An equities trader’s position is considered “flat” when they have zero exposure to the market – no net long nor net short the market.

In some platforms, there is a “flatten” button that a trader can press in a market crash.

This feature will try to exit their positions for equities traders until all their positions are closed.

It is a bit more complicated for the options trader, and there is likely no flatten button on your particular platform.

So today, we will show you how to buy a long put (or a long call) to flatten your portfolio delta temporarily.

Contents

-

-

-

-

-

-

- To Flatten Positive Delta Dollars

- How Many Put Options To Buy?

- To Flatten Negative Delta Dollars

- Frequently Asked Questions

- Summary

-

-

-

-

-

By getting your portfolio delta to as close to zero as possible, we remove the directional exposure. We are not eliminating the vega (or volatility) exposure.

However, directional exposure is the most important concern in preserving capital if the market moves fast in one direction.

To Flatten Positive Delta Dollars

Since the market moves faster going down than up, we will start with an example portfolio with a positive delta and pretend that the market is moving down against us.

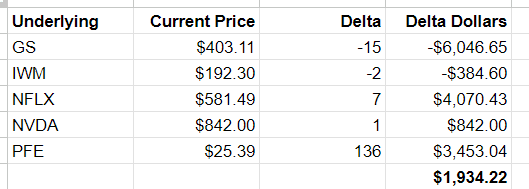

Suppose we have options positions on these stocks:

It doesn’t matter if the position is an iron condor, butterfly, calendar, or diagonal because the Greeks give us all the necessary information.

To eliminate directional exposure, we are only concerned with the positional delta of each position.

The most important number to calculate is the portfolio Delta Dollars.

To calculate this number, we multiply the position delta by the stock’s current price.

Aggregate this for all stocks in the portfolio.

In the above spreadsheet, we calculated the portfolio Delta Dollars to be positive $1934.

This is equivalent to an equities trader being long $1934 worth of stock.

Trying to get the $1934 Delta Dollar down to zero by selling or adjusting option positions is too time-consuming when the market is moving fast.

How Many Put Options To Buy?

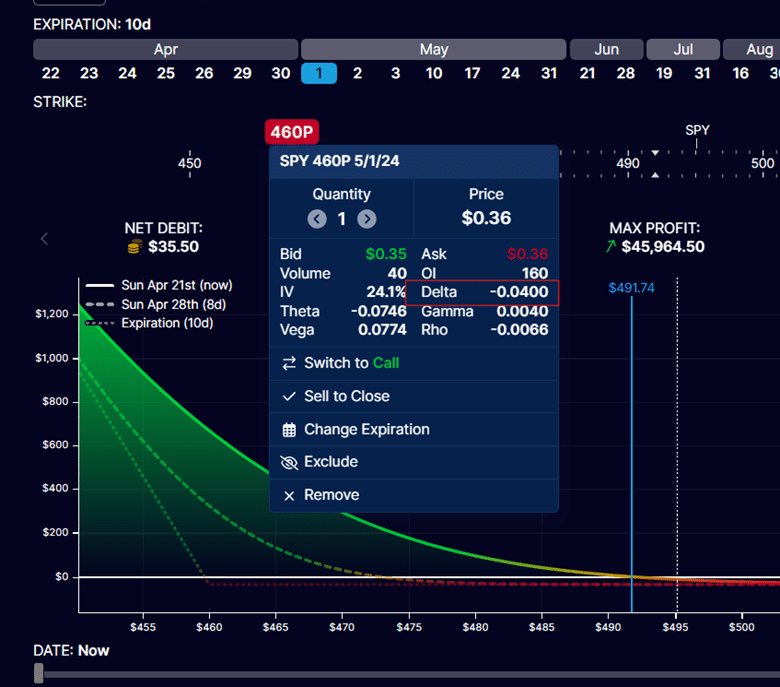

Instead, we will buy a put option in SPY (the S&P 500 ETF).

Suppose that the size of SPY is $495 at the time.

$1934 / $495 = 3.9

We need a SPY put option that has a -4 delta.

Looking around the option chain, we find that a put option with the 435-strike price expiring in 26 days has about a -4 delta.

This put option costs about $60.

Or we can buy a put option with the 460-strike price, expiring in 10 days, with a similar -4 delta. This option will cost less at $35.

But it will lose its value faster.

In any case, this is a temporary measure while the market is dropping.

It gives you time to properly adjust or exit your positions.

As the market moves, the delta dollars will surely change, and the put option may need to be exchanged with another one with different deltas.

To Flatten Negative Delta Dollars

If the portfolio Delta Dollars is negative and the market is going up against us, we need to buy a call option.

Because the market is going up, we need a bullish call option.

We need one with the right amount of delta to offset the negative Delta Dollars by performing a similar calculation.

Frequently Asked Questions

Why can’t we just look at the position delta of each position?

Simply looking at the position delta is not sufficient. In the above, we see that PFE has a delta of 136.

One might think that this is the position that has the most directional exposure.

But that would be incorrect.

The size of the underlying price is important. NFLX, with a delta of 7, has a larger Delta Dollar than PFE because one share of NFLX is many times larger than one share of PFE.

Hence, we need to look at the Delta Dollars for the calculation.

Does the number of contacts matter?

The number of contracts does matter.

However, it is already accounted for in the position delta.

The position delta of the position already considers the number of contracts.

A position with double the number of contracts would show a positional delta twice as large.

What if we have negative Delta Dollars, and the market is crashing?

If the market is going down while you have negative Delta Dollars, the portfolio should theoretically gain value as the market is going in the same direction as the delta.

However, the effects of vega have not been accounted for and may be affecting the P&L of the position.

In either case, the negative Delta Dollars may change quickly, and you need to recalculate this number quickly (if your platform does not already do it for you).

At some point, the negative Delta Dollars may even become positive Delta Dollars.

Can we use another underlying to hedge?

It is also possible to use another underlying, such as IWM, SPX, or RUT, to perform this delta hedge.

If you find that you need a 100-delta put, don’t buy an option that is so far away from the money.

Instead, buy two 50-delta put options.

If you find that you need 10 SPY put options, you can buy one SPX put option instead – roughly speaking, you need to do the exact calculations.

How come I don’t find a 4-delta put option in the option chain?

The platform may show the delta on a “per share” basis.

The deltas we are using in this article are on a “per contract” basis, meaning they have already been multiplied by 100.

What we call a 4-delta put is shown in some platforms as “-0.04.”

Can we use this hedging technique for stock portfolios?

Yes, one share of stock is one delta, so if you have five shares of NVDA at $842 per share.

Then your Delta Dollars is $4210 for that position.

Summary

To flatten our portfolio delta, we need to know the Delta Dollars of our portfolio.

Take this number and divide it by the price of SPY to determine what delta put or call you need to buy.

Buy a put if the market is going down against our position.

Buy a call if the market is going up against our position.

We hope you enjoyed this article on how to quickly flatten delta.

If you have any questions, please send an email or leave a comment below.

Trade safe!

Disclaimer: The information above is for educational purposes only and should not be treated as investment advice. The strategy presented would not be suitable for investors who are not familiar with exchange traded options. Any readers interested in this strategy should do their own research and seek advice from a licensed financial adviser.

Original source: https://optionstradingiq.com/how-to-quickly-flatten-delta/