There’s never been a better time to be a trader.

The costs of trading are at all-time lows, and fantastic trading education is readily available.

Even the wealthiest Wall Street traders from 20 years ago would have loved to have the software beginners can access cheaply.

As a result, trading is no longer just a rich man’s game. With only $100, you can open a brokerage account and trade stocks with similar access to billionaires (so long as you’re not trying to trade on a minute-to-minute basis).

There’s no longer an excuse to delay.

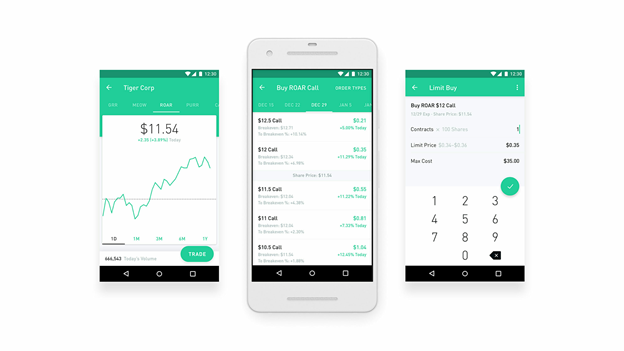

Robinhood, the primarily mobile-based stock broker, is one of the key figures in this democratization. They were the first widely available broker to offer commission-free trading.

If you’re very new to trading, you may take this for granted, but it’s importance to the development of novice traders cannot be understated.

You see, before Robinhood was around, it cost $5 to place a trade; that’s $5 for the buy, $5 for the sale.

Forget scaling in and out of positions, taking a “feeler” position to incentivize you to pay attention, or even creating a broadly diversified portfolio with several tiny stock positions.

Imagine having to pay $10 for each round trip trade with a $1,000 trading account. You lose 1% of your account just placing a trade, and it’s like the casino taking “rake” out of each pot at a poker game.

Robinhood’s value proposition was simple. Free trades, limited technology, and resources. It’s a trade-off nearly all novice traders were willing to make.

The alternative was trading account death by a thousand fees.

Soon after that, the rest of the brokerage industry, including behemoths like Charles Schwab and E*TRADE, followed suit and cut their trading commissions to zero.

Can You Trade All Penny Stocks With Robinhood?

The term “penny stock” doesn’t have a strict definition. To most, it refers to a stock with a share price in the pennies.

However, to me, a penny stock is a catch-all term for small stocks that move wildly, whether it’s a $1 stock or a $0.01 stock.

You might be surprised to find out that Robinhood doesn’t allow clients to trade the vast majority of penny stocks.

While nearly every stock listed on the NYSE or NASDAQ exchanges is available to Robinhood clients, there’s an entire underbelly of the stock market known as the over-the-counter (OTC) market is mostly closed off to Robinhood clients.

OTC stocks aren’t listed on an exchange like NASDAQ, nor do they have the financial reporting standards that exchange-listed companies do. As a result, the vast majority of these are tiny, shoddy companies with shady backgrounds.

That doesn’t stop penny stock traders from trading them, though, as they usually hold these stocks for less than a week anyhow.

Take a look at some screen results from Finscreener’s OTC Top Gainers page. On any given day, dozens of stocks you’ve never heard of are multiplying in price.

However, the kicker is that most of these move on little volume, in other words, they’re untradeable.

Each week, a small minority of these stocks move on large volume, creating real trading opportunities, in any case—trading opportunities that are closed off to Robinhood traders.

Going further, Robinhood will sometimes selectively restrict purchases of stocks they deem to be high-risk.

Typically, these are companies with questionable financials which just multiplied in price several times on a puffed-up press release.

For example, in 2018, Robinhood restricted the purchase of Helios and Matheson, the MoviePass parent company. Sure, the company stock cratered more than 99.99%, but do you want your broker making these decisions for you?

What if you saw a great technical pattern on the chart and wanted to take a small position?

The Fees of Trading Penny Stocks With Robinhood

Many brokers, even those who typically charge zero commissions for trading, will charge per-share for certain penny stocks they deem high-risk. Robinhood does not get into these sorts of games.

All trading is free. If they don’t want their clients trading a stock, they will restrict the stock’s purchases, rather than charging fees.

There are no fees for trading penny stocks with Robinhood.

Pitfalls Of Trading Penny Stocks With Robinhood

The relentless volatility of the 2020 stock market crash due to coronavirus concerns exposed the potential severe drawbacks of trading with a new broker like Robinhood.

Traders couldn’t buy or sell securities for significant periods in early March 2020. The Verge reported that “Robinhood experienced its third outage in a week as US stocks have plummeted,” with one of the outages lasting for an entire trading day.

Not being able to trade during extreme volatility is horrifying for day traders. Many day traders don’t employ stop losses and instead manually exit their positions.

Many of those traders planned to risk a small amount like 1% on their trades and ended up losing upwards of 10% sheerly due to infrastructure failure.

Further, Robinhood didn’t design their software for traders.

It’s primarily meant for investors and stock market hobbyists. Serious traders use low latency desktop trading platforms with hot-keys mapped for quick execution.

This allows them to quickly initiate or exit position the second they desire to do so.

Compare the Robinhood app to DAS Trader, for example.

The former is a mobile app created for ease-of-use; the latter is a trading platform developed for speed and execution efficiency.

Alternatives to Robinhood for Trading Penny Stocks

If you’re looking to trade penny stocks with a relatively small trading account, one of the large discount brokers is probably the way to go. I’m talking Charles Schwab, Fidelity, E*TRADE, or TD Ameritrade.

They all have advanced software, which they offer for free to active traders, and they also have free commissions.

I like Schwab because they don’t charge commissions on OTC trades, and their platform StreetSmart Edge, is a simple, no-frills solution for basic active trading.

However, all of the above choices are great.

As you get more advanced and build your trading account, other options begin to make sense. Interactive Brokers is the next step up.

IBKR charges commissions because they’re a direct market access broker.

You can choose where and how to route your orders and avoid payment for order flow, unlike the big-box brokers.

If you are an advanced short seller who likes to short hard-to-borrow stocks (nearly all penny stocks are hard-to-borrow), you’re likely well-suited to brokers like Lightspeed Trading or Centerpoint Securities.

Both are boutique brokers that specifically cater to serious and highly active traders.

Bottom Line

Robinhood’s contributions to the trading community should not be taken lightly. The founders, Vladimir Tenev and Baiju Bhatt, deserve immense credit for fostering thousands of now-professional traders’ careers.

Beyond that, the firm has made investing as easy as downloading the app, filling a few forms, and buying a few recommended index funds—all without fees.

However, when it comes to serious short-term trading, Robinhood is likely the worst choice of big discount brokers. Competitors like Schwab, E*TRADE, and TD Ameritrade all have a deep pool of resources like software, research, and support which you can lean on.

The post Is Robinhood Good for Penny Stocks? appeared first on Warrior Trading.