To Trade support and resistance with options involves combining technical analysis principles with options trading strategies.

Credit spreads, such as the bull put spread and the bear call spread can be used to capitalize on the expected price movement within a given range.

Contents

-

-

-

-

-

- Using A Bear Call Spread

- Mechanical Credit Spread

- Bull Put Spread

- Bull Put Spread Gone Wrong

- How Can We Prevent This?

- Conclusion

-

-

-

-

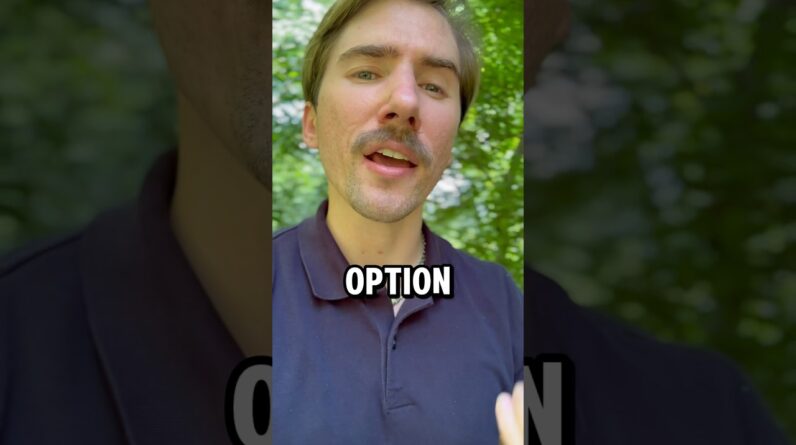

Using A Bear Call Spread

A trader notices a double top resistance zone on the daily chart of Coinbase (COIN):

Seeing that the price is not likely to go above $90, the trader sells a bear call spread one month out with a short call at $90 and a protective long call at $95.

Date: March 29, 2023

Price: COIN @ $67.74

Sell two May 5 COIN $90 call @ $2.70

Buy two May 5 COIN $95 call @ $2.04

Net credit: $131

The Greeks of this spread being:

Delta: -5

Theta: 1.3

Vega: -0.86

Theta/Delta: 0.2

One week later, this trade made more than 50% of its maximum potential profit and could be taken off for a profit of $74.

In this example, the position delta of the short strike happened to have been placed at the 25-delta on the option chain.

This is an example of a discretionary credit spread trade where the trader places the short strike based on the location of the resistance zone.

