Today we are doing a dataroma review.

I only recently found out about this site, and it is extremely interesting.

This article will give an overview of the Dataroma site and talk about some of the different features and helpful information it has.

Let’s get started!

Contents

-

-

-

-

- Dataroma Overview

- The Super Investor Section

- The Home Page

- The Search Section

- The Grand Portfolio

- Insider Section

- Commentaries/Articles

- Why Should You Use Dataroma?

- The Limitations of Dataroma

- Concluding Remarks

-

-

-

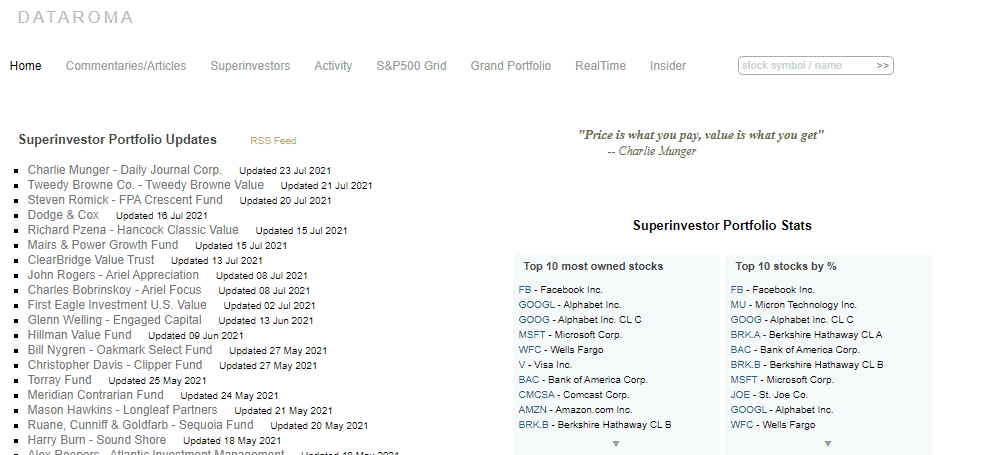

Dataroma Overview

There are many sites and areas of the internet showing different investment data.

Despite this, one of the unique sites I have come across is called Dataroma.

Dataroma is a website offering information on insider and hedge fund trading.

Upon first glance, the site itself may seem a bit unimpressive.

Source: Dataroma

Missing are the fancy graphics and charts that other sites may have.

Despite this, once you spend more time on the site, you realize many exciting features and information are available.

All this is available for free, without any ads or “premium sections.”

So while at first glance, the site may seem bland, there is more than meets the eye. Let’s dive in.

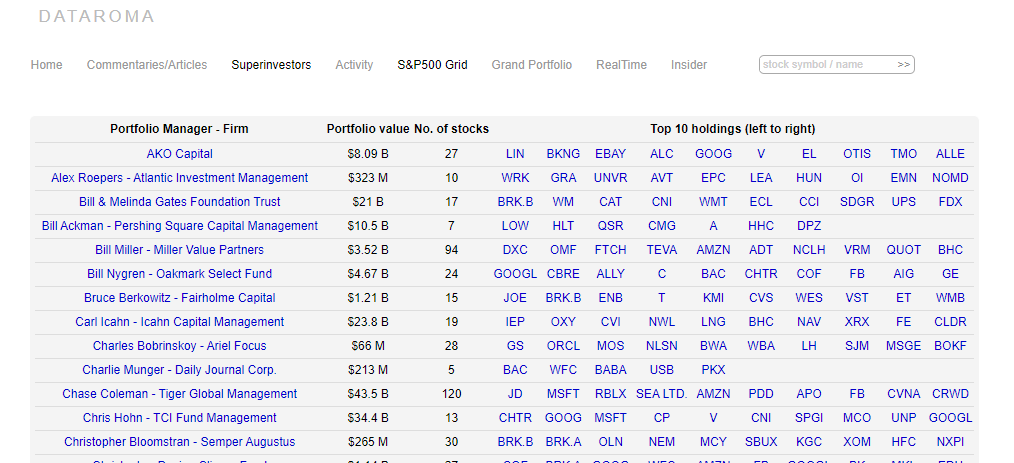

The Super Investor Section

The super investor section shows a snapshot of the largest holdings across different funds.

Source: Dataroma

Here we have famous funds and names such as Carl Icahn and Bill Ackman.

A remarkable feature of this page is that if we have a particular fund or manager that we like, we can click on them to get more information on their complete holdings and recent trades.

For example, perhaps OXY petroleum is Carl Ichan’s second-largest holding, but maybe he has recently sold his shares?

Or perhaps he now feels more decisive about the company and is buying more?

All this information allows you to get a better feel of how the manager thinks about a stock.

