Today, we’re doing a CMLViz review.

This is a piece of software that I use regularly and today you will learn all about how to use it.

You will learn how to set up option backtests, how to add technical trigger, profit targets and stop loss levels.

We will also look at other features such as the Today tab and Scanner.

Contents

- Introduction

- Running A Backtest

- Adding A Technical Trigger

- Profit Target and Stop Loss

- Does The Strategy Work On Other Tickers?

- The Create Tab

- The Today Tab

- Scan

- Technical Long Strangle Example

- How To Use CML Viz Trade Machine

- Conclusion

Introduction

CMLViz TradeMachine from Capital Market Laboratories is more than just a stock and options backtester.

It has a Pro Scanner, an alerts manager, and more.

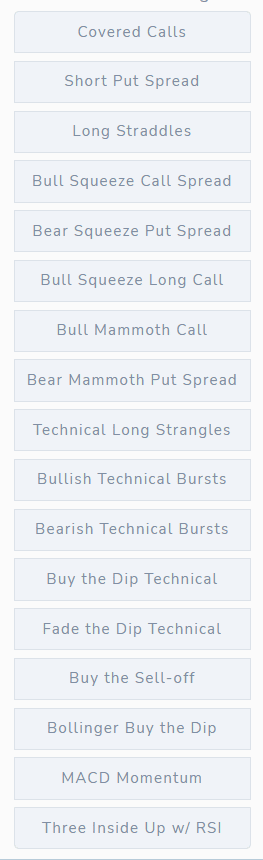

It comes with many pre-built options strategies, and technical triggers in the Pro Scan tab of TradeMachine:

For those who want to trade earnings, pre-earnings, and post-earnings, they have strategies for those as well.

If you are a TradeMachine member, you would be able to see precisely the technical trigger and the options structure of these pre-built strategies.

You would be able to see the various backtest results of that strategy, as well as tweak the parameters of that strategy and run your own specific backtest periods.

By choosing a ticker group:

You can see which tickers performed the best in that particular strategy and backtest period.

As a general example, the strategy could be when the price crosses some moving average while RSI is below a specific value, then buy the 50 delta call while selling the 20 delta call at a shorter expiration, or something like that.

Some of the strategies have quite selective triggers, such that you might only get one trade triggered per year per ticker.

The triggers are selective in order to capitalize on a particular edge that has been shown to exist in backtesting. This selectivity increases the win rate of the trades.

Even if you knew the specifics of the strategies, imagine if you checked each of the 30 Dow stocks daily to see if any of the strategies have triggered for you to put on a trade. That would take a bit of time.

Even if you were dedicated to spending the time to do it, you might not get a trigger for months. Some might be discouraged that getting a couple of trades took that much time.

This is where the “Alerts” tab and the “Today” tab in TradeMachine come in.

You can just have Trademachine text or email you when a strategy is triggered for any of the tickers you specify.

Alternatively, you can just take a minute to look at the “Today” tab each day to see if any of their pre-built strategies have triggered. More on this below.

