Today, we’re looking at an example of layering iron condors. We will first look at a standard adjustment, then look at an example of layering. Enjoy!

Contents

- Standard Adjustment

- Layering Adjustment

Home Depot (HD) has earnings on May 17, 2022, before the market open.

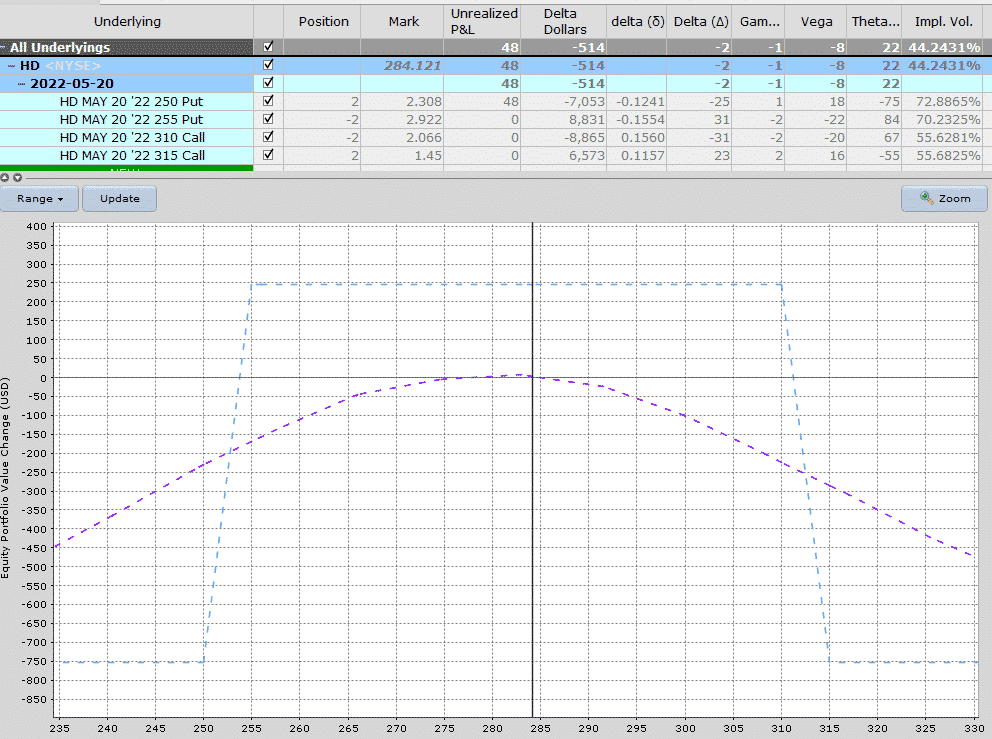

On May 11, 2022, we initiate an iron condor to hold through earnings:

The short strikes are out at around 15-deltas. May 20 is the expiry after the earnings announcement.

As we would also do on an earnings trade, this is a defined risk trade.

Using two contracts with 5-point wing widths, the trade has a maximum loss of $750.

It has a max potential profit of $250. We are risking three dollars to make one dollar.

We like to keep the risk to reward ratio low for earnings trades.

Three-to-one is good.

We wouldn’t want to make these 10-to-1 trades over earnings.

