QQQY is the Nasdaq 100 Enhanced Options & 0DTE Income ETF symbol.

Contents

-

-

-

-

- Performance Of QQQY

- High Distribution Rate And Frequency

- One-For-Three Reverse Stock Split

- Hypothetical Investor

- Ex-Dividend Date

- Conclusion

-

-

-

Defiance started this fund in September 2023.

The CEO of Defiance Funds is Sylvia Jablonski.

On the fund’s main page, it claims to be the “first put-write ETF using daily options.”

“Put-write” means selling put options and attempting to collect option premiums for income.

“Daily options” implies that these options are zero-DTE options expiring on the same day they are sold.

They may also utilize other options that have several days to expiry – known as “near-term options.”

This is in an attempt to capture the rapid time-value decay of the options that are expected to expire worthless by the end of the day.

The fund manager actively manages these options, and they may be sold or bought at their discretion.

If you look at the fund holdings, you might not see many of these put sales.

That is because they’ve already expired or actively closed at the end of the market session.

The holdings page may not be updated in real time.

If you look at the fund’s “schedule of investments,” you can see the premium collected from the options sales.

A portion of the fund holds U.S. Treasury Bills and cash.

The main objective of this fund is to generate income via these option sales.

The second objective is to gain exposure to the Nasdaq 100 Index.

Exposure to the Nasdaq 100 Index does not mean that the fund invests directly in the index, nor does it invest directly in any of the companies that comprise the index.

Therefore, shareholders are not entitled to any dividends from such companies.

Exposure to the Nasdaq 100 index means that the fund’s performance tends to mirror the performance of the Nasdaq.

This is because the performance of short puts on the index tends to correlate to the performance of the underlying itself (for the most part).

However, by selling puts, there is a cap on the potential gain.

Performance Of QQQY

Speaking of performance, how did the QQQY fund do in 2024?

The Nasdaq-100 (NDX) had an upward-sloping curve of a gain of 26% in 2024.

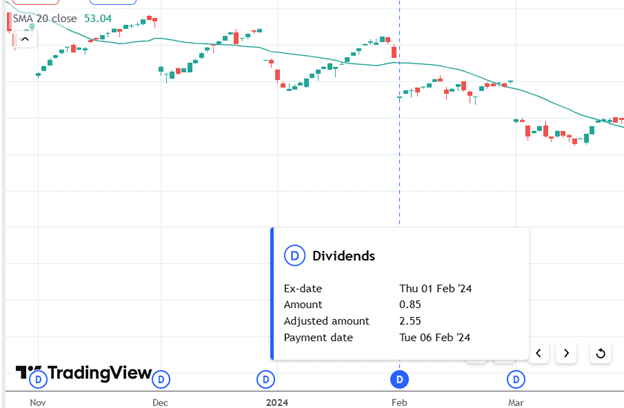

Before you completely dismiss the QQQY after seeing its chart for the same time period:

You have to look at all those tiny “D” symbols across that bottom of the TradingView chart.

High Distribution Rate And Frequency

The fund is giving a fairly high dividend distribution rate to its shareholders.

In late 2024, it increased its distribution frequency to weekly.

That means the shareholders get income every week.

These distributions cause an erosion on the fund’s NAV, causing it to drop from $52.64 (split-adjusted price) to $30.86 during the year 2024.

Also, some of the NAV erosion comes from the expense of running the fund.

NAV is the Net Asset Value, which represents the fund’s per-share value and is commonly used to measure mutual funds, ETFs, and other investment funds.

One-For-Three Reverse Stock Split

Those numbers are not entirely accurate either. Because on August 1, 2024, a tiny “S” symbol in the chart represents a 1-for-3 reverse stock split.

If you had three shares of QQQY before that day, then you would find yourself with only one share after that day.

Of course, your one share will be worth three times as much as the original share.

So, these splits have no impact on the shareholders’ equity.

TradingView is showing the post-split adjusted price.

While TradingView was showing $52.64 on January 2, 2024, the shareholders were seeing $17.54 on that day.

Hypothetical Investor

Pause here to guess what you think is the annual return of a zero-DTE.

Then, we will run the numbers to find out.

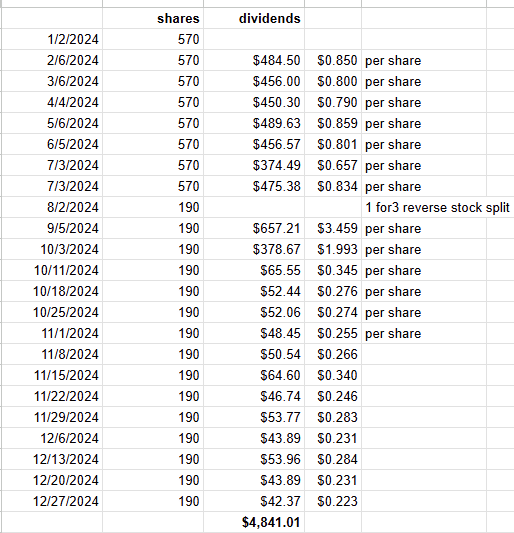

Suppose an investor wanted to invest $10,000 in QQQY on January 2, 2024; he would have bought 570 shares that day.

On February 6, 2024, the investor would have received a dividend of $0.85 per share.

Taking into account each of the dividends received, the net dividends received by the end of the year would be $4841.

On August 1, 2024, the investor would have only 190 shares due to the one-for-three reverse stock split.

At the end of the year, with 190 shares and an NAV of $30.86, the investor would still have $5863.40 in the fund.

$5864.40 + $4841.01 = $10,704.41

The initial $10,000 investment had become $10,704.41 at the end of the year, an annual yield of 7%.

Was this close to your guess?

Ex-Dividend Date

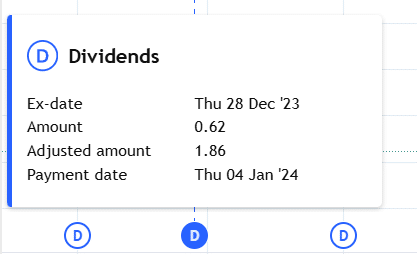

Why didn’t we calculate the $0.62 per share dividend shareholders received on January 4, 2024?

The investor will not receive this dividend because the investor has not yet bought into the fund on the ex-dividend date of December 28, 2023.

Similarly, we didn’t calculate the dividend the investor would receive on January 3, 2025, because we are only looking at the investor’s performance in 2024.

But if you were to argue that this dividend should be included, even if the investor exited the fund on December 31, 2024 (the ex-dividend date), the dividend “check is in the mail.”

Okay, then add an extra $45.41 to the return for that dividend check.

Conclusion

Today, we learned that we cannot simply look at a line on a graph to determine the performance of a complex fund.

By turning on the display of dividends and stock splits, we can figure out what would have happened to an investor’s money if they had invested it in QQQY in 2024.

We hope you enjoyed this article on the QQQY etf performance.

If you have any questions, please send an email or leave a comment below.

Trade safe!

Disclaimer: The information above is for educational purposes only and should not be treated as investment advice. The strategy presented would not be suitable for investors who are not familiar with exchange traded options. Any readers interested in this strategy should do their own research and seek advice from a licensed financial adviser.

Original source: https://optionstradingiq.com/qqqy-etf-performance-review/