Running A Backtest

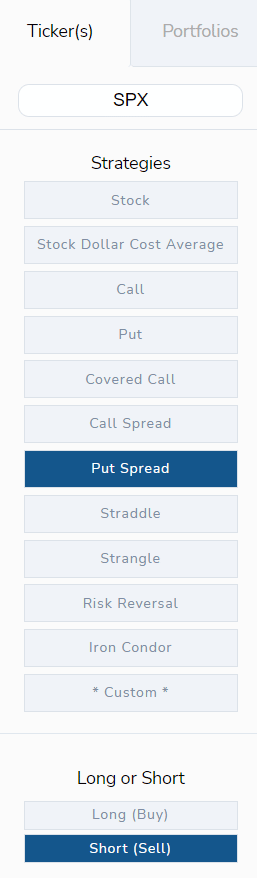

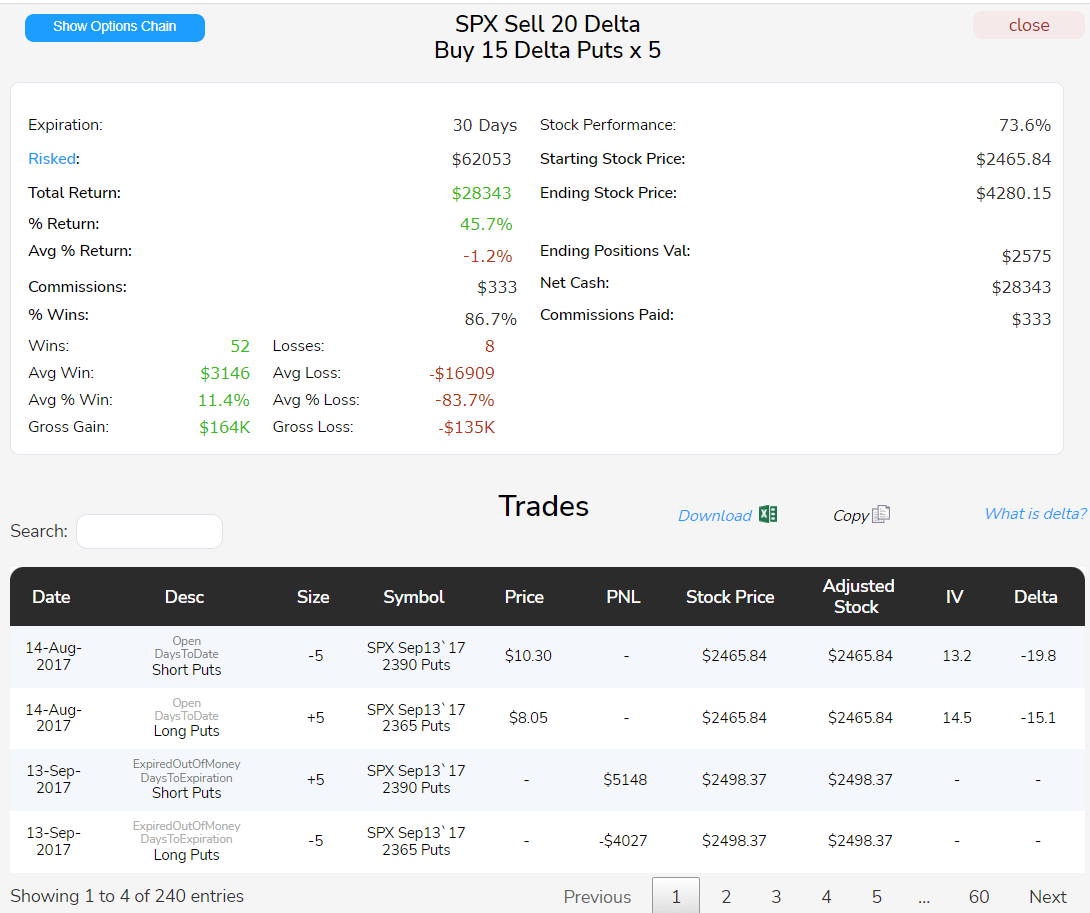

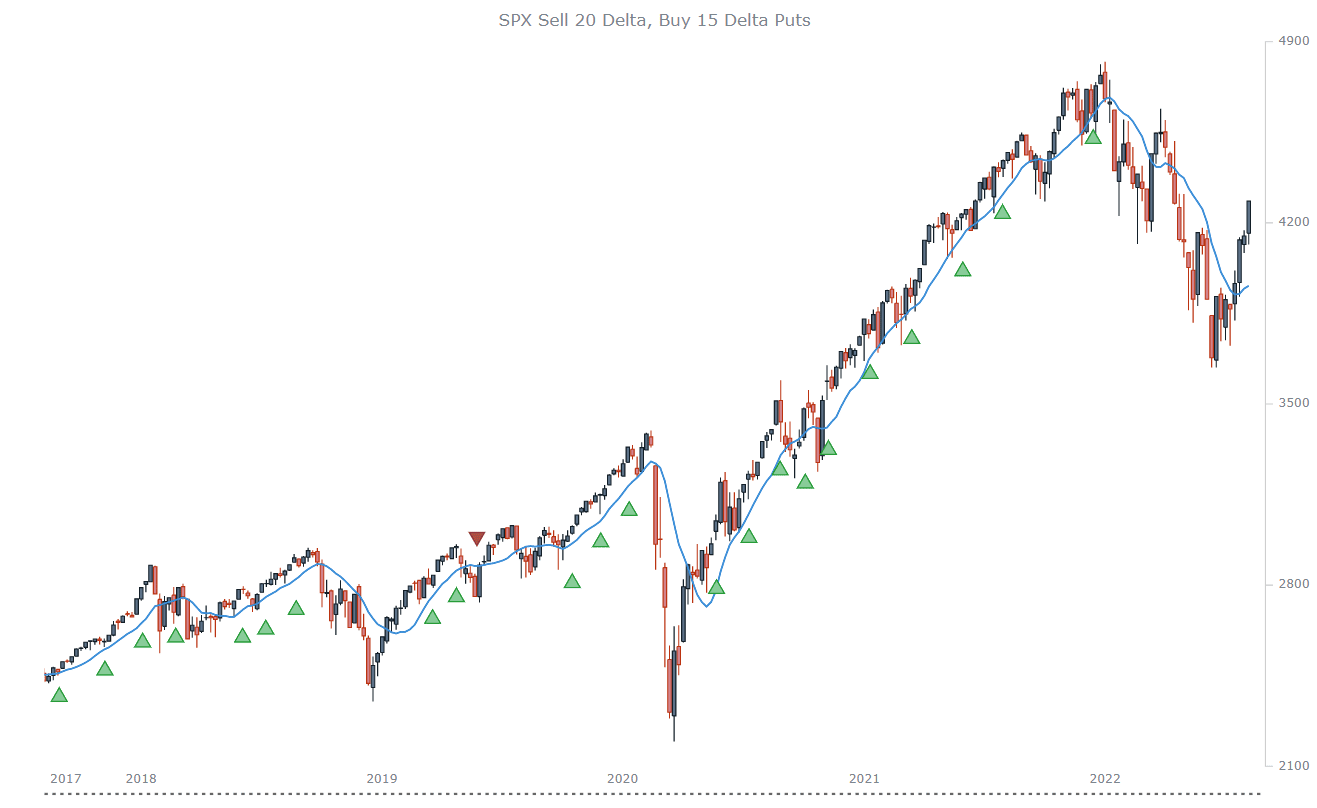

To give you a feel on how to use TradeMachine, let’s run a 5-yr backtest of selling a bull put spread on SPX with 30 days to expiration.

