Today, we’re looking at how to make money with covered calls. We have done some backtesting with some interesting results.

Contents

-

-

-

-

-

- The Rules

- Example In An Uptrend

- Example In A Downtrend

- Example In A Moderate Market

- Managing Profits

- The Results

- When The Price Goes Above The Short Strike

- Summary

-

-

-

-

Instead of holding covered calls to expiration, we find that results can be improved by managing profits earlier in many cases. In particular, take profits on the short call to reach 80% of its profit potential.

Later, we will try to see if there is anything that we can do if the price starts to go up past our short strike.

The Rules

For our experiment today, we will use the following rules.

1. Sell an out-of-the-money covered call around the 30 delta in the monthly (not weekly) expiration cycle at least 15 days away.

2. Buyback the call and sell another call (a technique known as rolling) when you can buy back the call at 20% of the credit received for the call. In effect, we are taking profits on the short call when the call has captured 80% of its maximum profit potential.

The new call to sell (or the call you will roll to) will be around 30-delta with at least 15 days until expiration on a monthly expiration cycle (according to rule number 1).

Note that it is possible to roll to the same expiration if that expiration has at least 15 days till expiration.

It’s worth noting that you can conduct the roll on the expiration day if you can buy the call for 20% or less of the credit obtained.

1. If rule #2 is not satisfied, hold to expiration. In most cases, the stock will end up being called away at expiration, and you will no longer have stock or calls left. Otherwise, the call will expire worthless, and you will be left with just the stock.

2. Check profit and loss. Repeat the covered call if you want to continue by starting another covered call on the morning of the next trading day (usually Monday) after the expiration day. Buy stock (if needed) and sell another call per rule #1.

