Contents

-

-

-

- Introduction

- Trade Details

- Composition of Two Calendars

- Exit Before the First Expiration

- The Greeks

- Frequently Asked Questions:

- Conclusion

-

-

Introduction

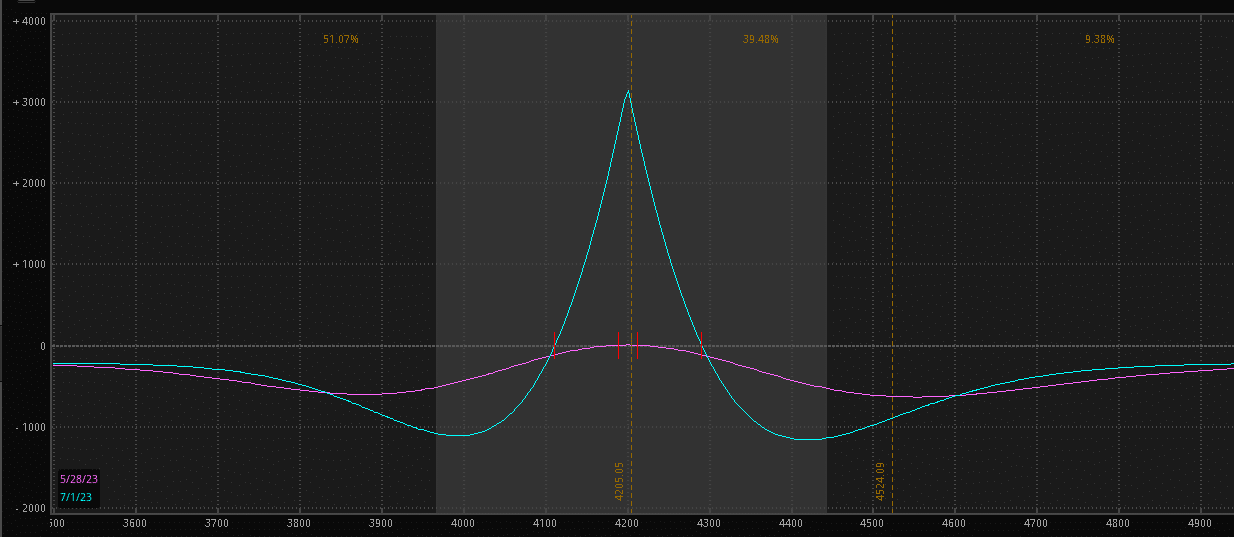

Options investors have creative names for their option strategies, such as the Condor, Rhino, Jade Lizard, Butterfly, etc.

What about this one?

Have you seen this exotic, yet beautiful, option creature?

This is the time fly. Its graph is all curves – no straight lines in sight.

The blue expiration graph resembles a winged creature flying gracefully through the air.

The purple T+0 line is initially somewhat flat but will bend and morph to conform closer to the expiration line as time in the trade passes.

A standard butterfly has options of three different strikes with the same expiration.

A time butterfly (or time fly) has options of the same strikes at three different expirations.

The above graph was constructed on the SPX (S&P 500 index) as follows:

Trade Details

Date: May 26, 2023

Price: SPX @ $4200

Sell 1 June 30 SPX 4200 put @ $62.80

Buy 2 July 31 SPX 4200 put @ $88.35

Sell 1 Aug 31 SPX 4200 put @ $111.70

Net debit: -$220

Because we are paying a debit, we are said to be “long” the time fly.

Composition of Two Calendars

You can think of the time fly as two calendars:

Long Calendar:

Sell one June 30 SPX 4200 put @ $62.80

Buy one July 31 SPX 4200 put @ $88.35

Short Calendar:

Buy one July 31 SPX 4200 put @ $88.35

Sell one Aug 31 SPX 4200 put @ $111.70

The problem is that when you short or sell a calendar (as in buying the July and selling the August), you can end up with a short put option if you happen to let the earlier long leg expire.

Having a naked short put option on a large index like SPX is prohibitive because your broker will likely assign a large margin requirement to the trade to account for the possibility of the short put going against you.

Exit Before the First Expiration

Like the calendar, the time fly is not meant to be held until expiration.

Exit the time fly before the earliest expiration.

If you let the first expiration expire, you will be left with two long puts and one short put, a directional position you probably don’t want.

The Greeks

The Greeks of our example time fly show characteristics of a long calendar.

Delta: -0.14

Theta: 17

Vega: 44

Gamma: -0.03

It is delta-neutral to start.

Being long theta means it makes money as time passes.

It is a long vega, just like a calendar.

It is negative gamma, which means that we prefer that the underlying price does not move.

Based on looking at the risk graph, we are risking about $1000 with the potential of making $3000 – a three-to-one reward-to-risk ratio.

Like the calendar, the expiration graph is not fixed.

It is dynamically changing throughout the trade. So this is only an estimate.

This is a characteristic of having expiration at different times, the outcome of which is having curved expiration graphs.

