Today we are looking at option adjustments and specifically, how to adjust debit spreads.

Contents

-

-

-

-

-

-

- Example Bear Put Debit Spread

- Example: Bull Call Debit Spread

- Give Debit Spreads More Time

- Locking In Profits

- Summary

-

-

-

-

-

Some investors do not adjust debit spreads.

It either makes money or loses money (amount predetermined when the position is placed).

They either close the trade or wait till expiration.

However, if you feel the need to “do something,” here is an adjustment that reduces the risk in the trade and lets the trade play out.

It never increases the trade risk and can be applied when you are in profit or when you are at a loss.

Example Bear Put Debit Spread

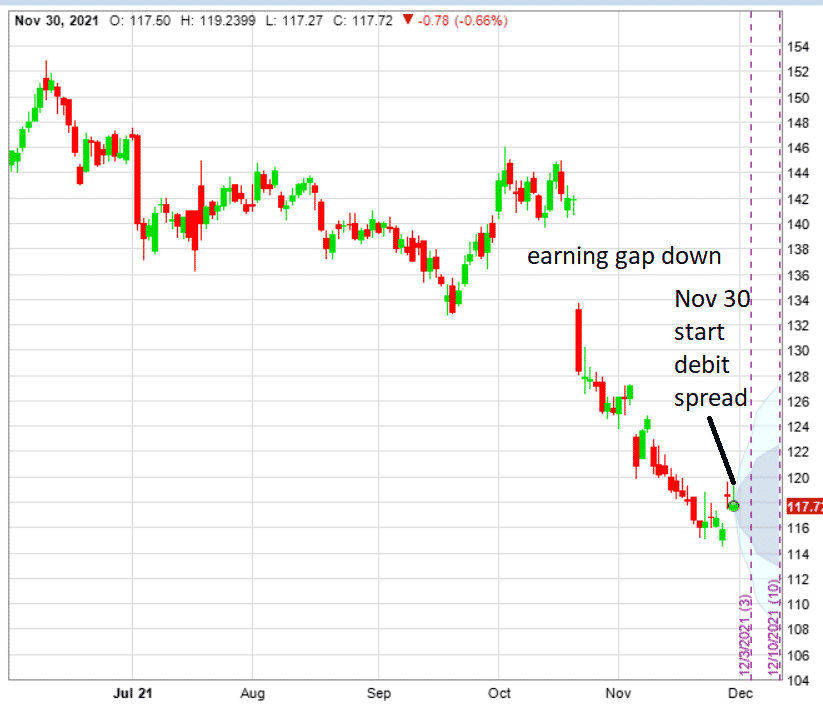

Suppose an investor saw that IBM gapped down on earnings and was on a downtrend.

source: OptionNet Explorer

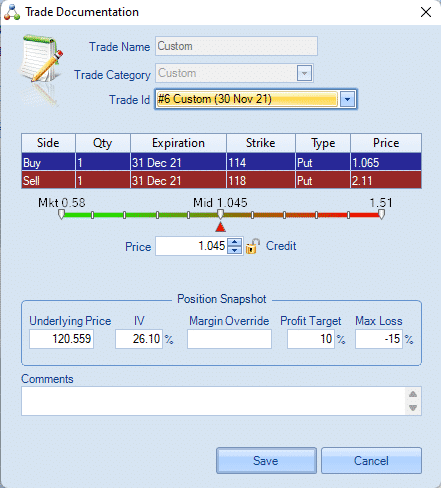

After a slight jump up in price, the investor decided to place a put debit spread on November 30, 2021, expecting the price to continue lower.

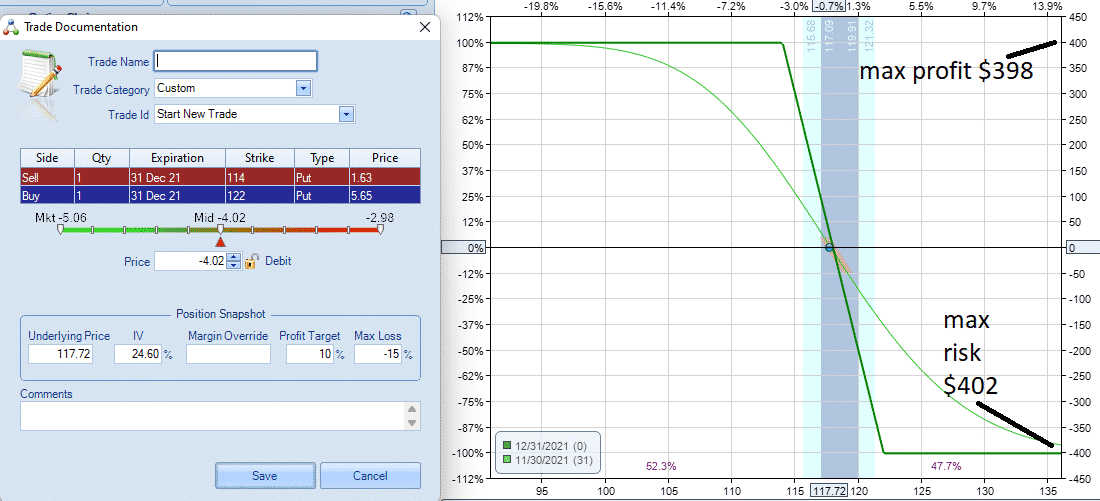

source: OptionNet Explorer

We are buying an in-the-money put and selling an out-of-money put with a month to expiration on December 31.

