Today, we are going to talk about credit spread mistake and five mistakes that new traders tend to make.

I know that I made all these mistakes when I was starting out.

Contents

- Introduction

- Mistake 1: Not Having A Plan

- Mistake 2: Letting Losers Be Too Large

- Mistake 3: Adjusting Too Late

- Mistake Number 4: Not Going In The Direction Of The Trend

- Mistake Number 5: Holding Too Close To Expiration

- FAQs

- Conclusion

Introduction

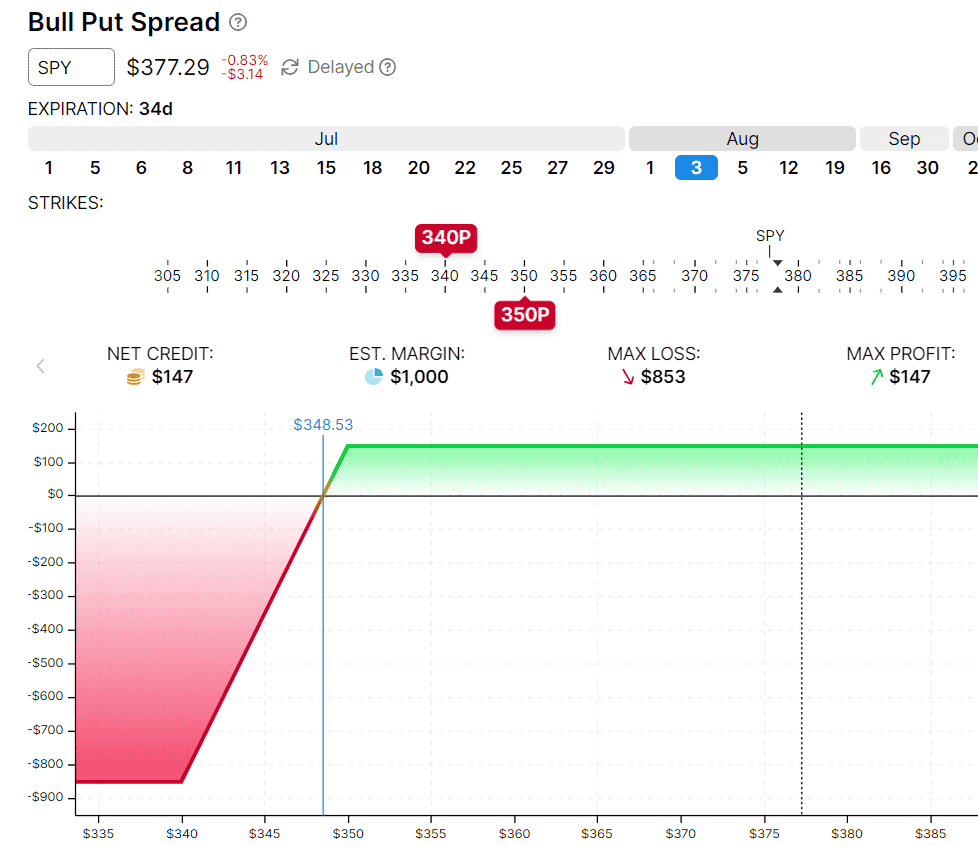

Here is the payoff graph of a typical out-of-the-money bull put credit spread on SPY (the S&P 500 ETF).

source: OptionStrat.com

- What is the maximum risk in this trade?

- What is the maximum potential profit?

- What is your plan for trading this spread?

- Under what conditions do you put such a spread?

- At what delta do you put the short strike?

- What is the width of the spread that you will use?

- When do you take profit?

- When do you adjust?

- And how?

- When do you exit for a loss?

- How long will you hold the trade?

Mistake 1: Not Having A Plan

These are all questions that you need answers to before putting on the trade.

In other words, you need to have a plan.

If you don’t have any plan, then you are just trading based on how you feel when you see the candles on the chart.

You are trading based on emotions.

Because you don’t have a plan, your decisions and actions will be inconsistent.

Some days you make one decision, and another day you make a different decision (perhaps based on your mood on a particular day).

Since the statistics of your trades that you are journaling are based on inconsistent actions, the results recorded cannot tell you what you are doing correctly and what you are doing wrong.

You cannot learn from the results of your journals if the actions are inconsistent.

In other words, you cannot tell if your strategy is working or not because you are not trading based on a fixed strategy.

If you are trading based on a plan, then the results can tell you if the plan is working or not.

This enables you to revise or improve the plan until you find the winning plan.

Maybe you plan to put on credit spreads and hold to expiration and let the statistics play out.

That is at least a plan.

This plan answers the questions of how long to hold when to take profit/loss, and when/how to adjust.

But unfortunately, the statistics of this particular plan do not play out in your favor.

I wish it did because it would make trading credit spreads that much easier.

Let’s see why. In the above example, the short strike of the credit spread was placed at the 20-delta.

Statistically, this means there is a 20% chance that the price of SPY will close below the short strike at expiration, and the trader would likely lose the max loss of $853.

There is about an 80% chance that we will keep the initial credit of $147.

So out of 100 trades, we would win 80 trades and lose 20 trades. Then our wins would be:

80 x $147 = $11,760

And our losses would be:

20 x $853 = $17,060

In the long run, we would incur a net loss.

Randomly putting on credit spreads would not work.

This plan does not have an entry criterion.

If you can figure out when to put it on such that direction goes in your favor most of the time, then perhaps you can make this plan work.

Across a large random set of credit spreads placed at the 20-delta, there is a 20% chance of that spread being in the money at expiration.

By selectively putting on credit spreads, you are no longer drawing from a random set.

That 20% chance statistics no longer hold.