Frequently Asked Questions:

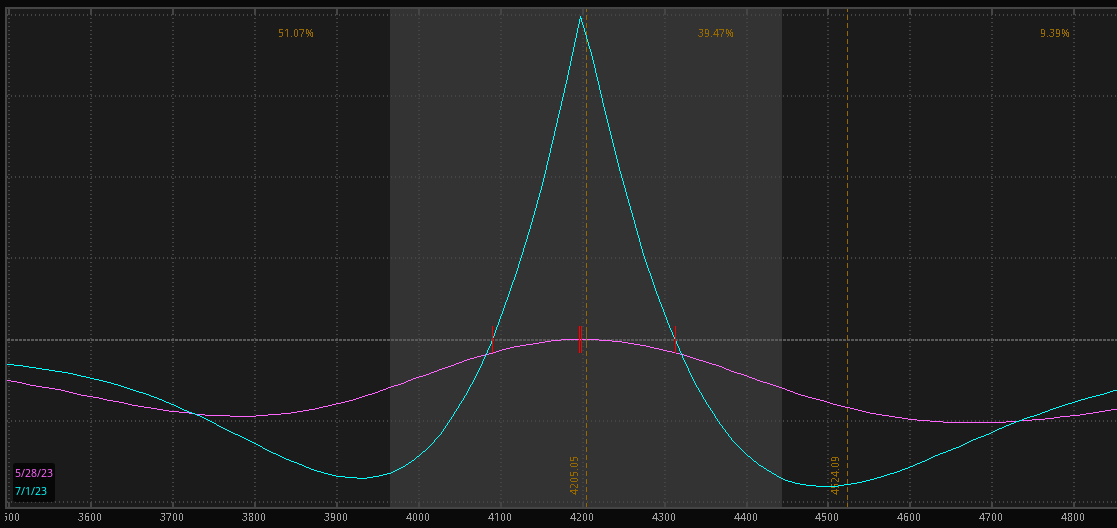

Can the time fly be done with call options?

Yes, here is the time fly when I switched all the put options to call options.

It looks similar but not identical.

The Greeks are equally similar.

Like the butterfly, you must construct the time fly with all puts or all calls, but not a mixture of puts and calls.

Never heard of time fly; did you just make this up?

No, I did not conceive of the idea nor make up the name.

While it is true that references to time flies are difficult to come across on the internet, there are references to time flies if you look hard enough in academic textbooks or dissertation papers.

Here, I’ll give you one reference. Look up Option Volatility and Pricing: Advanced Trading Strategies and Techniques by Sheldon Natenberg.

If you are searching on the internet, make sure you filter out results such as:

“Time fly when you are having fun.”

“He likes to spend time fly fishing.”

“It is time. Fly away to a remote island.”

“What are some techniques to make time fly.”

“At the same time, fly in and out of airport is a hassle.”

Then you might end up with a correct search result such as this one.

There you go; the time fly is not a mythical creature after all.

Is the time fly an advanced strategy?

Yes, it is an advanced strategy.

That is why it appears in Natenberg’s book, which covers advanced trading strategies and techniques.

Like the calendar, the time fly is heavily affected by volatility.

So it is also a volatility play.

The time fly is not recommended for new option traders.

Just use the long calendar instead.

Conclusion

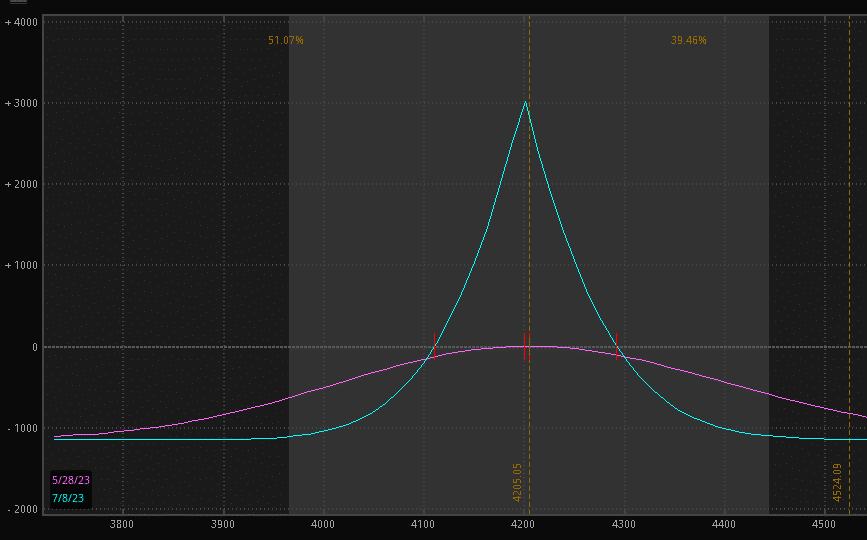

The time fly is more of an academic exercise than a practical strategy.

It is not practical due to the high margin requirements.

Its behavior can be mimicked with a standard long calendar instead.

Here is a standard long calendar on SPX with the same reward-to-risk ratio of 3 to 1 as our original time fly.

Source: ThinkOrSwim

Sell 1 July 7, 2023, SPX 4200 put

Buy 1 July 21, 2023, SPX 4200 put

The Greeks of this long calendar:

Delta: -0.02

Theta: 13

Vega: 90

Gamma: -0.03

The Greeks are similar, except that the time fly has lower vega giving it a lower vega/theta ratio.

While the standard calendar looks mundane now that your eyes have gazed at the time fly, it is more practical for everyday trading.

At least now you can say you have seen the esoteric time butterfly.

We hope you enjoyed this article on the time fly options strategy.

If you have any questions, please send an email or leave a comment below.

Trade safe!

Disclaimer: The information above is for educational purposes only and should not be treated as investment advice. The strategy presented would not be suitable for investors who are not familiar with exchange traded options. Any readers interested in this strategy should do their own research and seek advice from a licensed financial adviser.

Original source: https://optionstradingiq.com/time-fly-options-strategy/