Go to the “Backtest” tab, type in ticker SPX, and select “Put Spread” and “Short.”

And put in “5 years” with “30” days to expiration.

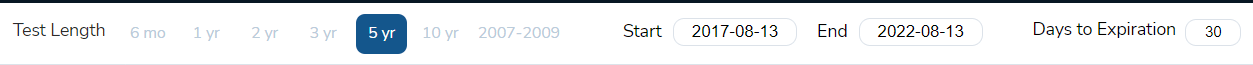

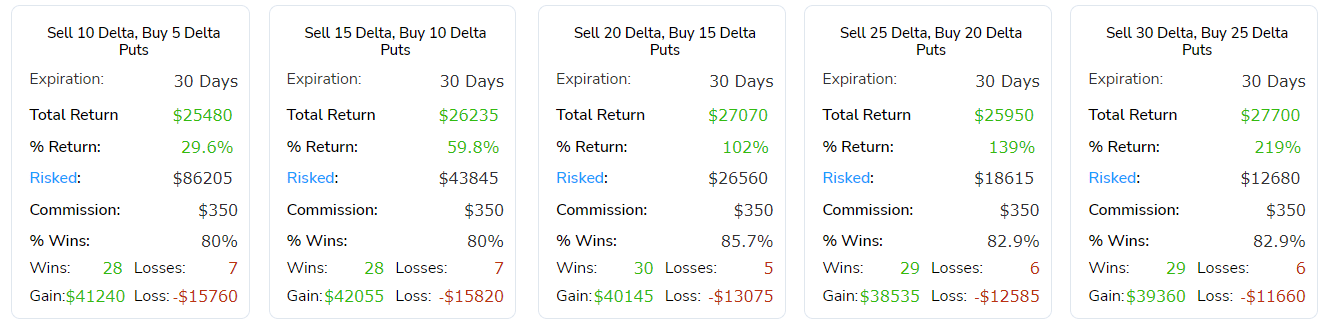

TradeMachine gives the backtest results in these tiles.

We can see a pattern that selling put spreads further out of the money will result in a higher win rate.

You can configure the delta of the long put leg as well as the short put leg,

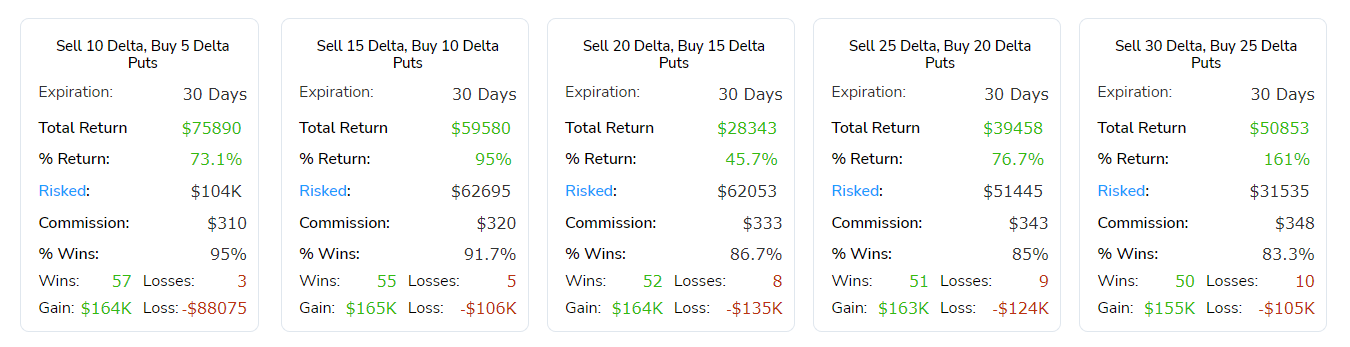

as well as other parameters of the backtest, including your commission fee structure, number of contracts, etc.

