Today we’re looking at option strategies for bear markets.

We will look at which strategies are appropriate and how to trade them.

Let’s get started.

Contents

-

-

-

-

-

-

-

-

-

- Introduction

- What Is A Bear Market?

- Inverse ETFs

- Timing

- Long Puts

- Bear Put Spread

- Bear Call Spreads

- Broken Wing Butterfly

- Diagonals

- Cash As A Position

- Bearish Butterflies

- Bearish Calendars

- Delta Neutral Strategies

- Backspread

- FAQ

- Conclusion

-

-

-

-

-

-

-

-

Introduction

Unfortunately, bear markets are a fact of life.

That sucks if you’re a buy and hold investor, but thankfully, as option traders, we can survive and even profit during bear markets.

Bear market options strategies typically have negative delta, meaning they will profit from falling stock prices.

Panic selling that occurs during bear markets can also see implied volatility skyrocket.

As a result, traders must learn different strategies to protect their account and potentially profit during bear markets.

What Is A Bear Market?

A bear market is typically defined as a downturn of at least 20% in the major market indexes such as the Dow Jones Industrial Average or the S&P 500.

On average, bear markets occur roughly every three and a half years and last around nine months.

There have been 26 bear markets in the US since 1928, but they have been less frequent since World War II.

Inverse ETFs

For non-option traders, there is still a possibility of making money in bear markets.

In a bull market, we “buy the dip.” In a bear market, we “sell the rip.”

In other words, we sell stocks and indices when they rally.

Known as “shorting,” we can sell shares even if we don’t own them, provided that your account has the necessary privilege level.

While you cannot sell shares of indices such as SPX (S&P500 index) or RUT (Russell 2000 index), you can short the ETFs that track them, such as SPY and IWM, respectively.

For accounts that do not allow shorting or investors who do not like selling assets they don’t own, investors can buy the inverse ETFs instead.

One of the inverse ETFs for the S&P500 is SH (remember “SH” for “short”).

The inverse ETF for the Russell is RWM.

The inverse ETF for the Dow Jones index is DOG.

The inverse ETF of Nasdaq is PSQ.

Timing

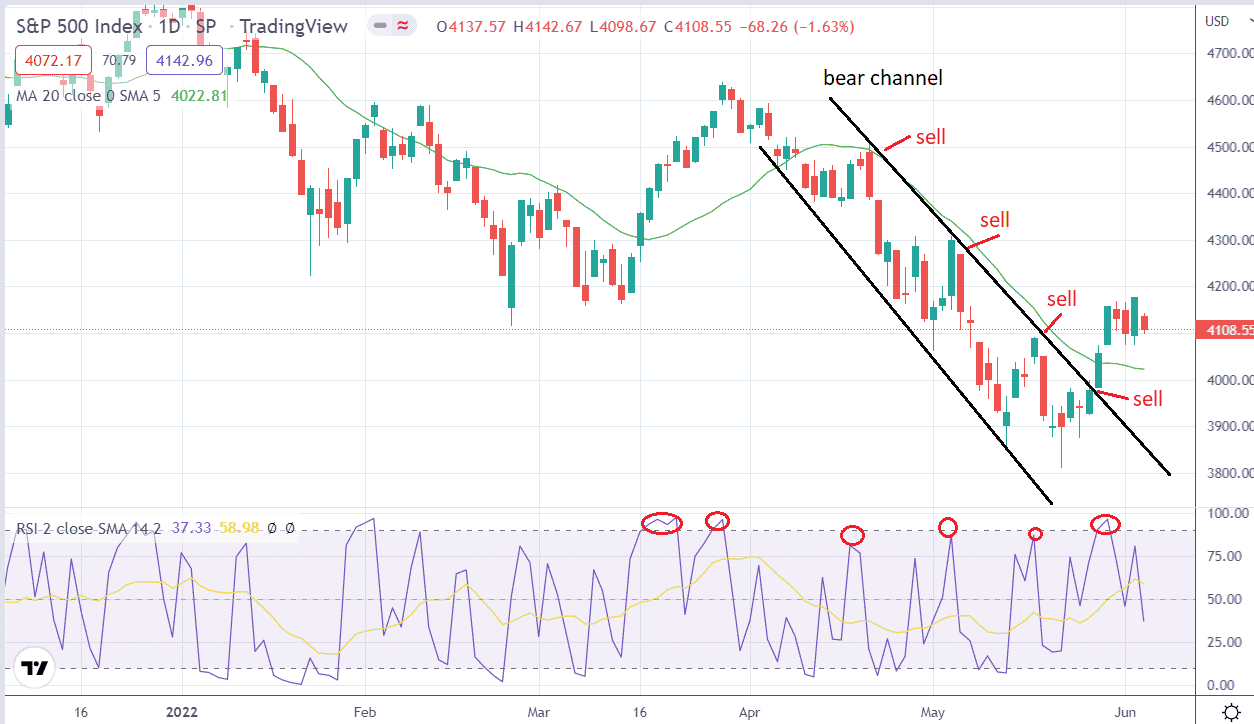

Instead of randomly shorting, traders will pick the right time to get in.