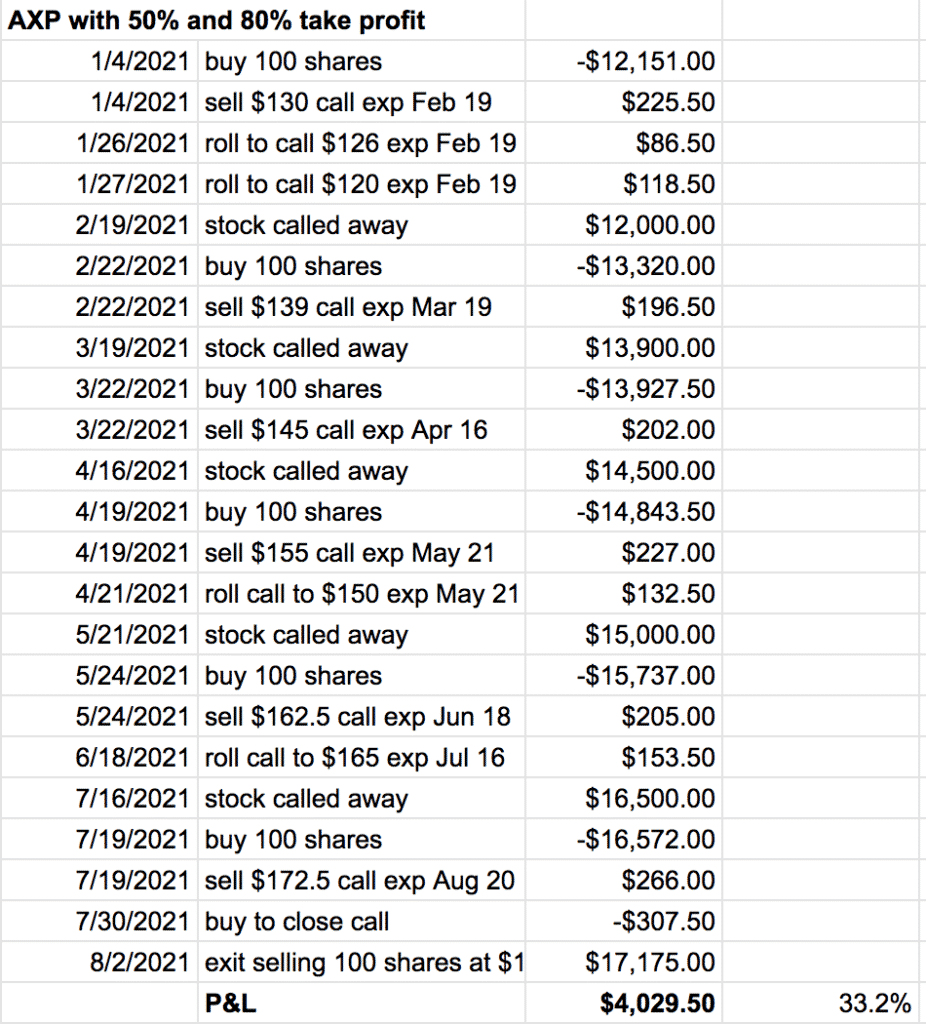

Example In An Uptrend

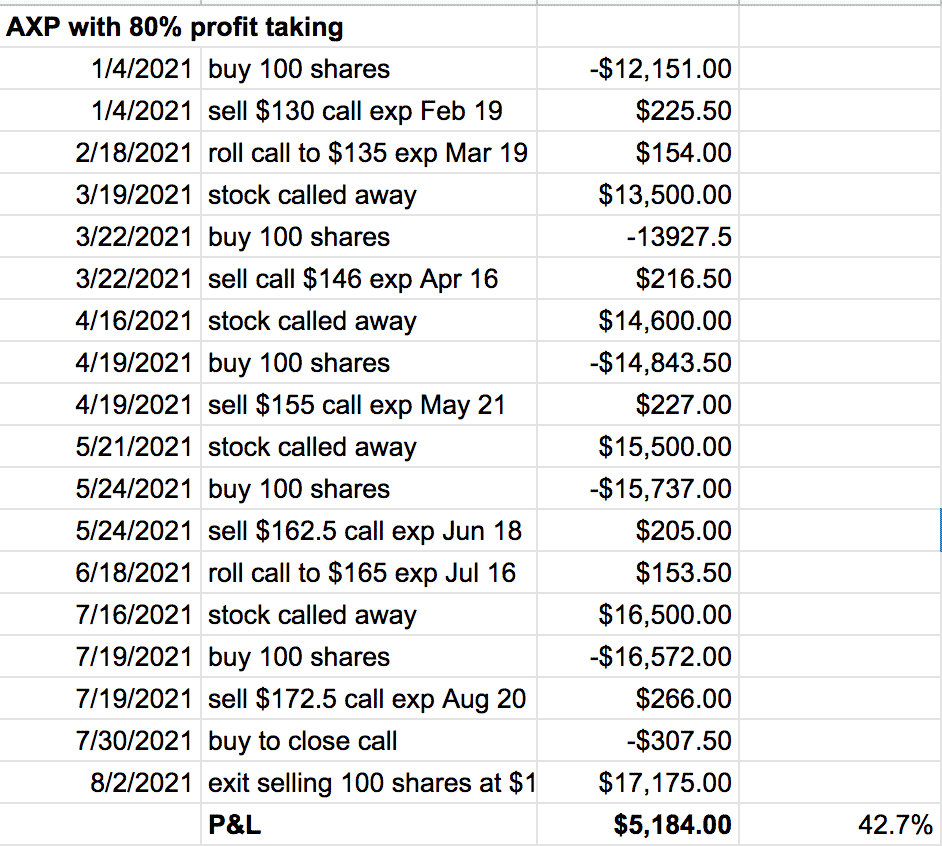

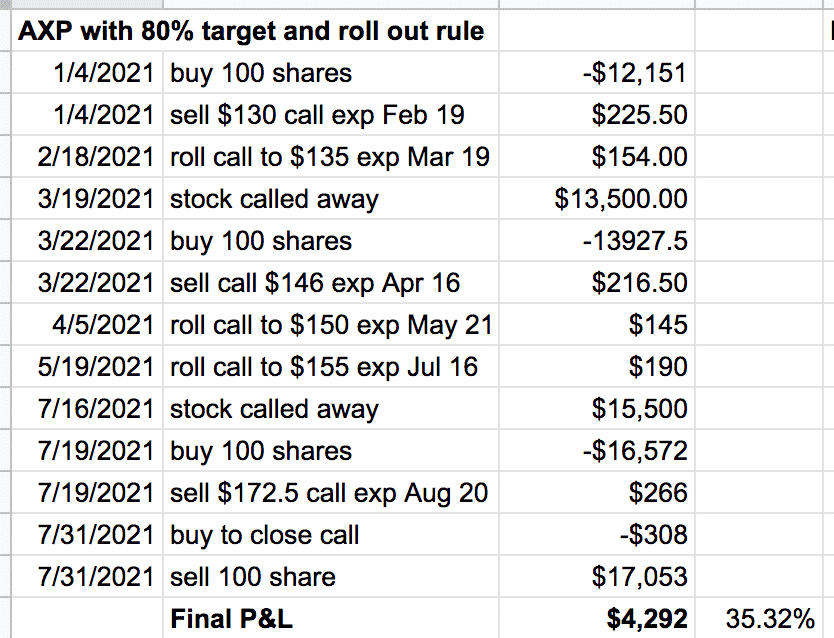

When we apply these rules to a covered call on American Express (AXP) during a very bullish uptrend period from the beginning of January 2021 to the end of July 2021, we get a 42.7% return on the initial investment.

Keep in mind that it was during a time when the stock itself rose 41.3% during an unusually bullish market. So the covered call strategy outperformed the buy-and-hold by 1.4%.

Here is our experimental data:

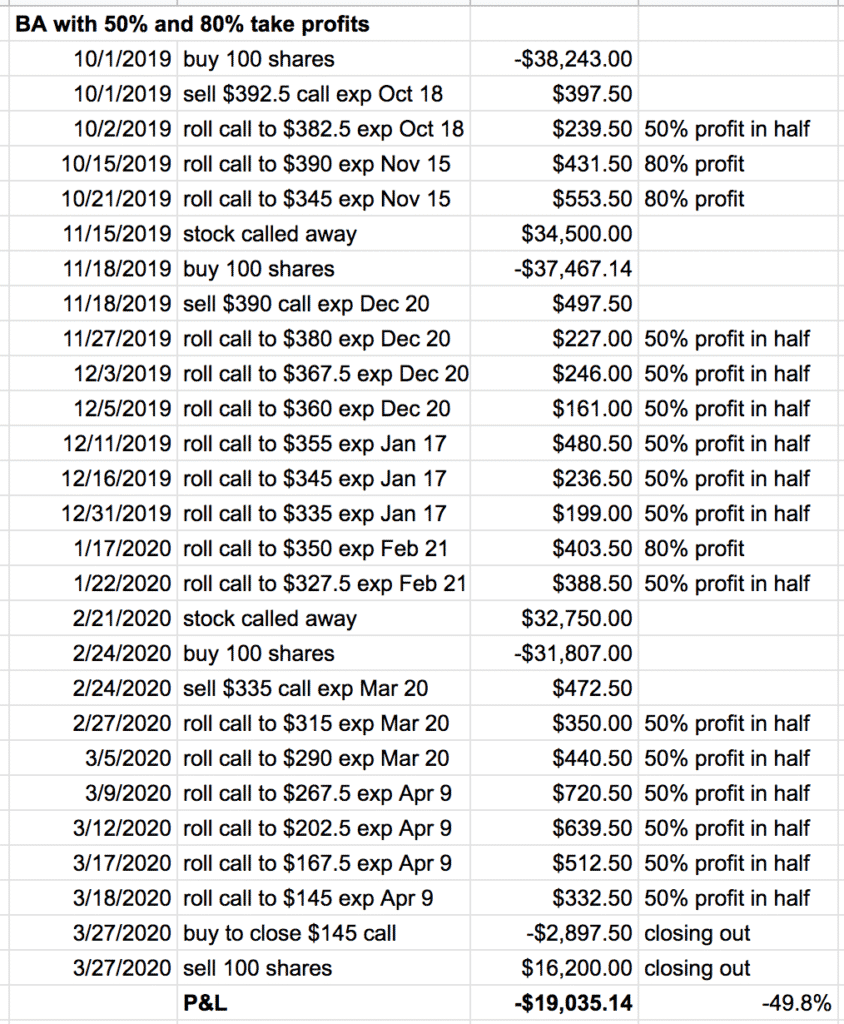

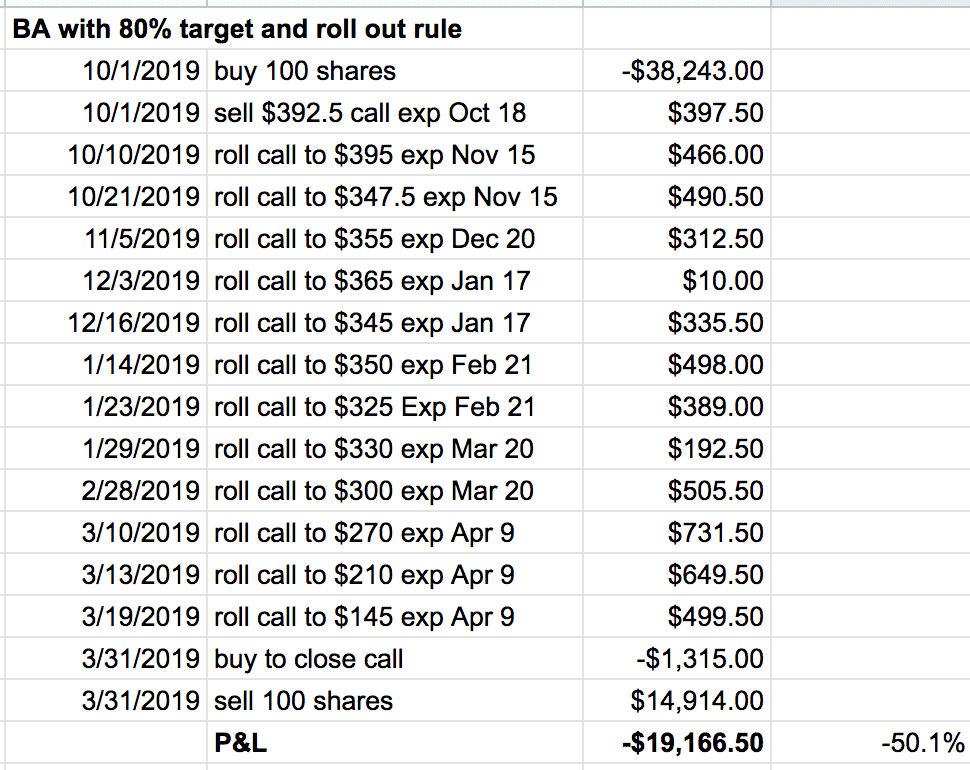

Example In A Downtrend

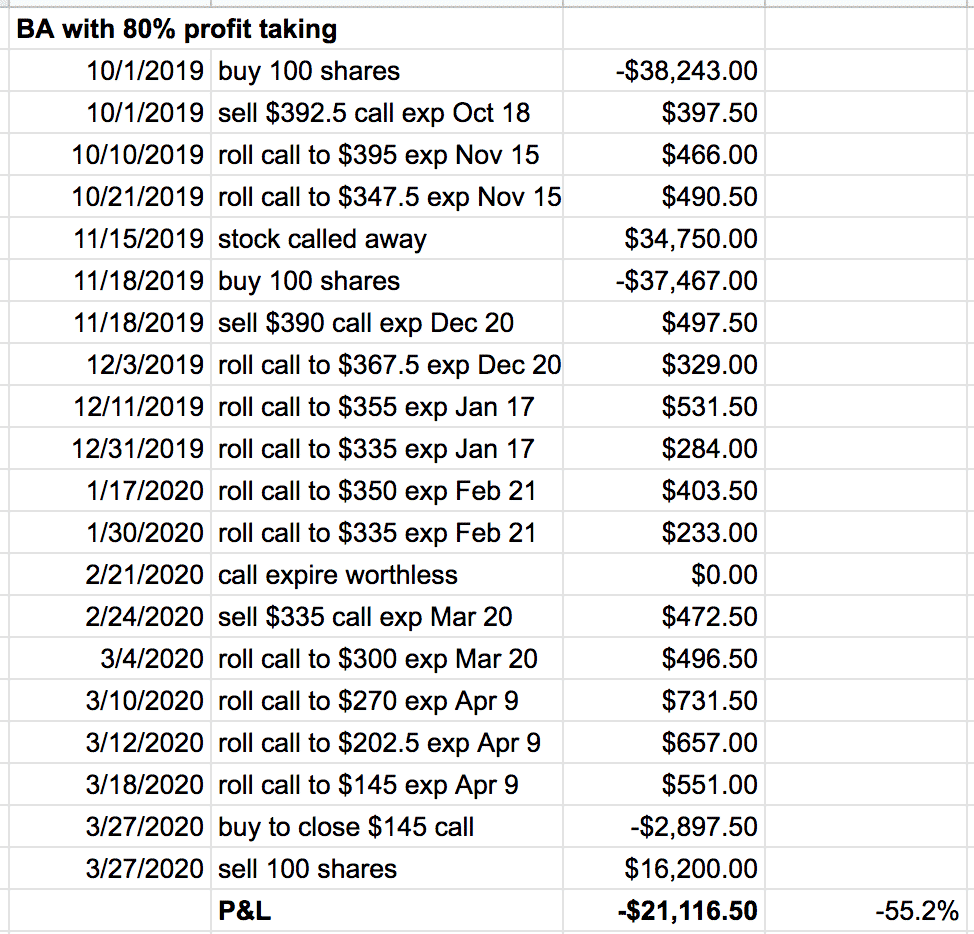

Running the rules in a downtrend, we see a 55% loss on Boeing (BA) from the period of October 2019 thru March 2020, which includes the pandemic selloff.

This performed slightly better than the buy-and-hold as the stock dropped 57.6% during that period.

These are only hypothetical trades using Option Net Explorer. In real trading, we would have terminated this trade long before. Because we know that covered call income will not be able to compensate for losses in the stock. We need to keep the loss on the stock position to single digits. When to stop is dependent on the individual investor. But a reasonable stop point would be when the stock loses 7% of its value.