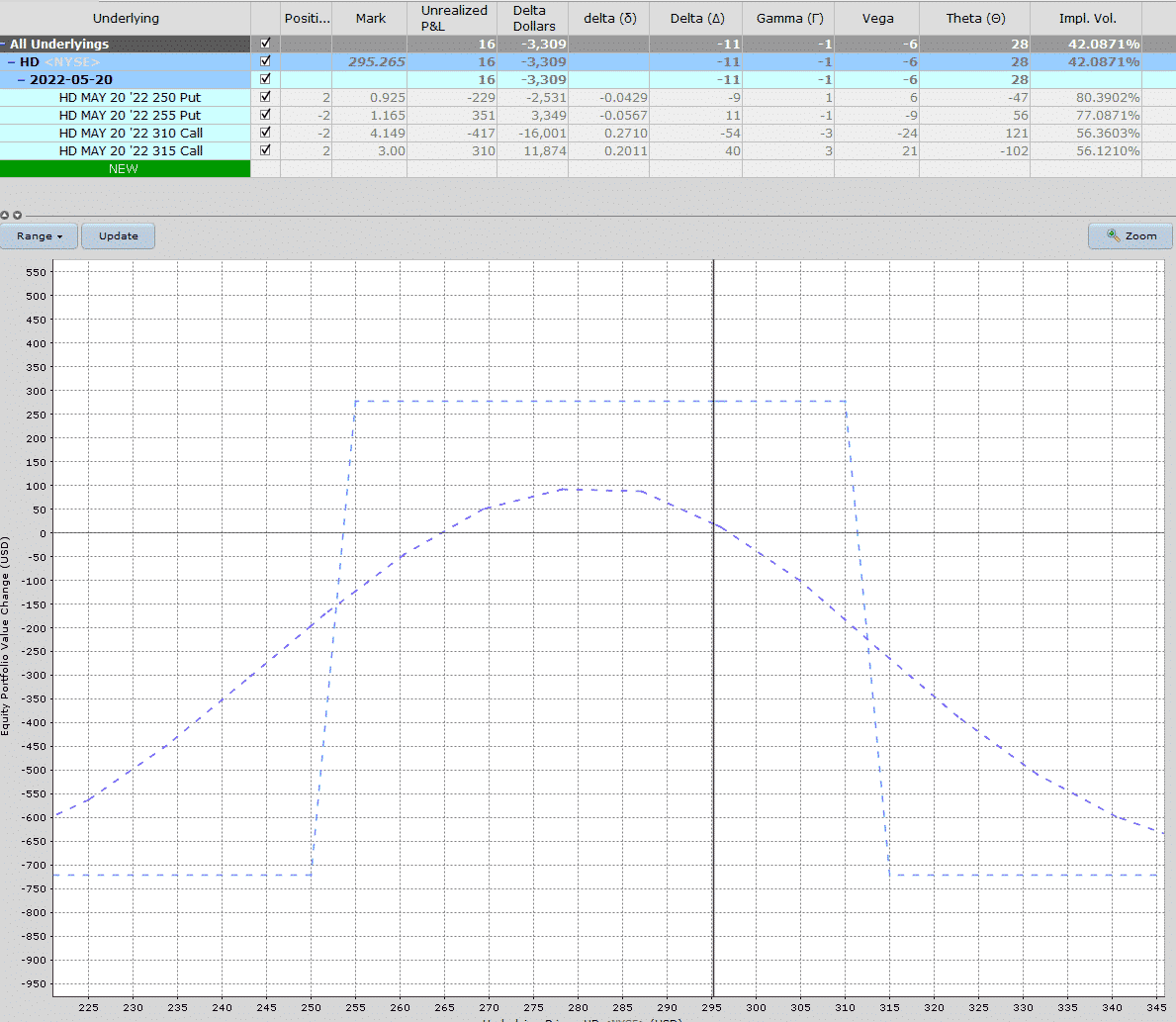

Right after placing the condor, Home Depot rallied the next day and the following day, reaching a price of $295 and starting to approach the call spread.

On May 13, 2022:

Standard Adjustment

Our standard adjustment is the roll the call spread further away from the current price.

