Today, we share with you a portfolio beta calculator. We will explain a little about portfolio beta and give you some examples.

Contents

-

-

-

-

-

-

- How to Calculate Portfolio Beta?

- Does Beta Guarantee The Performance Against An Index?

- Can Stocks Have a Negative Beta or a Beta of 0?

- What Is An Ideal Portfolio Beta?

- Concluding Remarks

-

-

-

-

-

It is often said that diversification is a centerpiece of an investment portfolio.

This is because a portfolio’s risk comes from two factors: unsystematic and systematic risk.

What diversification does is reduces this unsystematic risk.

In fact, a portfolio with as little as 20 well-picked securities will have eliminated over 90% of unsystematic risk.

As shown below.

Source: BBA Lectures

What we are left with is systematic risk.

If this were not the case, we could keep adding stocks till we had a portfolio with no volatility!

Systematic risk equates to market risk.

One of the major ways to measure market risk is through Beta.

Beta is a measure of a stock’s sensitivity to changes in the overall market.

Generally speaking, a Beta of 1 is assigned to the stock market or index (usually the S&P 500).

If a stock moves more than the market, it will have a beta of >1, while if it moves less, it will have a beta <1.

A portfolio with a beta of greater than one will normally do better in a bull market and will outperform the index.

Though in market turmoil and drawdowns, this portfolio will most likely do even worse than the index.

Conversely, a portfolio with a beta of <1 may underperform in a bull market but should do better in a severe market correction.

So how do we calculate Beta?

Let’s find out!

How to Calculate Portfolio Beta?

To calculate the Beta of a security, we need two things:

The variance of market returns and the covariance between the return of the security and the return of the market.

Beta = Covariance

Variance

For those who are not math inclined (myself included), the good news is that we can find individual stocks Beta easily online on almost any financial site.

Yet, with complex portfolios and different weights, calculating your portfolio beta may require some simple math.

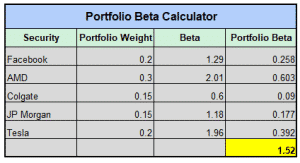

To do so, let’s assume a random portfolio of 5 stocks.

We will choose Facebook, AMD, Colgate, JP Morgan, and Tesla for this example and assign random weights in a hypothetical portfolio.

We simply calculated the weight of a security in our portfolio then multiplied it by the Beta.

We can then see how much Beta that security adds to our portfolio.

Lastly, we summed up all the values in our right column to get our portfolio beta of 1.52.

If you would like to check your portfolio’s Beta, please use the simple Excel tool we made for this example and input your own stocks.

So what exactly does the Beta of 1.52 mean?

In our above example, we can estimate that for every percentage gain or loss of the index, our portfolio will move by 1.52%.

If we think of it intuitively, this makes sense as we have a few high beta stocks such as AMD and Tesla and only one very defensive stock in Colgate.

Does Beta Guarantee The Performance Against An Index?

It is important to note that Beta does not guarantee future returns of a portfolio against that of an index.

As it is based on past data, it is simply an estimation.

In the example of our portfolio above, it is not impossible that the index returns 1%, and our portfolio is down 15% due to underperformance of the individual names in the basket.

Therefore it is good to consider portfolio beta as a good predictor of market risk but not use it exclusively.

Access the Top 7 Tools for Option Traders

Can Stocks Have a Negative Beta or a Beta of 0?

It is possible that stocks may have zero or negative Beta.

Negative values of Beta would imply that the stocks move independently or are negatively correlated to the market.

That being said, a beta of less than zero is rare and often misleading.

Some stocks may have a negative beta due to the prior macroenvironment and types of index drawdowns.