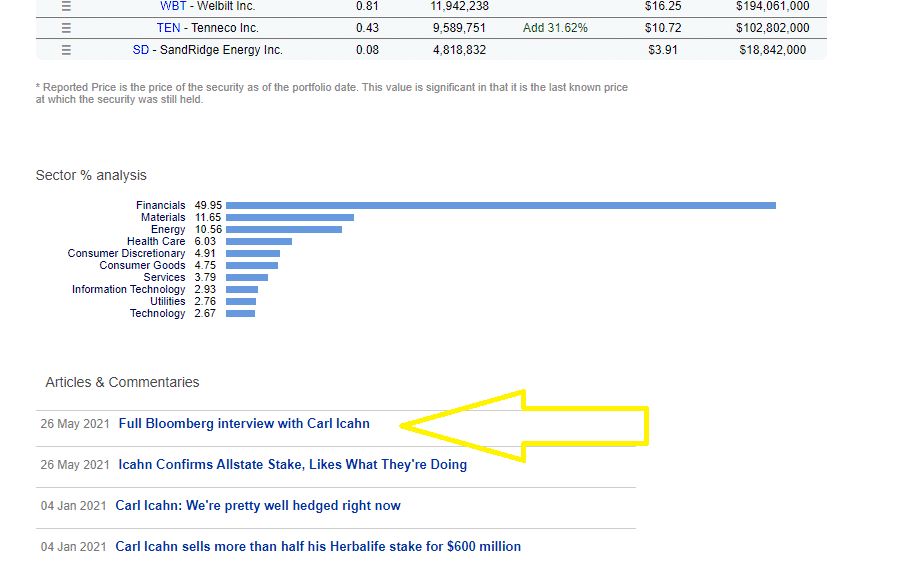

When you click on the manager, you can also view how they are allocated across different sectors.

Another cool feature, when you click on the fund manager, is a section that shows their most recent articles and commentaries.

Again, I found this super valuable.

For example, I clicked on Carl Icahn’s fund, and I immediately found a link available from a recent Bloomberg interview with him.

Source: Dataroma

If you have a couple of managers you like, this super investor section can be handy in gathering information and finding educational links.

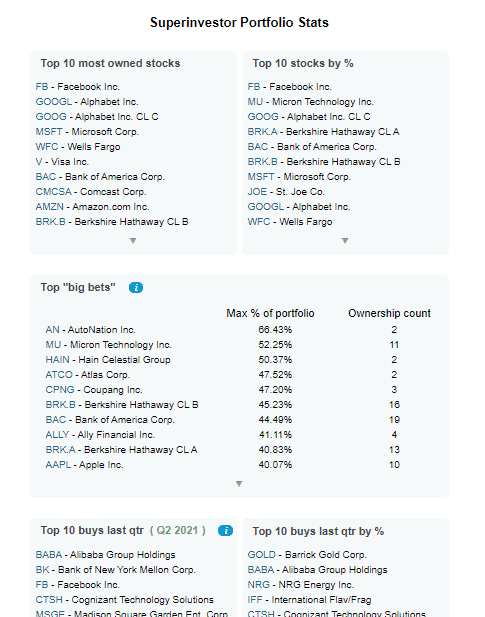

The Home Page

The home page has several valuable sections, ranking the most popular and trending stocks among fund managers.

Thus, as an example, if I thought that the fund managers are more intelligent than the market, I could simply create a portfolio of their top holdings.

Source: Dataroma

I found the top “Big Bets” section even more enjoyable personally.

This shows which stocks have the highest allocation in a fund manager’s portfolio.

For example, a fund manager has 66% allocated to Autonation (AN) in the image above.

Such high allocation to a particular stock shows that a manager is extremely bullish, so much so in fact to avoid diversification in a larger basket of names.

As most managers try to match the index, concentrating heavily on a specific name is risky, usually only backed up by higher conviction.

Below this, we have the top buys over the last quarter, showing what stocks have been popular recently among fund managers.

