Today, we are looking at how to trade options for income.

We will look at directional strategies such as covered calls and cash secured puts.

We will also look at non-directional strategies like iron condors, butterflies, and calendars.

Contents

-

-

- Introduction

- Option Selling Strategies

- Selling Put Options

- Selling Call Spreads

- Covered Calls

- Delta Neutral Income Strategies

- Butterfly Spreads

- Calendar Spreads

- Diagonals

- Double Calendars And Double Diagonals

- What Do They All Have In Common?

- Where Is The Edge?

- FAQ

-

Introduction

Traders that use options for income trading are known as income traders.

The strategies they use to generate this income are known as option income strategies.

Option strategies fall into two main categories: directional income strategies and non-directional income strategies.

The latter also being called delta-neutral income strategies.

While the pure income trader who is non-directional will only consider delta-neutral income strategies as the only strategy they would employ, in this article, we will talk about both categories.

After all, even for the directional income strategies, there is an income-generating element to the trade.

Option Selling Strategies

The foundation of option selling strategies is the selling of the premium that is in option contracts.

All options with some time left till expiration have a premium — some more and some less.

When you sell something, you get money in return.

This money is your income. Hence, income traders sell premiums, and the money they receive is their income.

Option premium is analogous to insurance premiums.

Insurance companies sell policies (such as home or auto insurance), which contain a premium.

The purchaser pays this premium, and the insurance company receives this payment as income.

Selling premium is not without risk. By selling this policy, they are obligated to pay a large amount of money if someone with that policy crashes their car.

The key to a successful insurance business is to sell the right policies to the right people at the right time so that they collect more premiums than what they have to pay out.

The key to being a successful income trader is to sell the right options at the right time with the right expirations so that they collect more premium than the losses that they incur.

The option seller will incur a loss when the option that they sell becomes in the money at expiration.

Selling Put Options

For example, suppose on May 4th, 2022, the income trader sells one contract of Microsoft (MSFT) $275 put option that expires on June 3rd, 2022.

The income trader receives $780 from this sale.

This amount is credited to the income trader’s account on May 4th at the time of the sale.

Consider this the income.

By selling this one option contract, the income trader is now obligated to purchase 100 shares of Microsoft at the strike price of $275 if MSFT is below $275 at expiration on June 3rd.

The is the “insurance” that the other party had purchased.

The contract ensures that the purchaser can off-load Microsoft stock at $275 regardless of how low MSFT drops.

This contract is only valid till the end of the trading day on June 3rd.

Let’s see what happened on June 3rd.

On June 3rd, MSFT closed at $270.

That means that the income trader had to buy 100 shares of Microsoft at $275.

The broker performs this purchase automatically.

Assignment

This process is known as assignment.

The income trader paid $27,500 and now owns 100 shares of MSFT stock.

Those 100 shares have a market value of only $27,000.

The income trader had to pay $500 more than the market value.

This $500 loss is offset by the $780 initial credit received.

The income trader made a net profit of $280.

Profit is the income minus the losses.

Had MSFT dropped much lower, the loss could have been more than the income and would have resulted in negative profits.

If MSFT had dropped to $0 at expiration, the loss would have been $27,500, offset by the initial credit of $780.

So, the income trader could lose up to $26,720.

To mitigate against such large (albeit unlikely) losses, many income traders would buy insurance to protect themselves.

Some call it “re-insurance.”

They are selling one insurance to others but are protecting themselves by buying a lesser amount of insurance.

The protection is not 100% because the insurance they buy is smaller (less expensive and less protective) than the insurance they sold.

The closer to 100% protection they do this for, the less income they make.

They will have the potential to generate more income if they forgo the purchase of this protection or buy minimal protection.

Selling Call Spreads

The same principle applies when the income trader sells call options.

However, it is not recommended that the income trader forgo the protection in this case.

It is better to sell an option spread instead of selling a single naked call option.

For example, on May 4th, 2022, an income trader sells a call option spread on SPY (the ETF that tracks the S&P500).

