Despite spiking yesterday, market volatility is hovering around the lowest levels we have seen for the last six month as measured by the VIX index.

The next VIX spike could be just around the corner, so today I thought we would look at some large cap stocks with low implied volatility percentile.

Implied volatility percentile is one of the most common metrics used when trading options.

IV Percentile is a measure of implied volatility where current implied volatility is compared to the range of implied volatilities in this past.

This comparison is made on the same stock.

For example, Apple’s IV percentile takes the current implied volatility and compares it to the past implied volatility levels Apple has had.

This is then made into a percentage ranging from 0-100%.

A percentage of zero would depict a stock is currently at the lowest level of implied volatility it has been during the lookback period.

In contrast, an IV percentile of 100% illustrates that the stock is trading at its highest level of implied volatility.

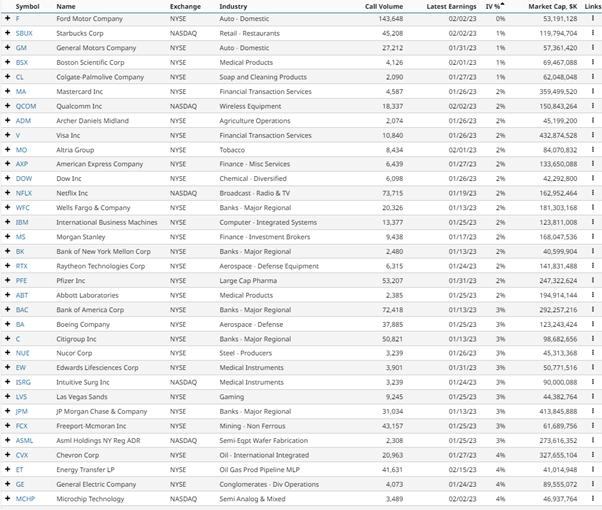

Here we have the latest screener results from Barchart sorted by IV Percentile.

How To Use IV Percentile

As a general rule, when implied volatility percentile is low, it’s better to focus on long volatility trades such as debit spreads, long straddles and long strangles.

It also makes sense to compare a stock’s current IV Percentile to the market in general.

If all stocks are showing low IV Percentile, then there might not be much of an edge in buying volatility on a specific stock.

But, if general market IV percentile is high, that could be a good time to buy cheap volatility in some of the names above.

It’s also a good idea to keep an eye on the upcoming earnings dates as stock can make big moves following earnings announcements.

Stocks With High Implied Volatility

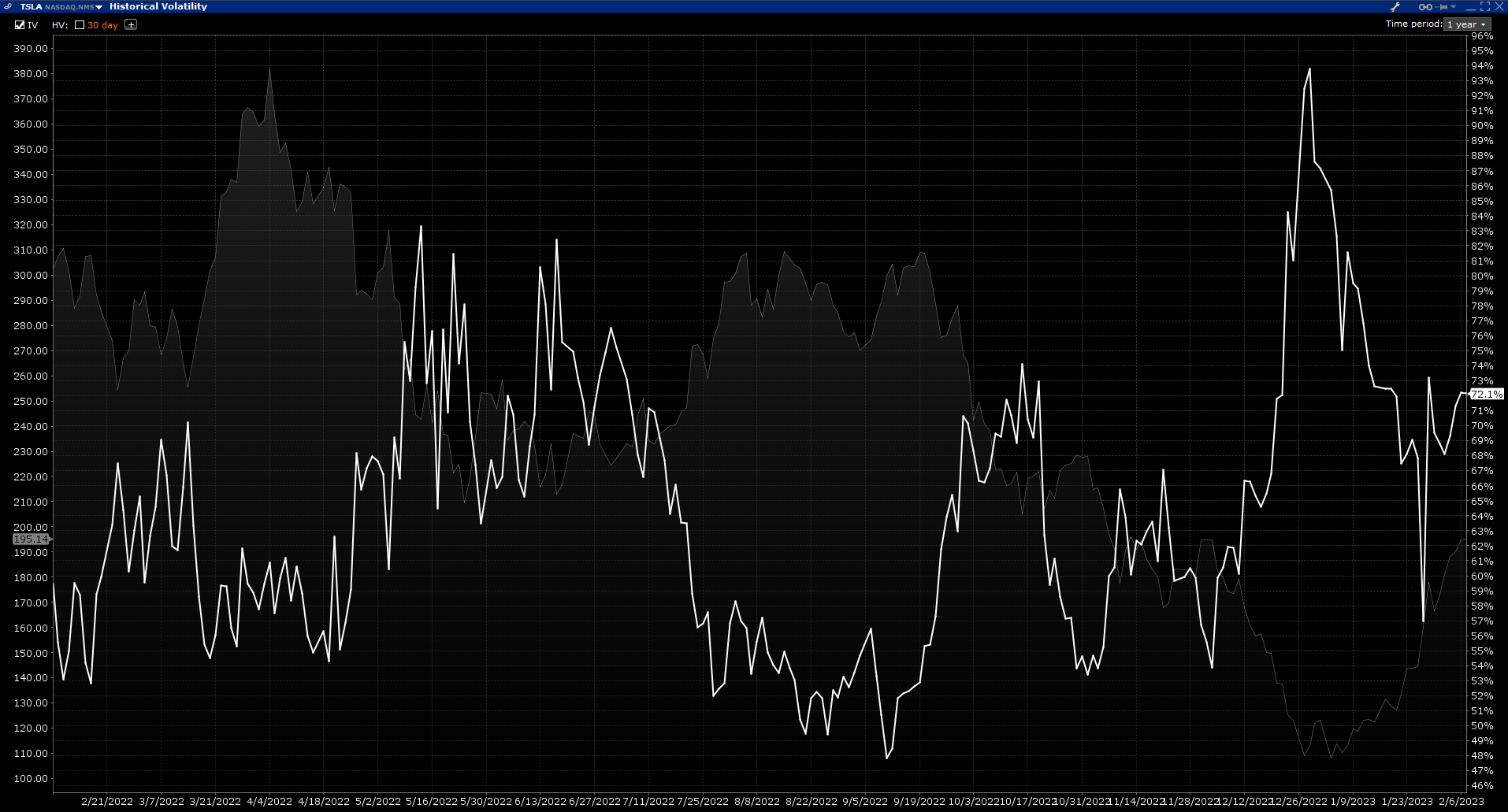

There are only three stocks currently showing an IV Percentile above 70%. Of those, only TSLA has reported earnings already.

Here we can see the IV chart for TSLA for the last twelve months. Not the highest level of IV we have seen, but certainly not the lowest either.

That could mean it’s a good time for an iron condor trade on TSLA.

Trade safe!

Disclaimer: The information above is for educational purposes only and should not be treated as investment advice. The strategy presented would not be suitable for investors who are not familiar with exchange traded options. Any readers interested in this strategy should do their own research and seek advice from a licensed financial adviser.

Original source: https://optionstradingiq.com/low-iv-stocks/