Today, we are looking at the difference between futures and options.

We will first define options and futures, then discuss the key differences including which is better.

Let’s get started.

Contents

- What Are Options?

- Options Trading Example (Long Call)

- Futures Explained

- Futures Trading Example

- Difference Between Futures and Options

- FAQs

- Conclusion

What Are Options?

Options are contracts that entitle the owner of that contract to the right, but not the obligation, to buy or sell an underlying asset for a given price (known as the strike price) before its expiration date.

The underlying assets of options contracts can be indices, stocks, and ETFs.

Examples of indices include:

- SPX (S&P 500 index)

- RUT (Russell 2000 index)

- NDX (Nasdaq 100)

- VIX (S&P500 volatility index), etc

Examples of stocks include:

- AAPL (Apple)

- MSFT (Microsoft)

- JNJ (Johnson and Johnson)

- WFC (Wells Fargo)

- and many more

ETFs include:

- SPY (tracks the S&P 500)

- IWM (tracks the Russell)

- QQQ (tracks the Nasdaq 100)

- VXX (tracks the VIX)

- GLD (gold ETF)

- XLE (S&P energy sector ETF), etc

Calls

A call option contract is the right to buy shares of stocks at the strike price any time before expiration.

For ease of conversation, we will say “shares of stocks.”

But we know that it means stock, ETF, or indices.

Puts

A put option is the right to sell shares of stocks at the strike price any time prior to expiration.

Options Trading Example (Long Call)

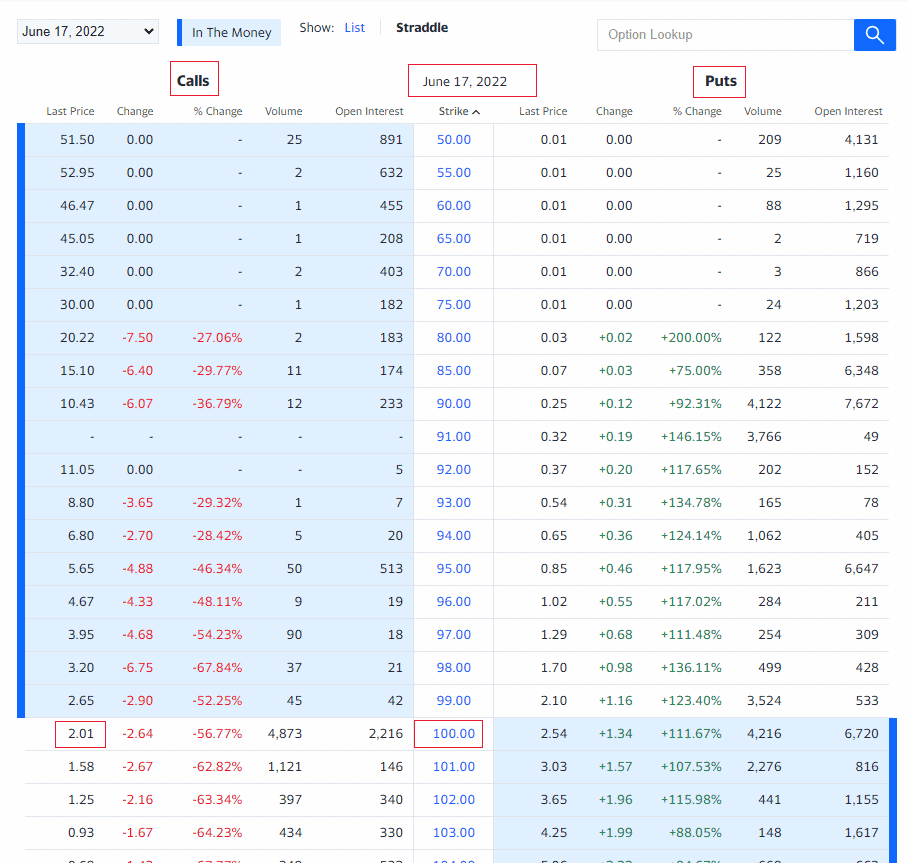

The prices of options contracts are listed on the options chain that is categorized by asset, expiration, strike price, and type of option (call or put).

source: finance.yahoo.com

We are looking at the prices of calls and put options on Disney (DIS) stock.

The options contracts shown here all expire on June 17, 2022.

We can see that the call option with a strike price of $100 costs $2.01 per share.

