Today, we’re looking at how to trade options on Robinhood.

Robinhood are one of the new players in the options broking world and have been particularly popular with younger traders.

Let take a look at trading options on Robinhood

Contents

-

- Introduction

- Robinhood App Features

- Indicators

- Exercising Options

- FAQs

- Conclusion

Introduction

Many people are attracted to Robinhood due to having no commissions on trades, including options trades.

Once you create a Robinhood account, you can start trading stocks.

However, in order to trade options on Robinhood, you need to update your investment profile so that they can determine if your level of experience and risk tolerance is suitable for options trading.

Based on this profile, Robinhood will grant you access to different levels of options trading.

Level 2 allows you to buy call and put options, sell covered calls and cash-secured puts, and buy straddles and strangles.

Level 3 allows you to trade debit spreads, credit spreads, iron condors, calendar spreads, and butterflies.

For options Level 3, you need to be on a Robinhood Instant or Robinhood Gold account, both of which are margin accounts (as opposed to cash accounts).

The best place to start if you want to trade options on Robinhood is to go through their series of articles on “Investing with Options” and “Getting started with options.”

They are actually quite well written.

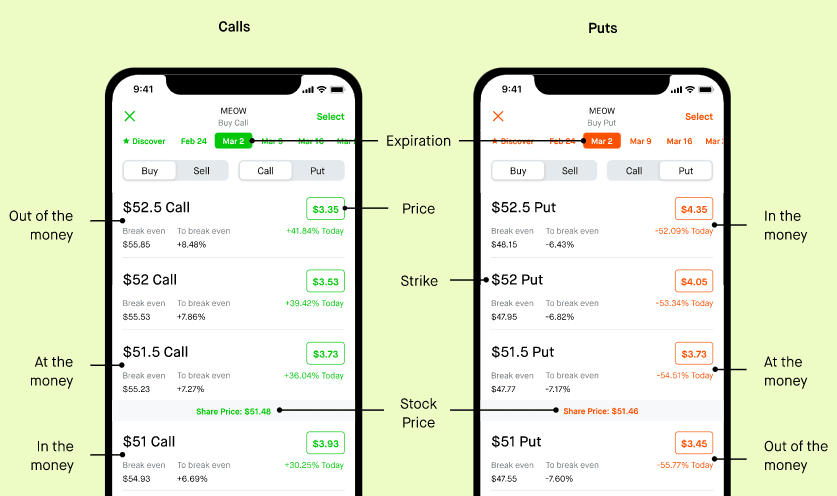

For example, it includes diagrams such as these how to navigate the option chain:

source: learn.robinhood.com

Robinhood App Features

Most users will use the Robinhood mobile app.

This app will show you the implied volatility, the Greeks, and a basic payoff graph of the options (which they call the P&L graph).

In mid-2018, Robinhood introduced the ability to trade multi-leg options in a single order.

This feature is essential for trading spreads, iron condors, and butterfly strategies.

Indicators

While the Robinhood app has only a limited number of indicators.

It does have five of the commonly used ones:

- Volume

- Moving Average (MA)

- Exponential Moving Average (EMA)

- Relative Strength Index (RSI)

- Moving Average Convergence Divergence (MACD)

Exercising options

In the mobile app, you have the ability to early exercise options that you own.

It even warns you if you are trying to exercise an out-of-the-money option.

Typically, investors will only exercise options that are in the money.

FAQs

Are options trades commission-free on Robinhood?

As of this writing, yes, it is. It only means you don’t pay any commissions on options trades in qualifying accounts.

However, there still may be miscellaneous fees, as noted in their fee schedule.

Does Robinhood have a desktop app?

While many investors use Robinhood on their mobile phones, they introduced a web-based application called Robinhood for Web in 2017.

Does Robinhood allow box spreads?

No, Robinhood does not allow box spreads.

A box spread is when you open a call spread, and a put spread with the same strike price and expiration.

Traders believe that they have a riskless trade.

However, this is not true.

They are exposed to risk if one of the legs is exercised early (for American-style options, not European options).

Call options especially can sometimes be exercised early due to dividend events.

What is the real reason why Robinhood disallows box spreads?

According to MarketWatch.com, a trader with a $5000 investment opened 500 “box spreads” on Robinhood because of the free commissions.

Because gains on each box are small, many contracts must be used.

If it were not for Robinhood being commission-free, the commissions would have wiped out any profits.

Unfortunately, 283 of the options were exercised early by the party on the other end of the trade. This broke the box and exposed the trader to large risks.

If, for example, a short call was exercised early, the trader would have to sell 28,300 shares of stock that he did not have.

Robinhood would have to exercise the long call to fulfill the obligation.

In the end, the trader lost about $58,000, and the account was closed.

Since then, Robinhood implemented the no-box policy due to criticism of how they were allowing a small account to be exposed to such large risks.

Conclusion

Robinhood is one of the few platforms that enable you to trade options commission free.

With multi-leg options order, it has enough to get the job done.

For advanced charting and options risk graph analysis, some traders with advanced strategies may need to supplement with other software and then use Robinhood to put in the trade.

We hope you enjoyed this article on how to trade options on Robinhood.

If you have any questions, please send an email or leave a comment below.

Trade safe!

Disclaimer: The information above is for educational purposes only and should not be treated as investment advice. The strategy presented would not be suitable for investors who are not familiar with exchange traded options. Any readers interested in this strategy should do their own research and seek advice from a licensed financial adviser.

Original source: https://optionstradingiq.com/how-to-trade-options-on-robinhood/