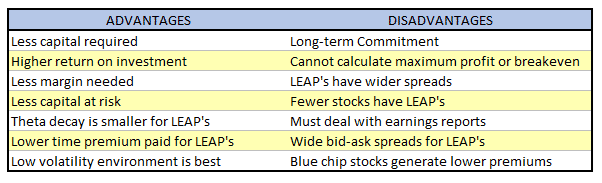

The Poor Man’s Covered Call (PMCC) is a strategy that mimics the traditional covered call but requires significantly less capital.

Instead of owning the underlying stock, traders buy a long-dated in-the-money call option and sell a short-dated out-of-the-money call against it.

This strategy can be attractive due to its lower cost and potential for income generation.

However, the PMCC is not without its risks, and one of the most significant is the potential for early assignment on the short call.

Early assignment can occur when the short call is in the money, and the holder exercises the option, forcing you to deliver the underlying stock.

Since the PMCC doesn’t involve actual stock ownership, being assigned early can result in a margin call or the forced sale of the long call position, potentially leading to substantial losses.

This article will explore how to navigate the PMCC strategy effectively, focusing on avoiding early assignments and knowing what to do if you find yourself in that situation.

Contents

-

-

-

-

-

- The Risk Of Early Assignment On The Short Call

- Strategies To Avoid Early Assignment

- What To Do If You’re Assigned On The Short Call

- Conclusion: Mastering the Poor Man’s Covered Call

-

-

-

-

The Risk Of Early Assignment On The Short Call

Early assignment is the most significant risk when trading the PMCC.

Unlike a traditional covered call where you own the stock, the PMCC involves holding a long call option. If the short call is assigned, you must deliver shares you don’t own.

This scenario can be particularly problematic if the long call is deep in the money, as the cost to acquire the stock could exceed the premiums received from the short call.

Early assignment typically occurs when the short call is deep in the money, especially as expiration approaches or when a dividend is imminent.

Traders must be vigilant about the conditions that increase the likelihood of assignment.

One key factor is the extrinsic value of the short call.

The assignment probability rises if it has little to no extrinsic value left.

Monitoring the ex-dividend date is also crucial because traders holding the short call may exercise to capture the dividend, leaving you on the hook.

This video explains a few things to watch out for when it comes to the early assignment of your short call:

The consequences of early assignment in a PMCC can be severe.

Some brokers will automatically exercise your long call, which means you might lose all the remaining time value of that call.

This is definitely a situation you want to avoid.

Check with your broker for any guidelines for this scenario, as it can vary from broker to broker.

If you receive a notification of an early assignment on the short call, the best thing to do is quickly buy 100 shares of the stock to cover the assignment and simultaneously sell your long call in the market.

Strategies To Avoid Early Assignment

Avoiding early assignments is a key aspect of successfully managing the PMCC strategy.

One effective approach is monitoring the short call’s moneyness and theta.

As the option approaches expiration, its extrinsic value diminishes, increasing the likelihood of assignment.

To mitigate this risk, consider rolling the short call to a later expiration date before its extrinsic value drops too low.

Rolling involves closing the current short call and selling another with a further expiration date, often at a higher strike price.

This not only reduces the risk of assignment but can also provide additional premium income.

Another strategy is to carefully choose the strike price of the short call.

Selecting a strike price that is out of the money can reduce the probability of early assignment.

The further out of the money the short call is, the lower the likelihood that the option will be exercised early.

Additionally, keeping an eye on the ex-dividend date of the underlying stock is crucial.

If the short call is in the money and the ex-dividend date is approaching, consider closing or rolling the position to avoid assignment.

Lastly, managing the size of your positions can help mitigate the impact of early assignments.

By limiting the number of contracts sold, you reduce the overall risk in your portfolio.

Smaller positions allow more flexibility in managing assignments and reduce the potential financial burden of being assigned.

This disciplined approach, combined with proactive monitoring and adjustments, can significantly reduce the likelihood of early assignment and the associated risks in trading the PMCC.

What To Do If You’re Assigned On The Short Call

Even with careful management, there’s always the possibility of early assignment.

If you find yourself in this situation, acting swiftly to mitigate potential losses is crucial.

The first step is to assess the market conditions and the current status of your long-call option.

As mentioned, once you receive the assignment notification, you might want to buy the underlying stock to fulfill the assignment.

You will also want to sell the long call if this occurs during market hours.

This approach essentially temporarily converts the PMCC into a traditional covered call.

Conclusion: Mastering The Poor Man’s Covered Call

The Poor Man’s Covered Call is a powerful strategy for traders looking to generate income with less capital than traditional covered calls.

However, the risk of early assignment on the short call is a significant factor that can lead to lost profits and significant stress if not managed properly.

Understanding the conditions that increase the likelihood of early assignment, implementing strategies to avoid it, and knowing what to do if you are assigned can enhance your success with the PMCC.

Avoiding overexposure, monitoring critical dates like expiration and ex-dividend dates, and being prepared to roll or close positions when necessary are essential practices.

Remember, the PMCC aims to capitalize on market opportunities while managing risk effectively.

With careful planning, disciplined execution, and a keen awareness of the risks involved, you can make the PMCC a profitable part of your trading arsenal.

We hope you enjoyed this article on early assignments and the poor man’s covered call.

If you have any questions, please send an email or leave a comment below.

Trade safe!

Disclaimer: The information above is for educational purposes only and should not be treated as investment advice. The strategy presented would not be suitable for investors who are not familiar with exchange traded options. Any readers interested in this strategy should do their own research and seek advice from a licensed financial adviser.

Original source: https://optionstradingiq.com/risks-of-poor-mans-covered-call/