Date: May 13, 2022

To close:

Buy two May 20 HD $310 calls

Sell two May 20 HD $315 calls

To open:

Sell two May 20 HD $320 calls

Buy two May 20 HD $325 calls

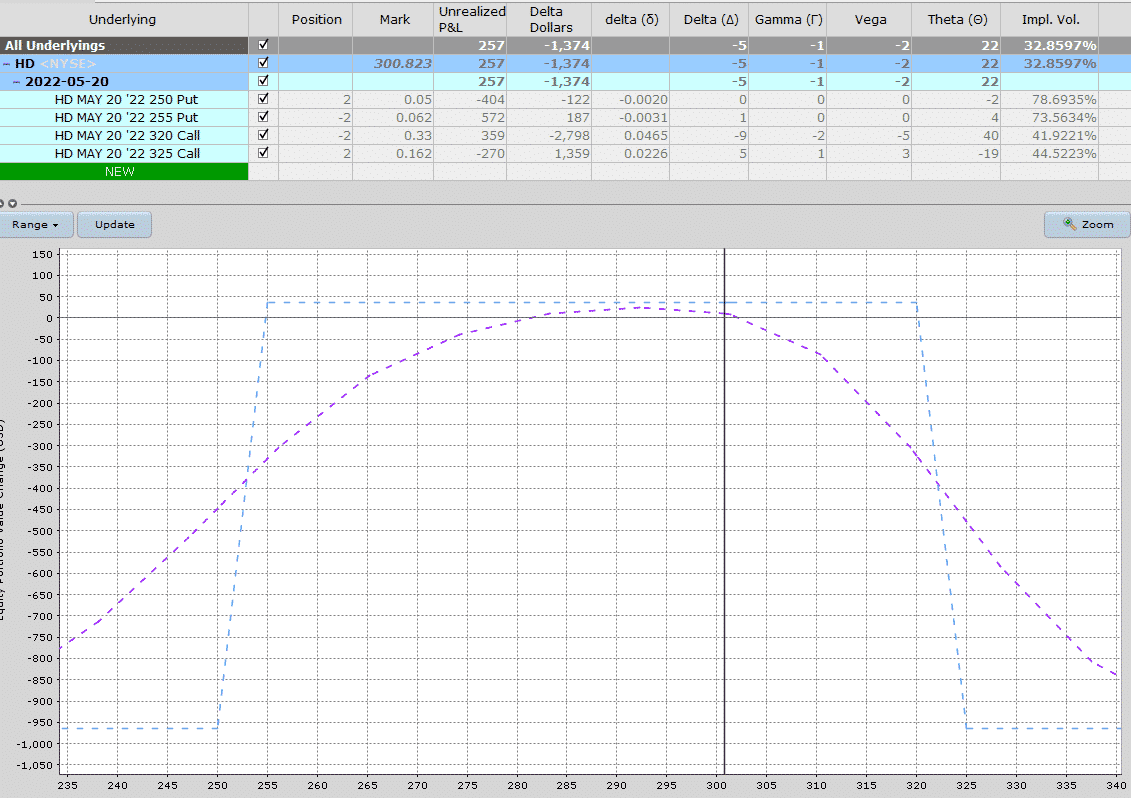

On May 17, 2022, after the earnings announcement, the condor was closed for a profit of $257:

Layering Adjustment

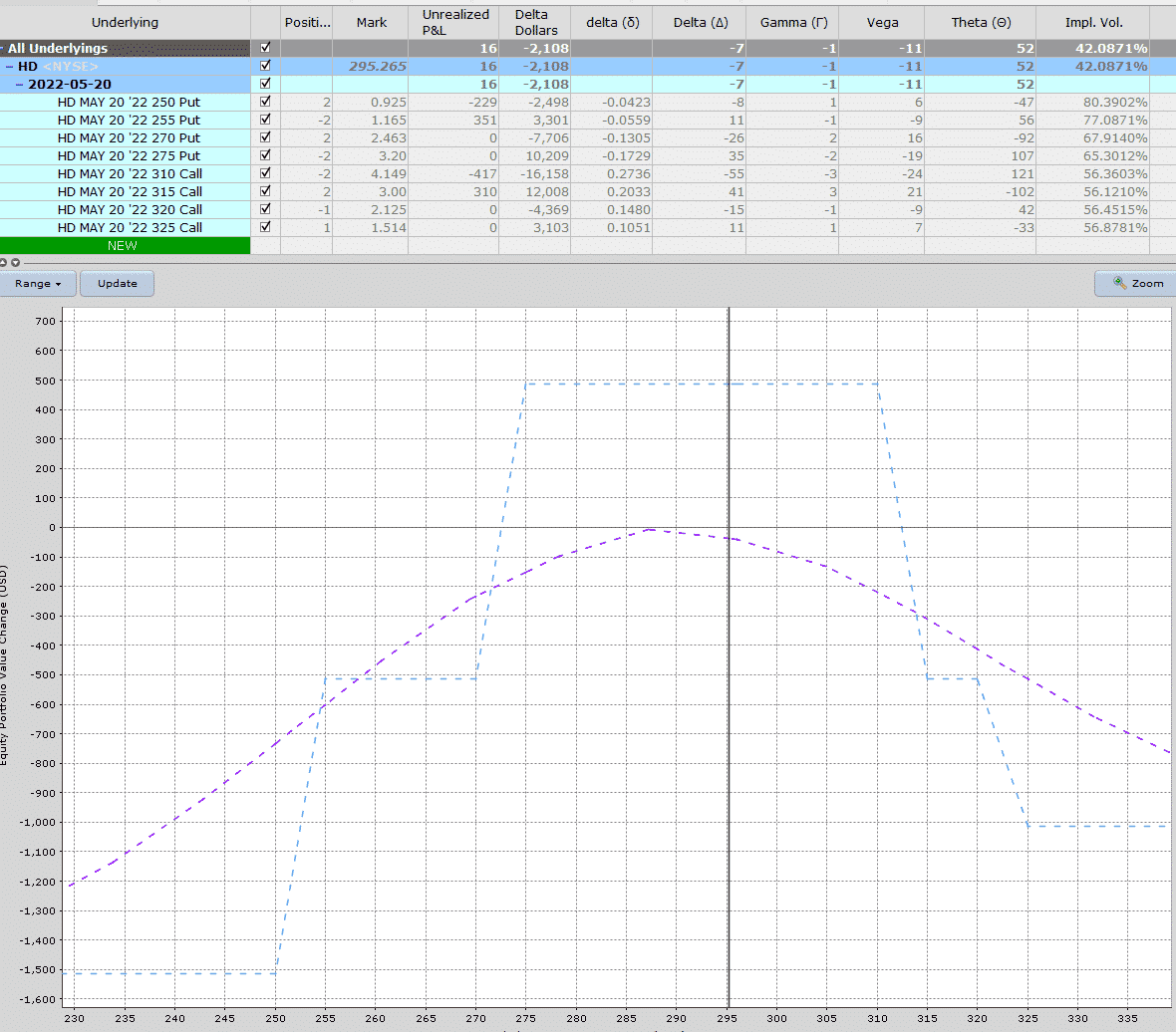

An alternative adjustment would have been to leave the existing condor as-is and add another condor on top.

This adjustment is a technique sometimes referred to as layering.

Here is what the new graph would look like after the adjustment:

The new condor has short strikes around the 15-delta.

Buy two May 20 HD $270 puts

Sell two May 20 HD $275 puts

Sell one May 20 HD $320 calls

Buy one May 20 HD $325 cals

Note that we have fewer calls than puts.

This structure keeps our delta from becoming too negative.

The adjustment reduced our delta from -11 to -7.

Because we have more condors, it increases are theta from 28 to 52.

It also doubles our capital at risk to $1500.

We hope you learned something from this example of layering iron condors, and if you have any questions, please send us an email or post a comment below.

Trade safe!

Disclaimer: The information above is for educational purposes only and should not be treated as investment advice. The strategy presented would not be suitable for investors who are not familiar with exchange traded options. Any readers interested in this strategy should do their own research and seek advice from a licensed financial adviser.

Original source: https://optionstradingiq.com/layering-iron-condors/