But you cannot buy a contract for one share of stock.

The smallest contract is for 100 shares of stock.

A trader buys one such option contract and pays $201 for that contract.

That gives the trader right to buy 100 shares of Disney stock.

This right can be exercised any time prior to the end of the trading day on June 17.

If Disney’s stock price is higher than $100 at the close of that trading day, the call option is said to be in-the-money.

In this case, many brokers would automatically exercise that contract, and the trader will find that he has 100 shares of Disney stock and that he paid $100 for each share.

Buyers of an options contract are never obligated to exercise their contract.

The buyer can call the broker prior to expiration to specify that they don’t want the broker to exercise the contract.

Most buyers of options contracts that do not intend to own the underlying shares of stock would sell the contract before expiration so that they don’t run into that situation.

Suppose hypothetically that Disney stock closed at $105 at expiration.

That would be a gain of $5 per share for the trader; because the trader would have purchased shares at $100 and could now sell them at $105 if he likes.

Considering that the contract costs $2.01 per share, that would be a profit of about $3 per share, or $300 for the 100 shares.

Suppose Disney stock closed at $95 per share at expiration.

Because this is below the strike price, the call option is said to be out-of-the-money.

It does not make financial sense for the trader to exercise the contract and buy it at $100.

The contract is now worthless because it expired.

The trader lost $201 on the purchase of the call option.

Futures Explained

Futures are also contracts.

The buyer of the contract is obligated to buy a particular commodity for a particular price, known as the forward price at a given time in the future, known as the delivery date (for physically delivered products) or the expiration date (for cash-settled products).

The seller of the futures contract is obligated to sell a particular commodity at the forward price on expiration.

Traditionally, the futures market started out so that producers and consumers of commodities such as sugar and natural gas could hedge price uncertainty.

A corn chip manufacturer wants to be able to buy corn at known prices in the future so that they are not forced to have to buy at high prices should it go up in the future.

The corn farmer wants to be able to sell corn at a certain price in the future and is assured that they have an obligated buyer of their corn before they spend all the hard work in growing the corn.

Futures contracts have a value that fluctuates depending on the commodity’s price.

Today the futures market has evolved to be a place where speculators, traders, and investors speculate on the directional movement of those fluctuations.

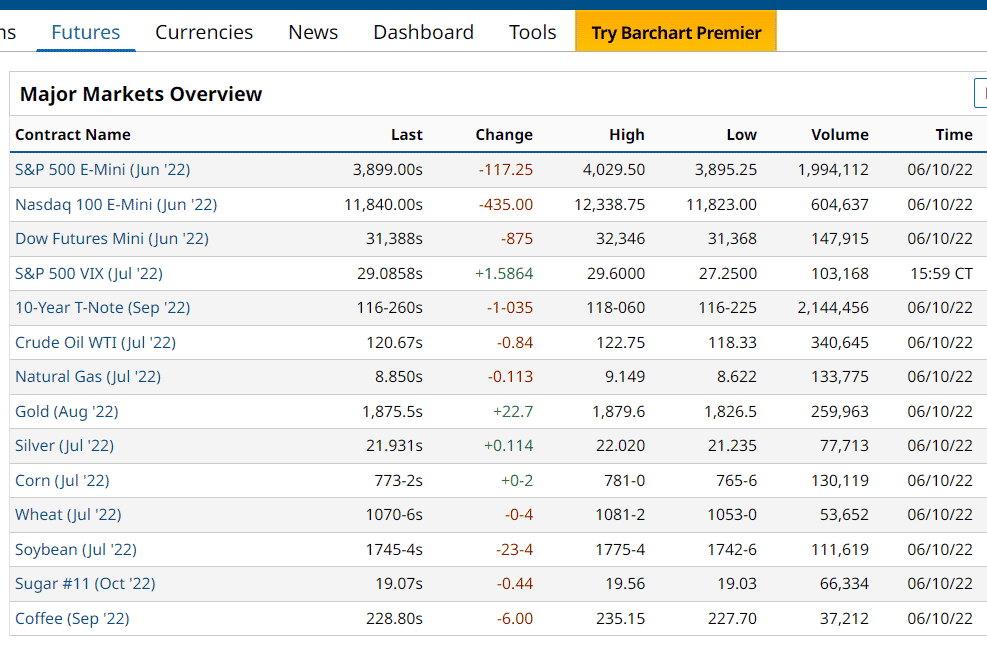

Here are the major futures markets that one can speculate on:

source: barchart.com

The numbers shown are the value of the futures contract of corn, wheat, and soybean in a unit of measure known as a point.