Sell one December 31 IBM $114 put Buy one December 31 IBM $122 put

Debit: $402

With the max risk of around $400 and the max potential profit of $400, this is a 50%-50% bet. If the investor can get a $200 profit, that might be good enough to close the trade.

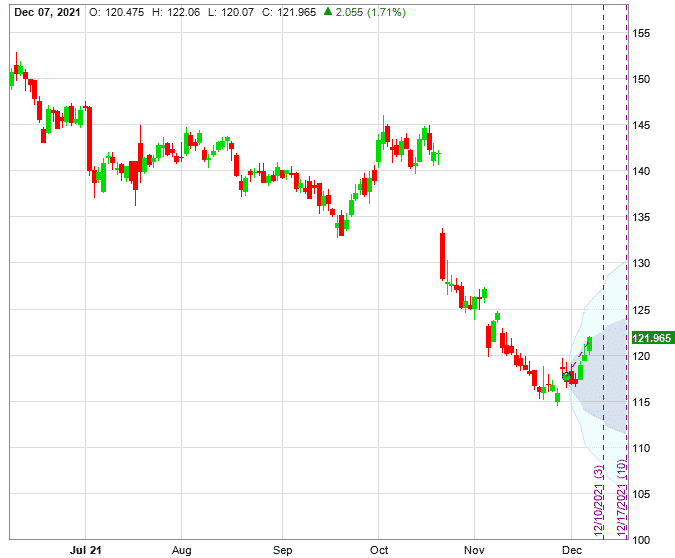

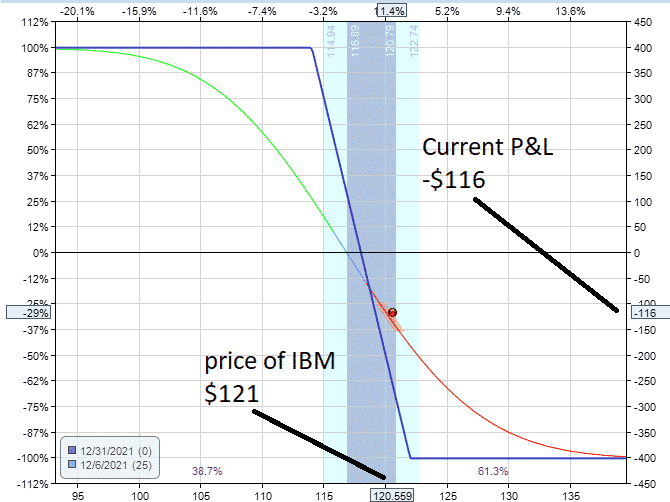

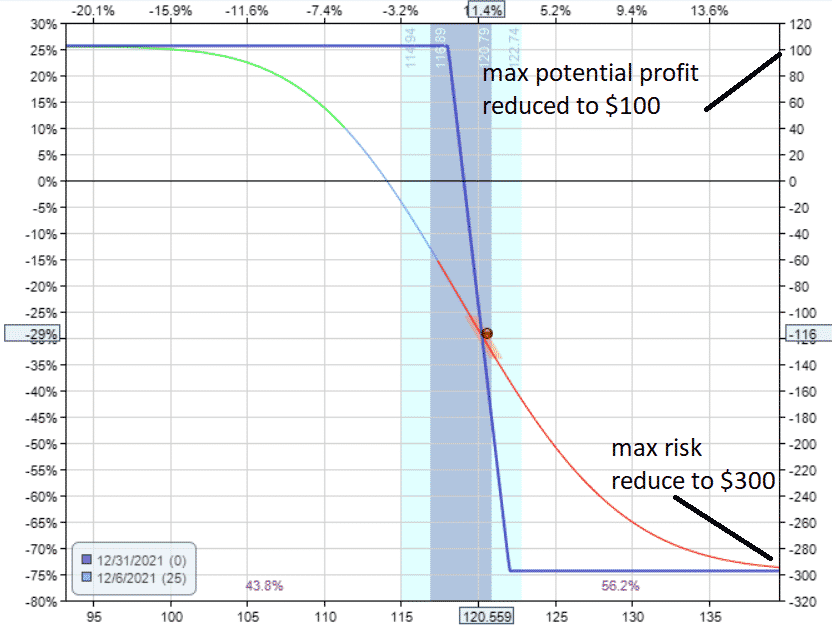

Unfortunately, the direction was wrong, and IBM rallied up to $121 by December 6.

The profit/loss (P&L) is at –$116.

As a proactive move, the investor makes the following adjustment to reduce the risk by rolling the short put option up from a strike of $114 to $118 and receiving a credit of $104.50.