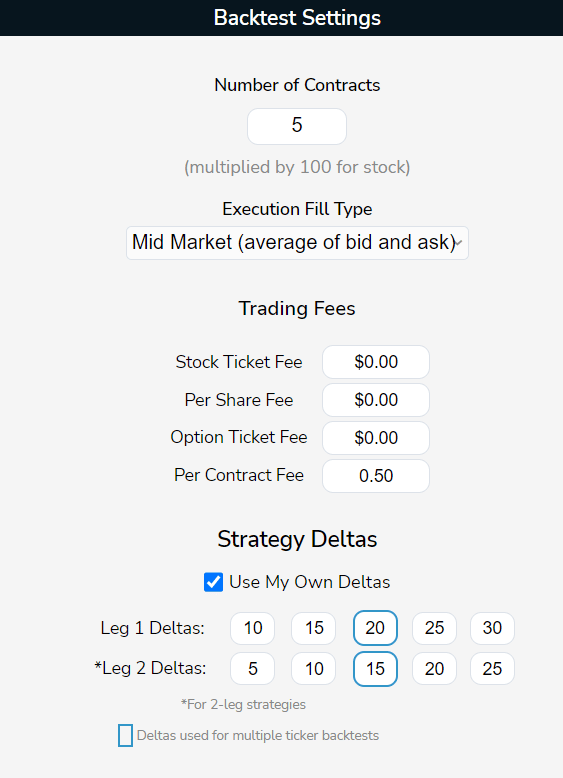

Clicking on a tile will give you access to the individual trades that the backtest initiated (which you can download or copy to a spreadsheet):

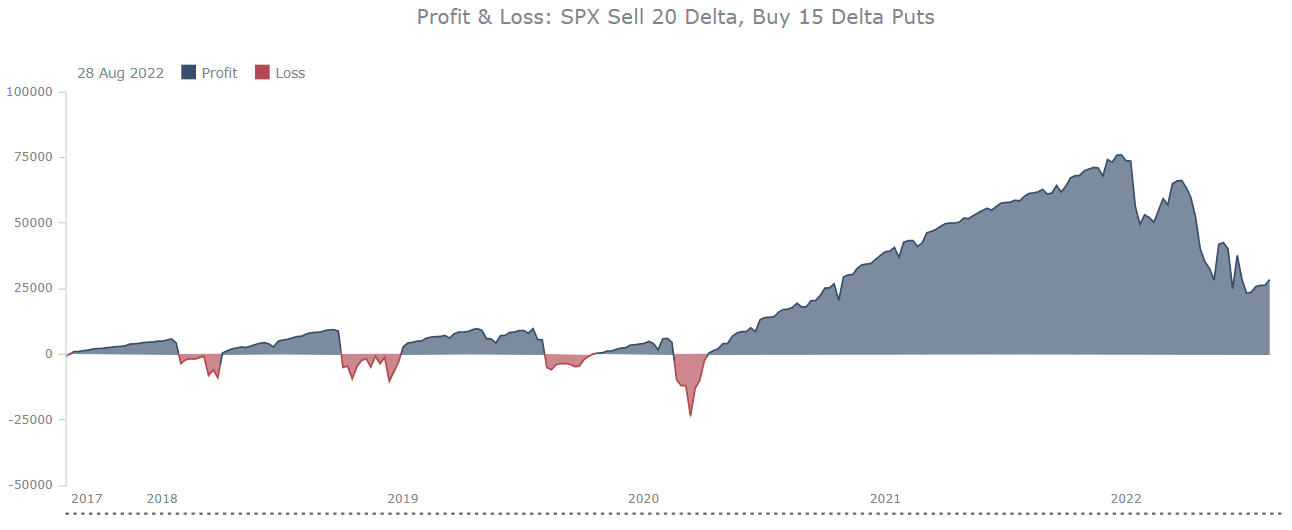

What is more important to see is the resulting P&L graph.

While positive over a 5-year period, we can see significant drawdowns.

For example, from December 2021 to July 2022, the P&L went from $75,000 to $23,000.

Adding A Technical Trigger

Let’s try to improve this by using a technical open trigger.

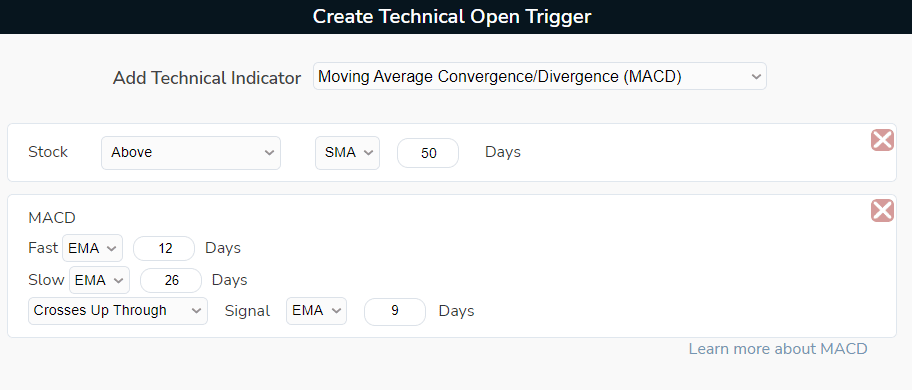

In the “Open Trade When” section, we select “Technical Open” so that we can add the following trigger.

The bull put spread is only initiated when the MACD line crosses through the signal line (a bullish signal).

In addition, we only take these bullish trades if the price is above the 50-day moving average.

