Today we will discuss a crucial topic for any trader. How do brokers make money, and how can it affect you.

Let us know what do you think about this.

Whenever you have a relationship with someone, it is important to know about their self-interest and your own.

For a retail trader, it is impossible to go to the New York Stock Exchange floor with your bid to buy a stock yourself; you need to sign up for a brokerage.

They provide you with a service that allows you to transact in the market.

Of course, they do not do this for free.

This article will explore the different ways brokerages make money off of us, the clients.

We will also explore some tips to mitigate these additional costs in our trading.

Let’s get started!

Contents

-

-

-

-

-

- Commissions

- Margin Fees and Other Charges

- Securities Lending

- Payment For Order Flow

- The Bright Side of Things

- Concluding Remarks

-

-

-

-

Commissions

A significant source of income for some brokerages is still commission dependent.

Despite this, commissions have been almost wiped out from many firms’ profits over the last years.

This reduction has been in part thanks to Robinhood, who pioneered commission-free trading with resounding success.

Nevertheless, many old school brokerages will still make a lot of money from commissions.

Even as commissions have dwindled, paying a few dollars per trade certainly adds up, especially if you are frequently trading.

Some commissions are less visible, such as FX rates, which will (in the case of some brokers) be embedded with a fee.

Moral: Try to pay little or no commissions, but understand that no commission brokers will make up their fees elsewhere.

Margin Fees And Other Charges

Miscellaneous charges are one of the favorites of both banks and brokerages alike.

A few dollars here and there may seem trivial but added up over thousands of accounts can make a big difference.

A few of these fees that brokers may charge are inactivity, account minimum, deposit, withdrawal, and data fees.

I am sure there are many more.

These fees vary drastically across brokerages.

Brokerages have the added benefit of enticing investors with the ability to buy stocks on margin.

At first, the rates may seem enticing.

In reality, this is a massive source of income for brokerages as they can borrow for almost nothing.

Furthermore, unlike a personal line of credit, where an investor can skip town with the money, the margin is calculated continuously.

This one means the broker faces a much lower risk.

When stuff turns sour, they can usually liquidate your positions to honor their loan.

They can do this at their own discretion with little to no warning.

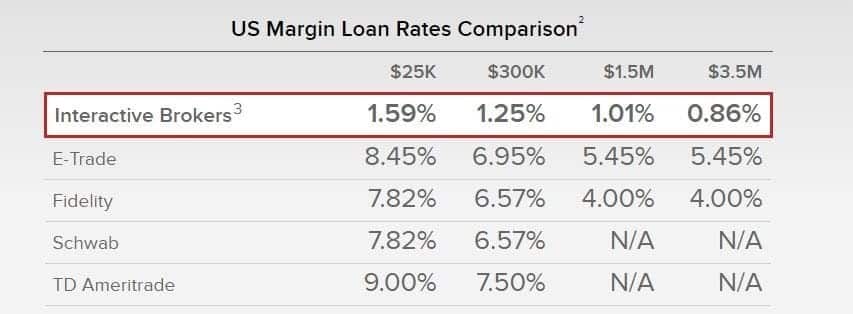

Regarding margin rates, we see that after comparing some of the rates below, it shows that almost all the major brokers are charging obscene amounts to investors who borrow on margin, except for Interactive Brokers.

These banks can borrow for nothing and lend to you at upwards of 7% with little risk on their side.

That sounds like a good deal!

Source: Interactive Brokers

There is no doubt that margin loan is a huge source of income for many brokerages.

In contrast, idle cash balances also offer brokerages the opportunity, as with banks, to make money on those reserves.

Some brokers will pay a nominal amount of interest, though it will undoubtedly be below what they are making themselves.

In today’s low-interest-rate world environment, idle cash doesn’t pay well, but this can be another substantial form of income if interest rates rise.

Moral: Try to avoid all non-essential fees if possible.

If you plan to use margin, shop around for the most competitive rate instead of simply paying whatever your current firm offers.

Access the Top 7 Tools for Option Traders

Securities Lending

Many brokers lend out your securities.

They then pocket the lending rate (that borrowers pay) for themselves.

For the most part, except for Interactive Brokers, who offer to split the borrowing fee with you, there is nothing in return.

While this doesn’t sound fair, good luck! You signed up.

Generally speaking, the securities lending that firms do is not very risky.

Mainly if they are regulated, that being said, if you are holding securities with a high borrow rate while not being paid for it, exploring alternatives is smart.

Moral: If you hold securities with a high borrow rate, consider brokerages such as Interactive Brokers, who will at least split the borrowing fee with you.

Alternatively, consider using options to create a synthetic long position that will pay out the borrowing rate for yourself.

In general, try to avoid brokers that will lend out your shares with no compensation.

