In our previous article, we gave an example of how it could end up in a risk-free options collar on a stock.

We are not talking about zero-cost collars.

Those are easy to construct and are quite common.

But they are not risk-free.

The truly risk-free collars are much more difficult to find, and there are no automated scans (which we are aware of).

Therefore, get a list of stocks to run the following manual steps.

Taking the 30 Dow Jones stocks or the Nasdaq 100 is a good start.

The list of stocks can be obtained by looking at the constituents of DIA and QQQ, respectively.

Contents

-

-

-

- Step One

- Step Two

- Step Three

- Step Four

- Step Five

- Step Six

- Step Seven

- Step Eight

- Step Nine

- Conclusion

-

-

Step One:

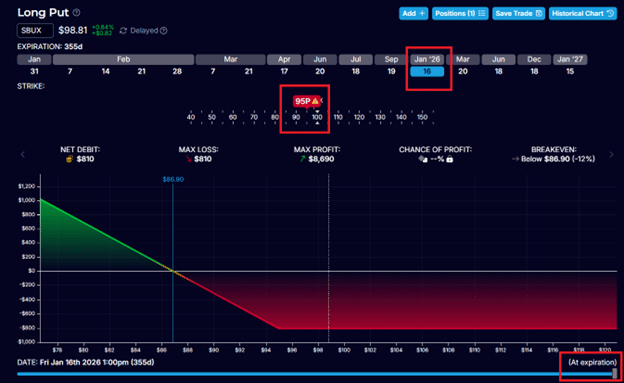

In OptionStrat, build a trade by selecting a long put option on a stock:

And type in a ticker symbol (such as SBUX for Starbucks).

Step Two:

Select an expiration date of about one year.

Here, we have selected the Jan 2026 expiration for Starbucks (SBUX).

Step Three:

Select a strike price that is close to where the stock is trading.

SBUX is trading at $98.81, and we have selected a strike price for the long put option at $95.

Typically, you want to start with a strike price just below the stock’s current price.

Slide the expiration slider all the way to the right to see OptionStrat render the risk graph at expiration.

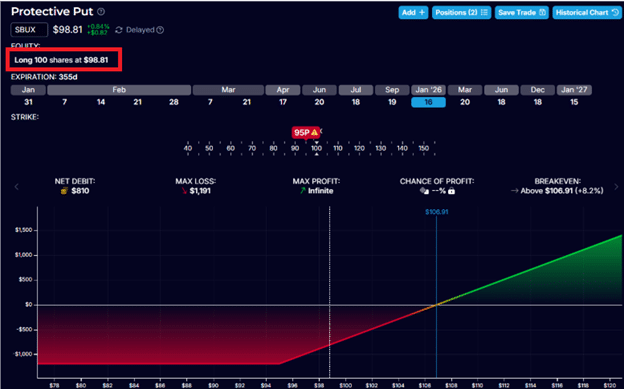

Step Four:

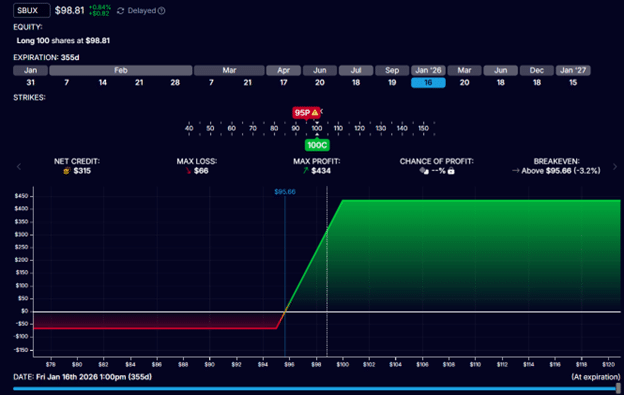

In OptionStrat, model the purchase of 100 shares of SBUX:

Now your risk graph should look like that of a married put:

The put option has stopped the downside risk of the stock.

But this put option cost $810.

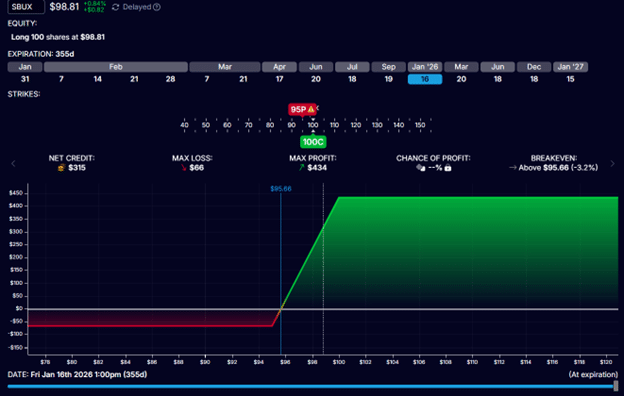

Step Five:

Sell a call option to try to recover this cost.

Here, we are selling the $100 call, which brings in a credit of $1125.

The closer we move the call to the current price, the more credit we can get.

We typically want the strike of the call to be above the current price and the put option strike price.

The credit more than covers the cost of the put option.