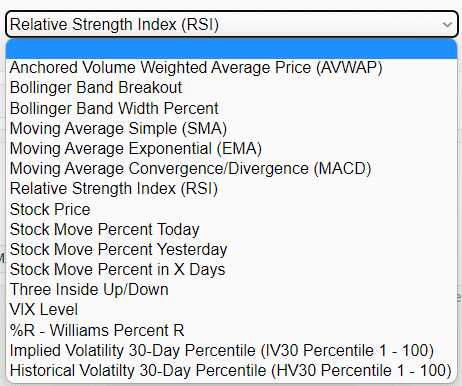

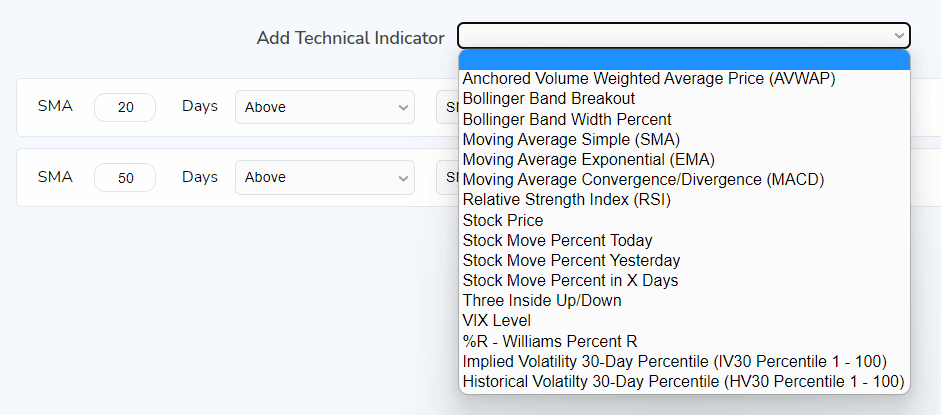

The available technical indicators that we can choose from to configure the trigger are:

I’m happy to see moving averages, RSI, MACD, and VIX being available.

It would have been nice to have seen other indicators such as ADX and Bollinger width.

Let’s say that you found a technical open that you like.

You can save that technical open as an alert.

Add in the tickers that you want to trade, and it will email or text you when any one of those tickers satisfies the technical condition.

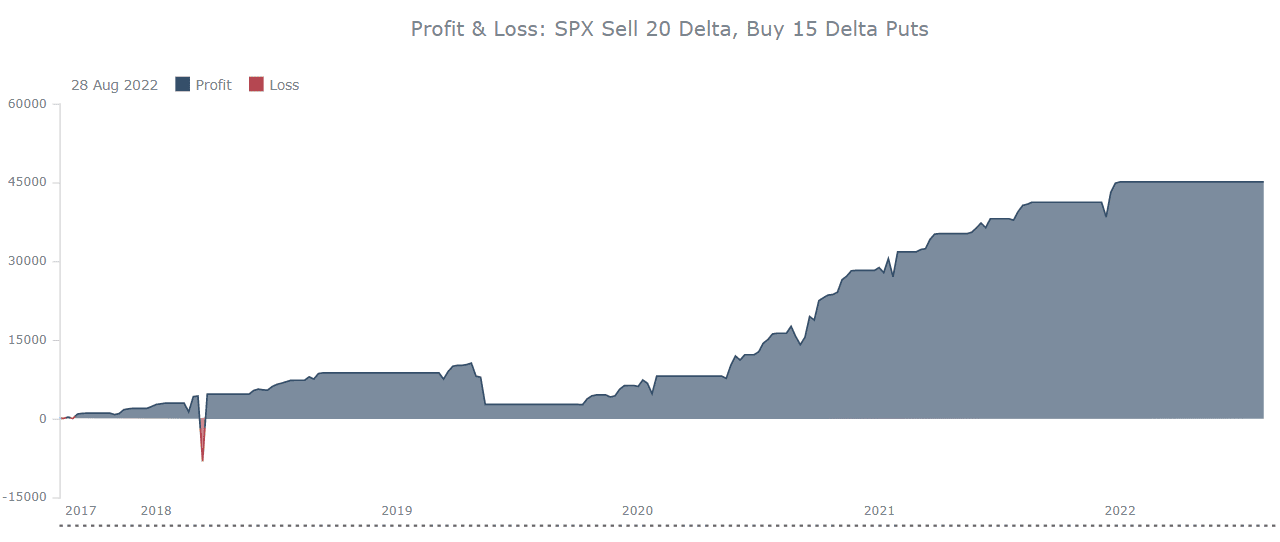

By being more selective about when to initiate the put spread, we get a much smoother P&L curve.

I like how the entry and exits are plotted on the candlestick chart along with the chosen moving average:

We also see better win rates:

The far out-of-the-money put spreads did not encounter any losing trade during this backtest.

This is not to say that it won’t happen in the future.

And when it does, the loss might be large compared to the initial credit received.

We will implement a stop to prevent a max loss on a put spread.

Profit Target and Stop Loss

So far, our strategy holds to expiration. We can set exit criteria based on technicals or profit and loss.

If we wanted to close the trade when we have captured 50% of our initial credit in the bull put spread, we can:

In the above settings, we also specified to exit the trade if our loss exceeds twice our take profit amount.