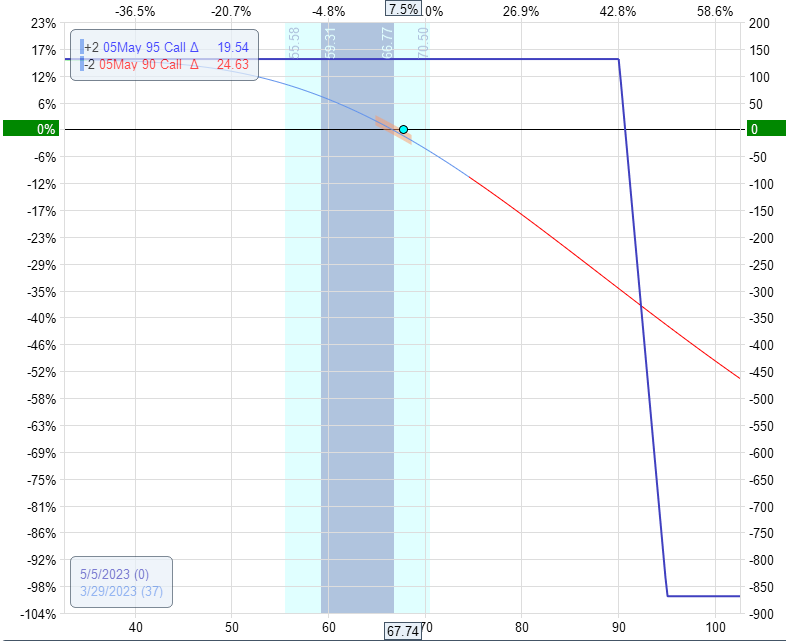

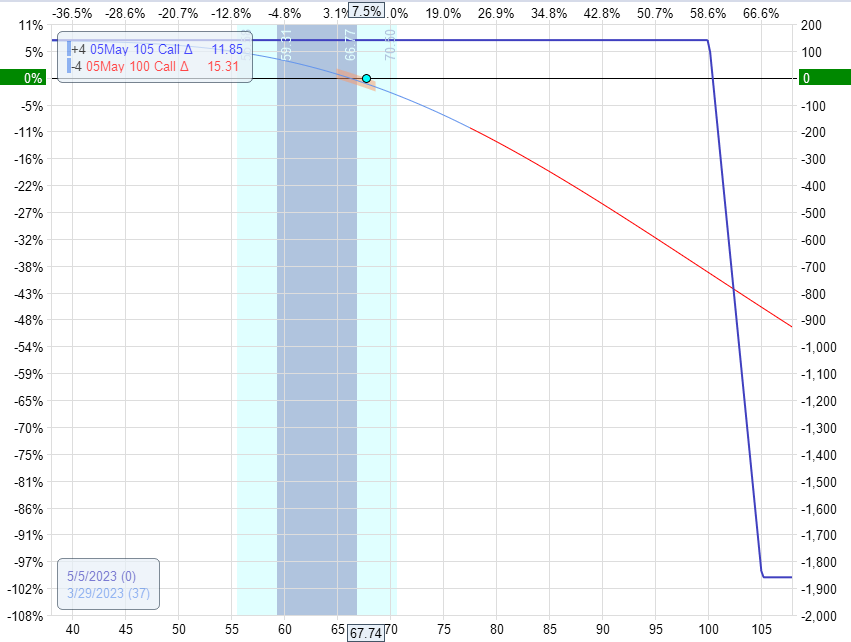

Mechanical Credit Spread

Another trader who employs mechanical credit spread strategies may have done this trade differently.

For example, if a trader is used to always placing the short strike at the 15-delta and always adjusting at the 22-delta-, Perhaps they are also used to placing spreads on an iron condor.

If that is the only way they have done credit spreads, and it works for them, then don’t change it.

The trader uses the observation of the double top resistance to inform them of the directional bias.

The stock is more likely to go down than up.

Hence, sell a bear call spread.

The trader would then trade the bear call spread mechanically at the 15-delta regardless of where the resistance zone happens.

In that case, they would have to trade four contracts instead of two to get the same reward potential because this trade would have a lower reward-to-risk but a higher probability of profit.

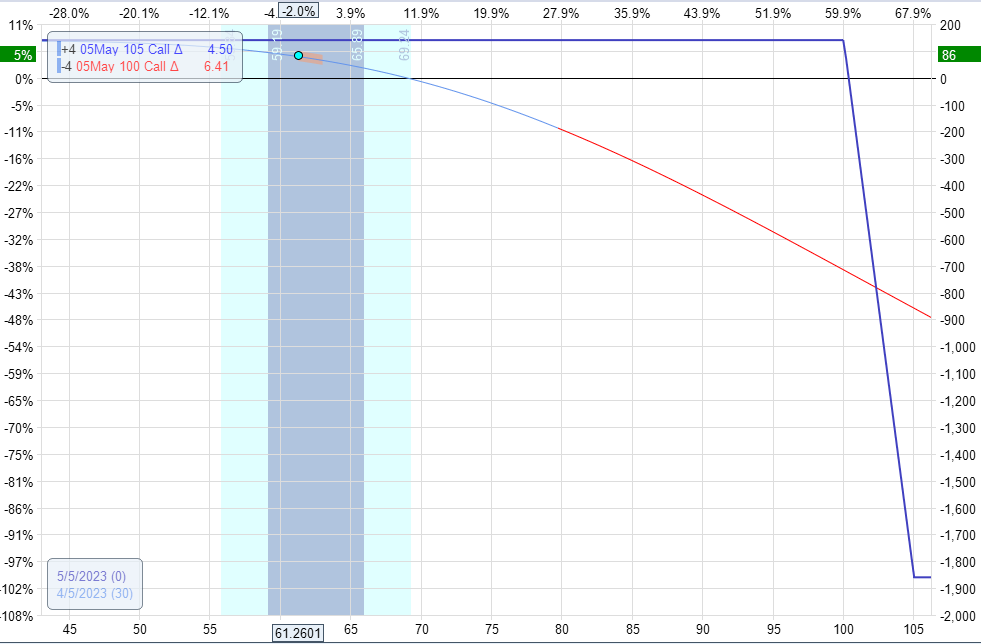

It would look more like this:

Date: March 29, 2023

Price: COIN @ $67.74

Sell four May 5 COIN $100 call @ $1.55

Buy four May 5 COIN $105 call @ $1.20

Net credit: $140

The Greeks of this spread being:

Delta: -14

Theta: 4.7

Vega: -3.3

Theta/Delta: 0.3

This trade also made a similar profit of $86 in a week.