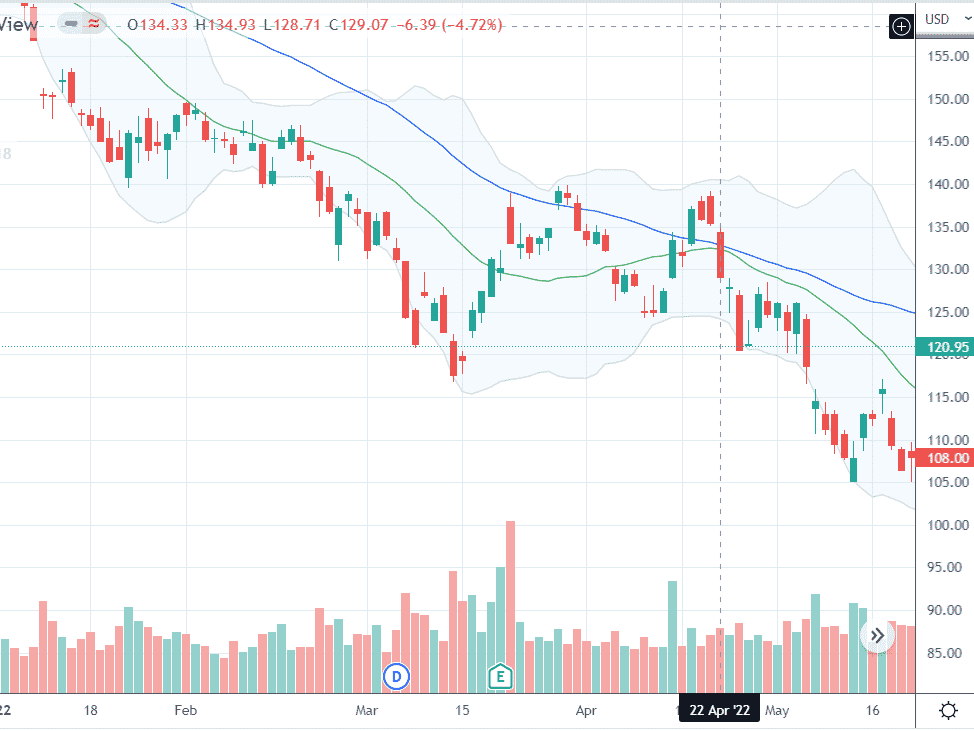

Here is the chart of SPX with the 20-day moving average plotted and the 2-period RSI plotted below.

Some traders wait for the price to come back up near a moving average.

Others may draw a bear channel and sell when the price returns to the channel’s top.

Others may use various indicators that tell them to sell when prices are overbought and ready to resume the bearish trend.

Some traders like to get in early in the down move to capture more profits.

Others want to get in later and wait for confirmation.

As you can see, not all signals work.

The last sell signal didn’t get a confirmation.

But if a trader sold early, the trader would have been caught in a “bear trap” and a “short squeeze rally” that took prices out of the bear channel on May 26, 2022.

Since we had such a long bull run, many traders have been accustomed to buying pullbacks.

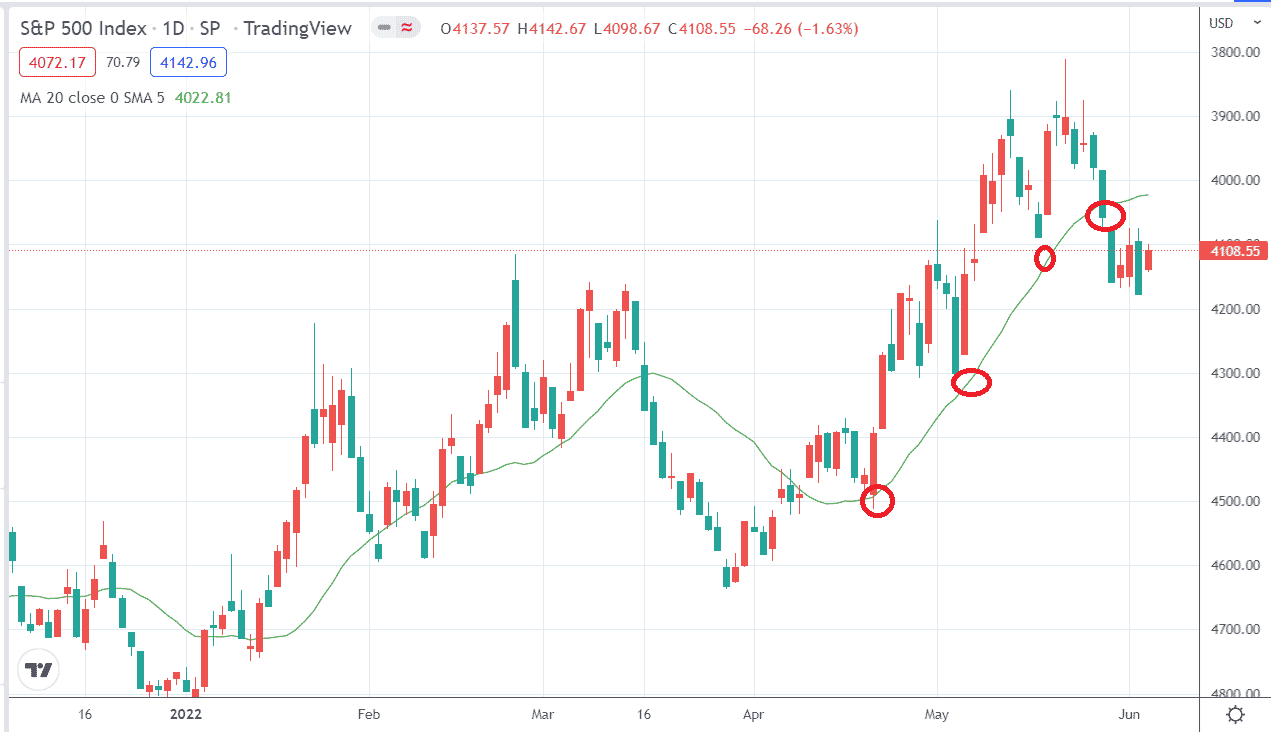

Many charting platforms let you flip the chart upside down.