The value of the futures contract may correlate to the actual prices of corn, wheat, and soybean, but they are not listed as dollars.

They are listed as points.

Futures Trading Example

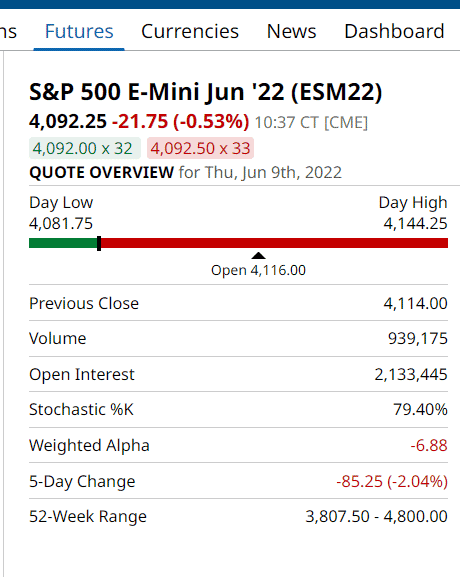

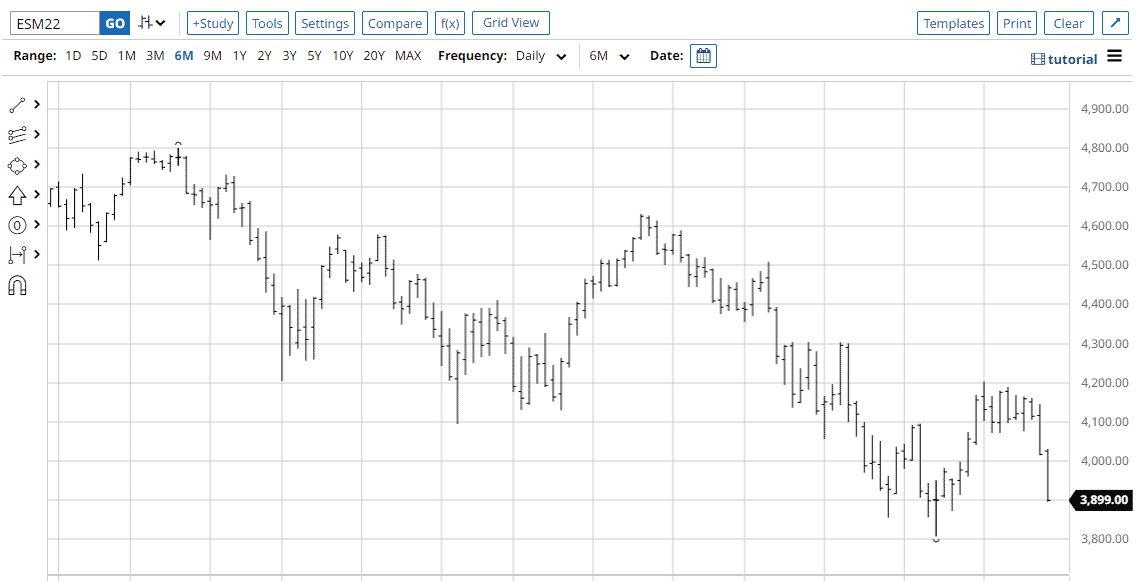

The S&P 500 E-mini futures is one of the most commonly traded.

source: barchart.com

As of June 9, the E-mini futures contracts are shown trading at 4,092.25 points.

In the symbol “ESM22”, the “ES” indicates the market that one is speculating on.

The expiration date is specified by the month code “M” and the year code “22”.

From the following mapping.

January – F February – G March -H April -J May – K June – M July – N August – Q September -U October – V November -X December -Z

the month code of “M” means that the contract has June expiration.

