There sure are numerous ways of trading and adjusting iron condors.

Today, we will look at an interesting case study where the condor ended up as a butterfly.

We are not saying this is the best way to trade an iron condor.

However, it always helps to look at different ways of trading and learn the pros and cons of different styles.

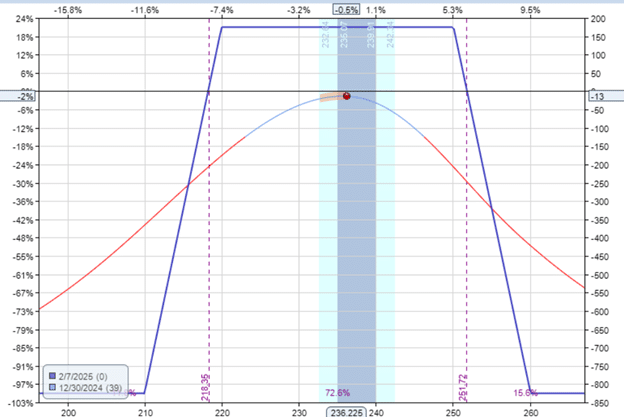

Consider an iron condor example on XLK (the technology sector ETF) with 39 days till expiration.

Date: December 30, 2024

Price: XLK @ $234

Buy one February 7, 2025, XLK $260 call @ $0.37

Sell one February 7, 2025, XLK $250 call @ $1.32

Sell one February 7, 2025, XLK $220 put @ $1.70

Buy one February 7, 2025, XLK $210 put @ $0.90

Net credit: $175

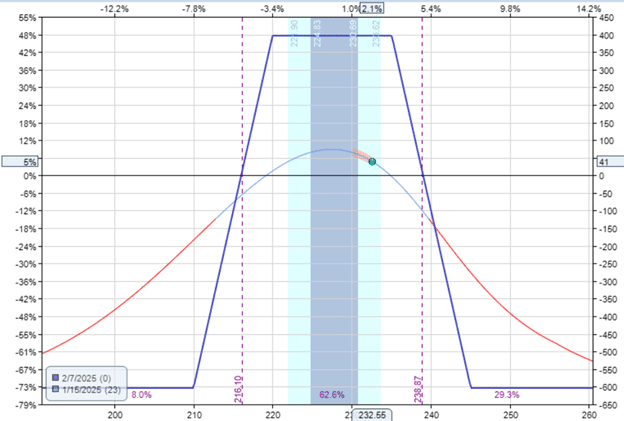

As you can see from this graph, the risk in the trade is around $825.

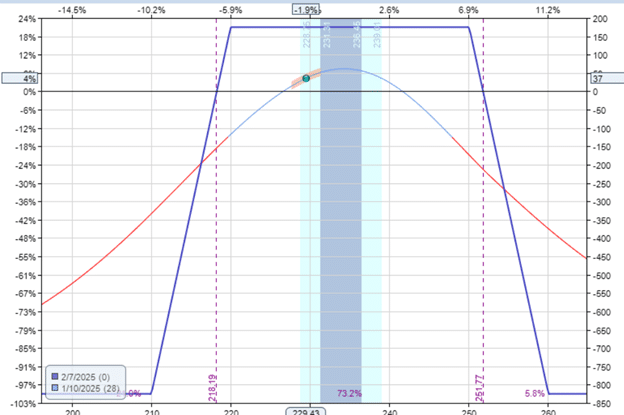

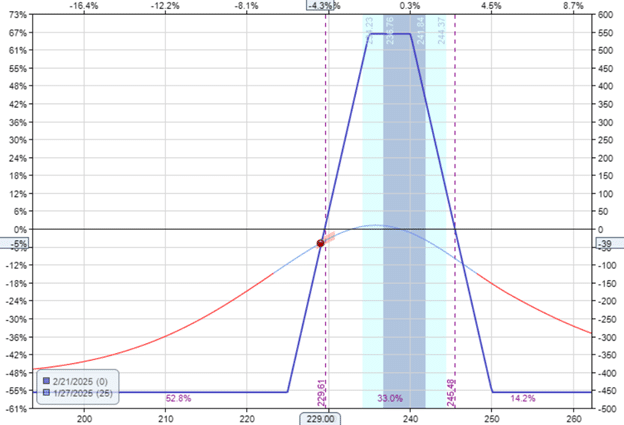

On January 10, the price of XLK went down, threatening the put credit spread.