Since it required a larger capital margin to achieve this profit, this trade has a lower return on risk of 5% as opposed to 9% in the first example.

We are not saying that one is more valid than another.

I’m just saying there are different ways to trade credit spreads.

Bull Put Spread

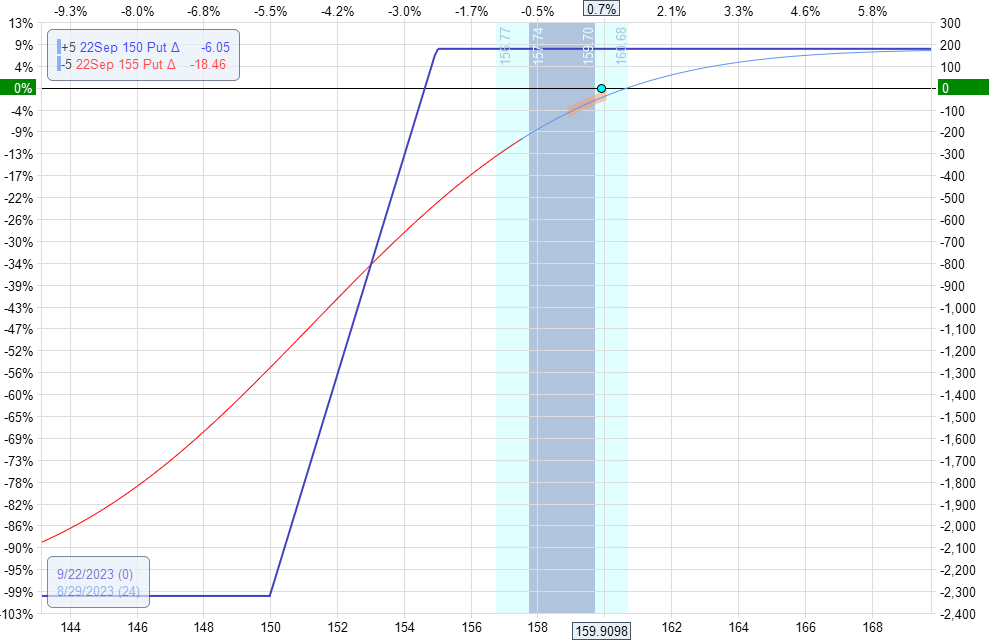

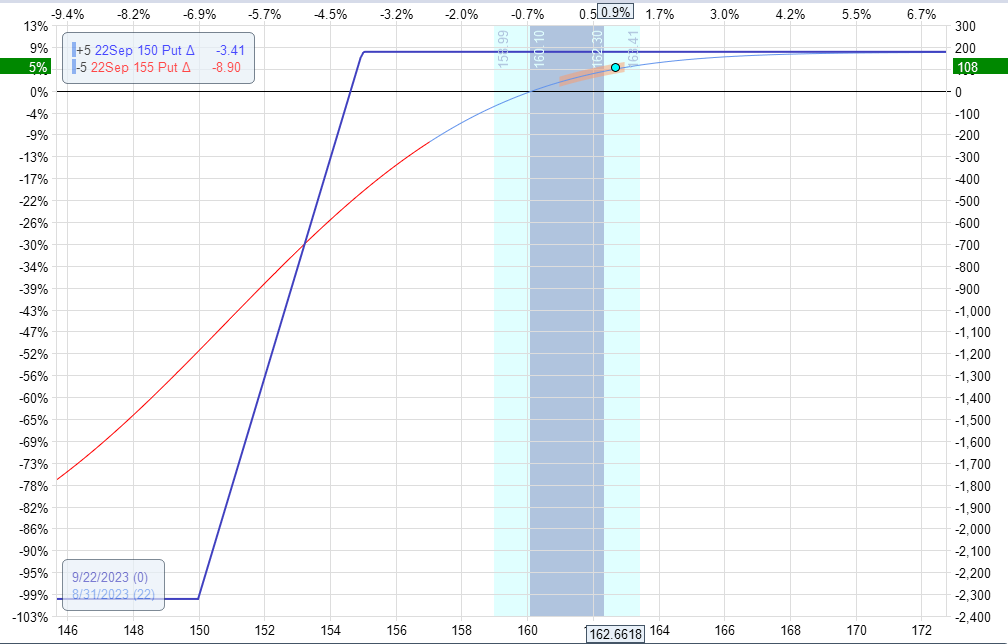

Looking at the following chart of Walmart (WMT), there is a support zone at the $154 level.

