When it comes to playing stock earnings announcement events with options, there are pre-earnings trades that enter and exit the trade before the earnings event.

Contents

-

-

-

- Example Of A Double Diagonal Pre-earnings Trade

- Closing The Trade

- IV Changes In The Pre-earning Double Diagonal

- Conclusion

-

-

There are earnings trades, meaning we initiate a trade right before earnings and exit the trade after the event.

There are many strategies out there that attempt to capitalize on this event.

Then there are the post-earnings trades, which are to wait for the stock to move after the earnings event and initiate the trade based on that move.

My favorites are the pre-earnings trades.

First of all, I don’t have to deal with the uncertainty of whether the stock will gap up or down.

And second, I don’t have to wake up at the market open after the event to either take profit or salvage the trade.

My preferred strategy for pre-earnings trades is the diagonal spread or the double diagonal.

If I have a directional bias that the stock will move up slightly before earnings, I would usually use the put diagonal, as explained in my video.

A call diagonal would be used if I have a directional bias in the down direction.

If I don’t have any directional bias, I will use both a put diagonal and a call diagonal at the same time, making it a non-directional double diagonal trade.

This will be the example shown today.

If you need a review of these time spreads, please refer to the links above.

Example Of A Double Diagonal Pre-earnings Trade

Alphabet Inc (GOOGL) has an earnings announcement after the market closes on Feb 4, 2025.

About one or two weeks before this date, the investor puts on a double diagonal with the short call and short put near the 15 delta on the option’s chain.

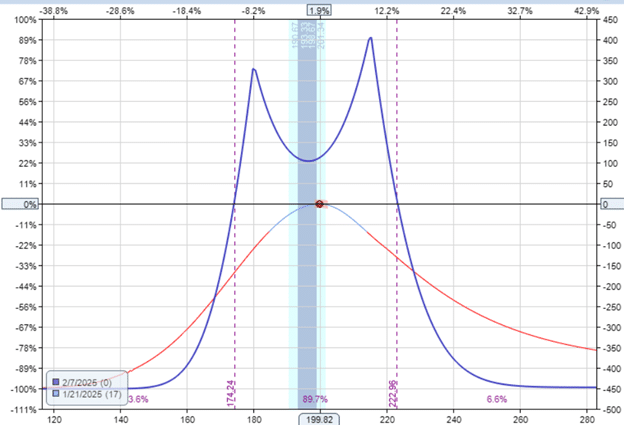

Date: Jan 21, 2025

Price: GOOGL @ $200

Put diagonal:

Sell one Feb 7 GOOGL $180 put @ $1.14

Buy one Feb 21 GOOGL $175 put @ $0.96

Credit: $18

Call diagonal:

Sell one Feb 7 GOOGL $215 call @ $2.17

Buy one Feb 21 GOOGL $220 call @ $1.84

Credit $33

Net Credit: $51

You can initiate these as two separate orders, which makes filling easier.

Or you can initiate both diagonals as one single order.

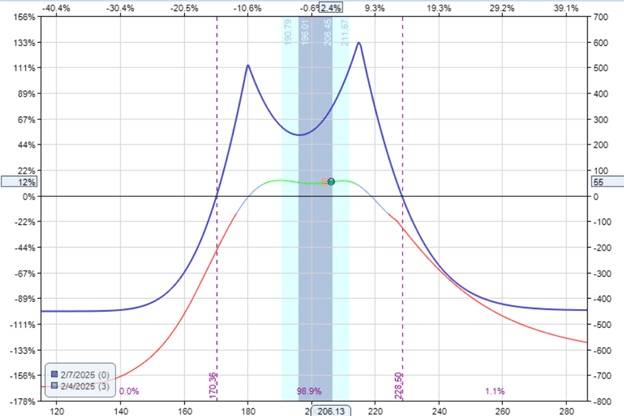

Based on the expiration graph modeled below, the capital at risk in this trade is about $450.

A few things to note about the construction of these diagonals.

We are always selling the shorter-dated expiration and buying the later-dated expiration.

The shorter-dated expiration must expire immediately after the earnings event.

This expiration will give you the highest premium to sell due to the event risk’s high implied volatility (IV).

We protect ourselves by buying the long options with expirations two weeks further out than the short options.

Because they are further away from the earnings event and their strikes are further out of the money, their implied volatility will be slightly lower.

In our example, our short options we are selling at 42 IV.

We are buying our long options at 14 IV.

We are selling high implied volatility and buying low implied volatility.

Closing The Trade

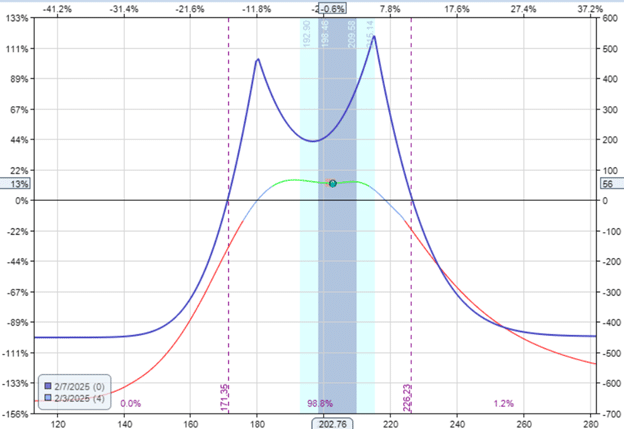

On the morning of Feb 3, the trade is showing a profit of $56.

The investor can certainly take profits here, as this is about a 12% yield on the capital at risk.

Since this is a pre-earnings trade, it is not meant to be held through earnings.

Therefore, the latest that the investor can get out of the trade is right before the market closes on Feb 4.

If he held to that time, the P&L wouldn’t have changed much in this case…

We don’t want to hold the trade through earnings because a large price move might put the price outside the expiration graph’s profit tent.

IV Changes In The Pre-earning Double Diagonal

All options IV in our double diagonal are expected to rise as we approach the earnings event.

The short options’ IV rose to 75.

This may sound bad because we are selling the short options and generally want the IV to drop.

However, if you look at the long option, their IV rose approximately by the same amount to 45.

A rising IV, in the long option, is beneficial to the trade.

In this case, the net effect is that volatility neither helped nor hurt the trade that much.

This is evidenced by the low vega Greek at the start of the trade.

The Greeks at the start of the trade:

Delta: -0.13

Theta: 12.87

Vega: 3.6

The dominant Greek is the positive theta, which was the main income generator for this trade.

Conclusion

The double diagonal is a very flexible trade, and you can adjust it by having more contracts on one side or the other to balance the delta.

Or you can adjust the width of the diagonals to increase or decrease its vega.

We hope you enjoyed this article on the double diagonal pre-earnings trade.

If you have any questions, please send an email or leave a comment below.

Trade safe!

Disclaimer: The information above is for educational purposes only and should not be treated as investment advice. The strategy presented would not be suitable for investors who are not familiar with exchange traded options. Any readers interested in this strategy should do their own research and seek advice from a licensed financial adviser.

Original source: https://optionstradingiq.com/double-diagonal-pre-earnings-trade/