Here is tradingview.com with Alt-i to display the chart inverted.

Where the trader would have bought the pullback (circled in red above), the trader could sell the rally.

On ThinkOrSwim, putting a negative sign in front of the ticker symbol would invert the chart.

I wouldn’t recommend doing trading on an inverted chart.

It’s just a fun fact.

Long Puts

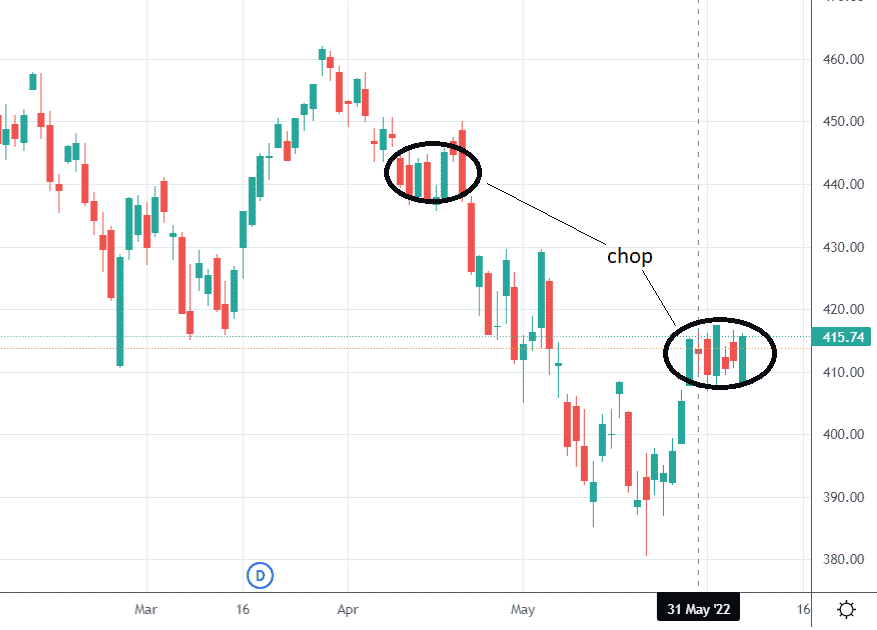

Another strategy that has negative theta is the single long put option.

If the trader is going to use this strategy to take advantage of the downward price movement of the underlying, the trader needs to time their entries.

If they buy a put option on SPY and the market chops around like this, they could be losing –$19 a day as measured by theta.

