Contents

- Tricky Spot

- Time to Close Trade

Today we will look at an iron condor on OIH. OIH is the VanEck Oil Services ETF — not to be confused with OHI, which is “Omega Healthcare investors.”

It is called an “iron condor” because one side uses a put spread and the other side of the condor uses a call spread.

In addition, it is a “balanced” iron condor.

These are when the width of the put spread is the same as the width of the call spread.

And in addition, both the put spread and the call spread have the same number of contracts.

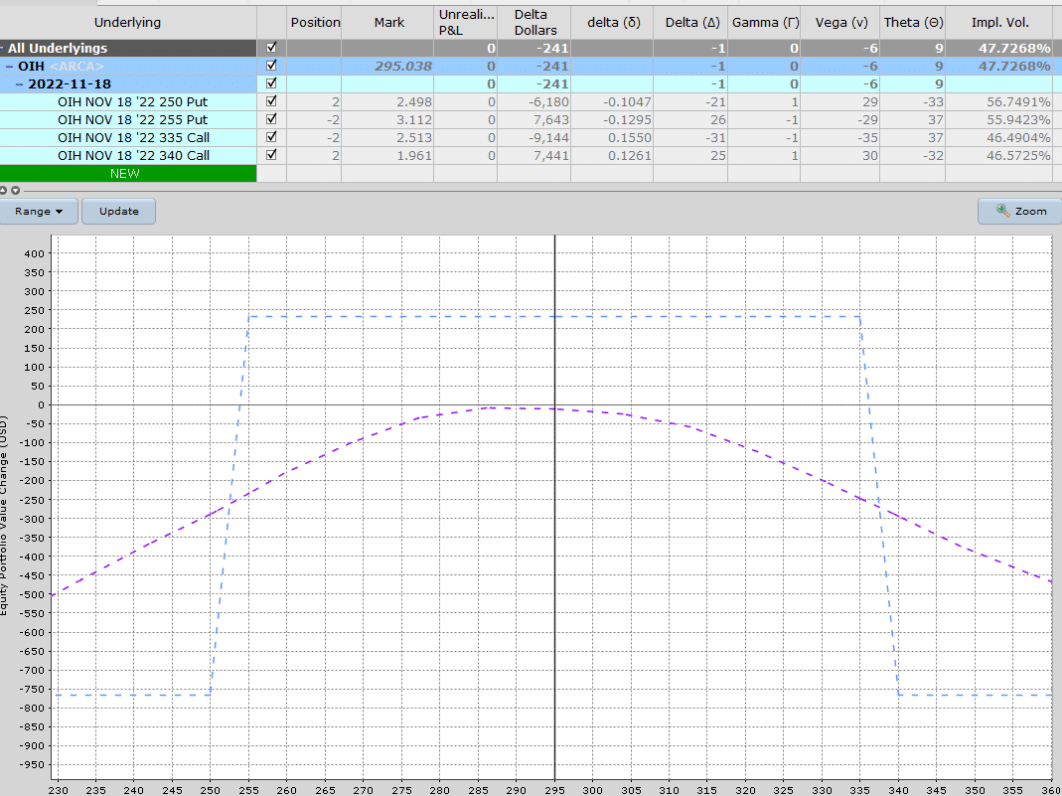

We will use two contracts as follows:

Date: October 26, 2022

Price: OIH @ $295

Buy two November 18 OIH $250 put @ $2.50

Sell two November 18 OIH $255 put @ $3.11

Sell two November 18 OIH $335 call @ $2.51

Buy two November 18 OIH $340 call @ $1.96

Net credit: $233.20

The max reward on this trade is the credit received.

The max risk is when either of the spread is completely breached, which would result in a $1000 loss in the spread.

We arrived at one thousand dollars because the spread is $5 wide, multiple by 100, and we have two contracts.

The $233 credit reduces the maximum loss.

So, our true max potential loss on this trade would be $767.

You can confirm that this is the case by looking at the max reward and max risk of the payoff graph here:

Tricky Spot

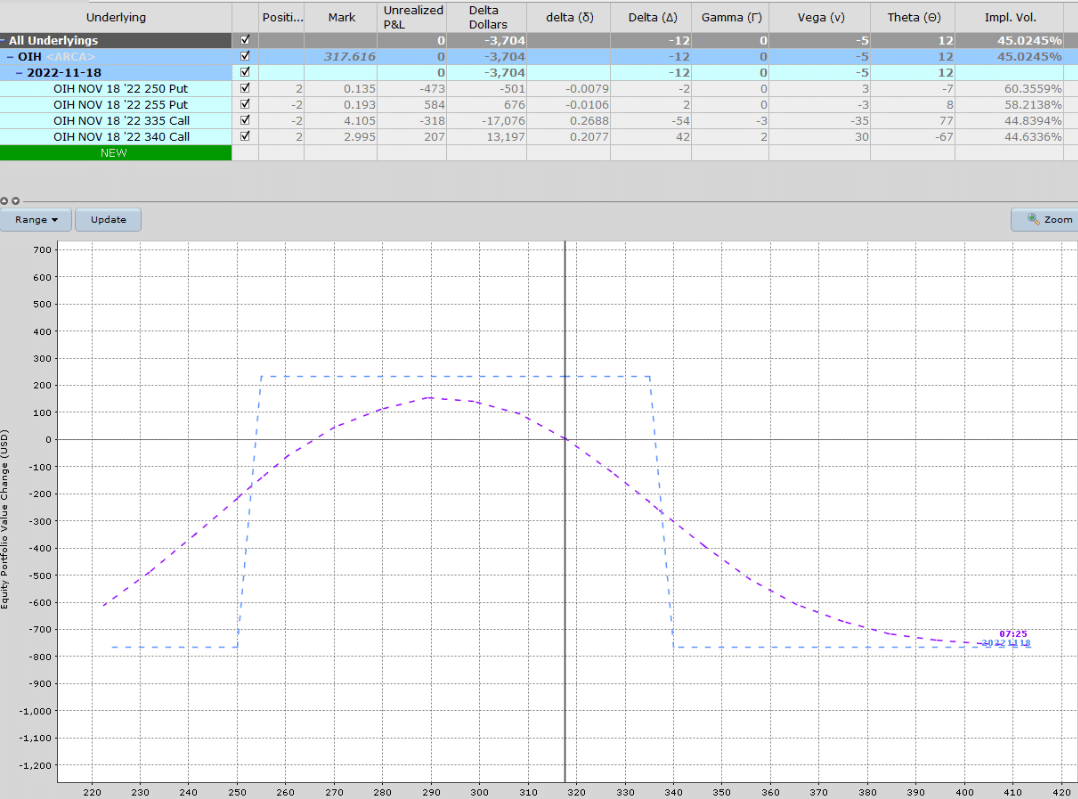

Two weeks later, on November 7, 2022, with only 11 days till expiration, the payoff graph looks like this:

Delta Dollars is way bigger than capital at risk. P&L is flat, at least thanks to time decay.

See that the price at $317.62 is approaching the call spread.

The short call hass passed the 25 delta, which means action needs to be taken.

At the very least, the calls need to be rolled out.

In addition, we can buy some stock (ETF in this case) to provide some additional delta hedge if the price continues to go up.

Another idea would be to roll out in time two weeks as well.

Lots of choices to think about. Ultimately, we roll the call spread up and buy two shares of OIH as follows.

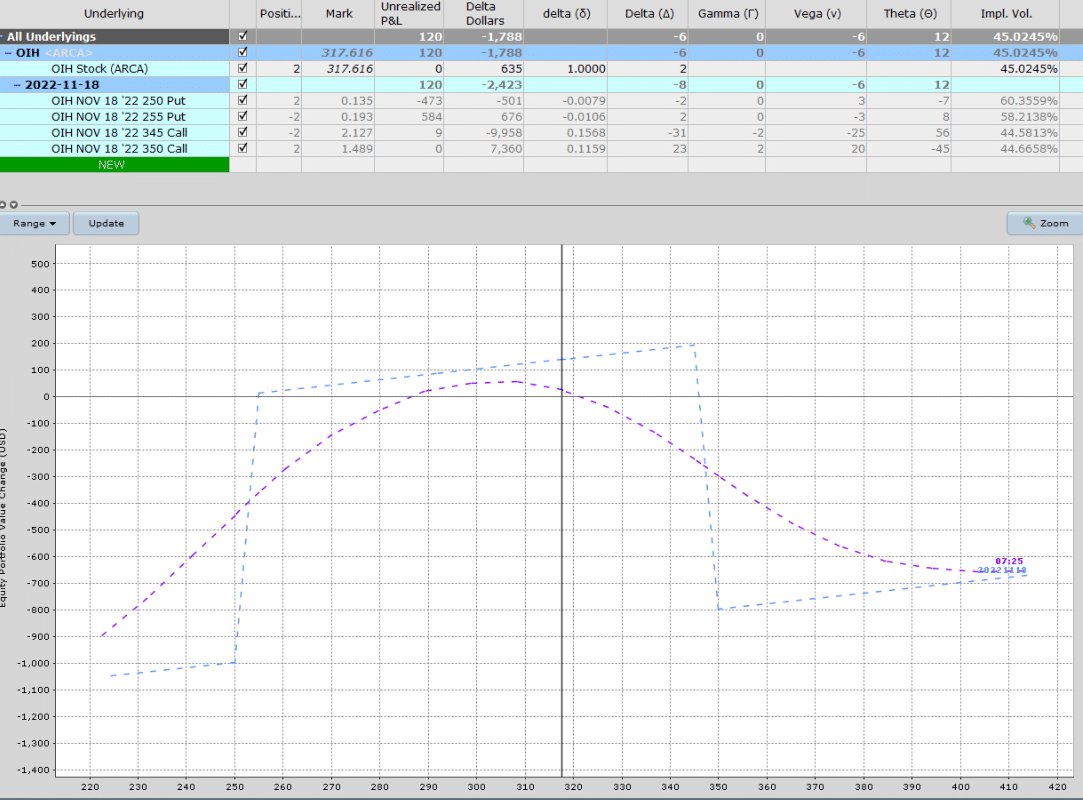

Date: November 7, 2022

Price: OIH @ $317.62

Buy to close two November 18 OIH $335 call @ $4.11

Sell to close two November 18 OIH $340 call @ $3.00

Sell to open two November 18 OIH $345 call @ $2.13

Buy to open two November 18 OIH $350 call @ $1.49

Debit to roll call spread: –$94.40

Debit to buy two shares of OIH: –$635.23

The resulting graph looks like a skewed iron condor:

Time to Close Trade

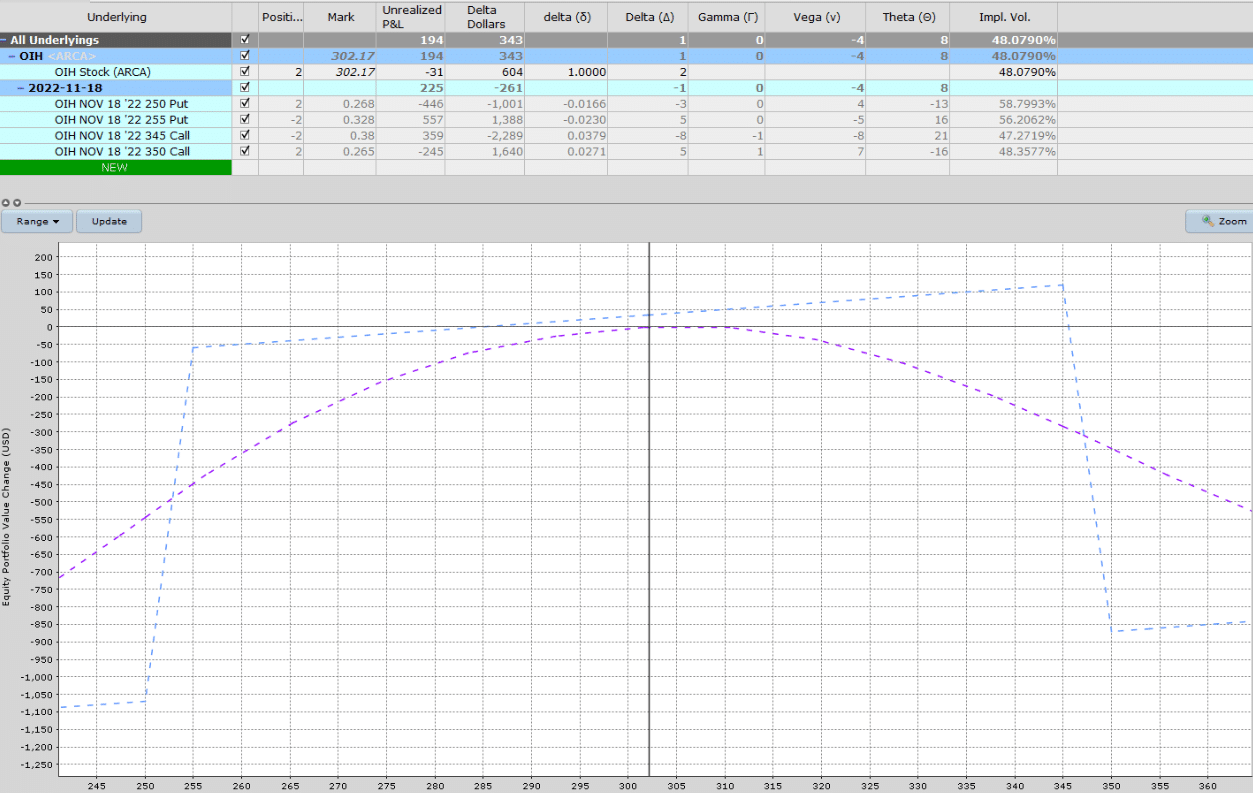

Two days later, on November 9, with only nine days left to expiration.

We can close the entire trade for a profit as follows.

Date: November 9

Price: OIH @ $302.17

Sell to close two November 18 OIH $250 put @ $0.268

Buy to close two November 18 OIH $255 put @ $0.328

Buy to close two November 18 OIH $345 put @ $0.38

Sell to close two November 18 OIH $350 put @ $0.265

Debit to close condor: –$35

Sell two OIH shares: $604.34

Tabulating our credits and debits to determine the P&L:

Initial credit Received: $233.20 Debit to roll call spread up: –$94.40 Buy two shares: –$635.23 Close condor: –$35.00 Sell two shares: $604.34

Net P&L: $73

The delta hedge of buying two shares lost $31, but it allowed us to stay in the trade and let the condor do its thing.

Pretty easy trade, all in all.

We hope you enjoyed this OIH condor example.

If you have any questions, please send an email or leave a comment below.

Trade safe!

Disclaimer: The information above is for educational purposes only and should not be treated as investment advice. The strategy presented would not be suitable for investors who are not familiar with exchange traded options. Any readers interested in this strategy should do their own research and seek advice from a licensed financial adviser.

Original source: https://optionstradingiq.com/oih-condor/