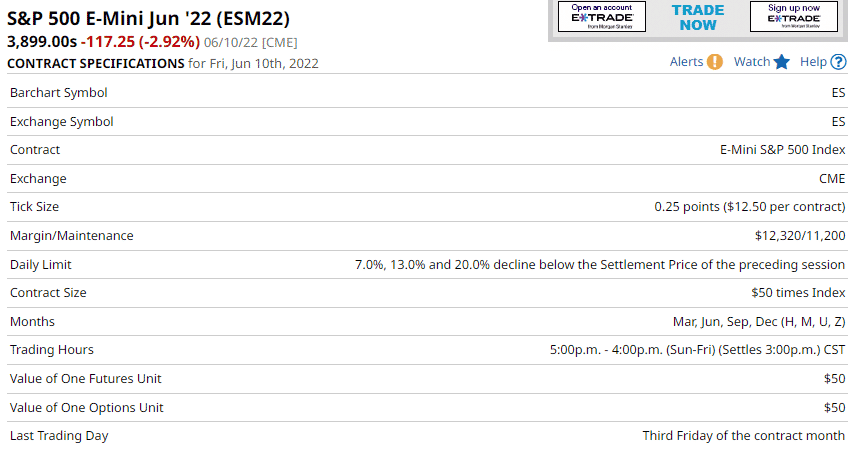

Looking at the E-mini contract specifications.

One “tick” is equal to 0.25 points.

And each tick is equivalent to $12.50 per contract.

Therefore one point in the E-mini is equivalent to $50.

The tick size and dollar equivalent are different for each futures market.

Suppose a speculator purchased one contract when the E-mini was at 4,092.25 points.

This contact in dollars is equivalent to $204,612.50.

But the speculator does not need to put up that entire amount.

They only need to deposit a certain percentage based on the margin requirements of the particular broker.

The chart of the E-mini showed that it dropped 117.25 points on Friday, June 10, 2022, and is at 3,899.00.

source: barchart.com

If the speculator bought one contract when the E-mini was at 4092.25 and sold it at 3899.00, the speculator lost $9662.50.

This is calculated by (4092.25 – 3899) x $50 = $9662.50.

Depending on the account size, this could be a lot of money lost in just a couple of days.

Traders new to futures or with smaller accounts should consider starting with the Micro E-mini, which is 1/10 the size of the E-mini.

The E-mini (ES) has a point value of $50 and a tick value of $12.50.

The Micro E-mini (MES) has a point value of $5 and a tick value of $1.25.

Difference Between Futures and Options

One key difference between futures and options is that futures contracts obligate both the buyer and seller regardless of financial profitability.

The buyer and seller of futures must buy or sell the commodity at expiration.

One will be financially profitable.

The other will not.

The risks are symmetrical whether you buy futures or sell futures.

The buyer of futures can have unlimited gains as well as unlimited losses, as can the seller.

Options contracts only obligate the seller of the option.

The buyer is not obligated to exercise the option contract’s right.

The risks are not identical from the point of view of a buyer of options and a seller of options.

The buyer of options has unlimited gain but limited loss.

The seller of options has limited gain but unlimited loss.

Settlement

Both options and futures can either be physically settled or cash-settled.

The options on stocks and ETFs are physically settled.

A seller of a put option that expired in-the-money will buy actual shares of the underlying.

A call option seller will be obligated to sell shares of the underlying at the strike price.

This is what is meant by physical settlement.

Because shares of indices can be bought or sold, the options on indices are cash-settled.

No physical shares of them are exchanged. Any profit and loss are settled in cash at expiration.

Futures can also be physically settled, or cash settled.

It is different for each futures market or commodity, so be sure to research the settlement process.

According to the gold settlement procedures, if you own one contract of gold futures (GC) at the delivery date, you will be delivered one hundred (100) troy ounces of gold with at least 995 fineness.

The gold may come in the form of one bar of 100 troy ounces or three one-kilo bars within a weight tolerance of plus or minus 5%.

This delivery shall occur on or before the last business day of the delivery month.

However, the Mini Gold (QO) futures are cash-settled upon expiration.

Having gold bars delivered to your home may not be so bad.

But unknowingly, receiving one contract unit of cattle might smell.

Margins

Futures trading has different margin types.

There is an initial margin which is the margin applicable when you initiate a trade.

The maintenance margin is the margin that you need to maintain during the trade; otherwise, you will receive a margin call.

There is an intraday margin that is applicable for trades in that you enter and exit a trade on the same day.

Futures margins are based on the risks of the commodity or assets.

This is known as a risk-based margin model.

The options margin is the same regardless of the underlying stock or ETF.

This is a rules-based margin model.

The margin requirements will depend on the particular broker chosen.

Many options and futures exchanges adopt SPAN margin, which stands for “standardized portfolio analysis of risk.”