There is also the ability to set a timed exit.

Here we have set it so that if neither take profit nor stop loss was hit after ten trading days into the trade, then exit the trade.

The resulting P&L graph is shown above next to the settings.

By implementing take profit and stop loss, there are some trade-offs, as can be seen in the results:

You limit the potential for large losses, but it can reduce the overall win rate and overall returns.

Does The Strategy Work On Other Tickers?

Yes, it does. Put in multiple tickers separated by a comma, and it will backtest all of them.

Here I threw in the RUT, plus a couple of ETFs and Microsoft stock.

The Create Tab

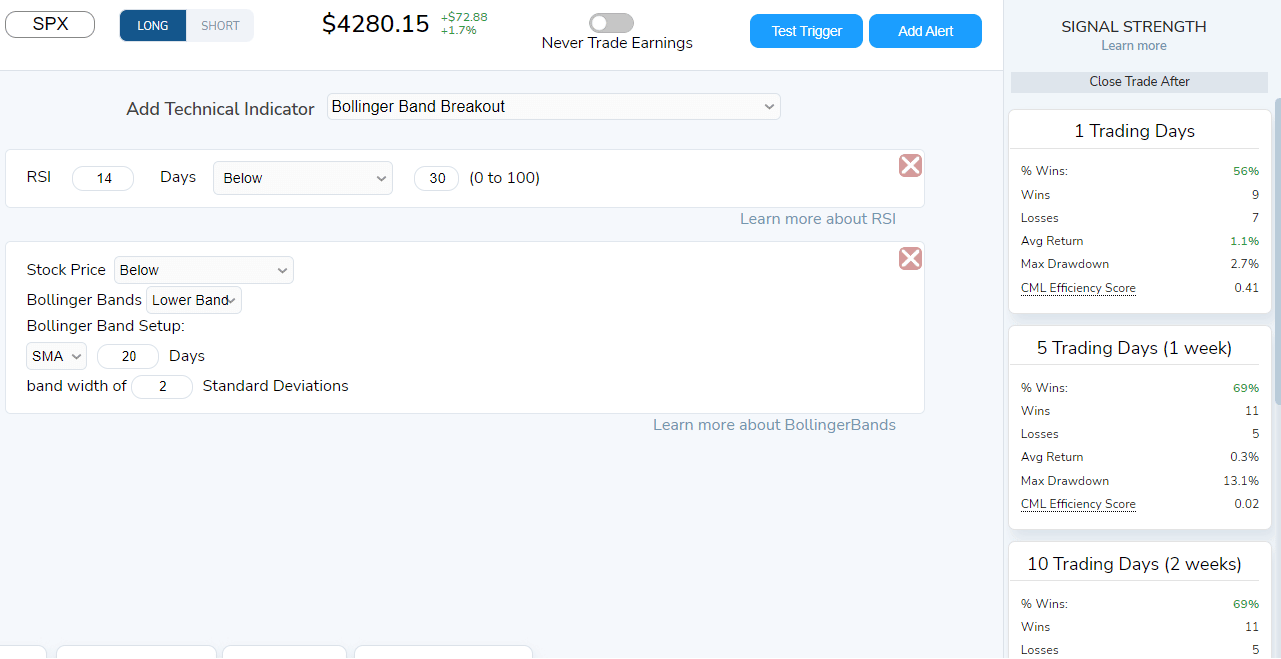

The “Create” tab in TradeMachine lets you test combinations of technical indicators independent of the option strategy you decide to employ.

Suppose we wanted to know if there is an edge if we go long when the price is oversold, as indicated by RSI being below 30 and price being below the lower Bollinger band.

The results (over 5 years) show that 56% of the time, the price is above where it started one trading day later.

For 5 and 10 trading days later, the price was higher 69% of the time.