Buy to close December 31 IBM $114 Sell to open December 31 IBM $118

Credit: $104.50

The effect is a reduction in the max risk down to about $300.

The exact amount that the risk had decreased is equal to the amount that was collected from making the adjustment (in this case, $104.50).

The unavoidable side-effect is that the max potential profit is also reduced.

But at this point, we just want to get back to break-even.

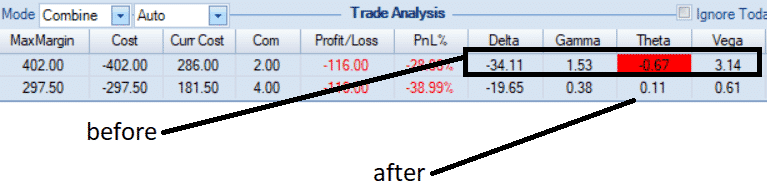

The Greeks improved.

We have a reduction in delta and vega, which means that the P&L will be less sensitive to price and implied volatility changes.

The theta increased, going from negative theta to having a positive time decay, which means the position now makes money from the passage of time rather than losing money.

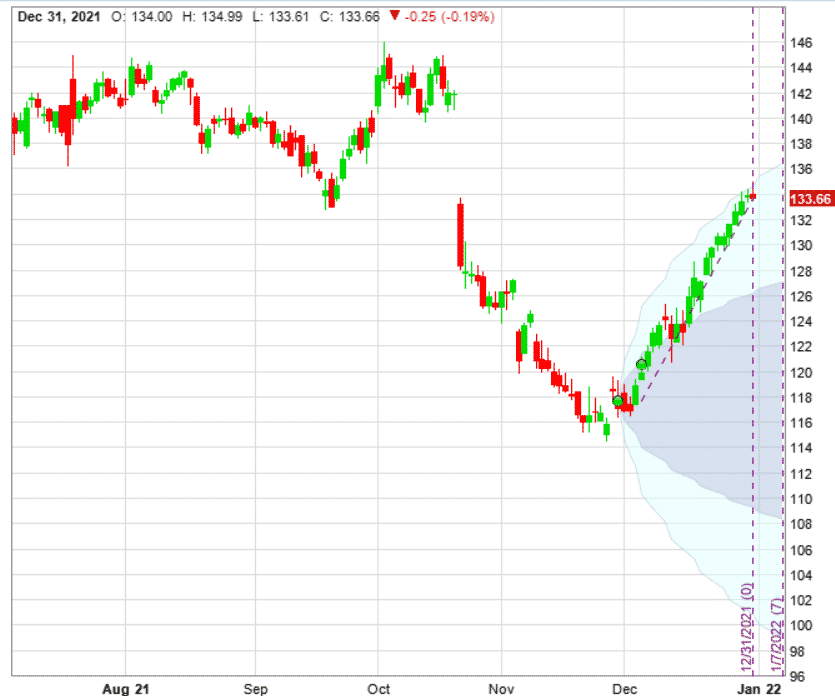

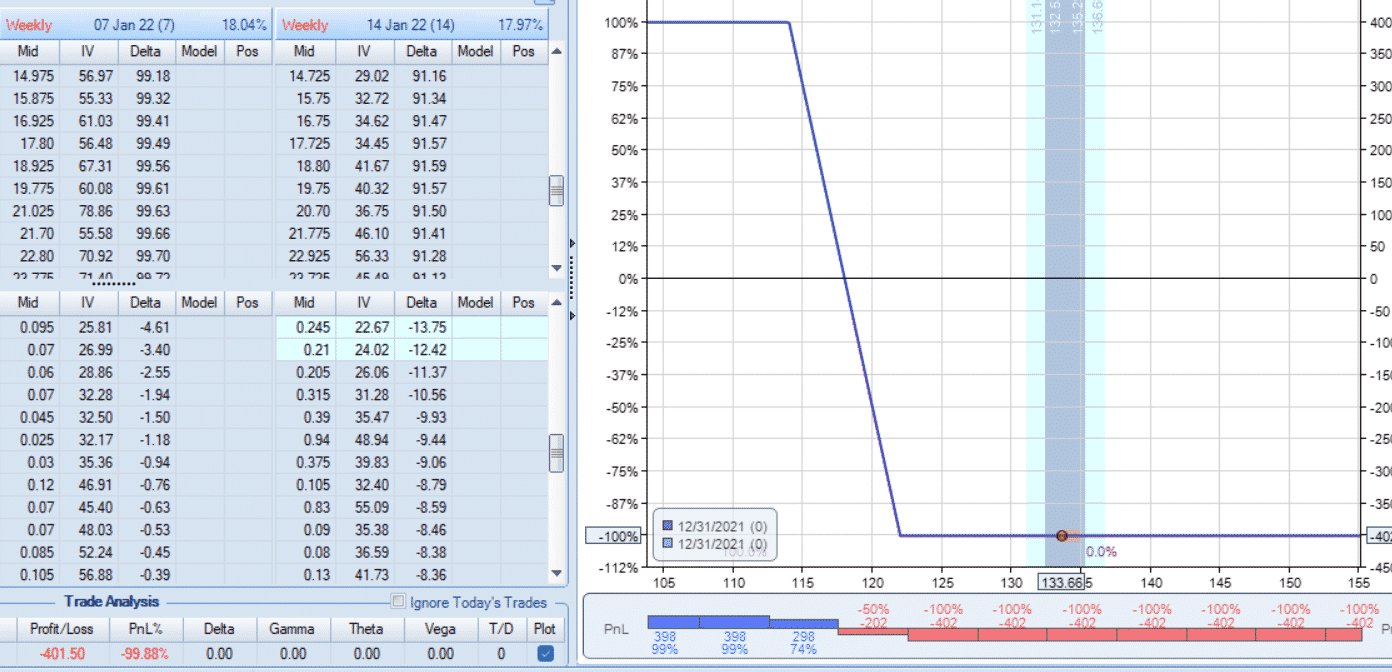

As the trade continues, IBM’s price keeps going up until our options expiration date on December 31.

IBM price at expiration was $133.66.

Both put options expired out-of-the-money worthless.

The net loss on the trade is –$297, which was the initial $402 debit minus the credit received for the adjustment ($104.50).

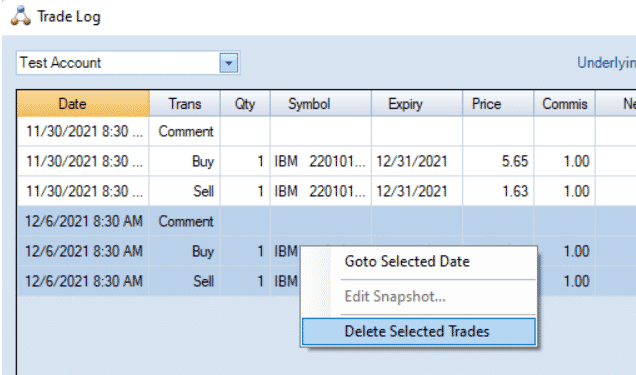

To see what would have happened if we did not adjust on December 6, we deleted those transactions from the logs of OptionNet Explorer.

And see that we would have lost $401.50, a bit more than if we had made the adjustment.

