SPX refers to the S&P 500 Index.

Think of an index as a number.

A number tells you the value of something. In this case, it tells you the value of the S&P.

The more commonly known abbreviation “S&P” comes from the financial services company named Standard & Poor’s Corporation.

Contents

-

-

-

-

-

- What Is The S&P?

- What Is SPY

- Options On SPX

- The Option Greeks

- Greeks Of SPX Versus SPY

- Delta Dollars

- In Summary

-

-

-

-

What Is The S&P?

The S&P 500 is often used as a benchmark for the overall U.S. stock market.

It comprises 500 of the largest publicly traded companies in the United States selected from various sectors, including technology, healthcare, financials, consumer discretionary, etc.

The index is weighted by the market capitalization of its constituent companies.

This means that larger companies with larger market capitalization will have a greater impact on the index’s performance than smaller companies.

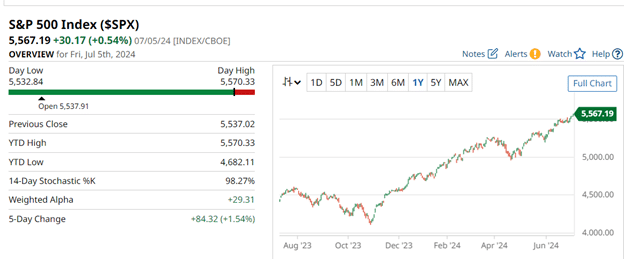

If you type in the symbol “SPX” into your charting software, you will see the graphical representation of the S&P 500 index:

This is a screenshot of barchart.com showing the SPX value at the close of Friday, July 5th, 2024. SPX is at 5567.19.

This is not a dollar amount.

It is just a number.

Because an index is a number and not shares of a company, you can not buy shares of the SPX.

However, various financial instruments are based on this number, including exchange-traded funds, options contracts, and futures contracts.

What Is SPY

SPY is the ticker symbol representing the exchange-traded fund (ETF) known as the “S&P 500 Depository Receipts” or “SPDR”.

When speaking, people just say “spiders” for short.

The SPY ETF is based on the S&P index.

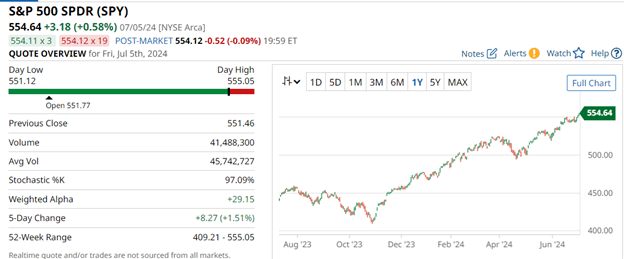

If you type the symbol SPY into a charting software:

You will see that the SPY chart looks the same as the SPX chart.

We say that the SPY tracks the S&P index.

It is a derivative product of the S&P index.

The value of the SPY, as shown, is $554.64.

This number does represent a dollar amount.

You can buy shares of an ETF just like buying shares of stock in a company.

At the moment, it costs $554.64 for one share of SPY.

Note that the price of SPY is about one-tenth the size of the SPX; this will become important later.

Options On SPX

While we can not buy shares of the SPX, we can buy and sell call and put options on the SPX like we can buy and sell options on SPY.

Buying one contract of a call on SPX that is about a month to expiration would cost thousands of dollars.

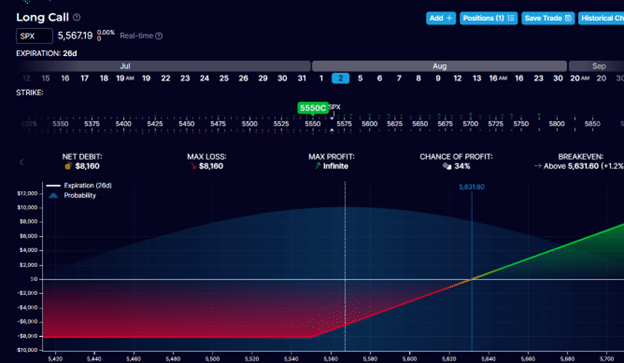

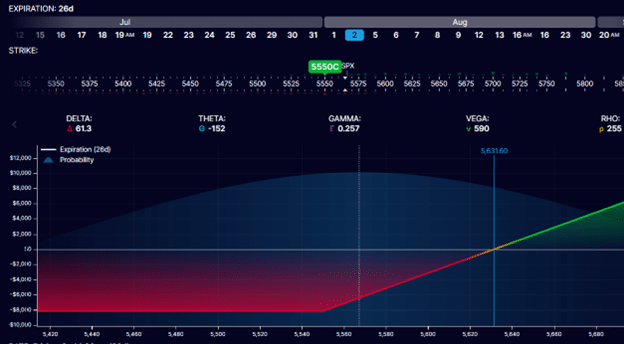

Here, OptionStrat.com shows the price of a long call on SPX with a strike price of $5550 (a near-the-money strike).