Date: May 4, 2022

Price: SPY @ $414

Sell one contract June 3, 2022 SPY $440 call @ $1.99

Buy one contract June 3, 2022 SPY $450 call @ $0.71

Net Credit: $128

The income trader sells one contract of the $440 call that expires on June 3rd.

The price of this option was trading at $1.99 per share.

Since one contract controls 100 shares of stock, the income trader received a credit of $199 — almost $200 of income for the sale of this option contract.

For protection, the income trader spends $71 to buy protection in the form of a call option with a strike price of $450.

So the net credit to the income trader’s account on May 4th is $128.

The option that the income trader sold (the $440 call option) is the option that is generating the income. It is known as the short option leg.

It is also the option that contains the risk.

If SPY’s price is greater than $440 at expiration, the trader is obligated to sell 100 shares at the strike price of $440 regardless of how high SPY price is.

At Expiration

If the price of SPY were at $470 at expiration, the trader would still have to sell it at $440 per share. Since the trader had sold one contract, that would equal 100 shares.

However, the income trader doesn’t have 100 shares to sell.

The broker would have purchased the 100 shares at the market price of $470 and then sold them at $440.

That would have been a loss of $30 per share, or $3000 for the one contract.

Fortunately, the trader had purchased the $450 call option to protect against such disasters.

In that case, the broker would have exercised the $450 call option to obtain the 100 shares of SPY, paying $450 per share. And then sell those 100 shares out at $440.

With the call spread, the loss from the assignment is only $10 per share or $1000 per contract.

Because the trader received an initial credit of $128, the net loss in P&L (profit and loss) is $872.

All this math should be done for you by options analytical software.