This is an example where the double-top resistance pattern became supported (green zone).

It also formed another double top smaller resistance zone later (red zone).

When the price bounced off support and broke through this small resistance on August 29, 2023, the trader initiated a bull put spread.

Date: August 29, 2023

Price: WMT @ $160

Buy five September 22 WMT $150 put @ $0.20

Sell five September 22 WMT $155 put @ $0.55

Net credit: $175

The trader made a profit of $108 in two days.

Bull Put Spread Gone Wrong

Credit spreads don’t always work so cleanly as in the last example.

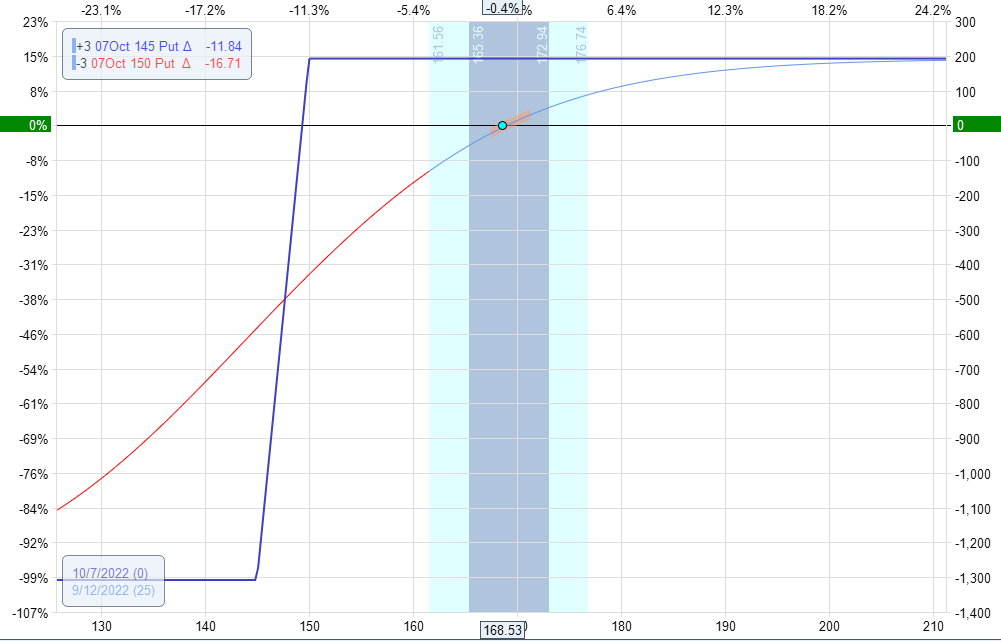

Let’s look at the following bull put spread on Meta (META) bouncing off support…

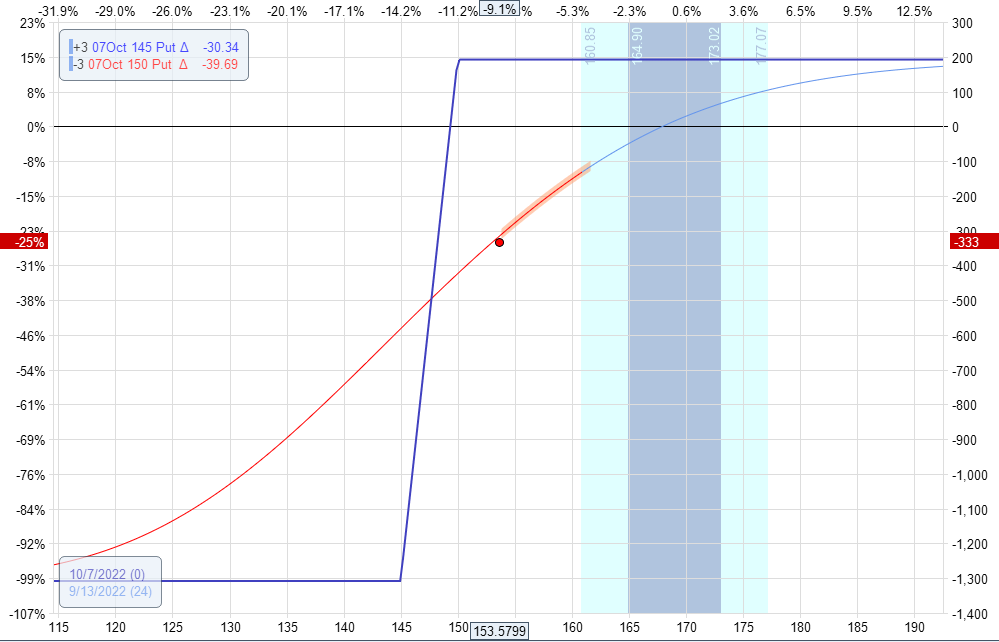

Date: September 12, 2022

Price: $168.50

Buy three October 7 META $145 put @ $1.31

Sell three October 7 META $150 put @ $1.95

Net credit: $192

Delta: 14.6