An extra $315 of credit.

This is a zero-cost collar.

However, that risk graph shows that this is not a risk-free collar.

There is a maximum potential risk of $66 for this trade, as can be seen by the red risk graph, which goes below the zero-profit horizontal.

This is because the put option only protects the stock after the stock has dropped to $95, which is a loss of $381 of equity value.

The extra credit offset $315 of that loss.

Hence, a loss of $66 remains.

Step Six:

Try different strikes for the put and call options.

It is even okay to move the put strike above the stock’s current price (known as an in-the-money put).

With OptionStrat, it is quick to slide the two options to various strikes to see if we can get the graph completely above the zero-profit horizontal.

In this case, we can not.

Therefore, no risk-free collar for SBUX for the Jan 2026 expiration.

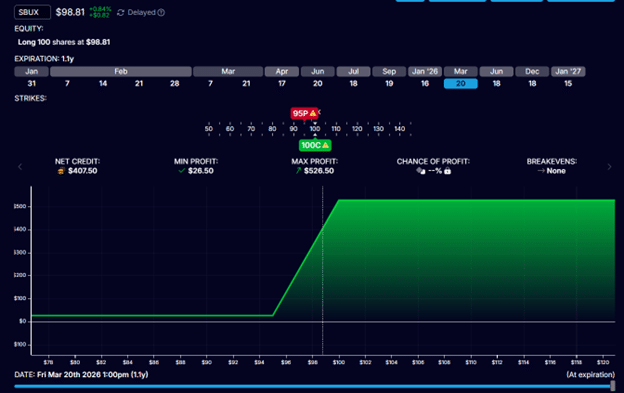

Step Seven:

Repeat the same for different expirations.

Going further out in time increases the likelihood of finding a risk-free collar.

Here, we found one on SBUX, but it potentially requires over one year to collect $526.50, which is not ideal.

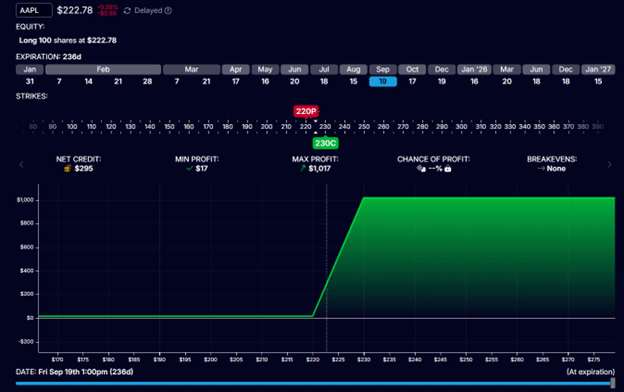

Step Eight:

Repeat this for different ticker symbols to see if we can find something with an expiration date of less than a year.

Here, we found one in Apple (AAPL) where we only have to wait 8 months:

Step Nine:

After finding potential candidates in OptionStrat, you can not rely on the prices given by OptionStrat because the free version has delayed pricing data.

It is also pricing things at the mid-price between the ask and the bid price, which may be unrealistic in live trading.

Before initiating the trade, you need to price things out in your trading platform, considering possible slippage and whether you can get filled at those prices.

Conclusion

Other considerations include looking for stocks you want to own, stocks that pay dividends, and, most importantly, stocks you think will go up.

After all, the collar is a bullish trade.

While the risk-free collar will not lose you money, we still want to make some money.

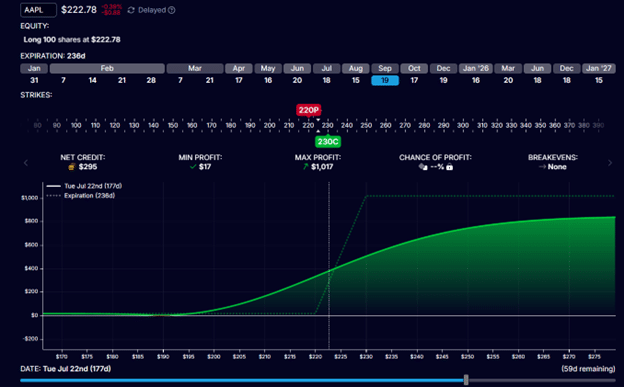

If the stock goes up high enough, some investors may decide to take a modest profit earlier instead of taking the full profit at expiration.

Using the expiration slider, we can see the risk graph of the AAPL trade 6 months into the trade.

If AAPL gets to $270 per share in that time, an investor may decide to take the $800.

Depending on your preference, these trades can be completely hands-off, “set and forget” type of trade, or they can be more actively managed.

Risk-free collars do exist.

Hopefully, the above tips will help you find them.

We hope you enjoyed this article on how to find risk-free options collar trades.

If you have any questions, please send an email or leave a comment below.

Trade safe!

Disclaimer: The information above is for educational purposes only and should not be treated as investment advice. The strategy presented would not be suitable for investors who are not familiar with exchange traded options. Any readers interested in this strategy should do their own research and seek advice from a licensed financial adviser.

Original source: https://optionstradingiq.com/finding-risk-free-options-collar-trades/