Example: Bull Call Debit Spread

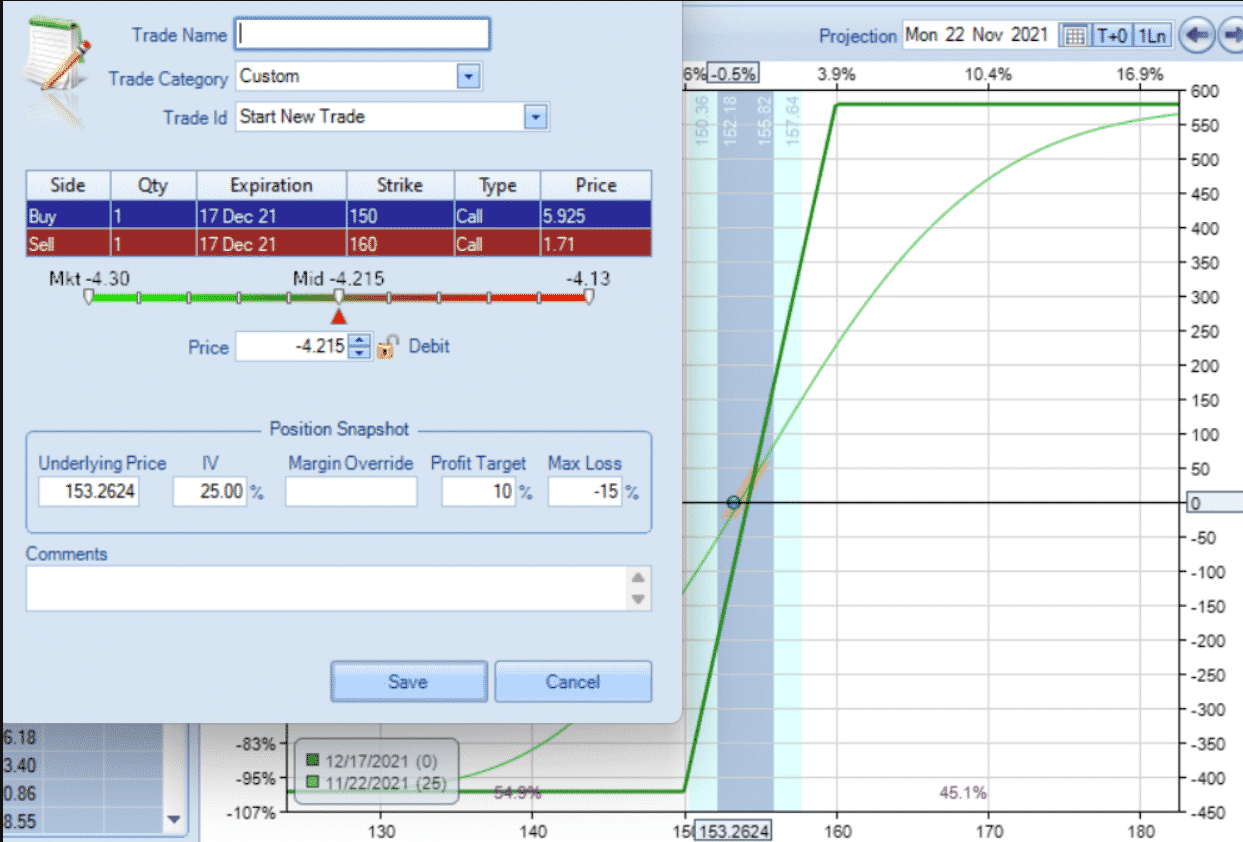

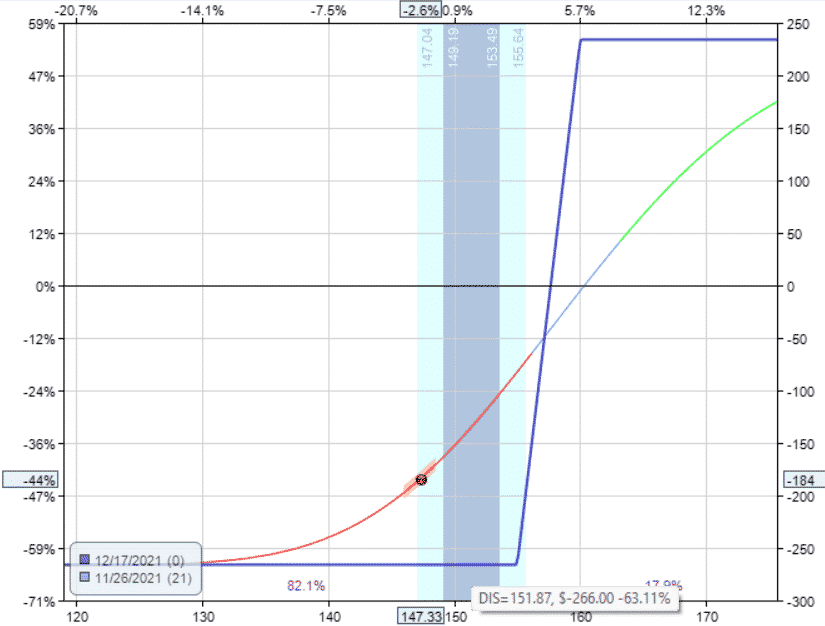

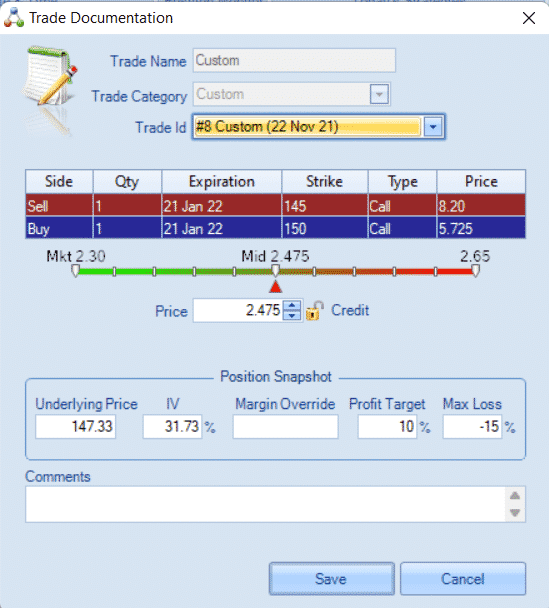

In the following example, we put on a bullish call debit spread on Disney (DIS) on November 22, 2021.

Our max risk is $421.50 because that was the amount we paid for the debit spread.

The trade has a potential profit of $578, but we may get out early if we can make half of that.

On November 26, we are at a loss of –$184.

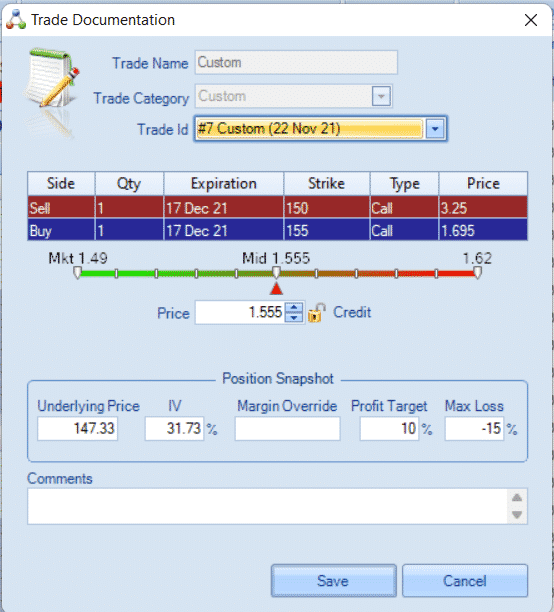

So we make the following adjustment to sell to close the existing $150 call and buy the $155 call in its place, receiving a credit of $155.50 in the process.

The updated payoff diagram reflects that our max risk has been reduced to $266.

At this point, the worst that can happen is that we lose another $82 from our existing loss of –$184.