Theta: 5.8

Vega: -7

Theta/Delta: 0.4

Oops. The next day, the price dropped, and we were down 25% with a loss of -$333.

This happens.

Exit the trade and look for another.

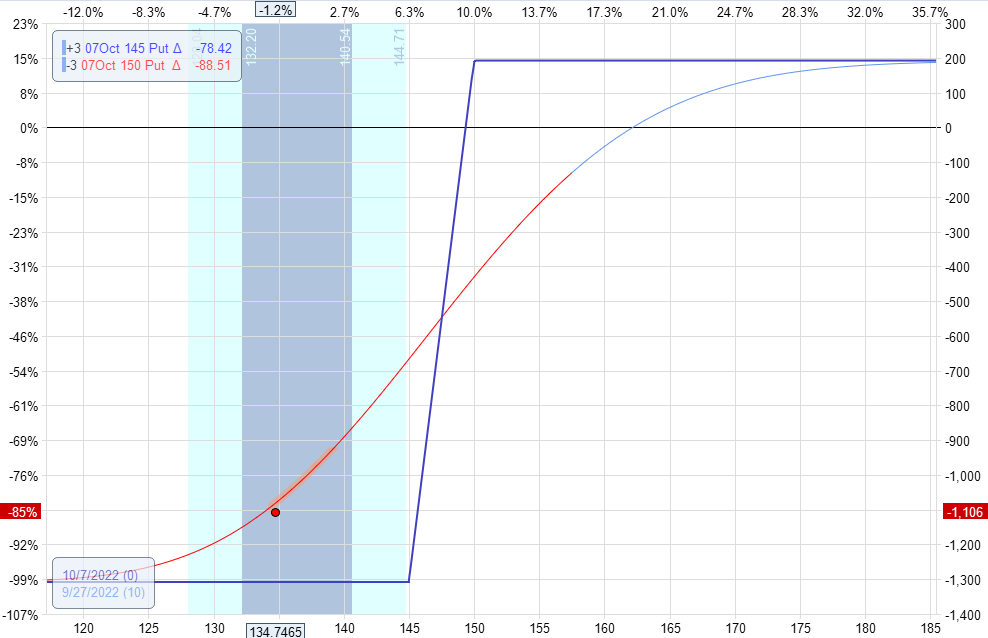

If not, Meta dropped further in the subsequent days, breaking through support:

This would leave the trader with a loss of over $1000 on September 27:

How Can We Prevent This?

Realize that support and resistance do not always hold.

Exit the trade when the zone is broken or if your pre-determined max loss is hit.

Do not hold trades over earning announcements, which can move the price.

Nevertheless, there is no way to prevent loss completely.

This is why they say trading involves risk. We can only manage the risk.

We mitigate the risk by trading further out in time (for example, spreads with more than 45 days till expiration).

That way, a one-day large move does not make as big of an impact on P&L.

