Vertical spreads are the building blocks for more complex option strategies. It is good to have a strong foundation in them.

They come in two flavors: the credit spread and the debit spread.

The two have completely different characteristics, so try not to confuse the two.

Contents

-

-

-

- Making Profits

- Rolling Up The Call Debit Spread

- Making It A No-Risk Trade

- Conclusion

-

-

Today, we are solely talking about the debit spread using Walmart (WMT), the world’s largest retailer, as an example.

Because debit spreads profit by getting the stock direction correct, let’s draw a simple 20-day moving average (green line) and the 50-day moving average (blue line) on a chart:

The stock is in an uptrend, with the 50-day moving average sloping up.

On January 23, 2025, the stock and the 20-day moving average are pulling back to the 50-day average.

Expecting the stock to continue to move up, the investor decides to initiate a bull call debit spread to capture profits if the stock moves up.

Date: January 23, 205

Price: WMT @ $92.40

Buy one March 7 WMT $90 call @ $4.67

Sell one March 7 WMT $95 call @ $2.20

Debit: -$247

The investor is bullish and buys a call option with a strike price of $90.

This one-option contract allows the investor to buy 100 shares of Walmart at $90 per share (before expiration).

The price for this option is quoted as costing $4.67 for the rights of each share.

Since one contract allows the rights on 100 shares, the one contract costs $467.

This contract expresses the investor’s bullish view.

He also sells the $95 call to collect $220, reducing the net cost of the call debit spread to $247.

Using a spread instead of a single option decreases the loss from time decay and decreases the effect of changes in implied volatility.

For the more advanced reader, the theta of the spread is 0.08, and the vega is -0.3.

But let’s not complicate ourselves with the option Greeks right now.

More importantly, the debit spread reduces the maximum risk in the trade.

The maximum risk in the trade is the net debit paid for the spread, which is $247.

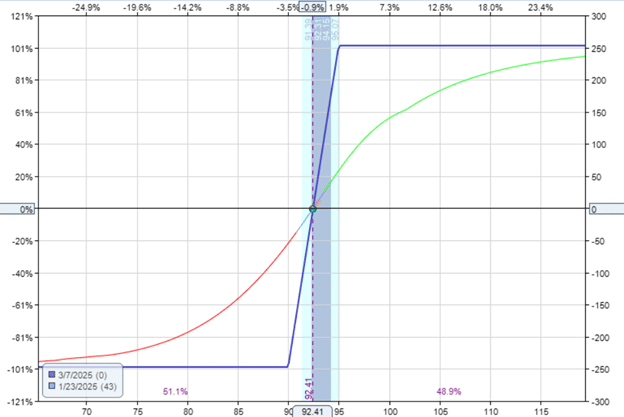

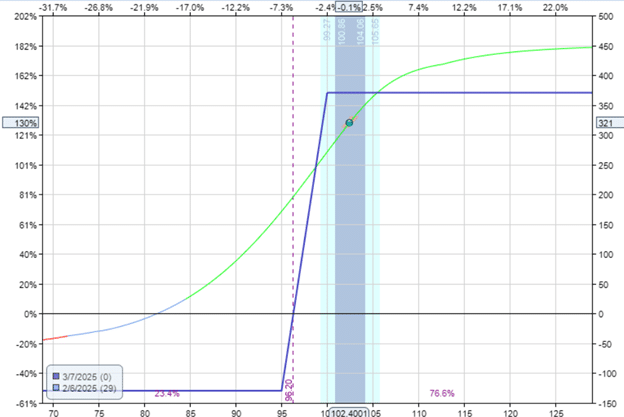

Looking at the P&L risk graph with the dollar profits on the vertical axis on the right, we see that if WMT moves above $95 on the horizontal price axis, the spread’s maximum profit is $250 (at expiration).

If WMT is below $90 at expiration, the max loss on the spread is -$250.

This is a one-to-one risk-to-reward setup. We are risking $250 to make $250.

Making Profits

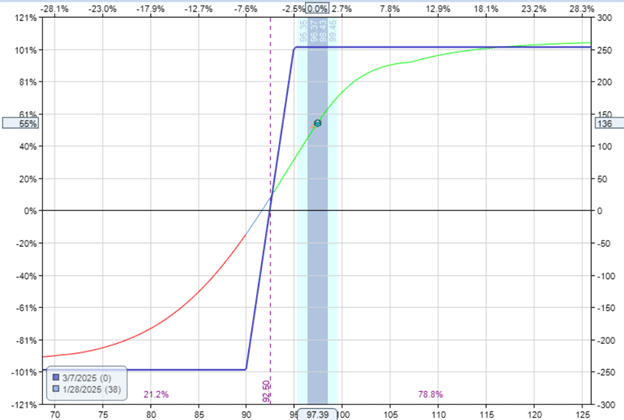

On January 28, the stock moved up, and the spread had a profit of $136:

The investor could take profit by closing the spread.