The trade still has the potential to end in a profit of $234.

The risk to reward is favorable, and we can just leave the trade till expiration to see what happens.

Or we can set a conditional order to take profit as soon as you get back to break even.

The net cost we paid out of our account is $421.50 minus $155.50, or $266.

That is the initial debit that we paid for the debit spread less the $155.50 credit that we could get back by making the adjustment.

So if we tell our broker platform to sell this spread for $266 or higher, we will break even on the trade — lose nothing, gain nothing (excluding commissions and slippage).

But this conditional order did not trigger since the price of Disney never got high enough for the spread to be sold at that price.

The trade expired on expiration day with a net loss of $266.

For debit spreads, you can lose what you pay out.

You can get some of the money back by making adjustments that give you a credit.

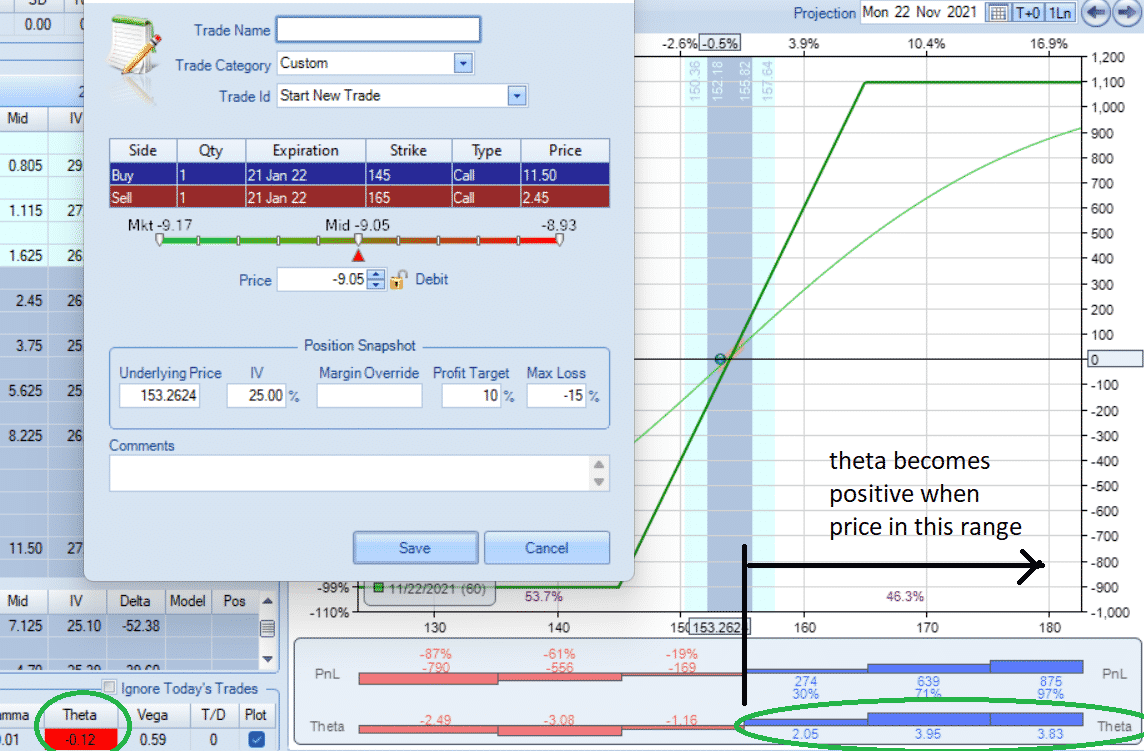

Give Debit Spreads More Time

The DTE (days to expiration) was only 25 days in the last trade.

We should give debit spreads more time so that stocks can make the moves that we want them to.

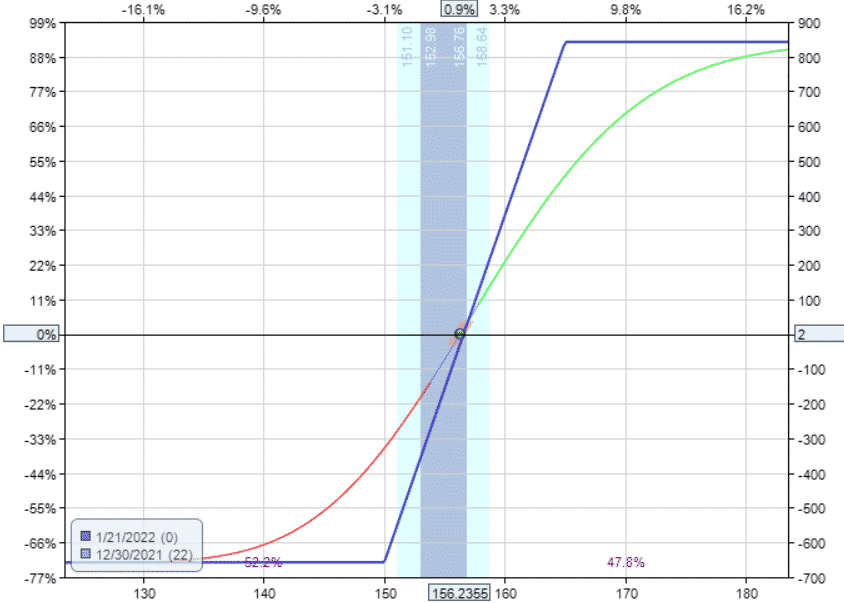

Let’s try the Disney trade again starting on November 22, 2021, just like before.

