After learning the put credit spread, an advanced version of the put credit spread is the put credit ratio spread.

Contents

-

-

-

-

- Put Credit Ratio Spread

- At A Loss

- Two Weeks Later

- Two Weeks Left

- At Expiration

- Conclusion

-

-

-

The best way to see the difference is to look at an example.

Consider the following typical put credit spread on Salesforce (CRM)…

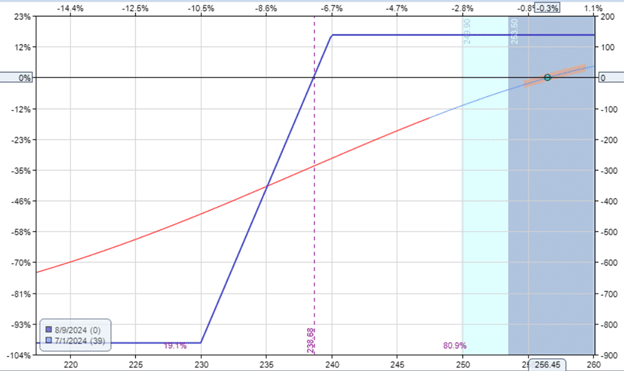

Date: Jul 1, 2024

Price: CRM @ $256.45

Sell one contract Aug 9 CRM $240 put @ $2.40

Buy one contract Aug 9 CRM $230 put @ $1.02

Net credit: $138

Delta: 12

Vega: -9.13

Theta: 2.76

Gamma: -0.74

Put Credit Ratio Spread

Let’s compare it with this put credit ratio spread on the same underlying, the same expiration, and collecting about the same credit at the start of the trade.

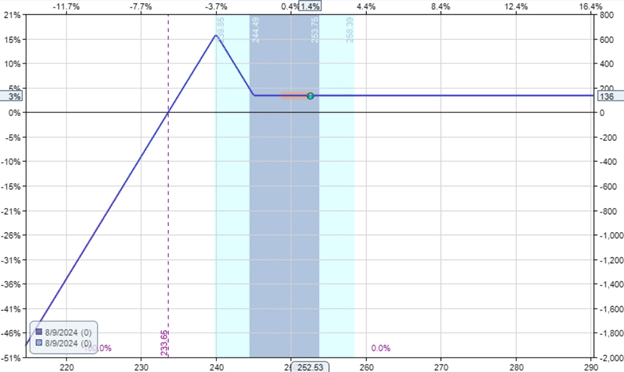

Date: Jul 1, 2024

Price: CRM @ $256.45

Sell two contracts Aug 9 CRM $240 put @ $2.40

Buy one contract Aug 9 CRM $245 put @ $3.43

Net credit: $136

Delta: 15.60

Vega: -19

Theta: 6.39

Gamma: -1.71

Both trades are bullish.

Both trades are selling premiums and collecting a credit.

Both trades will profit from time decay.

The big difference is that the put credit spread is a defined risk trade, whereas the put ratio spread is an undefined risk trade.

By capping the risk, it reduces the full potential of all the Greeks.

You can see that the put credit spread has a smaller delta, smaller vega, smaller gamma, and smaller theta.

Respectively, it means that the put credit spread is less directional and less sensitive to volatility and price movements.

And it takes longer to profit from time decay.

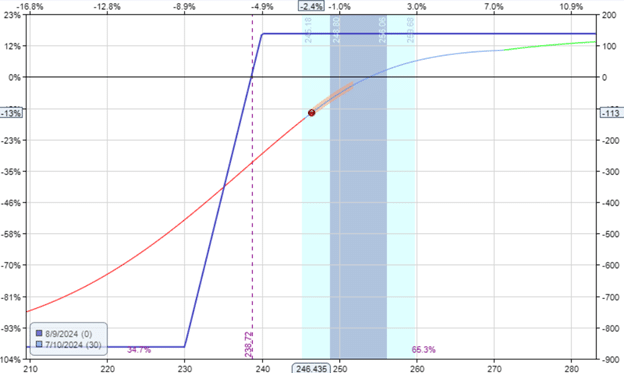

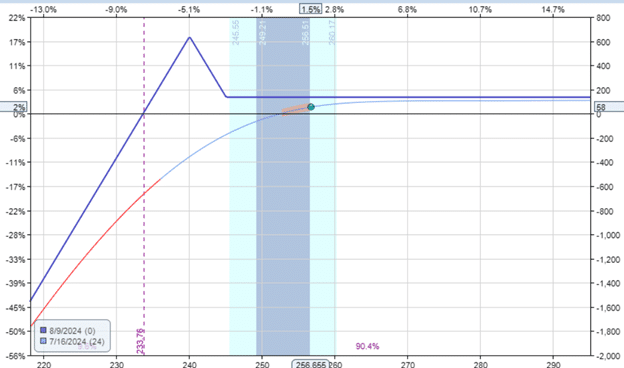

At a Loss

On Jul 10, after 9 days into the trade, the price of CRM dropped to $246.

Both trades are at a loss.

The put credit spread loss -$113

The put ratio spread loss is slightly less at -$94.

You can think of the ratio spread as a put debit combined with a short put option.

Put Debit Spread:

Sell one contract Aug 9 CRM $240 put @ $2.40

Buy one contract Aug 9 CRM $245 put @ $3.43

Short Put:

Sell one contract Aug 9 CRM $240 put @ $2.40

The put debit spread that is embedded into the ratio spread helped reduce the loss.

