During September 2020 Federal Reserve monetary policy meeting, the central bank made a big deal of targeting its inflation objective.

The Fed has determined that it needs to do whatever it can to push inflation back above its 2% target.

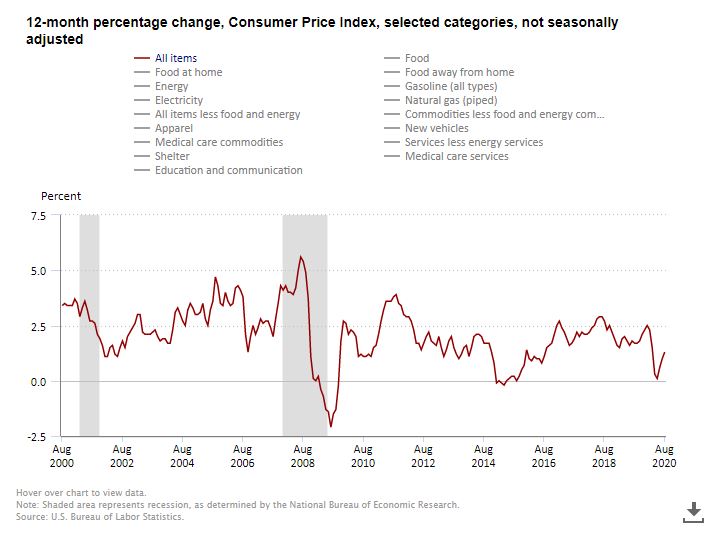

While there are several different ways to measure inflation the most popular and widely watched in the United States is the Consumer Price Index, reported by the Bureau of Labor Statistics (BLS).

What is the Consumer Price Index

Bureau of Labor Statistics

The consumer price index (CPI) calculates price changes for a basket of goods and services. This includes shelter, food, energy, transportation as well as, utility costs. CPI is available as far back as 1913.

The Department of Labor uses a benchmark for the index based on the index average during the period from 1982 through 1984 (base year period) which was set to 100. This would mean that the index was set at a benchmark of 100 during the period 1982-1984.

A reading of 200 would mean that inflation has increased by 100%. The CPI is the most widely used statistic in the US covering inflation.

It includes professionals that are employed as well as the self-employed, unemployed as well as retired individuals.

The consumer price index covers retail inflation which differs from the producer price index (PPI) that covers wholesale inflation. Both the CPI and the PPI are reported by the BLS which his part of the Department of Labor.

The difference is the PPI covers intermediate goods such as crude oil, while the CPI would report on goods used by consumers such as gasoline.

What Areas are Covered by the CPI

The CPI covers a basket of goods and services including:

- Housing

- Apparel

- Transportation

- Food

- Energy

- Healthcare

- Education

- Recreation

There are approximately 80-thousand items that are included in the CPI calculation. The index is calculated by determining the total cost of the basket of goods and services in the current period and dividing that number by the base year period.

There are several sub-components of the CPI. This includes a regional breakdown of the CPI as well as an employee level breakdown.

For example, the CPI-U measures consumer prices for urban living people. The CPI-W covers the CPI for urban wage earners.

Why Do Prices Move Up and Down

Supply and demand continuously drive prices. Prices will fluctuate creating inflation as prices rise and deflation as prices fall. Strong demand due to an increase in consumer confidence will lift prices as demand exceeds supply.

When consumer confidence declines and demand falls faster than supply, prices will fall creating deflation. Inflation and deflation can occur because of exogenous events such as a war or a pandemic, or even a natural disaster.

Why is the CPI Important

There are several pros and cons to inflation.

While inflation is generally good for an economy, it is never beneficial for an individual.

For an economy to grow, companies need pricing power, and the ability to raise prices as the demand for goods and services increases. When inflation rises at a steady pace, it removes the threat of deflation.

When prices are falling consumers will defer purchases and wait to see if prices continue to fall before they make a purchase. This reduces current demand which will hurt businesses.

When demand is reduced and businesses reduce their inventory, the entire business cycle can be affected.

Inflation can be detrimental to the individual especially if you live on a fixed income and have no way of increasing your revenue as costs rise. For example, if you are retired and live on an annuity stream from your pension higher inflation will erode your purchasing power.

If the price of essential goods and services rises, you will likely have to give up some of these goods and services if prices rise above your means. Inflation will also reduce the purchasing power of money in the future.

This can make a lender less interested in loaning money to someone for a long period, as inflation erodes their ability to pay the loan back.

When inflation rises too quickly, it can quickly overwhelm an economy.

For example, if prices rise and revenue growth is stagnant, demand will be reduced which will lead to economic contraction.

How is Inflation Managed

Inflation is generally managed by a central bank like the US Federal Reserve.

The Fed has a target inflation level that will allow prices to rise, while demand remains positive. When inflation rises too quickly the Fed will generally increase interest rates which reduced demand and cap price increases.

When prices begin to fall to quickly the Fed will cut interest rates to increase demand which can help prices rise.

Why is Inflation Important to Trader?

What is important to traders is how inflation will impact and economy and what the Fed will likely due to managing inflation.

If inflation is falling, traders will bet that the Federal Reserve will be accommodative, helping to lift stock and bond prices. When inflation is rising, traders will often believe that hard assets such as commodities will increase in value as the Fed looks to be less accommodative.

Traders will often evaluate whether the CPI that is reported was stronger or weaker than expected. Since a surprise, if often not incorporated into the price of an asset, it provides an opportunity to place a trade.

Bottom Line

The upshot is that the consumer price index is a very important widely use tools that can help traders determine inflation. Inflation is good when it is rising at a stable pace.

Generally, inflation is good for the economy and companies but not beneficial for the individual. Inflation is usually managed by a central bank. The goal is to keep inflation stable reducing the impulse to wait for prices to decline further, but not let it erode future earnings.

Traders will often attempt to determine whether the CPI was stronger or weaker than expected which can provide a trading opportunity.

The post Consumer Price Index: Why it’s Important to Traders appeared first on Warrior Trading.