But this time, we use the January 21, 2022 expiration cycle with 60 days to expiration.

The trade size is a bit larger, with a max loss of $905.

The trade starts with a slight negative theta of -0.12, which means we lose a little from time decay.

Since this is a spread (as opposed to a single long option), the amount that we lose from time decay is not terrible and acceptable.

Theta will become positive (which is what we want) if the price goes up in our favor.

The histogram in the above histogram shows how theta changes across a range of prices that the stock can make.

On November 26, we are at a loss of –$261 and make the following adjustment to sell to close the $145 long call and buy the $150 long call, giving us a credit of $247.50 and reducing our max potential loss down to $657.50.

That leaves us with a short $165 call and a long $150 call.

At this point, we will be happy if we can get out at break-even.

So we put in a conditional order to buy to close the $165 call and sell to close the $150 call.

We specify to buy and sell these two simultaneously if and only if we can get a net credit of $658 (or higher) for the transaction.

This order was triggered, and the spread was sold back to the market for a credit of $658 on December 30 with 22 days still to go till expiration.

Initial debit paid for spread: –$905 Credit received for the adjustment: $247.50 Sold spread to close: $658 Net P&L: $0.50 (excluding commissions and slippage)

The price of Disney was $156 at the time.

If we had chosen not to put in the conditional order and wait till expiration on January 21, 2022, we would incur a net loss of –$657.50 because the price of Disney would end up dropping to $137.38.