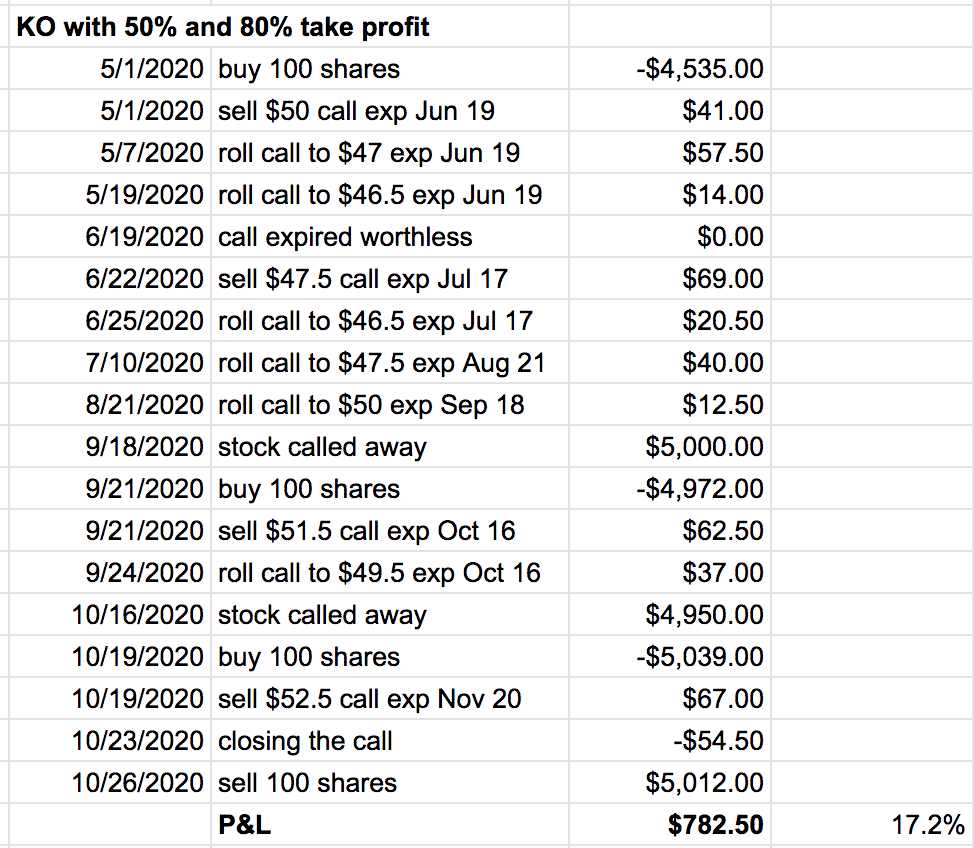

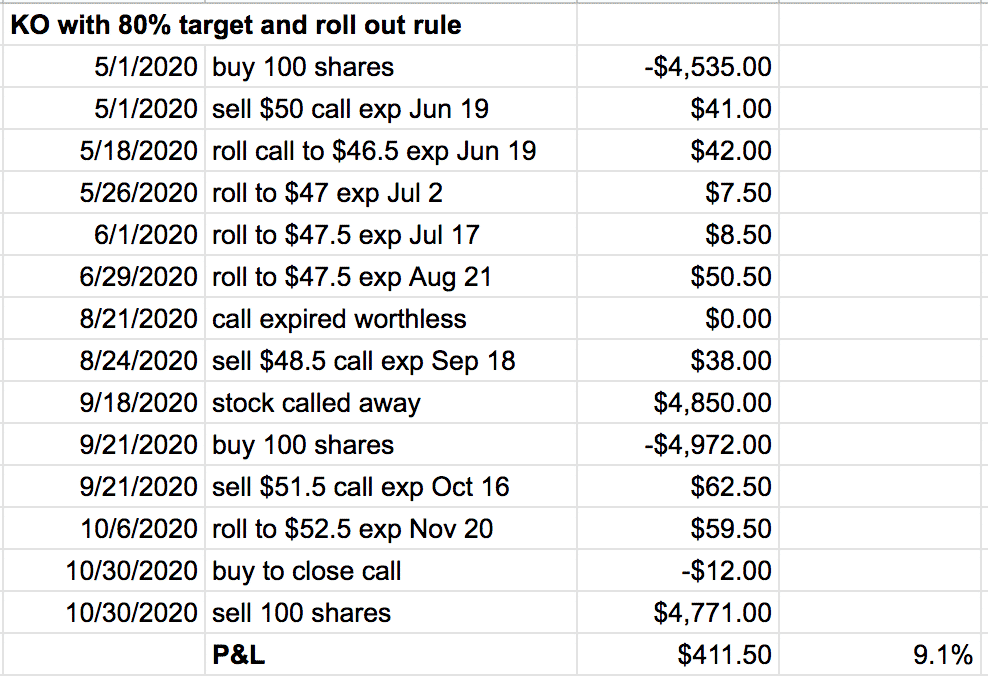

Example In A Moderate Market

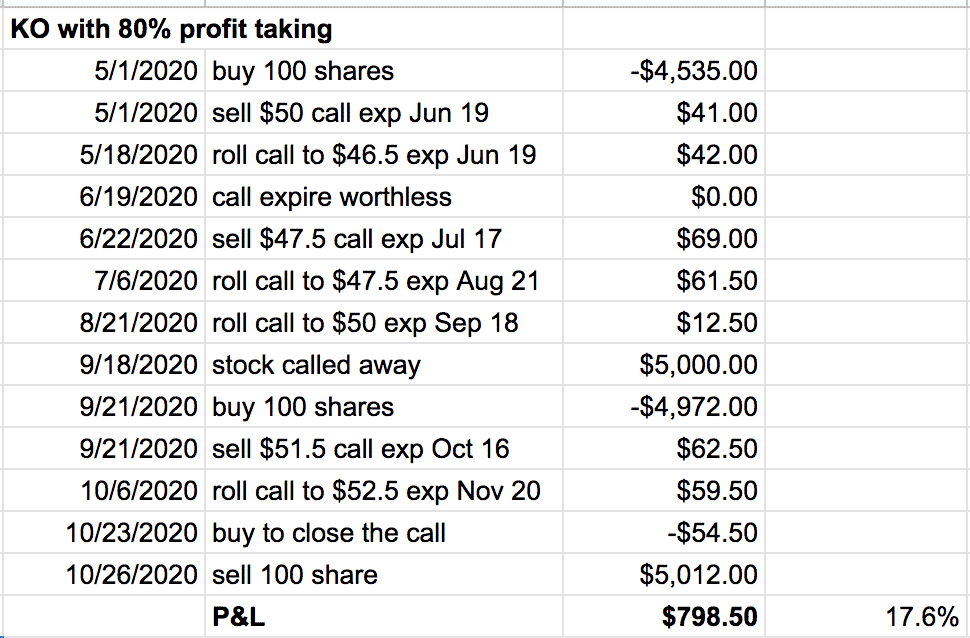

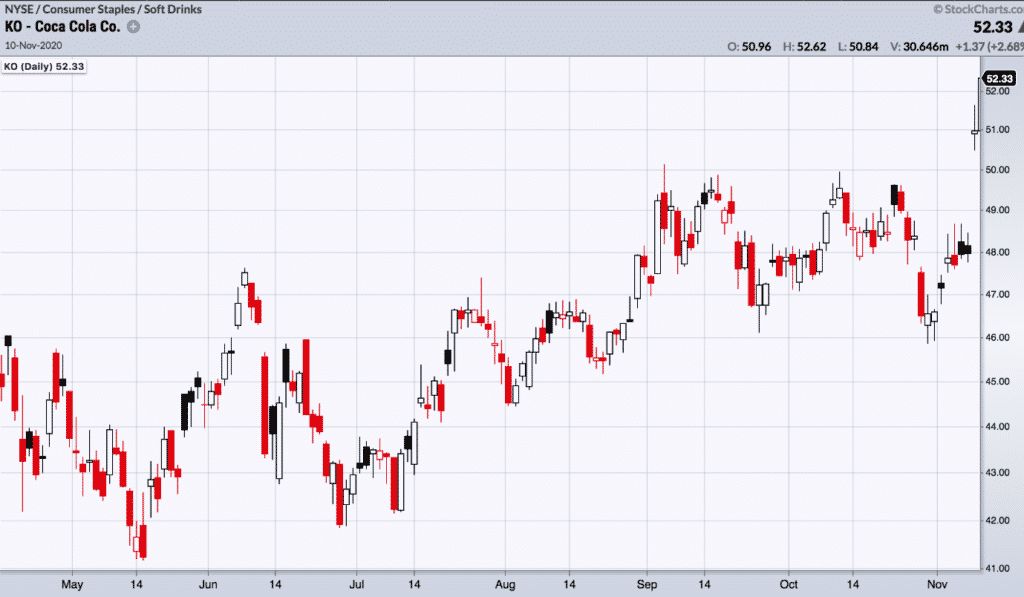

And finally, we run the rules in a more normal market. This is Cola-Cola (KO) from May to October of 2020.

The stock is up 10.5% during this period. The covered call strategy is up 17.6%

Managing Profits

The covered call strategy outperformed the buy-and-hold strategy.

And by taking profits on the short call, we get better results than letting the call go to expiration.

At least, that is the case in the three varied examples tested.

Of course, it will not always be the case for every possible scenario that the market throws at us.

I’m sure there will be cases where the buy-and-hold strategy will outperform, and there will be other cases where holding the call to expiration will outperform.