The Search Section

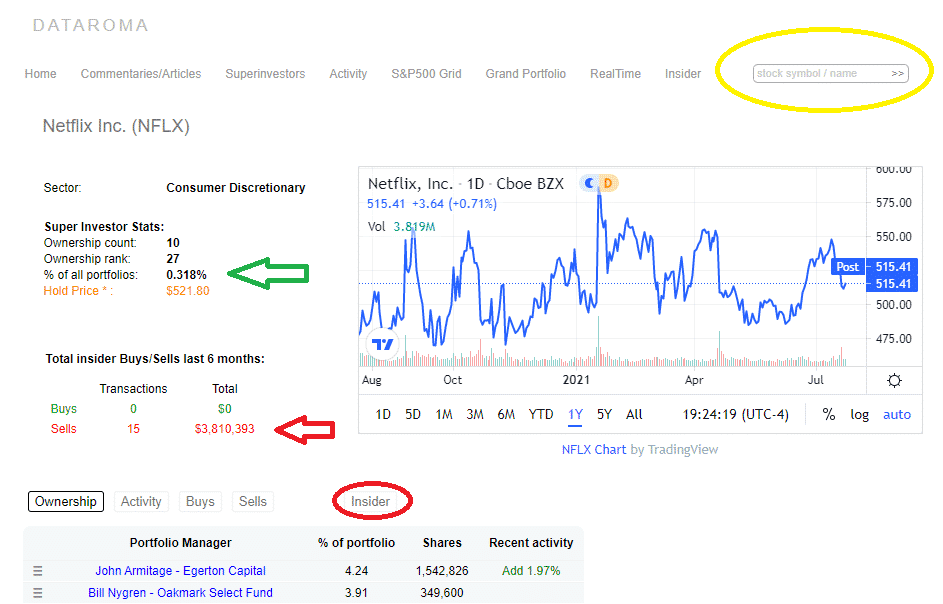

On the top right-hand side of the Datorama site is a search function (yellow circle in the image below).

This allows you to search up individual tickers to see ownership from significant funds and insider transactions.

Source: Dataroma

For the example of Netflix, we can see that 10 “super investors” own the stock.

If we want to see the activity of insiders in the company, we can simply select the insider tab (red circle) to get more information.

We can also see that insiders have been only selling the stock to the tune of a bit over 3 million dollars over the last six months.

All pretty cool stuff!

The Grand Portfolio

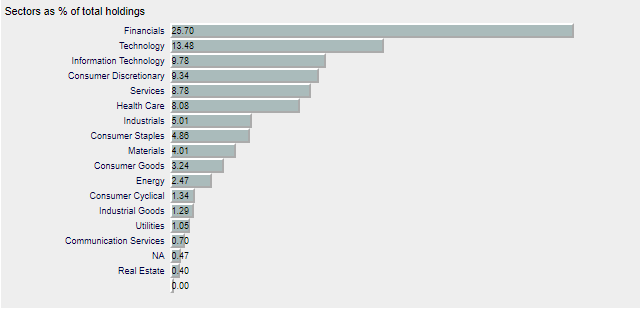

The Grand Portfolio section gives an overview of what all the super investors’ allocations are in general in one single snapshot.

Let’s say, for example, I have no preference in any one fund manager, nor do I know who I should follow.

Despite this, I want to invest with or against the fund managers and their macro views.

This is the section for you.

Source: Dataroma

Taking their sector holdings, we can tell that they are extremely bullish on the largest holding of the financial sector.

Their second-biggest holding is in technology, though if you compare to the general S&P 500 index, they would be underweight technology at the time of writing.

A pretty cool graphic overall.

Access the Top 7 Tools for Option Traders

Insider Section

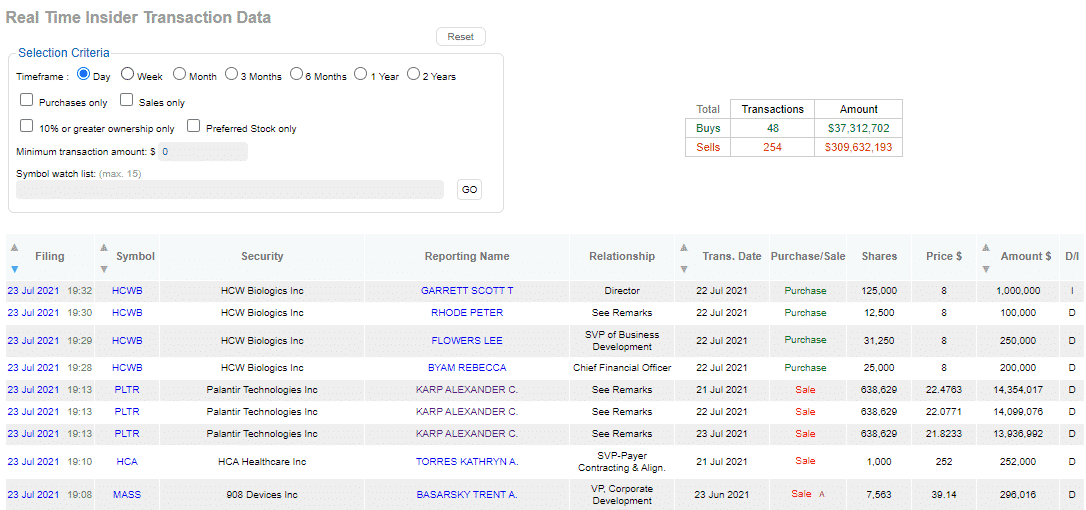

The insider section of Dataroma gives real-time updates on insider transactions.

