Iron Condors are a staple among option traders but setting them up and correctly managing them can be a bit challenging.

Some people assume it’s as simple as just selling two verticals and calling it a day, but that couldn’t be further from the truth.

In this article, we will look at the steps to select the right options, structure the condor correctly, and the proper way to manage the trade for maximum profit and minimal risk.

Whether you are a new Iron Condor trader or have been trading them for a while, odds are you will pick up some helpful tips from what we discuss below.

Contents

-

-

-

-

-

-

- Creating Your Iron Condor

- Managing The Position

- Roll The Unthreatened Side

- Roll The Threatened Side

- Buy Back The Threatened Side

- Roll The Condor Up/Down

- Roll The Condor Out

- Take The Loss And Move On

- Tips For Managing Iron Condors

- Conclusion

-

-

-

-

-

Creating Your Iron Condor

Iron Condors benefit most from a range-bound market, so for them to be most effective, they should be traded on a stock that you, as a trader, believe will remain range-bound for the duration of the spread.

Because these are a range-bound spread, choosing your edges is one of the most important parts.

One of the simplest ways to select your strikes is to look at the recent range and select inner strikes that cover roughly 80% of it.

As an example, let’s say that a stock has been ranging from $46.50 to $52.25; one could look at the $47 and $52 strike options for this spread.

The outer strikes are often the next strike up/down, so in this case, they couple with the $46 strike and the $ 53 strike.

Now that you have the strikes you want to trade, the next part is basically trading two verticals, a put spread and a call spread.

For the Put spread, you would sell the $47 strike and buy the $46 strike.

You would sell the $ 52 strike for the call spread and buy the $ 53 strike.

These outer wings help to protect you against any movement outside of the range.

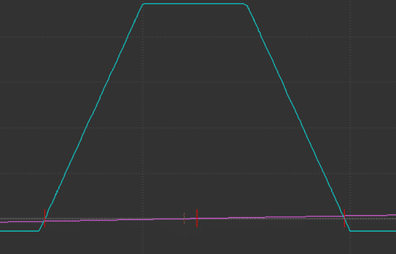

The total risk profile of this trade should look similar to the image on the right.

Now that the position is set up and active, let’s look at the different ways we can manage them effectively.

You can find an example in this article I wrote for Investor’s Business Daily.

Managing The Position

One of the Keys to success with Iron Condors is their management.

Because these trades rely on range-bound markets, they should be monitored closely for any changes in the range.

This is the first step in managing your Iron Condor.

Once you see where the price is going, you will find many ways to adapt your condor.

Roll The Unthreatened Side

The first option you have is to roll the untested side.

This effectively lets you change the width of your iron condor.

If the price moves toward only one side of the condor, roll the untested side slightly closer if the width allows.

As an example, let’s say the call wing is being threatened as the price moves up into it.

This would theoretically mean that the put wing is losing premium quickly due to theta and moving price.

You can roll the put wing up to a higher strike price, allowing you to collect more premium to offset potential losses on the call side.

This is known as an attacking adjustment.

Roll The Threatened Side

Like rolling the unthreatened side, you can also roll the threatened side of a condor.

While the steps are similar, this strategy is a true loss mitigation strategy because it is unlikely that you will profit from the rolled side.

It can, however, buy you some additional room on the trade and allow you to work your way through the underlying price movement.

This is known as a defensive adjustment.

Buy Back The Threatened Side

Another potential option is to buy back the threatened side.

This choice is a little trickier because of the time component and the underlying purpose of an Iron Condor.

Given that it’s a range-bound trade, you should expect to see the price move between your two short strikes, but if you feel that it’s no longer range-bound and the price is breaking out towards one side, buying that side back can help minimize losses.

You can then re-open another spread to widen the condor or just continue with the remaining vertical spread through expiration.

Roll The Condor Up/Down

Rolling the entire condor only really makes sense if you feel that the range the stock is trading in has adjusted.

An example of this would be if the stock we discussed initially started to trade between $48 and $54.

The stock is still range-bound, but it’s no longer inside the body of your spread.

In this instance, it would make sense to roll the entire condor up to the new range.

Depending on your executing broker and platform, there are a few ways to do this.

ThinkorSwim, for instance, allows you to roll an entire spread trade in either direction as one complete unit. I

f your broker does not allow this, you can close the current condor and open another with the new body and wings.

Roll The Condor Out

You can also roll the condor out, like rolling it up or down.

This is also a specific situation, though.

To consider rolling a condor out, you should still have confidence that the original range is correct and that any current price movements out of range are just short-term moves.

This can get tricky because if you are wrong, you only extend your time in a bad trade.

Take The Loss And Move On

Sometimes, the best option is to just take your lumps and close the entire position for a loss.

Adjustments may cost more than any gained value if the stock price has moved too far against you.

The positive side is that you know your maximum loss when you place the trade, and closing for anything less than that should be considered a small positive.

The key to managing Iron Condors is to fully understand all of the options you have in front of you.

Once you understand your choices, do not panic if the price gets close to one of the edges of your condor; this should be expected, given the nature of the trade.

Tips For Managing Iron Condors

Now that we have looked at how to build and manage an Iron Condor let’s look at some tips for better managing the spreads.

These are just tips and suggestions, not hard and fast rules; as with everything in trading, you should alter your adjustment style and techniques to fit your risk appetite and trading account.

Use Percentages to Roll

One way to know when it is time to roll a wing is when the price closes within a certain percentage of your wing contract (outer contract).

This percentage will depend on a few factors, the first of which is how volatile the stock you chose was.

The second factor is how expensive the stock is.

If it’s a $400 stock, it could be within 5% of the wing contracts; if it’s a $40 dollar stock, it could be within 1%.

Either way, this is a great method to start to look at rolling.

Take a look at the two stocks below: Chevron (CVX) is trading around $150/share. Booking (BKNG) is trading at around $3,500/share.

These aren’t the same trading ranges or the same price point, so trading them the same way is a surefire way to mismanage a position.

Aim for a Credit When Rolling

Another tip is to look to receive a credit for your roll.

Whether you are rolling one side of the spread or the whole thing, always look to receive a net credit between closing the first and opening the second.

Widen the spread on a roll.

Similar to aiming for a credit, try to widen the spread out on the roll.

If you have a $5 spread on the original trade, make it a $6-$7 spread on the roll to give yourself some additional room.

Consider Early Rolls for More Flexibility

If using percentages to determine if a roll is needed doesn’t work, you can always just look to roll with some time left on the spread.

If there are still several weeks until expiration, but the stock price is on the move, it may be better to roll early while you have more flexibility in strike selection and can still collect a decent credit.

Early rolls also minimize the risk of the stock moving too quickly before you have a chance to roll.

Conclusion

Rolling an Iron Condor is not a requirement.

You could always just close the trade for a profit or a loss; sometimes, this is the best course of action.

Sometimes, though, knowing when to execute a roll will take a loser and turn it into a winner or increase your already forming profit.

The strategies and tips above, whether rolling out on time, rolling a threatened side, or buying back the threatened side and just trading the vertical spread, can help improve your profitability when trading iron condors.

As with all trading techniques, it is best to first practice these on a paper account until you feel comfortable enough with their mechanics to trade them in a live account.

We hope you enjoyed this article on how to manage an iron condor.

If you have any questions, please send an email or leave a comment below.

Trade safe!

Disclaimer: The information above is for educational purposes only and should not be treated as investment advice. The strategy presented would not be suitable for investors who are not familiar with exchange traded options. Any readers interested in this strategy should do their own research and seek advice from a licensed financial adviser.

Original source: https://optionstradingiq.com/how-to-manage-an-iron-condor/