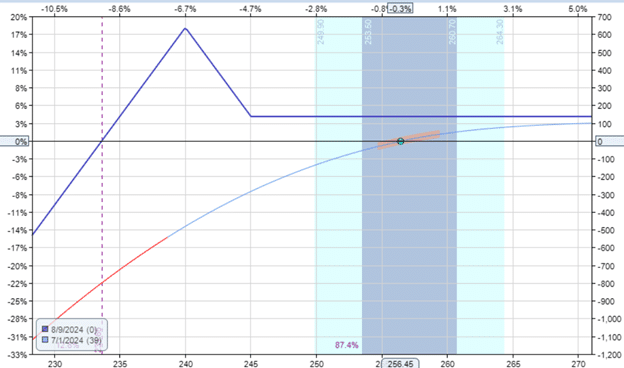

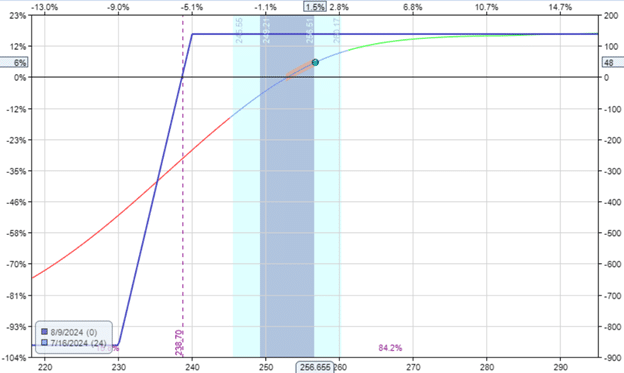

Two Weeks Later

On Jul 16, after 15 days into the trade, the price of CRM came back up to $256.65, basically back to where it started.

Put credit spread profits $47.50.

Put ratio spread profits slightly more at $58.

This is the effect of the larger theta of the ratio spread.

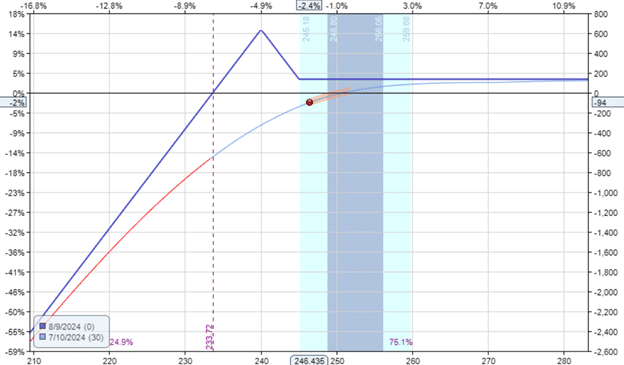

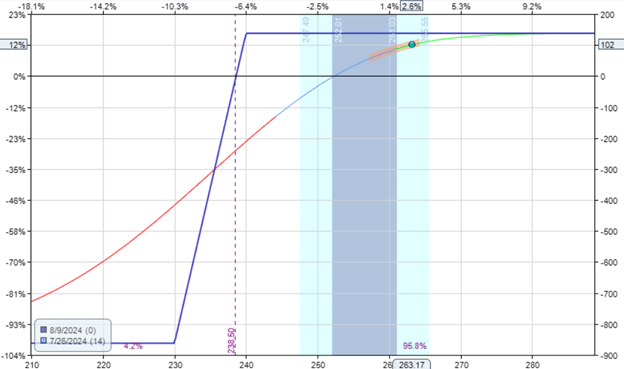

Two Weeks Left

On July 26, with two weeks left till expiration, CRM rallied up to $263.

The put credit spread profits: $102.

The put ratio spread profits slightly more at $111.50.

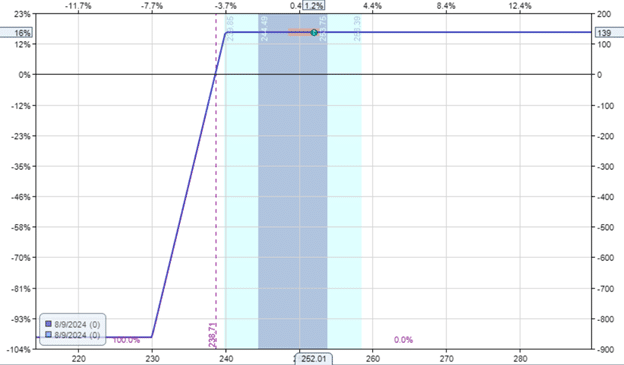

At Expiration

At the August 9th expiration, CRM closed at $252.53, which means that both put credit spread and ratio spread to keep the credit received – both about $136

Conclusion

When the price went against the trade, the ratio spread lost less than the credit spread.

When the price didn’t move, the ratio spread gained more.

When the price went in favor of the trade, the ratio spread gained more.

The benefit of the ratio spread is that it is more resilient due to the embedded hedge.

The drawback is that it is more complex and is an undefined risk.

The trader has to really monitor the trade and exit the trade manually to prevent large losses.

On the other hand, the put credit spread is a defined-risk trade, and the risk is capped.

While the credit spread is what everyone learns first, this example may explain why some experienced traders give the ratio spread great respect.

Jim Schultz of Tastylive has said this is one of his top strategies.

We hope you enjoyed this article comparing the put credit spread and the put ratio credit spread.

If you have any questions, please send an email or leave a comment below.

Trade safe!

Disclaimer: The information above is for educational purposes only and should not be treated as investment advice. The strategy presented would not be suitable for investors who are not familiar with exchange traded options. Any readers interested in this strategy should do their own research and seek advice from a licensed financial adviser.

Original source: https://optionstradingiq.com/put-credit-spread-vs-put-ratio-credit-spread/