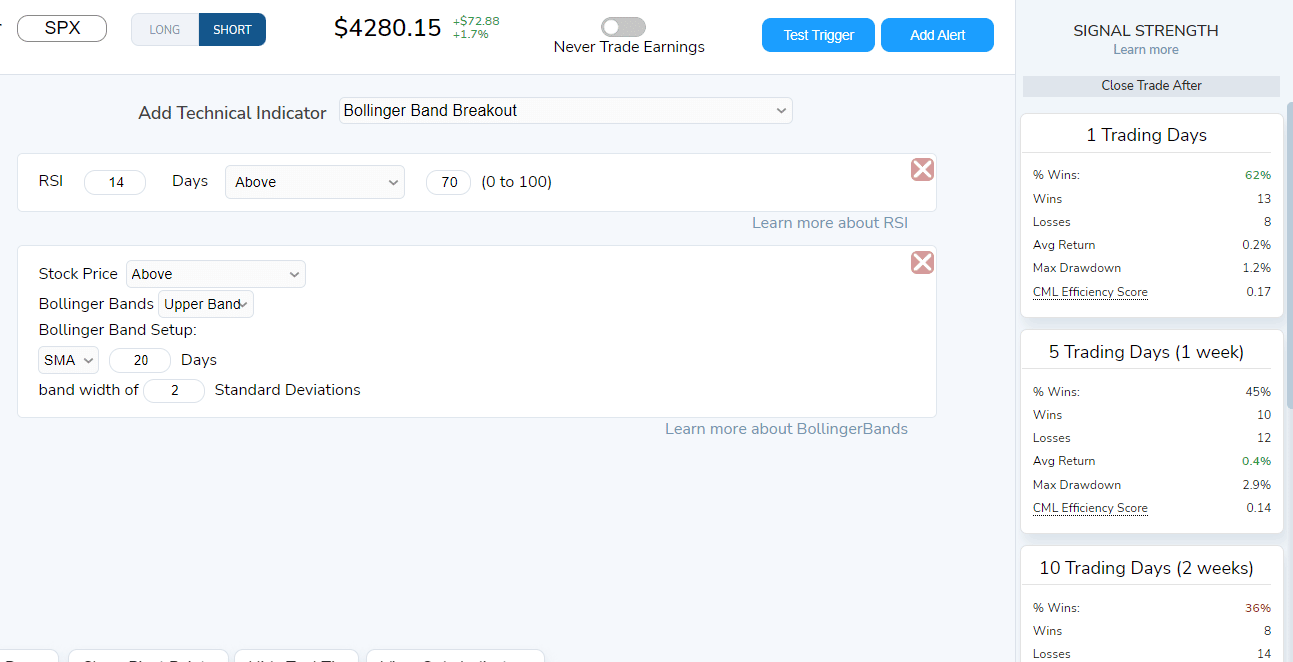

We can test the reverse — going short when the price is overbought:

The results are not great — at least for the SPX ticker we tested.

This may be because the market has an upward bias which causes shorting stocks to be difficult.

But if you do go short, do so for only a short duration because the results for the “1 trading day later” is the one that gave the best results.

Tip: Some people may encounter trouble adding multiple conditions of the same indicators. But it is certainly possible. Here I have two different conditions of the SMA indicator (both of which must be satisfied for the trade to trigger).

What you have to do after adding the first SMA is to select the “blank option” in the dropdown and then select the SMA again.

The Today Tab

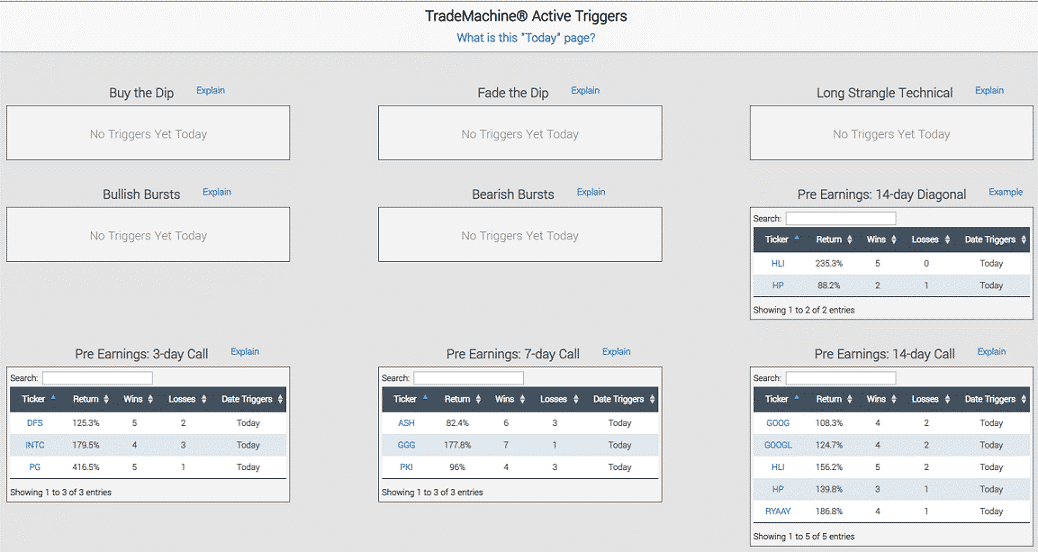

The ‘Today’ tab shows trades ideas that have triggered.

These trade ideas are from the experts behind CMLViz Trade Machine.

As passionate and experienced option traders themselves, they provide you with access to their researched and back-tested ideas as part of your subscription.

For example, a single day may see “Buy the Dip”, “Long Strangle Technical” and “Pre Earnings: 14-Day Diagonal” strategies trigger.

The ‘Today’ tab will show all of these opportunities in one place, allowing the user to select the trades that are most appealing to them.