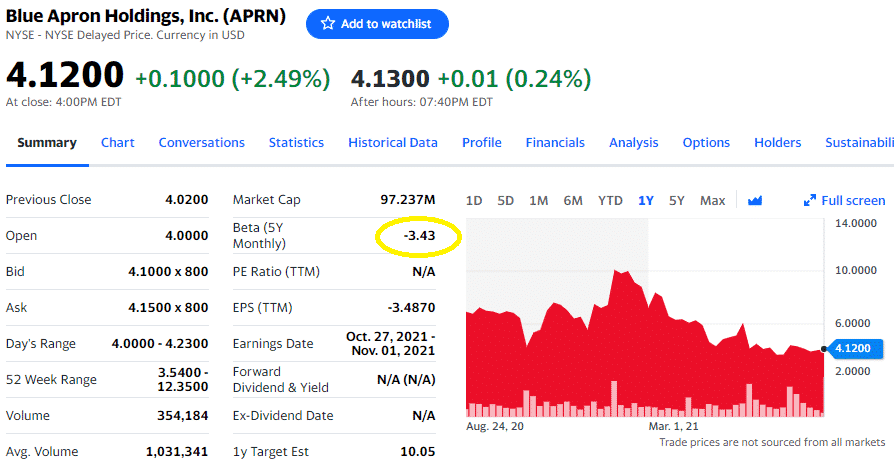

Let’s take the example of Blue Apron.

Source: Yahoo Finance

With a Beta of -3.43, Blue Apron sounds like the perfect addition to diversify any portfolio.

While there is no math error, we have to dig deeper to see why we could have a number so low.

Looking back to our most recent Coronavirus Crash of 2020, Blue Apron was one of the few stocks to benefit from the stay-at-home shift immediately.

Hence while the market was falling, it was outperforming.

Yet every crisis is specific.

If our next crisis is not a global virus pandemic, Blue Apron will perform poorly along with the market.

I think it’s fair to say that while Blue Apron moves relatively independently from the market, assigning it a negative beta going forward would judge its market risk incorrectly.

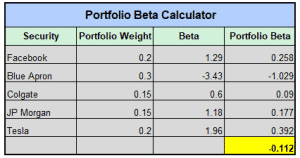

To illustrate how poorly a bad number can affect a portfolio’s Beta, we replaced AMD with Blue Apron.

According to our calculator, we now have a negative portfolio beta!

As a tip, when calculating portfolio Beta, if you have a beta that is way outside a normal range of 0-4, evaluate whether that beta number makes sense.

For most large cap stocks, the Beta will be reasonably accurate, though, for small caps, it can occasionally be significantly off.

What Is An Ideal Portfolio Beta?

A common question is what is a portfolio beta I should strive for.

There is no right answer.

For more conservative investors, choosing equities with lower betas is often an intelligent decision.

Low Beta stocks lead to a low portfolio beta and keep the focus on capital preservation.

Furthermore, low Beta securities are also commonly dividend payers, providing income.

Contrastingly, for investors looking for growth, a high beta portfolio may make sense.

Despite this, it is important to note that a high beta does not necessarily equate to long term outperformance.

For investors wanting to lower their portfolio’s Beta even further, keeping more cash on the sidelines will help.

Adding cash to our calculation is simple.

Find the percentage of cash you have in your portfolio, input it to the calculator and put a Beta of zero.

Also, simply because an investor is conservative, it does not mean they cannot invest in risky stocks, and vice versa for an aggressive investor.

For example, an investor with 10% Tesla stock and 90% cash would have a much lower portfolio beta than an investor fully invested in blue chip stocks.

Concluding Remarks

Calculating a portfolio’s Beta is remarkably simple once you have the Beta for the individual securities you hold.

Knowing your portfolio’s Beta provides a useful estimation of market risk.

Nevertheless, it is only an estimation, and forward results could differ substantially from what a portfolio’s Beta implies.

Trade safe!

Disclaimer: The information above is for educational purposes only and should not be treated as investment advice. The strategy presented would not be suitable for investors who are not familiar with exchange traded options. Any readers interested in this strategy should do their own research and seek advice from a licensed financial adviser.

Original source: https://optionstradingiq.com/portfolio-beta-calculator/