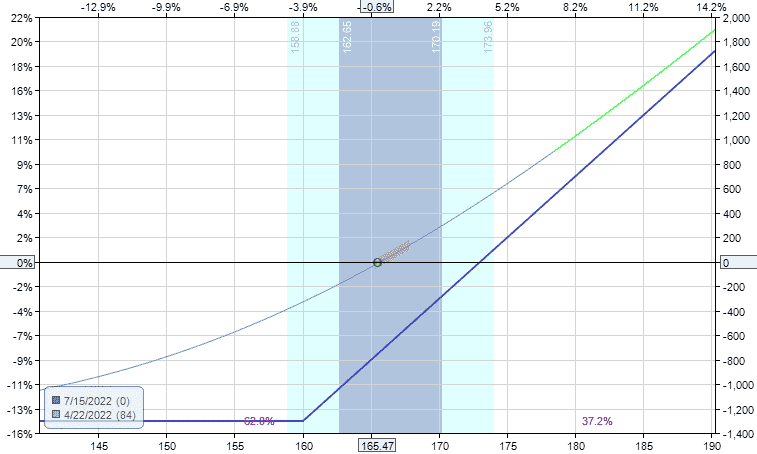

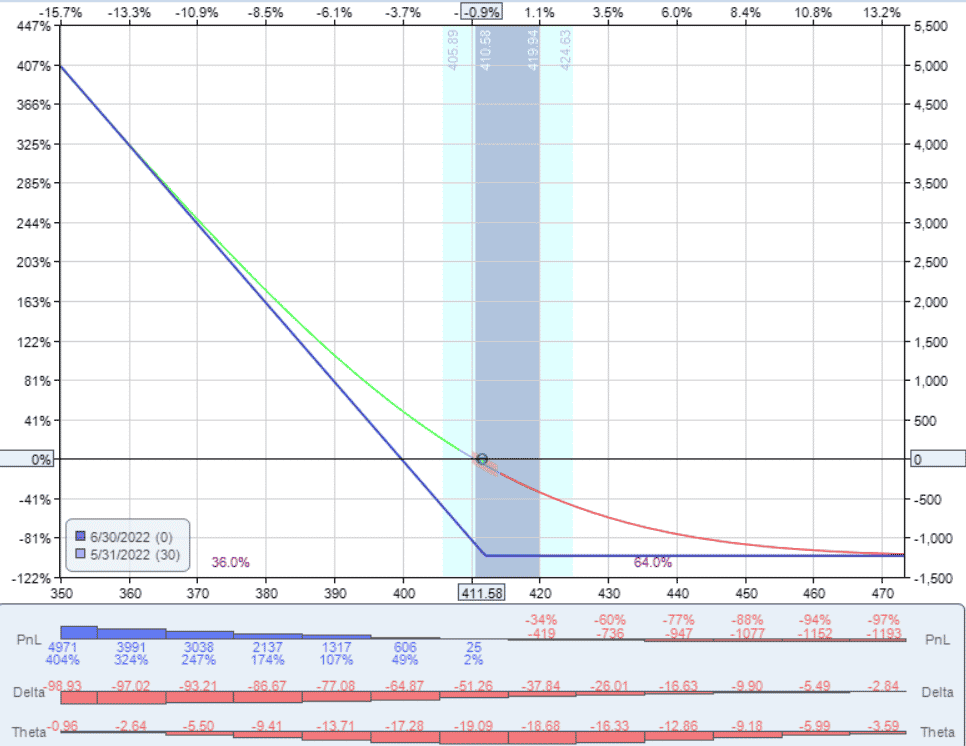

For example, suppose a trader made this purchase:

Date: May 31, 2022

Price: SPY @ $411.58

Buy one June 30 SPY $412 put @ $12.30

On June 6th, the position is down –$233, with SPY at $413.23.

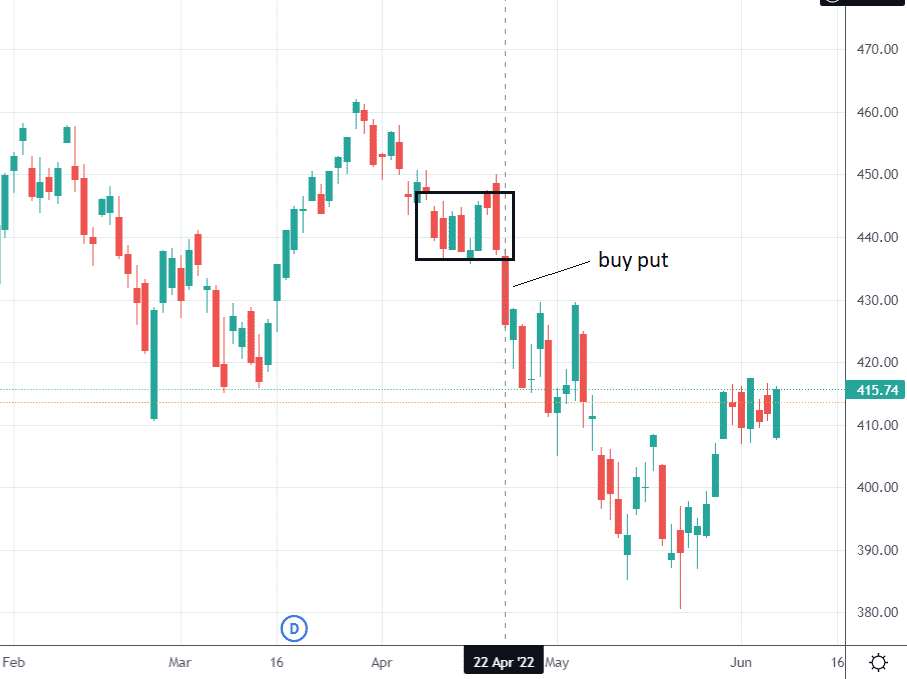

Ideally, the trader would buy a put option when SPY decidedly breaks out of the boxed range on the downside, like on April 22nd:

Date: Apr 22, 2022

Price: SPY @ $432.23

Buy one May 20 SPY $432 put @ $10.32

It too has -19 theta.

But the Greek delta is much more dominant than theta.

So, on the next trading day, when SPY makes a big move down to a price level of $420, the put is in profit of $699.

Put options are also good for protecting the stocks of longer-term investors.

