Taking the stress out of trading iron condors is taking longer DTE (days to expiration) trades.

The longer DTE makes the trade less sensitive to price movement.

Significant price moves are what cause stress in the trade.

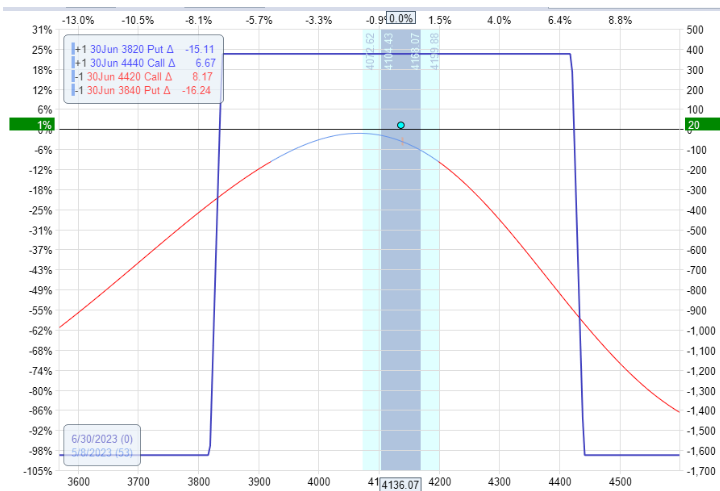

Here is an example of an iron condor with 53 days to expiration.

Date: May 5, 2023

Price: SPX @ 4136

Buy 1 June 30 SPX 4440 call @ $5.00

Sell 1 June 30 SPX 4420 call @ $6.35

Sell 1 June 30 SPX 3840 put @ $31.75

Buy 1 June 30 SPX 3820 put @ $29.55

Net credit: $375

Delta: -1.10

Theta: 8.38

Vega: -61

Theta/Delta = 7.6

The short put started at around 16 delta.

The short call started at around ten delta.

Both wings are 20 points wide.

One needs to monitor the trade daily and adjust if either the short strike of the put or the call hits 22 delta.

This did not happen, so there was no adjustment at all on this iron condor.

Or at least that did not happen during the time that the trade was checked once each day.

With such a long DTE, checking it more than once a day is unnecessary.

In fact, checking more might result in over-adjusting.

If you study Amy Meissner’s A14 trading style, she limits adjustments to once a day.

John Locke’s strategies have a specific checkpoint time when to check the trade.

Profit Target Reached

While not every strategy will have a specific profit target, most iron condor traders will have a profit target because they don’t like to hold iron condors to expiration.

A typical profit target could be to exit if profits exceed 50% of the credit received within the first half of the trade duration.

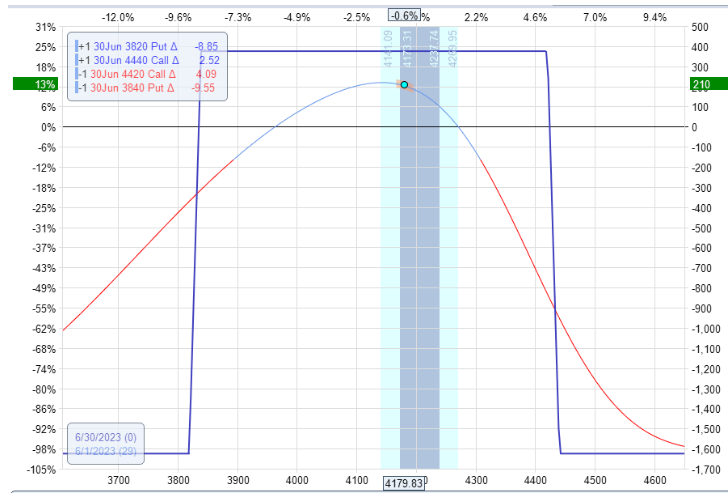

On May 31, 2023, the trade reached a profit target of $187.50, which is 50% of the initial credit received.

Here is how it looked at the end of the day:

The trade still has 29 days till expiration.

If it had reached 21 days to expiration without reaching the profit target, we would have exited the trade anyways with whatever profit we had.

This is known as a timed exit.

The P&L is $210 at a 12.9% return on margin after 24 days in the trade.

This P&L is considered a very good return, especially when we did not have to make any adjustments and were not stressed.

We hope you enjoyed this no stress iron condor example.

If you have any questions, please send an email or leave a comment below.

Trade safe!

Disclaimer: The information above is for educational purposes only and should not be treated as investment advice. The strategy presented would not be suitable for investors who are not familiar with exchange traded options. Any readers interested in this strategy should do their own research and seek advice from a licensed financial adviser.

Original source: https://optionstradingiq.com/no-stress-iron-condor/