The short put is at 30 delta now.

The call spread is far away with the short call at six delta.

The investor decides to take profit on the call spread by rolling it down and receiving a credit for the transaction.

Date: January 10

Price: XLK @ $229

Sell to close one February 7 XLK $260 call @ $0.14

Buy to close one February 7 XLK $250 call @ $0.37

Buy to open one February 7 XLK $250 call @ $0.37

Sell to open one February 7 XLK $240 call @ $1.77

Net credit $115

After that maneuver, the risk in the trade has dropped to $700.

The delta has been neutralized, with the price right between the two credit spreads.

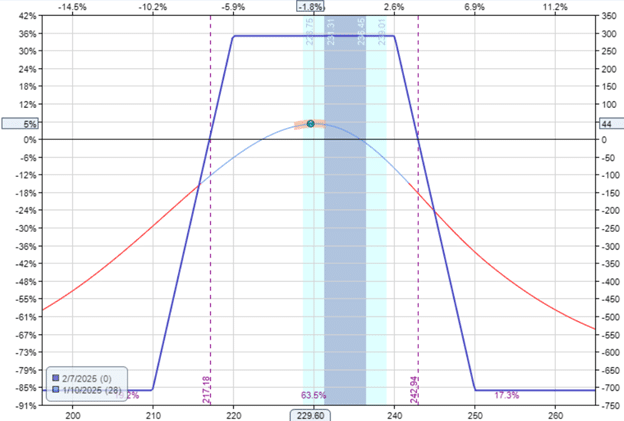

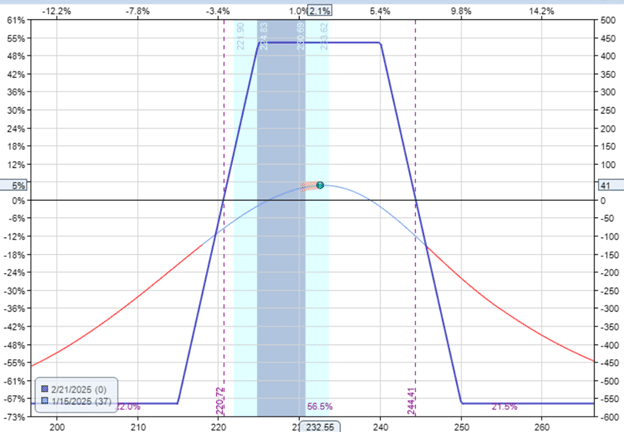

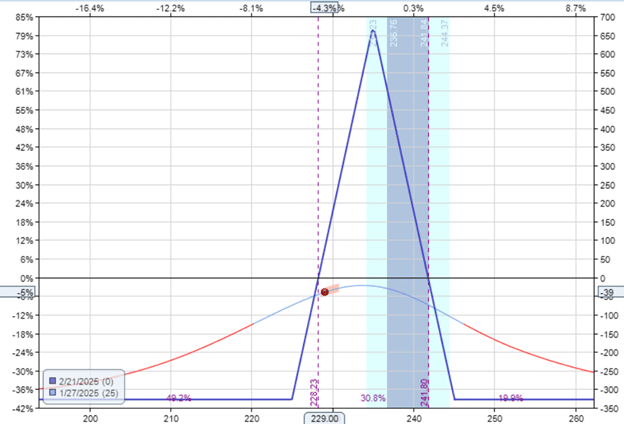

The following Monday, the price continues to go down:

The call spread has again gotten far away, with a short call of less than 15 delta.

The investor rolls the call spread down again to collect more credit.

Date: January 13

Price: XLK @ $226

Sell to close one February 7 XLK $250 call @ $0.39

Buy to close one February 7 XLK $240 call @ $0.93

Buy to open one February 7 XLK $245 call @ $0.45

Sell to open one February 7 XLK $235 call @ $2.04

Net credit: $105

With each subsequent credit that the investor collects, the risk goes down.

Risk is now down to $600.