The margin is determined based on portfolio risk.

Commission and Fees

Depending on the broker, various commissions and fees are charged for trading options and futures.

Commissions may be quoted as “per-contract” or as “per-side.”

When you buy a contact, that is one side.

When you sell that contract, that is another side.

Commissions may vary based on the level of trading activity and can sometimes be negotiated.

Fees include exchange and regulatory fees.

Check with particular brokers to see if there are any other fees involved, such as “clearing fees,” “routing or platform fees,” “daily carrying fees,” etc., or whether they lump some of the fees into the commission.

Trading Permissions

Both options and futures trading requires additional permissions on the trading account.

For options, there are different permission levels.

Lower level permission allows for only certain types of strategies.

Higher permission levels allow for riskier strategies.

FAQs

Which is better, futures or options?

Some traders think futures are better because they offer greater capital efficiency due to their lower margin requirements.

Plus, there may be some tax benefits.

Futures markets can be traded 23 hours per day, 6 days a week.

Options are limited to trading during normal trading hours of 6:30 am to 4 pm EST Monday through Friday.

Futures contracts have no time decay.

Options contract has time decay measured by “theta.”

Hence, some say that buying options is like buying a decaying asset.

Some traders think options are better because they can speculate on the direction of the stock price of particular individual companies.

You can not trade futures on Netflix, for example.

With ETFs available in almost all categories, options traders can speculate on the direction of commodities they previously were unable to.

However, the liquidity of less common ETFs can be lacking, resulting in wider bid/ask spreads.

There is greater liquidity in the futures market.

Options traders can construct multi-leg options strategies that have particular defined-risk characteristics, risk-reward ratios, and probabilities.

Options contract value depends on the price of the underlying, the implied volatility, and the time till expiration.

This gives the trader three dimensions to trade on.

Futures contract value depends only on the value of the underlying asset going up or down.

Therefore, futures traders are all directional traders.

They also tend to trade at shorter-time frames.

Futures are not subject to the Pattern Day-Trading Rule that options traders are subject to if their account is less than $25,000.

Options traders can be directional or non-directional.

They can construct strategies that do not need to predict direction but profit as time passes.

We think options trading is better due to its flexibility in controlling risk, the ability to trade non-directionally, and the potential additional edge in selling implied volatility.

Which is safer, futures or options?

Because of the lower margin requirements, futures are highly leveraged instruments.

Leverage is like horsepower in a racecar.

In the hands of a skilled driver, this provides great capital efficiency.

They can achieve large gains in terms of yield percentages with small amounts of money.

Leverage is also what makes futures riskier.

The margin requirement on some futures markets can be as low as 5% if one is only depositing 5% to control a lot of money in a position that can have unlimited risk in either direction.

In that case, it is certainly possible for one trade to lose more money than one’s entire account, regardless of whether you are a buyer or a seller of a futures contract.

For a trader that purchases a call option or a put option, which doesn’t use margin, the maximum loss in that trade is the debit paid for that contract.

The asymmetrical risk guarantees that the buyer of an options contract can not lose more than the debit paid for that option.

This comes from the fact that the buyer of the contract is not obligated to exercise if not financially favorable to do so.

Therefore buyers of options can not lose more than their account value.

Sellers of options contracts can lose more than their account value (for example, selling an uncovered call option and the underlying price goes up.)

Options traders can limit their risk by using only defined-risk strategies such as spreads and other constructions.

Futures traders can limit their risk by always using stop-loss orders.

Place the stop loss as soon as you place the trade and before you place your take-profit order.

In summary, we feel that options are safer.

Are there options on futures?

Yes, there are.

Options and futures are both financial derivatives. Options on futures are derivatives on derivatives.

That is a whole new layer that is beyond the scope of this article.

You can read about future options here.

Conclusion

There are distinct differences between futures and options.

It is just a matter of which one you have an affinity for.

There are successful futures traders.

And there are successful options traders.

We hope you enjoyed this article on the difference between futures and options.

If you have any questions, please send an email or leave a comment below.

Trade safe!

Disclaimer: The information above is for educational purposes only and should not be treated as investment advice. The strategy presented would not be suitable for investors who are not familiar with exchange traded options. Any readers interested in this strategy should do their own research and seek advice from a licensed financial adviser.

Original source: https://optionstradingiq.com/difference-between-futures-and-options/