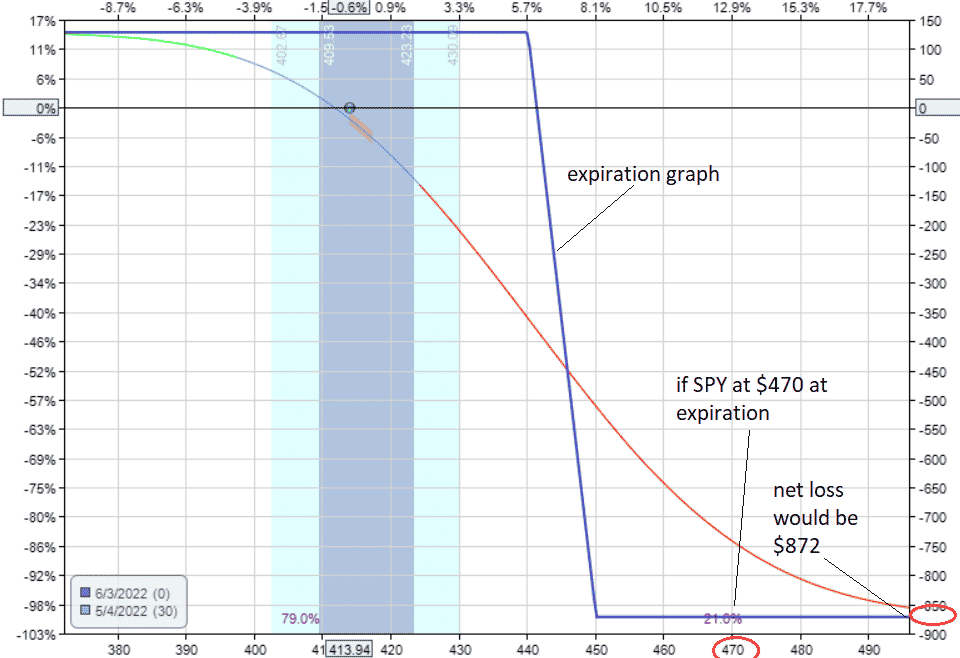

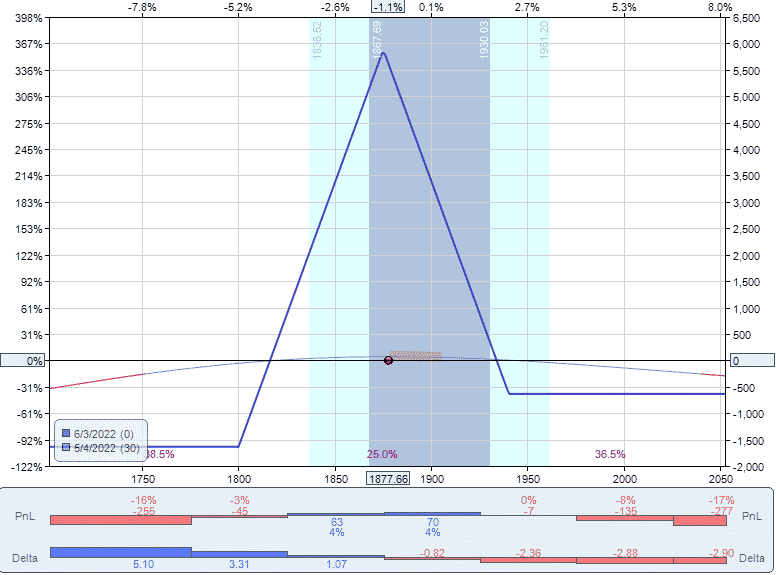

Here we see a screenshot of the “payoff diagram” for the call spread in OptionNet Explorer.

Bear Call Spread Payoff Graph

source: OptionNet Explorer

The expiration graph shows that if the price of SPY is $470 at expiration, the loss would be $872. The graph shows there is no loss greater than this.

This is the max possible loss for the option spread.

If the price of SPY is anywhere below $440 at expiration, the profit would be $128.

The income trader would keep the full $128 credit received.

From the graph, it is clear that the trader will benefit when the price of SPY goes down.

The trader expects or wants the price of SPY to go down when they placed the trade.

Hence this is known as a bear call spread.

It is also known as a call credit spread because the trader receives a credit for initiating the trade.

It would also be correct to say it is a bear call credit spread.

However, it might be redundant because all call credit spreads are bearish.

And all bear call spreads are initiated for credit.

Using the same concepts, it is a good exercise for the reader to construct a bull put credit spread.

Similarly, all put credit spreads are bullish.

And all bullish put spreads are for a credit.

Both the bull put spread and the bear call spread are directional income strategies.

The put credit spread benefits when price goes up.

The call credit spread benefits when price goes down.

However, they both have an income generating element built into the trade.

Covered Calls

One of the most popular ways to trade options for income is via covered calls.

Covered calls are perhaps the easiest strategy to understand for beginner option traders.

Investors that are familiar with stock ownership, can sell call options against shares they own.

The call option provides a premium that the investor can keep.

The investor continues to receive dividends from the stock investment as well.

Some investors refer to covered calls as a “double dividend” strategy.

If the stock rises above the call option strike price, the shares will be called away at that price.

If the stock stays flat or drops, the investor holds on to the shares and can continue selling covered calls to generate more income.

Let’s look at an example.