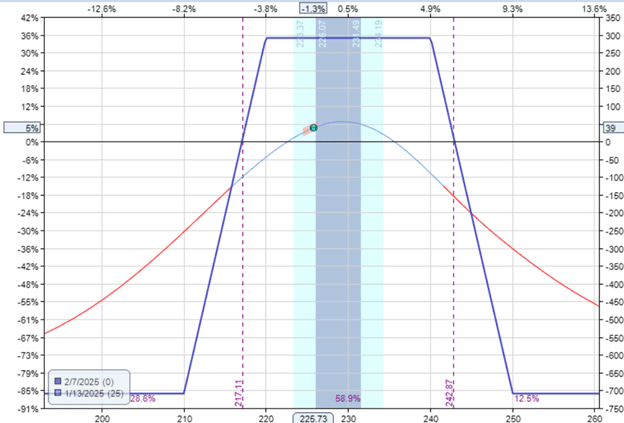

One problem with moving the call spread down too aggressively is that the price can reverse and go up to threaten the call spread as it did on January 15.

Seeing that the condor has only 23 days left until expiration, the investor felt he needed more time to get the target profit.

So he rolls the entire condor two weeks later in the expiration and centers the condor at the same time.

Date: January 15

Price: XLK @ $232.50

Sell to close February 7 XLK 210 put @ $0.74

Buy to close February 7 XLK 220 put @ $1.20

Buy to close February 7 XLK 235 call @ $3.90

Sell to close February 7 XLK 245 call @ $0.80

Debit: -$356

Buy to open February 21 XLK $215 put @ $1.29

Sell to open February 21 XLK $225 put @ $2.95

Sell to open February 21 XLK $240 call @ $3.03

Buy to open February 21 XLK $250 call @ $0.74

Credit: $395

Net credit: $39

This new condor is so narrow because he wanted to get a credit for the roll.

The only way to get enough credit is to sell closer to the money.

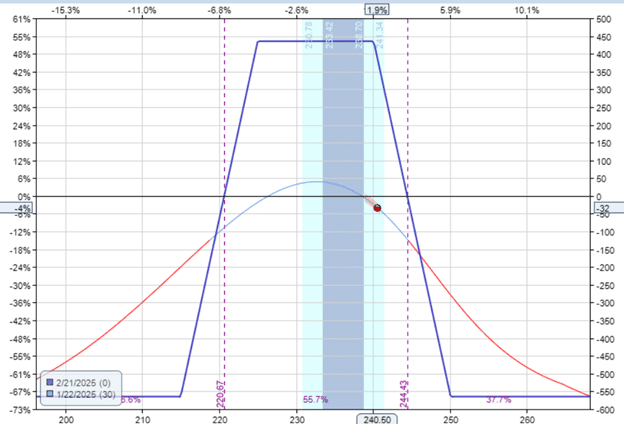

The problem with narrow condors is that the spread can easily be breached, similar to what happened on January 22, when the price went all the way to the short-call option.

At this point, the investor rolls the put spread up:

Date: January 22

Price: XLK @ $240.50

Sell to close February 21 XLK $215 put @ $0.42

Buy to close February 21 XLK $225 put @ $0.97

Buy to open February 21 XLK $225 put @ $0.97

Sell to open February 21 XLK $235 put @ $2.61

Net credit: $108

The risk in the trade has been reduced to -$450.

The P&L is down only -$32 with still 30 days till expiration.