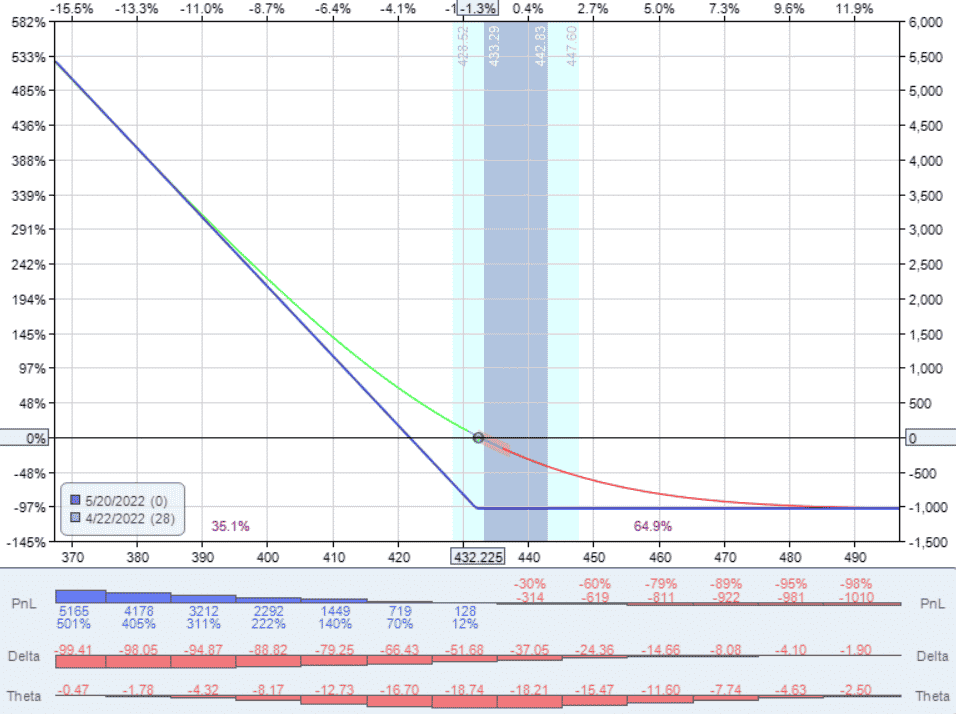

Investors who own stock have downside exposure in a bear market, as seen on this payoff graph of 100 shares of Apple.

But if they buy the $160 put, that is 84 days to expiration.

Date: Apr 22, 2022

100 shares of AAPL @ $165.47

One Jul 15 AAPL put $160 option @ $7.55

It caps their loss on the position and changes their payoff graph to this.

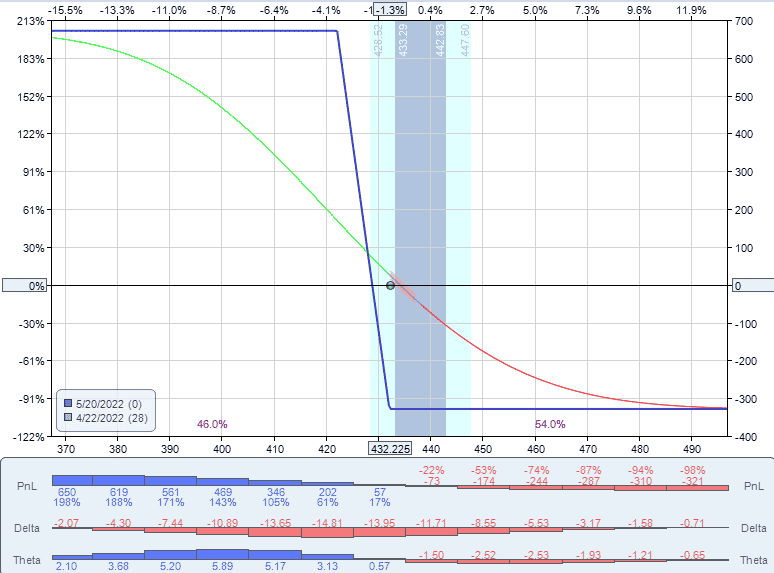

Bear Put Spread

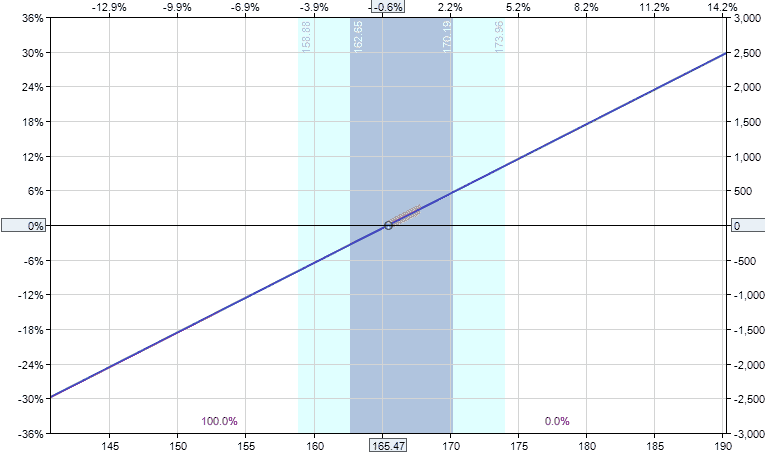

For shorter-term traders, they may consider the bear put spread.

It is like buying a put option, but with an additional short put to help finance it.

For example:

Date: Apr 22, 2022

Price: SPY @ $432.23

Buy one May 20 SPY $432 put @ $10.32

Sell one May 20 SPY $422 put @ $7.03

Net Debit: –$329

It has the effect of capping the loss in the trade.

The maximum the trader can lose is the debit paid ($329).

It also caps the profit that can be made (in this case is $671).

Having both a long and a short option negates the effect of theta.

Unlike that put option alone, this spread has a theta of near zero at the start of the trade.

The tradeoff is that it has lower delta, which means that the trader will not make as much money if they get the direction correct.

However, they can still make decent money.

On the next trading day, when SPY makes a big move down to a price level of $420, the put spread is in profit of $154, which is a 47% return on the capital at risk.

Bear Call Spreads

As options investors, we instead go short by using bearish options strategies.

We can buy and sell options on the indices even though you can not buy and sell their shares.