We can use either sort by date to get the most recent transactions or set up a watchlist of tickers we would like to see.

For traders who want to make trades based on what company insiders are doing, this is a straightforward and effective tool to use.

Source: Dataroma

Commentaries/Articles

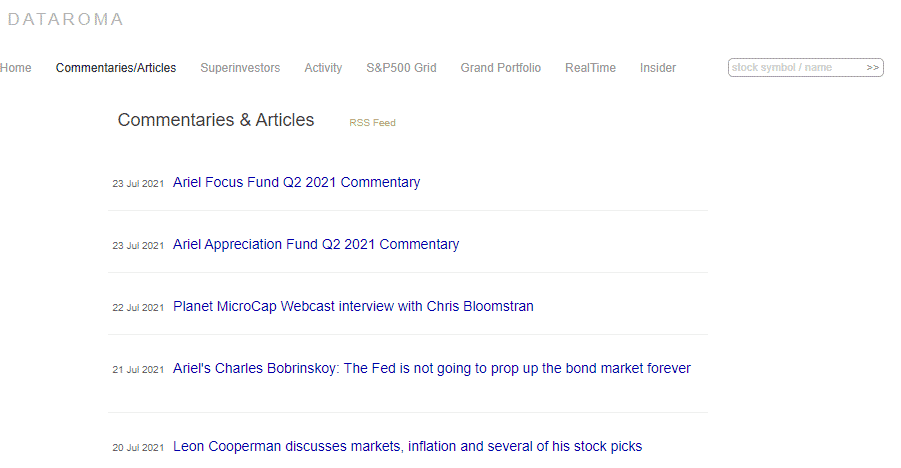

Lastly, we have the commentary and articles section.

This offers a feed of the latest articles featuring the various fund managers.

These can be either opinion pieces, interviews, or fund updates.

Overall a pretty good way to scrape for recent material that has some value and relevant opinions.

Source: Dataroma

Why Should You Use Dataroma?

There is a saying on Wall Street that the money is in the data.

The more you have, the better off you will be.

There is a reason why people pay $30,000 for a Bloomberg terminal.

*Hint* It is not because of the fancy keyboard!

The more access to data you have, the better.

Dataroma offers a lot of data specifically on what the big players in the industry are doing.

This information is valuable.

Carl Ichan is worth billions of dollars not because of his excellent commentary on Reddit with flashy puns but because of his investment returns.

Dataroma conglomerates this “smart” investor.

We have hedge fund managers who do a large amount of due diligence and insiders who naturally have more information about the company than we do.

If these people know more about the company than we do, why not trust them with our investment decisions?

It is a reasonable thought.

The Limitations of Dataroma

Before you think you found the holy grail of investing, you need to take a step back. There is an important reason why all the above information is not as valuable as it may seem.

The reason is that this information is already publicly known.

For example, knowing beforehand if Warren Buffet is going to buy a stock is valuable. Learning after the fact, along with everyone else, is not.

The reason is that after the news comes out, the stock will instantaneously react positively as people will aggressively buy up shares, assuming the manager’s opinion is valued. So, the question has almost become:

Do you feel the stock should have reacted more or less to the news?

The insider information may also appear to be valuable but comes into the same realm of being public.

We also have the added issue of understanding the reasoning behind trades.

For example, a CEO dumping shares of his stock seems like a bearish signal.

“He must believe less now in the company, and it’s prospectus,” one might think.

While this could certainly be true, it could also simply be that his yacht club membership came due, and he needs some extra money to pay it off.

Jumping to conclusions is something our brain loves to do as it makes it easy for us.

Despite this, doing so can make us ineffective traders.

Just because someone buys 1,000 out-of-the-money Tesla call options, it does not make them bullish, especially if they are short 100,000 shares and using it as a hedge.

Understanding the why is a lot more important than simply understanding the what.

Concluding Remarks

Datormama offers an abundance of data showing fund allocations and insider trading.

All this is available for free from their website without any subscriptions or add ons.

This site is an absolute gold mine for investors who already trade based on hedge fund holdings and insider information.

For those who do not, simply looking through the site will not provide any groundbreaking trades as the information is already public.

Despite this, these investors should still check out the site at the very least, take advantage of some of the links to great articles and commentary from some of the top managers.

Overall, Dataroma is highly recommended, so go and take a look at it for yourself!

Trade safe!

Disclaimer: The information above is for educational purposes only and should not be treated as investment advice. The strategy presented would not be suitable for investors who are not familiar with exchange traded options. Any readers interested in this strategy should do their own research and seek advice from a licensed financial adviser.

The post Blog first appeared on Options Trading IQ.

Original source: https://optionstradingiq.com/dataroma-review/