Today, we are talking about rolling cash secured puts.

We will look at five different choices we can make and go through each example.

Contents

- Introduction

- Example

- Choice 1: Do Nothing

- Choice 2: Roll The Short Put Out In Time

- Choice 3: Roll The Short Put Down

- Choice 4: Roll The Short Put Down And Out In Time

- Choice 5: End the trade

- FAQs

- Conclusion

Introduction

Selling cash-secured puts, also known as writing covered puts, is a common strategy used by many investors.

Today, we are going to talk about when and why we might want to perform a rolling adjustment to cash-secured puts.

First, let’s understand the rationale for using cash-secured puts.

Investors will typically sell a cash-secured put on stocks that they believe will go up in price and that they do not mind buying.

If they initiate a cash-secured put with this mindset, they will be in a win-win situation.

Example

For example, suppose an investor is bullish on Alphabet (GOOGL) and, on August 10, 2020, sells a cash-secured put option with a strike price of $112.

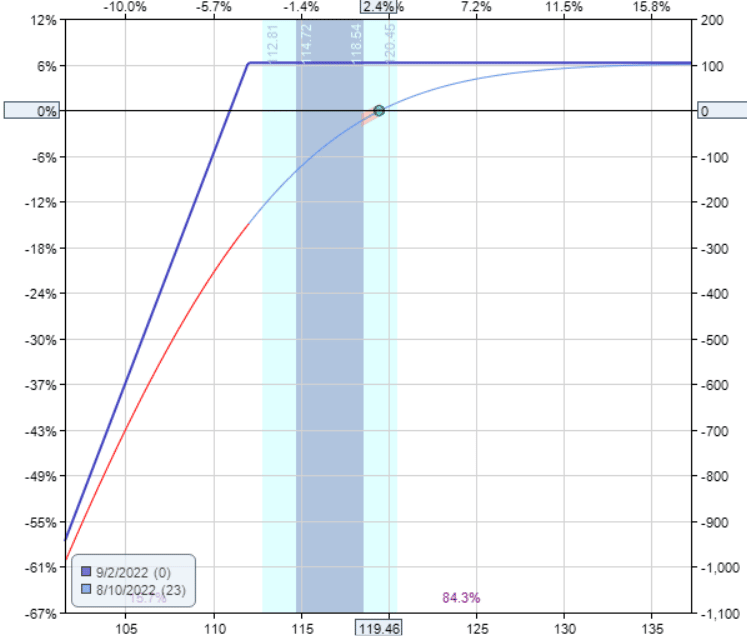

Date: August 10, 2022

Price: GOOGL @ $119.46

Sell one Sep 2 GOOGL $112 put @ $1.04

Total Credit: $104

If the price of Alphabet goes up, then the investor keeps the Credit received, or a portion of it if the trade is taken off early.

If the price of Alphabet goes down such that the price is below $112 on September 2nd expiration, then the investor is obligated to buy 100 shares of Alphabet at the price of $112 per share.

This price would be lower than the August 10 price of GOOGL (which is $119), so the investor doesn’t mind, especially if this is for a longer-term accumulation of the stock or if it is for the wheel strategy.

Let’s see how this trade progresses.

On August 22, GOOGL was down to $114.19 and getting close to the short strike of 112.

There are several choices available to the investor.

Choice 1: Do Nothing

Do nothing and wait until expiration to see if the price ends above $112.

If it does, the investor keeps the initial Credit received. If not, the investor will buy 100 shares of GOOGL at $112 per share.

Choice 2: Roll The Short Put Out In Time

Buy to close one Sep 2 GOOGL $112 put @ $1.68

Sell to open one Sep 9 GOOGL $112 put @ $2.17

Credit: $49

The investor was able to delay the expiration date by one week.

And the investor was paid a credit of $49 to do so.

This choice will almost always be for a credit because a longer-dated put option will be at a higher price than a shorter-dated option of the same strike.

Choice 3: Roll The Short Put Down

Buy to close one Sep 2 GOOGL $112 put @ $1.68

Sell to open one Sep 2 GOOGL $110 put @ $1.12

Debit: –$56

This will almost always be for a debit because an out-of-the-money put option further away from the underlying’s price will be at a lower price than a put option closer to the money.

Choice 4: Roll The Short Put Down And Out In Time

Buy to close one Sep 2 GOOGL $112 put @ $1.68

Sell to open one Sep 9 GOOGL $110 put @ $1.56

Debit: –$12

This can either be for a debit or a credit, depending on the strikes chosen and how far out in time it is rolled to.

If it is for a debit, the debit will typically be less than the debit of choice #3.

If it is for a credit, the Credit will typically be less than the Credit of choice #2.

Choice 5: End The Trade

Remember, at any point in time, you can buy just back the short put and end the trade.

You do not have to roll.

This may be the best choice if you are no longer bullish on the stock, or you no longer want to own the stock.

FAQs

Which rolling choice is best?

That depends on what the price of the underlying does next.

There are scenarios where choice 1 is the best, and there are scenarios where choice 2, 3, or 4 is the best.

With that said, some investors are more inclined to take a credit for the roll rather than take a debit.

That would mean choice 1 or choice 4.

Why not if the investor is given money to perform the roll to delay assignment?

The investor may be inclined to take the offer once or twice, especially if the price of the underlying is still above the strike price.

Can I roll for a credit forever?

In some situations, yes.

But not in all situations.

Just like in some situations, you can roll a covered call forever; there are some situations where you can roll the short put forever.

Since you are rolling the short put to another put of the same strike but with further dated expiration, it would be for a credit.

Note that just because you are rolling for a credit does not mean that you will be profitable.

In which situation can I roll for a credit forever?

Consider the situation where GOOGL’s underlying price fluctuates around $112 forever.

Then it is possible to continue to roll the short $112 put out in time to another short put at $112 forever.

When would it not be wise to roll for a credit?

Consider the situation where GOOGL continues to drop in price, to say $50.

Then the short put of $112 will be so far in-the-money that rolling it to a later expiration would give you very little or no credit at all.

At some point, it would not make sense to maintain the $112 short put because that means that eventually, you will need to buy 100 shares of GOOGL at $112 per share when it is worth only $50 per share.

You will be at a big loss.

When a stock is declining, there comes to a point when it is better just to take ownership of the stock and apply techniques to stop the loss.

When you own the stock, you will be able to stop the loss by,

- placing a stop loss order

- buying a protective put to turn it into a married put position

- buy put and sell covered call to turn it into a collar

This will turn your unlimited loss short-put position into a defined-risk position.

Alternatively, you can turn the short put position into a covered call position or into a wheel strategy.

Conclusion

We believe selling cash-secured puts to be a good strategy to initiate on stocks that investors might want to accumulate or to start the wheel strategy.

Wise and timely rolling of the short put can further enhance the strategy’s profit potential.

Knowing exactly when and where to roll that short put is a bit of art that comes with practice.

This choice partly depends on how much the investor likes owning the stock and at what price.

But don’t fall into the trap of rolling and rolling the short put and end up with a big loss.

In some situations, taking stock ownership may be the best choice.

We hope you enjoyed this article on rolling cash secured puts.

If you have any questions, please send an email or leave a comment below.

Trade safe!

Disclaimer: The information above is for educational purposes only and should not be treated as investment advice. The strategy presented would not be suitable for investors who are not familiar with exchange traded options. Any readers interested in this strategy should do their own research and seek advice from a licensed financial adviser.

Original source: https://optionstradingiq.com/rolling-cash-secured-puts/