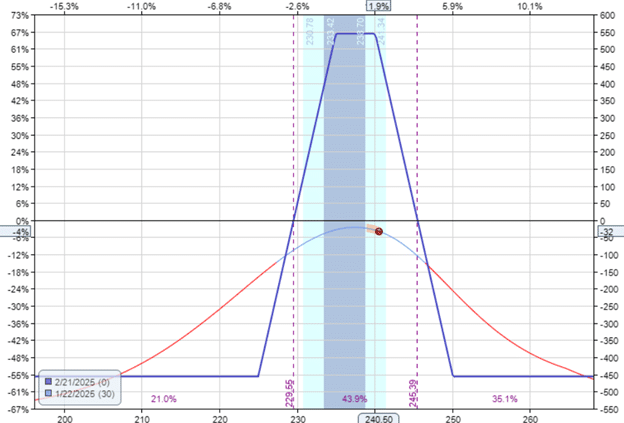

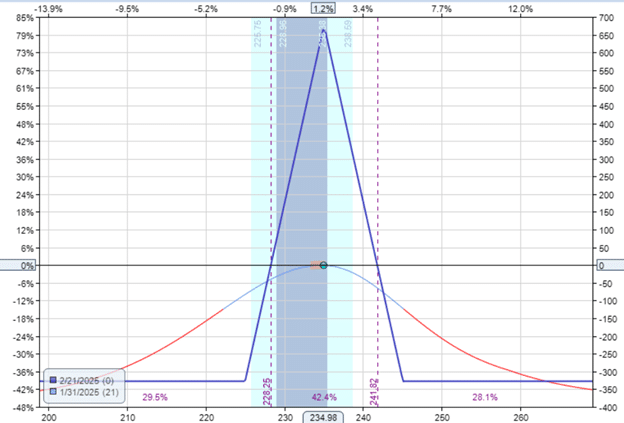

On January 27, the price swung the other way:

Rolling the call spread down to collect more credit.

Date: January 27

Price XLK @ $229

Sell to close February 21 XLK $250 call $0.30

Buy to close February 21 XLK $240 call $1.50

Buy to open February 21 XLK $245 call $0.66

Sell to open February 21 XLK $235 call $3.15

Net credit: $128

The risk is down to $325.

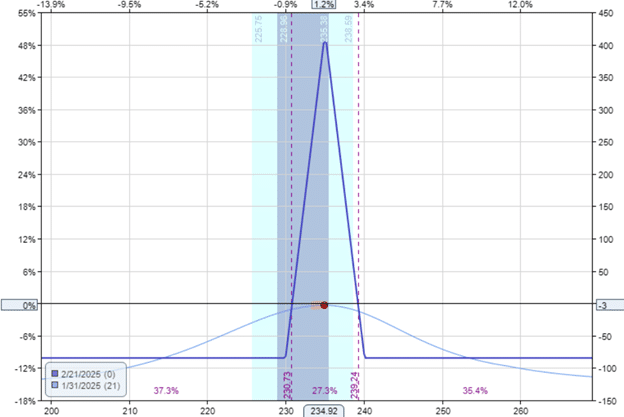

On January 31, with 21 left to expiration, the trade is back to breakeven, with the price sitting right at the center of the butterfly:

The investor has one last trick in his toolbox to further reduce the risk of the trade.

This is to roll in the butterfly’s wings to narrow it.

Date: January 31

Price: XLK @ $235

Sell to close the $245 call @ $1.20

Buy to open the $240 call @ $2.63

Sell to close the $225 put @ $1.56

Buy to open the $230 put @ $2.67

Debit: -$255

But this time, the move requires a debit.

However, the risk in the trade has dropped down to about $75.

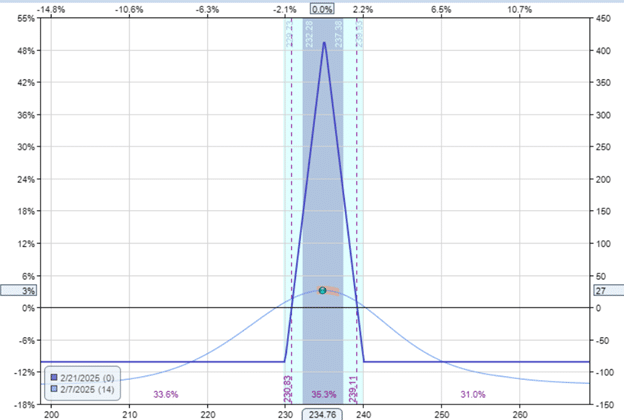

Then, on February 7, with 14 days till expiration, the trade showed a profit of $27.

Some investors may call it quits here.

However, with such a small risk on the table, some investors may take the gamble to hold till expiration, hoping for a pin trade where XLK ends up close to $235 at expiration.

Conclusion

The investor was intent on always making adjustments that reduced the overall risk in the trade.

This came in the form of rolling the untested side in or rolling out in time in order to collect credits.

The downside is that it narrows the condor, making the price much easier to breach one of its sides.

At some point, the condor becomes so narrow that it becomes a butterfly.

We hope you enjoyed this article on how an iron condor became a butterfly.

If you have any questions, please send an email or leave a comment below.

Trade safe!

Disclaimer: The information above is for educational purposes only and should not be treated as investment advice. The strategy presented would not be suitable for investors who are not familiar with exchange traded options. Any readers interested in this strategy should do their own research and seek advice from a licensed financial adviser.

Original source: https://optionstradingiq.com/how-an-iron-condor-became-a-butterfly/