Option greek are incredibly important when it comes to trading options. If you think you can trade option with knowing the greeks, then you are sorely mistaken or have ben mis-informed.

The main option greeks are Delta, Gamma, Vega and Theta. There is Rho as well, but that one is less important and can pretty much be ignored.

Bookmark this page and refer back to it whenever you need, because this contains all the information you will need when it comes to option greeks.

Contents

-

- Delta

- Gamma

- Vega

- Theta

- Rho

Option Greeks are risk assessment metrics commonly employed in the Options Market to analyze different types of risk related to such securities.

They are known as ‘The Greeks’ since each of the metrics is named after a particular Greek word.

There are five main Greeks and in this article, we will help you in understanding which kind of risk each of them measure.

If you’re a complete options beginner, you should check out my 15,000 word post on Options Trading 101.

Delta

Delta tracks the degree in which an option price changes in relation to the price of its underlying asset.

The calculation of Delta results in a range of 0 to 1 or -1 to 0 depending on the type of option (put or call) and it indicates the expected variation in the price of the option if the price of the underlying asset changes by 1%.

For example, a Delta of 0.3 indicates that if the price of the underlying asset increases by 1%, the price of the option will increase by 0.3%.

RELATED ARTICLES

Understanding Option Delta

How To Delta Hedge An Iron Condor

EWZ Short Straddle With Delta Hedging Pays Off Nicely

Delta Neutral Option Strategy – Short Straddle with Delta Hedging

Why Delta Dollars Will Change Your Option Trading Forever

How to Hedge Option Delta Using Futures

OIH Sold Puts With Delta Hedging

A Quick and Easy Way to Cut Your Exposure in Falling Markets

Best of Options Trading IQ

Gamma

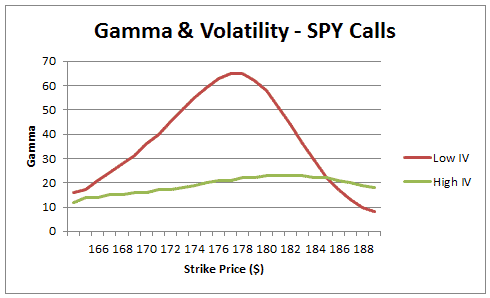

Gamma can be understood as a Delta-related calculation, as it measures the degree in which the Delta of a particular option will change if the price of the underlying asset varies by 1%.

It is, therefore, an estimation of how sensitive the Delta of the option is.

If Gamma is high, it means that the Delta of the option is highly volatile and therefore it can’t be relied on as a sound indicator of its potential behavior.

RELATED ARTICLES

Option Gamma Explained

Long Gamma and Short Gamma Explained

Scalping Gamma From Long Puts

TLT Gamma Scalp Example

Gamma Risk Explained

Vega

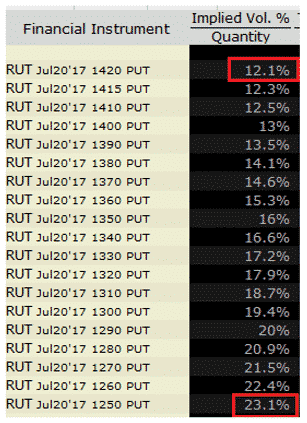

Vega measures the response of an option’s price to a change in the implied volatility of its underlying security.

The implied volatility is understood as the estimated potential variation of the price of a security.

In this context, Vega indicates the potential variation in the option’s price if the implied volatility varies by 1%.

For example, a Vega of 0.7 is saying that if the implied volatility of the underlying asset changes by 1% the price of the option will vary by 0.7%.

Therefore, a security that is becoming highly volatile will increase the premium paid on the option.

RELATED ARTICLE

The Complete Guide To Option Vega

Understanding Implied Volatility

Make Vega Your Friend

Long Strangle Option Strategy

Why Calendar Spreads Are An Oxymoron

How To Trade Volatility Using The VIX Index

Do Buyers of Options Benefit From High Volatility

Volatility Trader Makes Gigantic Bet for December

How To Trade Volatility – Chuck Norris Style!

Option Strategies For Low Volatility Environments

Theta Vega Ratio For Option Sellers

What Is Volatility Skew

Best Ways To Scan For Stocks With High Implied Volatility

What Is Vomma

Buying Pre-Earnings Straddles

3 Best Strategies For Trading Rising Volatility

Theta

Theta measures the change in the price of an option as time passes and the expiration date approaches.

Theta is commonly expressed in absolute values and an option could have a negative or positive Theta.

A negative Theta of say -0.30 indicates that each day that passes the option’s price will decrease by $0.30.

RELATED ARTICLES

The Complete Guide To Options Theta

Do Options Lose Value Over The Weekend?

The Ultimate Guide To The Bear Call Spread

Poor Man’s Covered Call

Rho

Rho measures the price sensitivity of the option in relation to a change in interest rates.

The higher the Rho the more sensitive it is to potential fluctuations in interest rates.

A positive Rho means that the option will behave in the same direction as the interest rate.

If rates increase the option’s price will increase, while a negative Rho indicates that the option’s price will behave in the opposite direction of interest rates.

A Rho of 0.04 means that a 1% increase in interest rates will add $0.04 to the price of the option.

Trade safe!

Disclaimer: The information above is for educational purposes only and should not be treated as investment advice. The strategy presented would not be suitable for investors who are not familiar with exchange traded options. Any readers interested in this strategy should do their own research and seek advice from a licensed financial adviser.

The post Blog first appeared on Options Trading IQ.

Original source: https://optionstradingiq.com/option-greek/