Locking In Profits

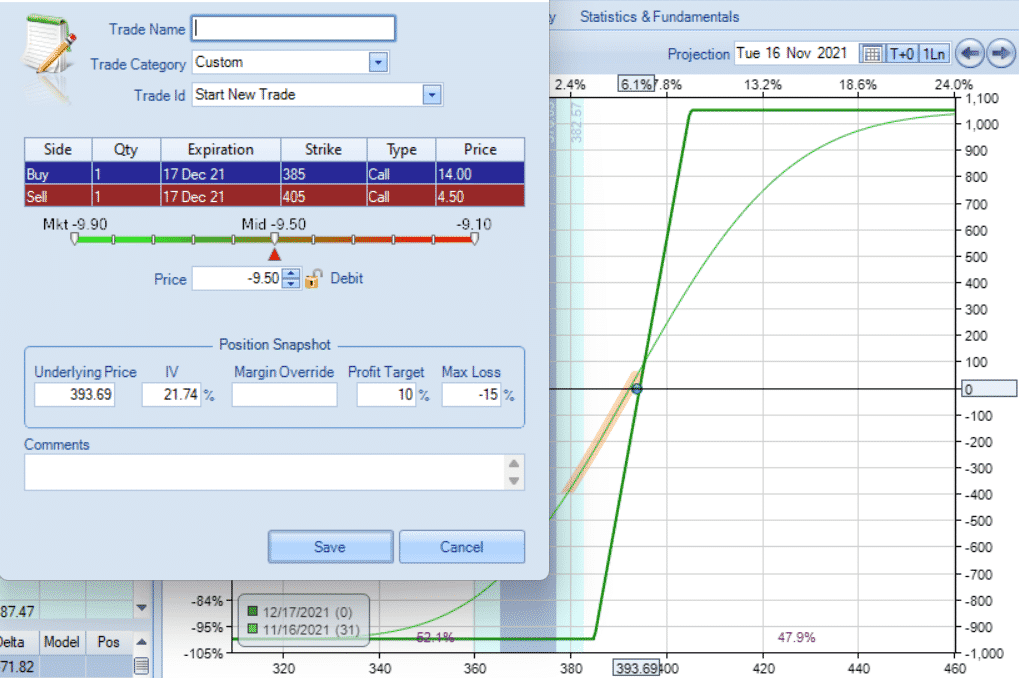

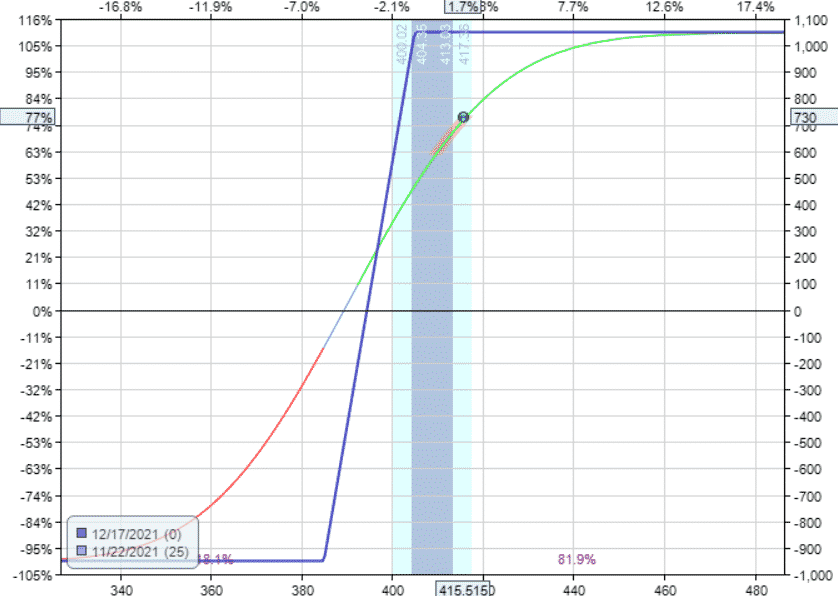

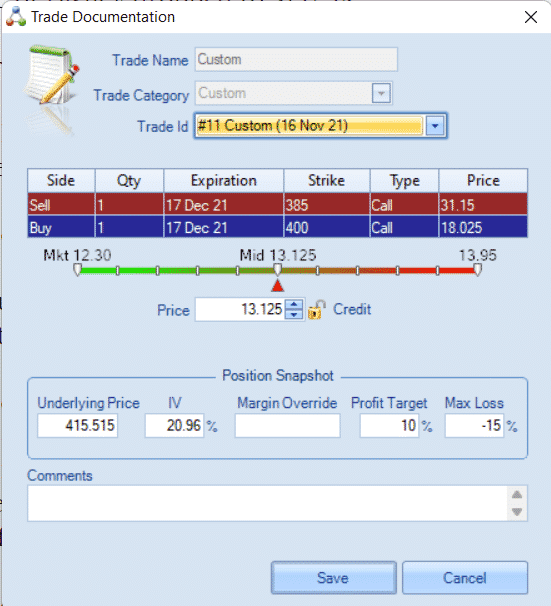

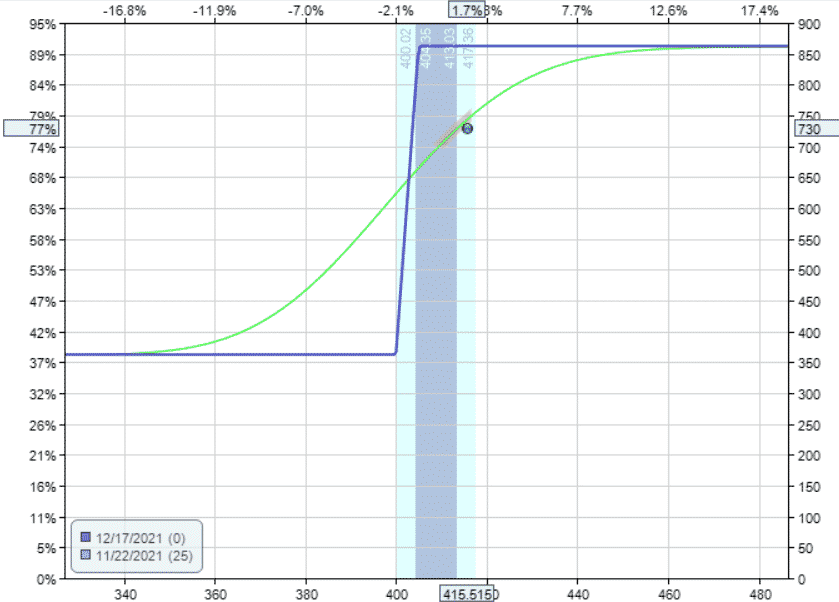

Suppose we purchased a bull call debit spread for $950 on Home Depot (HD) on November 16, 2021.

The trade went our way, and four trading days later, it reached 50% of its max profit potential.

We want to continue to press for more profits, but we don’t want to take a loss on the trade.

So we roll the $385 call up to $400, collecting $1312.50 of credit.

Because the credit we collected is larger than our initial debit, the trade is now “risk-free.”

No matter what happens, we will end up with a profit of at least $362, as can be seen by the updated payoff diagram.

This is how we lock in profits and let the trade ride.

Summary

We hope you have learned something from this article. Maybe it is:

1. How to adjust debit spreads to reduce the max potential risk in the trade. The key is to make the adjustment for a credit and narrow the width of the spread.

2. How to use the adjustment to lock in profits.

3. How to use conditional orders to have your platform sell the spread at the price you specify without your presence at the computer.

4. In our example, we told the platform to sell to get us to break even, but you could have told the platform to sell to get you 50% of the max potential profit or whatever you want. You can even place an order at the start of the trade and adjust or cancel the order later.

5. How to use OptionNet Explorer to try out what-if scenarios and how various adjustments affect the Greeks and payoff diagrams. All the screenshots in this article were of OptionNet Explorer.

Trade safe!

Disclaimer: The information above is for educational purposes only and should not be treated as investment advice. The strategy presented would not be suitable for investors who are not familiar with exchange traded options. Any readers interested in this strategy should do their own research and seek advice from a licensed financial adviser.

Original source: https://optionstradingiq.com/option-adjustments/