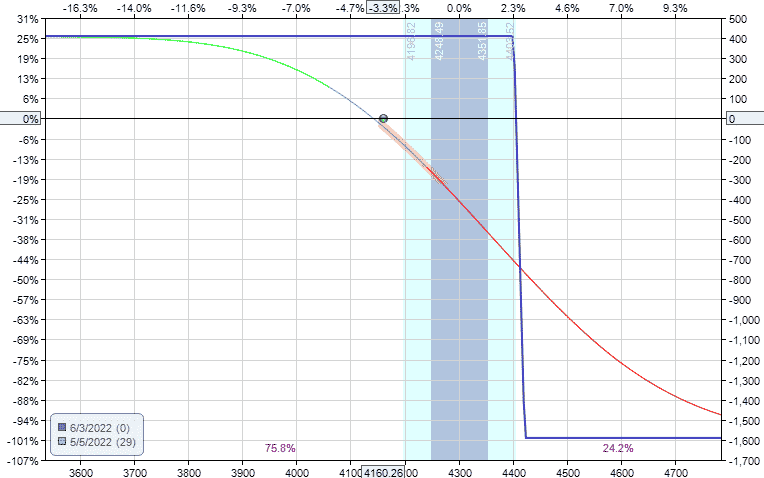

The first strategy for most investors is the bear call credit spread.

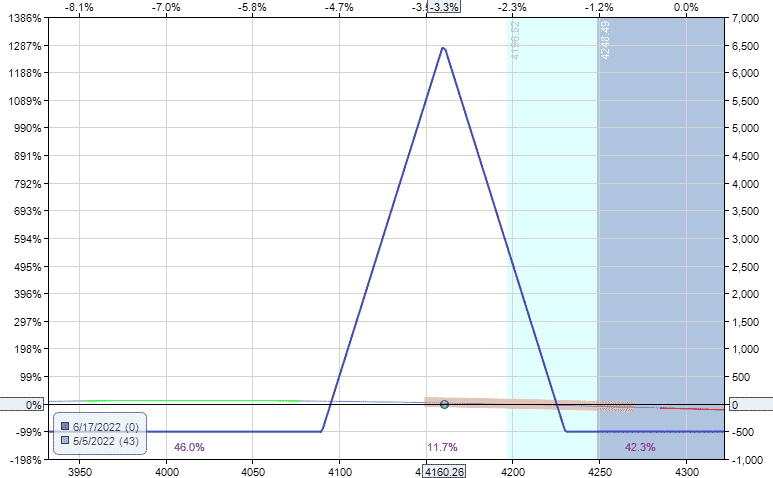

Here is an example of shorting the SPX on May 5th with a bear call spread.

Date: May 5, 2022

Price: SPX @ $4160.26

Sell one Jun 3 SPX 4400 call

Buy one Jun 3 SPX 4420 call

Credit: $410

Delta: -2.23

Theta: 11.08

Vega: -23.65

Looking at the Greeks, we see it is bearish with a negative delta.

It has positive theta with time on our side.

And it benefits if volatility drops.

Volatility tends to go up as price goes down.

This would not be of benefit to the bear call spread.

However, the benefit of the price movement outweighs vega’s effect.

On May 9th, the trader could have exited with a profit of $270, or a 17% return on risk.

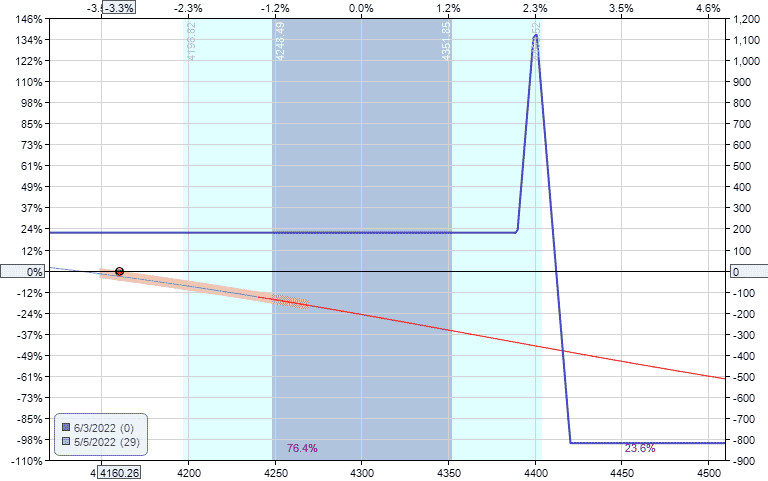

Broken Wing Butterfly

The broken wing butterfly can similarly be used as a premium collection vehicle with a directional assumption.

This broken-wing butterfly collects $180 of credit and has a max risk of $820.

Date: May 5, 2022

Price: SPX @ $4160.26

Buy one June 3 SPX 4390 call

Sell two June 3 SPX 4400 call

Buy one June 3 SPX 4420 call

Credit: $180

Delta: -1.09

Theta: 5.61

Vega: -12.26

On May 9th, the trader could have exited with a profit of $120, or 15% return on risk.

