If you are a trader who uses chart patterns or a different methodology to trade, then the answer is probably not.

The tools are more expensive for something that wouldn’t materially impact your trading performance.

We hope you enjoyed this Cheddar Flow review.

If you have any questions, please send an email or leave a comment below.

Trade safe!

Disclaimer: The information above is for educational purposes only and should not be treated as investment advice. The strategy presented would not be suitable for investors who are not familiar with exchange traded options. Any readers interested in this strategy should do their own research and seek advice from a licensed financial adviser.

Original source: https://optionstradingiq.com/cheddar-flow-review/