Date: January 28, 2025

Price: WMT @ $97.39

Sell to close one March 7 WMT $90 call @ $8.63

Buy to close one March 7 WMT $95 call @ $4.80

Credit: $383

Paying $247 at the start of the trade and now receiving $383 gives $136 of profit.

Rolling Up The Call Debit Spread

The trade could have ended there.

Instead, the investor is still bullish and opens a new call debit spread at higher strikes.

Date: January 28, 2025

Price: WMT @ $97.39

Buy to open one March 7 WMT 95 call @ $4.80

Sell to open one March 7 WMT 100 call @ $2.15

Debit: -$265

By performing this order in the same trading session, he considers this an adjustment of an existing trade instead of a new trade.

This adjustment is known as “rolling up the debit spread.”

The effect is a new P&L graph as follows:

Note the difference in this new graph.

The max loss in the trade had decreased to $125.

Making It A No-Risk Trade

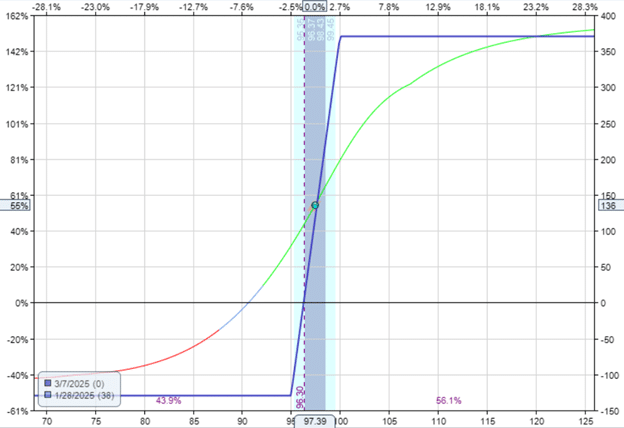

On February 6, WMT continued to go up to $102.40, and the spread continued to make money.

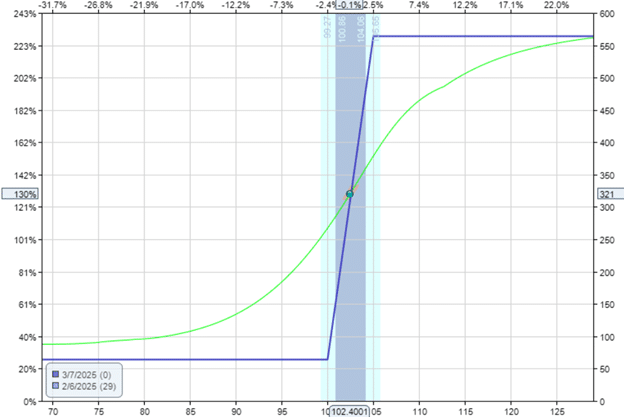

The overall trade profit is now $321.

The P&L graph shows that this spread has a little more profit potential, with the max profit capped at $360.

The investor rolls the spread up again.

Date: February 6, 2025

Price: WMT @ $102.40

Sell to close March 7 WMT $95 call @ $9.50

Buy to close March 7 WMT $100 call @ $5.00

Credit: $450

Buy to open March 7 WMT $100 call @ $5.00

Sell to open March 7 WMT $105 call @ $2.44

Debit: -$257

Net credit for the roll: $193

Look what happened to the risk graph after this roll:

It is completely above the zero-profit horizontal.

Even in the worst-case scenario where the world’s largest retailer goes bankrupt, this trade that started on January 23 would at least make $60.

Conclusion

Debit vertical spreads are a directional play.

As long as you get the direction correct, you will be rewarded.

Techniques like rolling the spread can help manage risk and lock in profits (sometimes to the point of making the trade risk-free).

The debit spread is also good for directional traders with small accounts.

In our example, the trader never risked more than $250 and does not have any large margin requirements.

Yet this trade was able to make $320 in two weeks (if the trader gets the direction correct).

If the trader gets the direction wrong, the debit spread has a cap on the loss.

This enables the trader to hold the position to see if the stock turns around and gets out at breakeven.

The spread can even be rolled out in time if necessary.

We hope you enjoyed this article on locking profits with the debit spread.

If you have any questions, please send an email or leave a comment below.

Trade safe!

Disclaimer: The information above is for educational purposes only and should not be treated as investment advice. The strategy presented would not be suitable for investors who are not familiar with exchange traded options. Any readers interested in this strategy should do their own research and seek advice from a licensed financial adviser.

Original source: https://optionstradingiq.com/locking-in-profits-with-the-debit-spread/