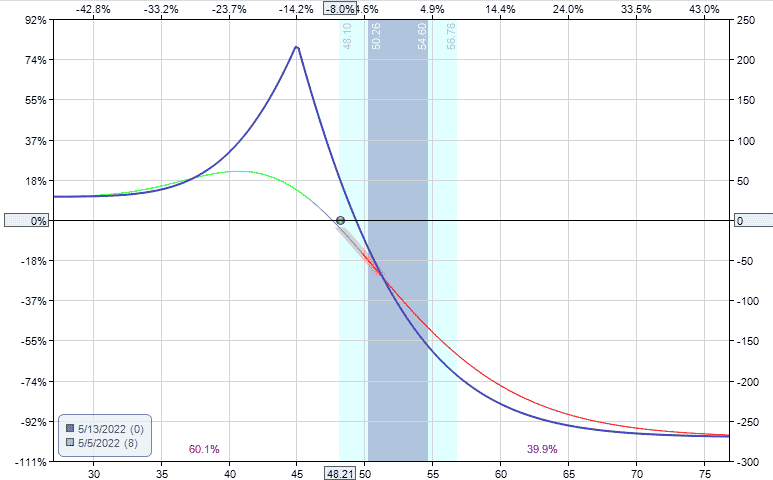

Diagonals

When prices go down, put options are bought to profit from the downward price movement.

Traders confident that the direction will make a quick and strong move down may simply buy the put options.

But the move needs to happen soon; otherwise, time will erode the value of the put option.

To help finance the long put and slow down time decay, traders will sell a shorter term option to collect some premium.

This becomes a diagonal.

For example, here is a bearish diagonal on the ARKK ETF:

Date: May 5, 2022

Price: $48.21

Sell one May 13 ARKK $45 put

Buy one June 3 ARKK $48 put

Debit: –$271

On May 9th, the trader could have exited with a profit of $85 or a 31% return on the capital at risk.

Cash As A Position

Some traders may want to stay out of the market while it is making its crazy moves.

That’s perfectly fine.

Knowing when to trade and when not to trade is part of a profitable strategy.

Bearish Butterflies

Then others don’t want to stay completely out. But want to take smaller positions and limit their risks.

Depending on their account size, they may say they want to risk at most $500.

Then directional butterflies can be a good choice.

These symmetrical butterflies are low-cost trades where the debit you pay is the most you can lose.

The reward to risk ratio is good and can be around 4 to 1.

Nike (NKE) is in a downtrend, as noted by the downward sloping 20-day and 50-day moving averages.

The trader decides to make a bearish play on April 22 after seeing prices gapped down on the open after Nike formed a double top pattern.

The trader places the centre strikes of the butterfly at $120 as the price target.

Date: April 22, 2022

Price: NKE @ $131.80

Buy three May 06 NKE $110 put

Sell six May 06 NKE $120 put

Buy three May 06 NKE $130 put

Total debit: $477

It costs $159 for each butterfly.

The trader was able to buy three butterflies for less than $500.

For this example, let’s set good-to-cancel orders to take profit at 30% and 50% with orders to sell the butterflies for a credit of $207 on one and a credit of $239 on another.

The very next day, both those orders had triggered.

In hindsight, it might have been better to have set the profit targets at 50% and 100%.

The butterfly’s value had gone up as the price of NKE started to move towards the short strikes.

On April 27th, the butterfly’s value is at $396, which is when the trader decides to sell the last remaining butterfly.

In net, the profit from the trade was:

First butterfly: $207 – $159 = $48 Second butterfly: $239 – $159 = $80 Third butterfly: $396 – $159 = $237

Total profit: $365 77% return on capital invested

Buying these butterflies is like buying umbrellas at a low price when the sun is out.

Then sell them at a higher price when it starts to rain.

Bearish Calendars

The same concept can be applied using bearish calendars.

Here the trader buys three calendars.

Date: April 22, 2022

Price: NKE @ $131.80

Sell three May 06 NKE $120 put

Buy three May 20 NKE $120 put

Total debit: $204 $68 for each calendar.

They are even less expensive than butterflies.

Again, we set take-profit orders to sell one calendar for a credit of $89 and another for a credit of $102.

Both calendars were sold the following day.

And the third calendar was sold on April 27th for a credit of $130.

First calendar: $89- $68= $21 Second calendar: $102 – $68= $34 Third calendar: $130 – $68= $62

Total profit: $117 57% return on capital invested

Delta Neutral Strategies

In a bear market, prices can make big moves in either direction.

In May 2022, we saw the ATR of the SPX go up to 100 and stayed there.

It is common for the S&P500 to make 2% daily moves.

While this can give delta-neutral income traders higher premiums to sell, the large moves can make it difficult to keep the position delta neutral.

Traders who feel comfortable can still sell iron condors and put on delta-neutral butterflies.

There are certain spots in the chart where there is enough two-way price movement where these may work.

But it is easier to see in hindsight than in live trading.

The symmetrical at-the-money butterfly may seem like a delta-neutral non-directional structure.

However, when applied to an underlying like SPX with put-call skew, it behaves a little bit bearish.

Let’s see how well it can handle a large down move.

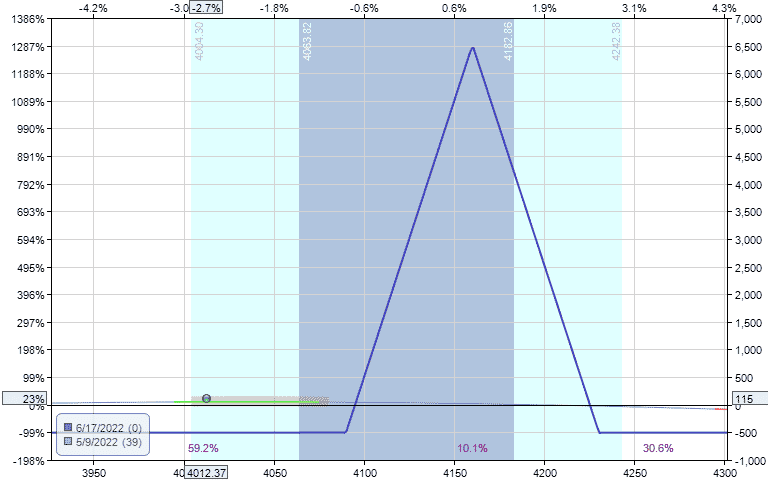

Date: May 5, 2022

Price: SPX @ 4160.26

Buy one Jun 17 SPX 4090 put

Sell two Jun 17 SPX 4160 put

Buy one Jun 17 SPX 4230 put

Debit: –$505

It starts with a position delta of -0.52.