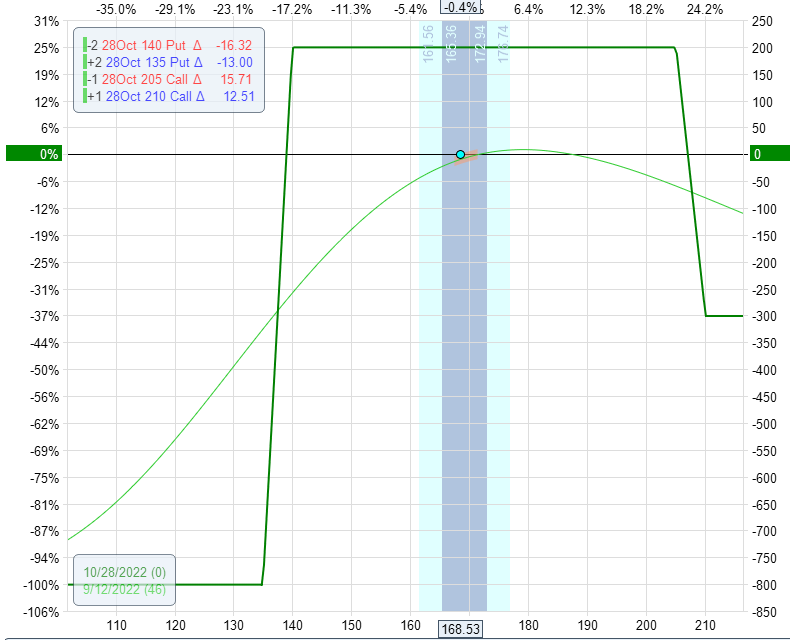

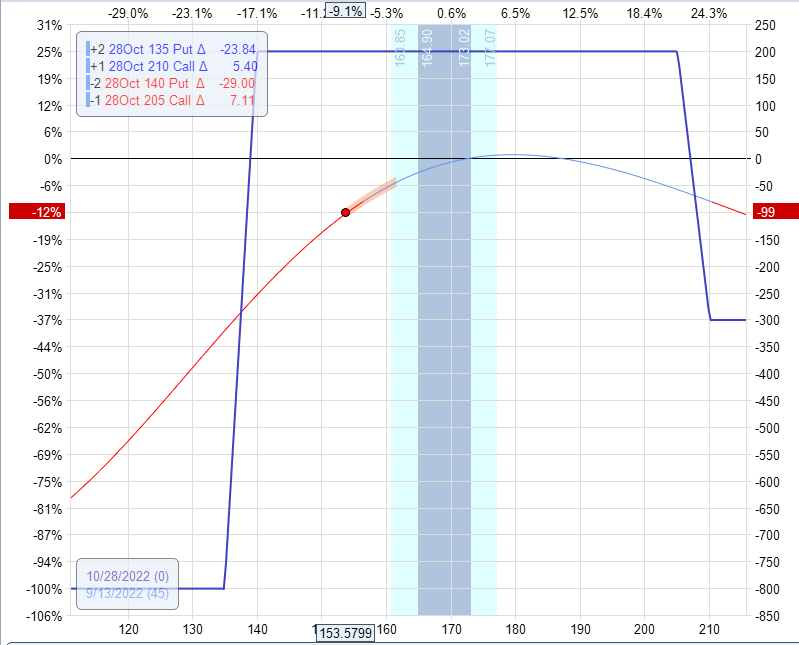

If the trader doesn’t want to be too directional, they can use an unbalanced iron condor with a slight bullish bias.

For example, if we use two bull put spreads and one bear call spread:

Date: September 12, 2022

Price: $168.50

Buy two October 28 META $135 put @ $2.38

Sell two October 28 META $140 put @ $3.13

Sell two October 28 META $205 put @ $2.13

Buy two October 28 META $210 put @ $1.63

Net credit: $199

Delta: 3.5

Theta: 3.5

Vega: -6.4

Theta/Delta: 1

The next day, this trade only lost -$99.

Conclusion

Integrating support and resistance levels with credit spread strategies can provide a structured approach to options trading.

Traders aim to capitalize on anticipated price movements or movements where price is not likely to do.

The careful selection of options, consideration of risk-reward ratios, and ongoing trade monitoring are essential components of this approach.

It’s imperative to stay attuned to market conditions, manage risk effectively, and be prepared to adjust or close positions as needed.

We hope you enjoyed this article on how to trade support and resistance with options.

If you have any questions, please send an email or leave a comment below.

Trade safe!

Disclaimer: The information above is for educational purposes only and should not be treated as investment advice. The strategy presented would not be suitable for investors who are not familiar with exchange traded options. Any readers interested in this strategy should do their own research and seek advice from a licensed financial adviser.

Original source: https://optionstradingiq.com/trade-support-and-resistance-with-options/