No one strategy works best in all cases. We are just looking for a strategy that works well in most cases.

If taking profits early is a good idea, what about taking profits even earlier and more often?

So let’s try adding in an additional rule between rules #1 and #2: if the short call reached 50% of its profit in less than 50% of the time in the trade, we roll the call.

This is in addition to the 80% take profit rule.

In a down-trending market, it means that we are rolling the short call down more frequently and more aggressively.

Hence, the results are even a little bit better at -49.8% — we are losing less.

However, it didn’t do as well for extreme uptrend:

And for the moderate uptrend stock, it did about the same:

Because we are rolling the calls before they get close to expiration, the calls are not spending much time near expiration and hence are not getting the fast theta decay.

Another theory is that by frequently turning over the calls, we are not giving the stock price rise up to the short call strike price.

We know that the max profit is achieved in a covered call when the price reaches close to the strike price.

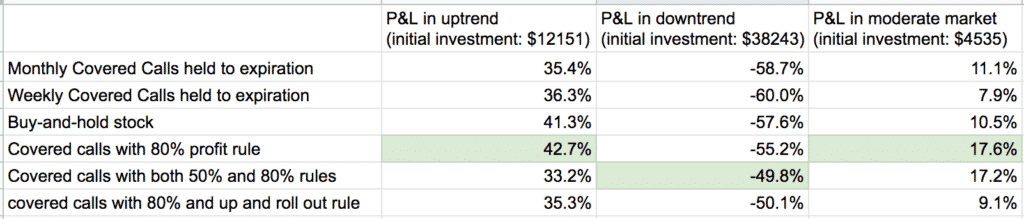

The Results

This is how the results stack up:

We see that the 80% take profit rule outperforms the buy-and-hold as well as the monthly and weekly covered calls held to expiration.

Adding the take profit rule at 50% profit improves results for the case of the stock in a downtrend.

When The Price Goes Above The Short Strike

The last row in the table is our attempt at finding a rule to tell us what to do if the price goes above the call short strike.

It is the result of adding the following rule in addition to the 80% take profit rule.

When the price gets to the short strike or above, roll the call out to the next monthly expiration cycle if that expiration cycle is less than 60 days till expiration.

Perform the roll only if you can receive a credit and the roll is to a strike that is above the current price.

If these conditions are not met, continue till expiration or when the 80% take profit rule takes effect.

While this did well of the downtrend case:

In the other two cases, it did not do as well as just using the 80% profit rule by itself.

This goes to show that sometimes things sound good in theory until you start backtesting them.

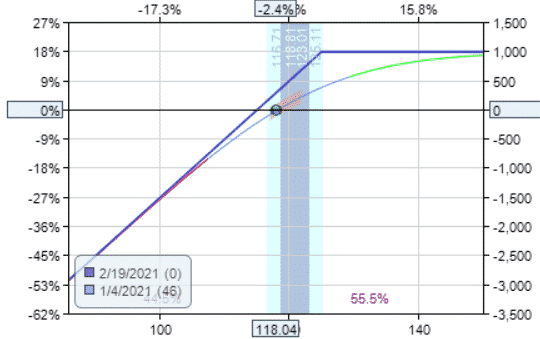

In a covered call, you want the stock price to go up even if it means taking some loss on the call option. You can see this in the payoff diagram.

The higher the stock price goes, the more money we make.

By eliminating the call option every time the price gets to the strike price, the calls are not spending much time near expiration where the fast theta decay happens.

Summary

The 80% take-profit rule on covered calls is one that investors like to use. Our simple backtest results show that there is some validity to this rule. Nevertheless, you should backtest it on your own to see if it make sense for you.

Trade safe!

Disclaimer: The information above is for educational purposes only and should not be treated as investment advice. The strategy presented would not be suitable for investors who are not familiar with exchange traded options. Any readers interested in this strategy should do their own research and seek advice from a licensed financial adviser.

The post Blog first appeared on Options Trading IQ.

Original source: https://optionstradingiq.com/how-to-make-money-with-covered-calls/