If the market makes a big move down, the butterfly does not get hurt and may even profit.

We also selected a further out expiration with 43 days away.

Further out options are less affected by price movements of the underlying.

The next day, the position is down $25, but price is still inside the profit tent.

The following trading day was a Monday with a large price move down.

The price of SPX at 4012 is now outside the butterfly tent, so we would exit the trade.

Even though VIX went up (which is not good for this short vega trade) and price went outside the graph, the trade is made $115.

Backspread

The backspread is a strategy that can capitalize on large price moves.

In a bear market, there can be days when there is a strong rally.

If the trader had on a call backspread when that occurred, they would have profited from the big move up.

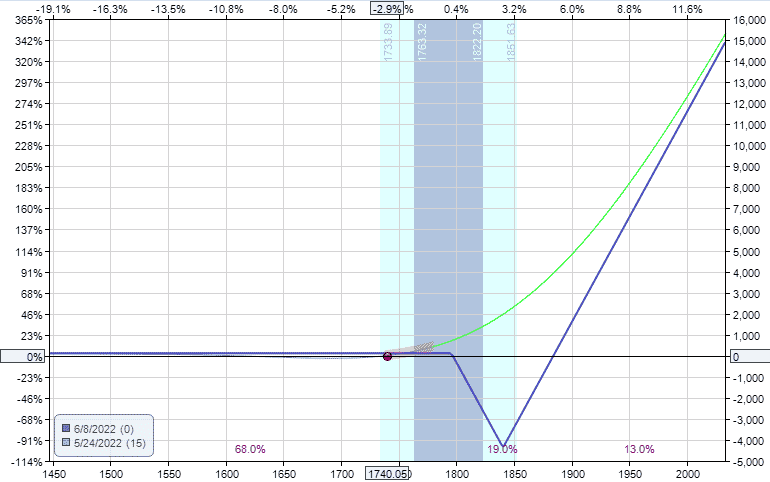

Date: May 24, 2022

Price: RUT @ 1740

Sell one June 8 RUT 1795 call

Buy two June 8 RUT 1840 call

Credit: $120

The key to this strategy is adjusting the strikes to get a credit.

That way, if the price goes down (as it would likely do in a bear market), you lose nothing.

It is true that to keep the entire $120 credit, you need to hold to expiration.

But that is not recommended.

This trade is meant for you to take your profit and get out as soon as you can.

The trade has a large negative theta.

Every day that you stay in the trade, you lose money if the price does not move.

If RUT ends up at the price of $1840 at expiration, you lose $4000.

With expiration 15 days away, most traders of this strategy would at most stay in a few days.

If there is a short squeeze rally and price shoots up during that time, just take the profit and exit the trade.

In this cherry-picked example, the trade made a profit of $270 the next day, and we would exit the trade.

That is a 6% return on the capital at risk.

FAQ

Can you make money trading options in a bear market?

Absolutely!

Many option strategies will make money in a bear market; specifically long puts, bear put spreads, bear call spreads, and bearish diagonals.

What types of options could be used to limit losses in a bear market?

Buying protective puts is the most common way to limit losses in a bear market.

Some traders will sell a further out of the money put, turning it into a bear put spread and reducing the cost.

What is the most profitable option strategy?

We believe iron condors are the most profitable option strategy when traded correctly.

These form the basis of most of our trades.

What are bearish options strategies?

Bearish option strategies have negative delta such as long puts, bear put spreads, bear call spreads, and bearish diagonals.

These strategies make money when stock prices decline.

Long puts, bear put spreads, and bearish diagonals also benefit from rising volatility.

Rising volatility tends to occur during bear markets.

Should you sell puts in a bear market?

Selling puts in a bear market is highly risky.

Stocks can suffer rapid and severe declines, which can see put sellers lose significant amounts of money in a short period.

It is better to wait until stocks stabilize before selling puts during a bear market.

Use the 50 and 200-day moving averages as a guide.

Conclusion

Investing in a bear market is more difficult because “buy and hold” when everything is going down is psychologically difficult.

Even for those who want to swing trade the downside, the price movements can exhibit large reversals and not be able to hold the trend for a long time.

This causes traders to go to shorter time horizons to scalp whatever profits that the market can give them.

Hopefully, some of the ideas mentioned here can help.

We hope you enjoyed this article on option strategies for bear markets.

If you have any questions please send us an email or leave a comment below.

Trade safe!

Disclaimer: The information above is for educational purposes only and should not be treated as investment advice. The strategy presented would not be suitable for investors who are not familiar with exchange traded options. Any readers interested in this strategy should do their own research and seek advice from a licensed financial adviser.

Original source: https://optionstradingiq.com/option-strategies-for-bear-markets/