By selectively putting on credit spreads based on technical analysis, fundamentals, or other patterns, you are skewing the probabilities in your favor because the 20% chance statistics do not take these other factors into account.

Having a plan is a necessary but not a sufficient requirement for successful credit spread trading.

We also need to have a winning plan and a plan that has rules to prevent the trader from making the next four mistakes.

Mistake 2: Letting Losers Be Too Large

One big mistake when trading credit spreads is that the losses are too much larger than the wins.

It is easy for this to happen because of the risk structure of the credit spread.

In the above example, you can see that the potential loss ($853) is much larger than the potential win ($147).

The risk-to-reward ratio is near 6.

In other credit spreads, the ratio can be as high as 10, which means that one losing trade can take away the profits of ten winning trades.

Not only that, but out-of-the-money credit spreads have negative gamma, which means that as the trade loses money, the losses accelerate.

However, if the trade is winning money, the win doesn’t accelerate.

Quite the opposite, the wins get more and more difficult to accrue.

While this effect is not great, this asymmetry makes it easy for beginning credit spread traders to have losses that are just too large.

Build into your trading plan rules to limit the losses.

Some possible examples might be:

Do not let losses be more than two times the credit received for the credit spread.

If profits are taken at 50% of max potential profit, then that means that one loss cannot wipe out more than four wins.

It need not be two times the credit received.

It could be three times.

Or some traders might limit the loss to the amount of credit received.

You need to play with the numbers and, based on the win rate and other stats, find the rules that give your plan a positive expectancy of profits.

Some traders may decide to take profits based on the percentage return on the capital at risk.

In this example trade, the capital at risk is $853.

A trader may have the rule to take profit at 10%, or $85 profit.

If that is the case, the trader might have a rule that says losses cannot exceed 15%.

This keeps the amount lost not too much greater than the amount won.

Mistake 3: Adjusting Too Late

Okay, now that you have a max loss number in mind.

The second mistake is adjusting too late.

If one’s max loss is 15%, and the trader starts adjusting the trade when it has already lost 14%, this is adjusting too late.

That is too late if you wait until the price touches the short strike before adjusting.

The adjustment takes time to work if it even works at all.

So if the max loss is at 15%, start adjusting way before your max loss, like when the trade is down 7%.

Or have as a rule to adjust when the short strike is at a certain delta, or when the price is a certain percentage from the short strike, etc.

Mistake Number 4: Not Going In The Direction Of The Trend

Credit spreads are directional trades.

It helps if you go in the direction of the dominant trend.

You don’t want to be selling bull put spreads in a bear market, for example.

Don’t try to predict market reversals and capture tiny counter-trend moves with credit spreads.

If you are selling credit spreads with 30 days to expiration, you might have to hold it for five days or a couple of weeks to get good profits.

In that time, the short counter-trend move might have come and gone, and the price would have started moving back into the dominant trend.

Mistake Number 5: Holding Too Close To Expiration

Don’t hold credit spreads into the last week of expiration.

Some are tempted to do this because they have seen that the theta decay curve accelerates into expiration, thinking that theta is highest in the last few days till expiration.

This is a generalization and is true only for at-the-money options.

More in-depth studies indicate that it is not necessarily the case for far out-of-the-money options and spreads.

Starting at four weeks to expiration, theta decay does decay more and more as it approaches expiration.

However, in the last few days till expiration, this decay rate slows down.

You are not really getting that much faster decay into those last few days.

Plus, now you have an increased gamma risk.

A big price move during those last few days can turn your profitable credit spread into a losing trade in a very short time.

It is not worth the risk of holding the spread at the last week of expiration, especially when you have a profit in your hands.

FAQs

Is it better to trade bull put credit spreads or bear call credit spreads?

You should only trade bull put credit spreads in an uptrend and bear call credit spreads in a downtrend.

However, bull put credit spreads are easier to trade.

Bear call credit spreads are more difficult because they are traded in a downtrend and often in a bear market.

Prices in a bear market are less consistent and have larger gaps and more volatile moves.

Plus, you don’t get as much credit in call spreads as in put spreads.

When to adjust credit spreads?

If selling a credit spread with the short strike at 15 delta, consider adjusting when that short strike gets to be around 20 to 25 delta.

How to adjust credit spreads?

There are many ways to adjust credit spreads.

You can roll the credit spread further out away from the money.

You can roll the credit spread further out in time to a later expiration.

You can buy a debit spread as a hedge.

For example, if your bull put spread is threatened with the price coming down.

Buy a put debit spread that profits when the price goes down.

Or you can even just buy a put.

You can buy them with the same expiration as your original spread.

Or consider buying them with expiration one month further out in time.

This way, you don’t lose as much on the theta decay.

Some traders sell an opposing spread turning the credit spread into an iron condor.

How much should you adjust credit spreads?

A standard adjustment would reduce the position delta by about half.

For example, if your bull put credit spread has a position delta of 6 and needs adjustment.

Put on an adjustment that reduces the position delta to 3 deltas.

You usually don’t want your adjustment to be so strong that it flips the delta sign.

For example, you don’t want to turn your bull put spread into a bearish trade.

Conclusion

To trade credit spread successfully, come up with a plan and trade with the trend.

Losses in credit spread can come quickly, especially when you hold them too close to expiration.

Therefore, be quick to adjust and avoid big losses.

Trade safe!

Disclaimer: The information above is for educational purposes only and should not be treated as investment advice. The strategy presented would not be suitable for investors who are not familiar with exchange traded options. Any readers interested in this strategy should do their own research and seek advice from a licensed financial adviser.

Original source: https://optionstradingiq.com/credit-spread-mistakes/