The price is $8160 as of close on July 5th, 2024, with the option expiring on August 2nd, 2024.

The risk graph shows that the option value will increase if the price of SPX increases.

So, investors speculating on the upward movement of SPX might purchase such an option contract.

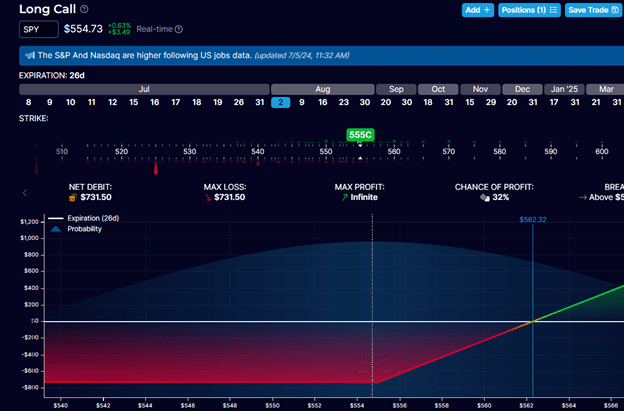

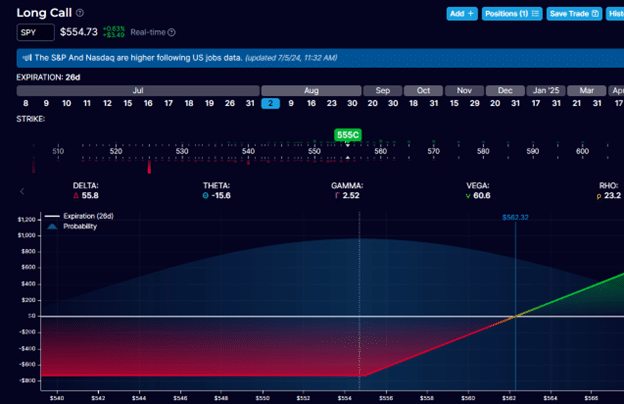

If the price tag of $8160 is too much, then some investors might purchase the call option on SPY instead.

The risk graph looks the same.

But the price of the $555 strike call option on SPY is only $731.50 (about one-tenth as much) – for the same August 2nd expiry.

The Option Greeks

Delta is the first Greek that one might learn about when trading options.

It is just a financial metric that tells you how the option’s value might change as the price of the underlying asset changes.

So, a delta of 0.75 means that the value of the SPY option increases by $0.75 if the SPY price moves $1 up in price.

OptionStrat shows that our example long call in SPY has a delta of 55.8.

Other options include analytical software, which can also show this, but they may calculate these numbers slightly differently (so don’t expect them to show exact numbers).

This implies that if the SPY price goes up one dollar, the call option price should increase by $55.8 if all other factors remain the same.

The option price is affected by many other factors besides the price of SPY.

Greeks Of SPX Versus SPY

The delta of our example SPX option is also about the same at 61 delta:

That means if SPX goes up by 1, the option’s value would increase by $61.

Even though the delta is about the same, the investor with one call option on SPX would have about ten times the market exposure as the investor with one call option on SPY.

Another way to look at it is that one Delta in SPY is like owning one share of SPY.

One Delta in SPX is like owning one share of SPX.

Since SPX is ten times the size of SPY, one delta in SPX is ten times the exposure as one delta in SPY.

If SPX goes up 10 points (from 5550 to 5560), SPY would go up 1 point (from 555 to 556).

The SPX option investor would make about $610. And the SPY option investor would make $56.

Delta Dollars

The point I’m trying to make is that the delta does not represent an investor’s exposure to the market.

The delta and the underlying size represent the investor’s exposure to the market.

This is where Delta Dollars come in handy.

Delta Dollars is the delta multiplied by the price of the underlying.

In the example of the SPY investor, the Delta Dollars is 55.8 x 555 = $30,969

The SPX investor’s Delta Dollars is 61.3 x 5550 = $340,215.

In Summary

SPX is an index.

SPY is an ETF.

As such, you can not purchase shares of SPX.

But you can SPY.

Both of them have options, and both are very liquid.

SPY has tighter bid/ask spreads and is said to be the most liquid of all.

At option expiration, SPX is cash-settled.

SPY has the possibility of being assigned shares.

SPX is ten times larger than the SPY.

Consider the Greeks and the Delta Dollars when deciding whether to buy or sell options on SPX or SPY.

We hope you enjoyed this article on the difference between SPX and SPY.

If you have any questions, please send an email or leave a comment below.

Trade safe!

Disclaimer: The information above is for educational purposes only and should not be treated as investment advice. The strategy presented would not be suitable for investors who are not familiar with exchange traded options. Any readers interested in this strategy should do their own research and seek advice from a licensed financial adviser.

Original source: https://optionstradingiq.com/difference-between-spx-and-spy/