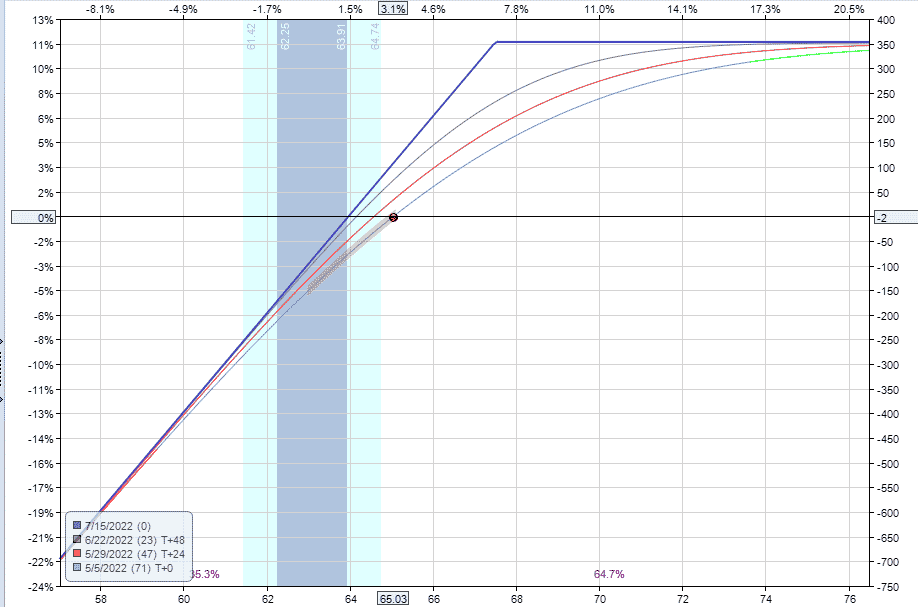

Date: May 4th, 2022

Price: KO @ $65.03

Buy 100 KO shares @ 65.03

Sell 1 July 15, 2022 KO $67.50 call @ $1.05

Cost of KO Shares: $6,503

Call Premium Received: $105

Net Cost: $6,398

Delta Neutral Income Strategies

Another sub-category of income strategies is the non-directional income strategies.

These are pure income strategies that have no directional assumption to the trade.

The most popular is the iron condor consisting of a bull put spread and a bear call spread.

Again, we collect a credit, or premium, at the start of the trade.

We want the price of the underlying to neither go up nor down.

The iron condor will benefit if the price goes sideways.

Delta is the options Greek that measures the directionality of the option strategy.

A positive delta means that the trade will benefit if the price goes up.

A negative delta means that the trade will benefit if the price goes down.

For income traders that do not want to choose a direction, they will construct an options structure with delta as close to zero as possible — as delta-neutral as possible.

Iron Condors

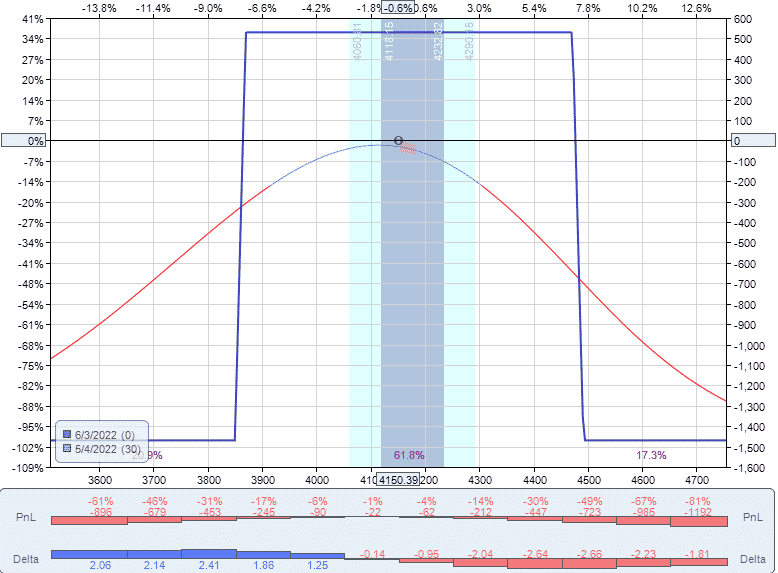

Here is an iron condor on SPX (the S&P500 index) with an initial position delta of -0.40.