Scan

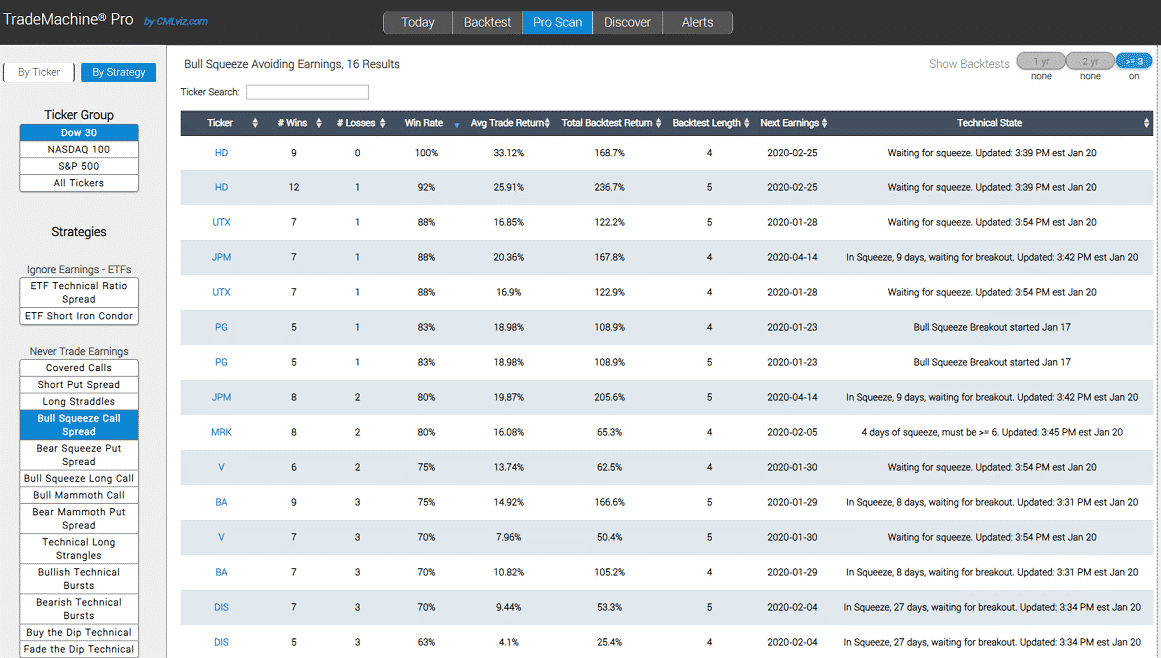

The CMLViz team provides users with dozens of options trading strategies, which the platform runs daily against all of the stocks in the market.

Users can also conduct their own scan in a matter of minutes with just a few clicks.

For example, say you were interested in identifying the best opportunities for using the “Buying the Dip” strategy.

The “Buying the Dip” strategy is one of the strategies created by the CMLViz team and available to Trade Machine subscribers.

To develop this strategy, the team conducted tens of thousands of backtests across the Nasdaq 100 and came up with three technical settings that consistently identified a “Buying the Dip” opportunity.

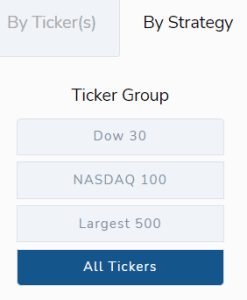

In the ‘Scan’ tab, users select the ‘By Strategy’ page, choose a Ticker Group (e.g. Nasdaq 100, S&P 500, etc) and then select the strategy (‘Buy the Dip Technical’ is found under the ‘Never Trade Earnings’ section).

The system then generates a table with all the best performers for this strategy.

The system lists the Ticker (e.g. AMD, APPL, etc.), the number of times this strategy generated winning and losing trades, win rate (%), average trade return (%), total backtest return (%), backtest length and the next earnings date.

If you find a performer you’re happy with, e.g. Apples (ticker: APPL), but want to test it against other stocks, you can do that through the ‘Backtesting’ tab.

Technical Long Strangle Example

The below video shows how to set up a backtest for a long strangle trade.

Typically buying calls and puts is a losing trade, as shown in the video.

But, by adding some technical parameters we can see the performance is greatly improved.

CMLviz Option Back-testing and Technical Analysis to Find Volatility from CML Support on Vimeo.

How To Use CML Viz Trade Machine

This video walks you through how to use the Trade Machine for those that are more visual learners.

How to Use TradeMachine from CML Support on Vimeo.

And here is an extended video for those that really want to do a deep dive.

How to Use TradeMachine from CML Support on Vimeo.

Conclusion

The examples I gave here are only starting points.

It is your job to tweak the settings to get the results that you like.

Would tightening the stop loss make the results better or worse?

What about extending the days to expiration?

How would the results be if we were to change the technical open conditions?

These are the answers that this software can provide you with just a few clicks.

To get these answers manually would be quite time-consuming.

To get these answers based on trial and error of live trading would not only be time-consuming but potentially expensive as well.

So is TradeMachine worth it?

I’ll let you decide.

As an affiliate of CMLViz, I am able to provide a discount link to sign up for $129 per month as opposed to $199 per month.

We hope you enjoyed this CMLViz Review.

If you have any questions, send an email or leave a comment below.

Trade safe!

Disclaimer: The information above is for educational purposes only and should not be treated as investment advice. The strategy presented would not be suitable for investors who are not familiar with exchange traded options. Any readers interested in this strategy should do their own research and seek advice from a licensed financial adviser.

Original source: https://optionstradingiq.com/cmlviz-review/