Payment For Order Flow

So your broker is not charging commissions.

Your account is free, and you do not pay any monthly fees.

You are not trading on margin or holding any hard-to-borrow stocks.

Is your trading now free?

Almost!

Yet, the brokers have another tool to scrape a bit more money from you.

Payment for order flow involves a brokerage selling orders to a market maker or fund.

Selling orders is beneficial to market makers for a few reasons.

First, they can see and be the first to interact with your order.

That gives them an advantage as they can make you a market that suits their needs and inventories.

It could result in a fractionally worse fill price on your trade than if it was submitted directly to the exchange.

Another advantage for the market makers is from the order flow; they can evaluate who is trading where and where the smart money is going.

Hedge funds will also often jump in to buy this order flow to make informed decisions.

Some order flow is more expensive than others.

Robinhood’s order flow is a Wall Street favorite for obvious reasons.

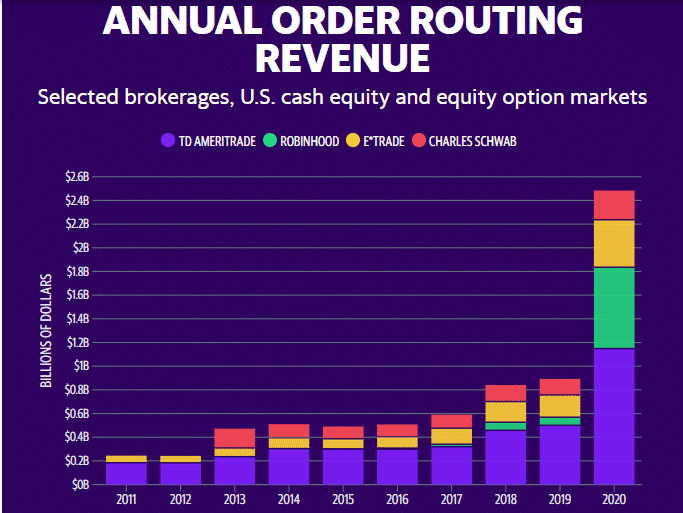

Source: Alphacution Sec Company Data/ Yahoo Finance

We can see here the dramatic rise in payment for order flow.

As commissions have dwindled, we can see payment for orders taking over as a major driver of many brokerages’ profit lines.

In sum, if your brokerage is commission-free, odds are it really is not.

The brokerage is making money off of your orders regardless.

If you do not pay for the product, you are the product.

Before you cry evil market makers and hedge funds, it is important to note that the amount of money they can scrape off each trade is extremely minimal.

They make money only due to the immense scale of their high-frequency trading.

Furthermore, they have to compete against each other for this order flow, just as brokerages have to compete for customers.

Moral of the Story: Take into account that your order flow may be sold.

Use limit orders, especially when you trade illiquid names, to reduce the cut taken per trade.

Try to avoid overtrading if it does not add value to your portfolio.

The Bright Side of Things

After this article and reading more in-depth about how brokerages make money, they may appear to be trying to trick you at every turn.

Did you really think brokerages were a charity?

Simply put, they are businesses.

In fact, for consumers who want to trade and invest, choosing a broker has never been better.

Commissions are the lowest they have ever been, fees have been reduced, and data has been improved.

The cost and accessibility to trade have never been lower.

It is not thanks to the generous nature of brokerage companies (because they are not generous), but because of the competition among them to obtain customers.

As an example, when Robinhood pioneered commission-free trading, big established brokers quickly followed suit.

This behavior drove down costs for consumers across the board.

It was not to benefit other brokers, who were forced to earn less to stay competitive.

Their share prices fell as a result.

While trading is not free, it is getting closer and closer for the average investor.

If you are still convinced that brokerages companies have a fail-proof model to profit (which they don’t), you are in luck.

Most brokerages have their shares listed in the common market.

So, you can simply buy their stock and benefit indirectly, in whatever trivial amount, from your own commissions and fees. Ironic.

Concluding Remarks

Brokers have numerous ways to generate profits.

A lot of them are outside of what investors will see visually on their commission slip.

Some of these include miscellaneous fees, lending, borrowing and payment for order flow.

Despite this, for mindful investors, it is not challenging to minimize these costs, either by trading less or choosing a broker that is a better alternative for your investing style.

Picking the right broker allows investors to focus on maximizing profits without subtracting much from their bottom line.

Trade safe!

Disclaimer: The information above is for educational purposes only and should not be treated as investment advice. The strategy presented would not be suitable for investors who are not familiar with exchange traded options. Any readers interested in this strategy should do their own research and seek advice from a licensed financial adviser.

The post Blog first appeared on Options Trading IQ.

Original source: https://optionstradingiq.com/how-do-brokers-make-money/