Date: May 4, 2022

Price: SPX @ $4150.39

Buy one Jun 3, 2022 SPX $3850 put @ $41.60

Sell one Jun 3, 2022 SPX $3870 put @ $44.90

Sell one Jun 3, 2022 SPX $4470 call @ $10.15

Buy one Jun 3, 2022 SPX $4490 call @ $8.15

Net Credit: $530

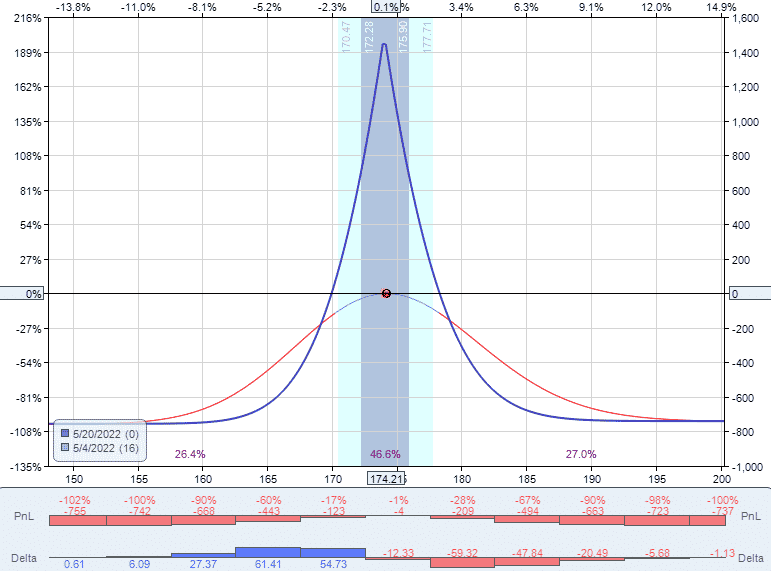

Butterfly Spreads

Some income traders prefer to sell options closer to the money.

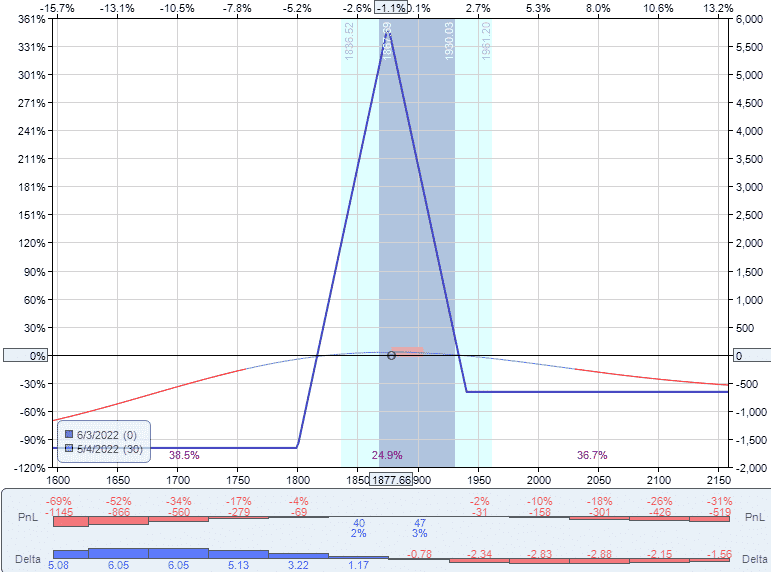

Here is a broken wing butterfly selling an at-the-money call spread and at-the-money put spread on the RUT (Russell 2000 index)

Date: May 4, 2022

Price: RUT @ $1877.66

Buy one June 3 RUT $1800 put @ $40.00

Sell one June 3 RUT $1875 put @ $67.35

Sell one June 3 RUT $1875 call @ $66.45

Buy one June 3 RUT $1940 call @ $35.40

Net Credit: $5840

The strikes are selected to achieve delta-neutrality with an initial position delta of 0.05.

Not all income strategies start with a credit. It is possible to have an income strategy that starts with a debit.

Below is a broken wing butterfly on RUT that is equivalent to the last example but instead is constructed with all put options.

Date: May 4, 2022

Price: RUT @ $1877.66

Buy one Jun 3 RUT $1800 put @ $40.00

Sell two Jun 3 RUT $1875 put @ $67.35

Buy one Jun 3 RUT $1940 put @ $101.05

Net Debit: $635

As long as the strikes and the expiration are the same, the two trades are the same with nearly the same Greeks and payoff graph.

One difference with this one is that it is paying a debit instead of a credit.

This trade still generates income via the sale of the two center options, whose value will decay with time.

It will decay much faster than the other two legs such that this butterfly can be sold later for a credit that is larger than the initial debit — if all goes well and the price does not make a big move.

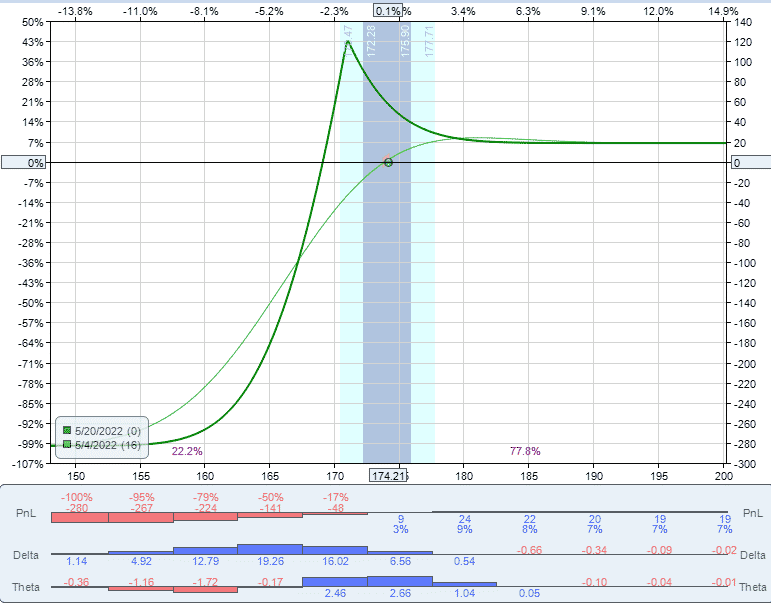

Calendar Spreads

The calendar is another delta-neutral income strategy that is initiated by paying a debit.

Here are 10 contracts of calendars on GLD.

Date: May 4, 2022

Price: GLD @ $174.21

Sell ten May 20, 2022 GLD $174 put @ $2.41

Buy ten May 20, 2022 GLD $174 put @ $3.15

Net Debit: –$740

It has an initial position delta of -0.56.

The goal here is to sell back the calendar for a credit that is greater than the initial debit.

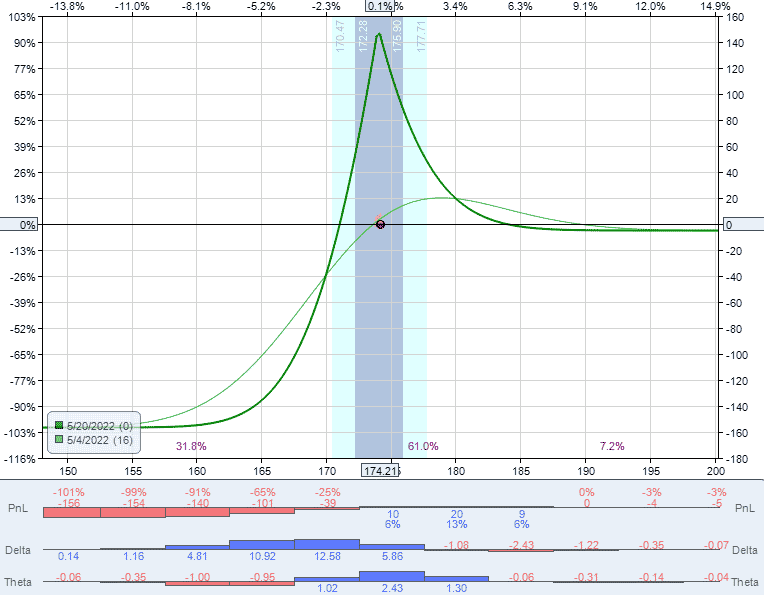

Diagonals

The diagonals are a mix between a credit spread and a calendar.

The credit spread is directional; the calendar is not.

The diagonal is somewhat directional.

The diagonal spread is placed for a credit. The calendar is placed for a debit.

The diagonal can be placed for a credit or for a debit, depending on which strikes and expirations are used.

Double Calendars And Double Diagonals

The double calendar and double diagonal are both delta-neutral income strategies.

A double calendar is initiated for a debit.

A double diagonal, like the diagonal, can be initiated for a credit or a debit, depending on its construction.

What Do They All Have In Common?

You have seen a whole bunch of income strategies.

Some are directional, and others are delta-neutral.

Some are placed for a credit, and some for a debit.

What is the characteristic that ties all of them together?

They all have positive theta.

Theta is an option Greeks that inform us whether the option strategy P&L (profit and loss) will increase as time passes (positive theta) or whether the P&L will decrease as time passes (negative theta).

This assumes that all other factors are equal.

Here is the graph of a diagonal that is initiated for a credit.

It has positive theta of 2.82

Here is the graph of a diagonal that is initiated for a debit.

It too has positive theta of 2.39.

All income strategies benefit as time passes and as we approach expiration.

You can say that income strategies generate income via the passage of time.

Another way of saying it is that they all experience premium decay. Income is being generated because option premium is decaying.

Suppose you sell a large ice cube for $10.

The ice cube melts and becomes smaller, so you can buy back the ice cube for $1.

You just made $9 of profit.

This is how theta decay works. You are selling assets that decay with time.

Where Is The Edge?

Besides having time work in our favor, there is an additional slight edge to selling options premiums.

This is known as variance risk premium, which suggests that option prices are priced slightly higher than the risk protection that it provides.

This is not true all the time but is true much of the time — especially in times when there is excessive fear and greed in the investors willing to “pay extra” to buy those options.

An investor is willing to “pay up” for buying put options when they are fearful of a market crash.

An income trader is willing to sell these options with elevated premiums.

If the market does not crash, the income trader profits.

However, on some occasions, the market crash does happen, and the income trader loses.

In rare events known as black swan events, the income trader can lose big with losses that are many times their typical gains.

To prevent such tail risk, the income trader adds some protection to the options structure.

The iron condor is the sale of a strangle with two further out of the money options as protection.

The butterfly is the sale of a straddle with two long options as wings for protection.

The calendar is the sale of a put or call option with the purchase of a longer-dated option for protection.

FAQ

How can options be used to generate income?

Options can be used to generate income via strategies such as covered calls, cash secured puts, and iron condors.

These strategies involve selling options to generate a premium and can be done with or without holding the underlying stock.

Can you make a living by selling options?

Yes, many traders make a living selling options.

However, it has been described as “the hardest way to make easy money.”

Selling options takes time to learn and requires significant amounts of capital to make a living.

How do you get passive income with options?

Passive income from options can be derived by selling call options on stocks you already hold, as one example.

Other strategies such as iron condors, butterflies, and calendars do not require you to hold the underlying stock and are pure income trades.

What is the most profitable option strategy?

We believe iron condors are the most profitable option strategy when traded correctly.

These form the basis of most of our trades.

How can I make money on options without exercise?

To make money on options without exercise, traders need to buy back the options before the expiration date.

In the money options will be automatically exercised on the expiration date.

In the money options can also be assigned early before the expiration date.

Early assignment tends to happen when the option is close to expiration when there is little time value left or if the stock is going ex-dividend.

Conclusion

If you are reading these concepts for the first time, this will be a lot to digest because we threw in a lot of new vocabulary.

Go through some of the links and learn the bits and pieces and come back to the article.

It will eventually all make sense.

Trade safe!

Disclaimer: The information above is for educational purposes only and should not be treated as investment advice. The strategy presented would not be suitable for investors who are not familiar with exchange traded options. Any readers interested in this strategy should do their own research and seek advice from a licensed financial adviser.

Original source: https://optionstradingiq.com/options-for-income/