Contents

-

-

-

-

-

- Rolling Down A Covered Call

- Rolling Up A Covered Call

- Rolling A Short Put

- Rolling A Put Spread

- Rolling An Iron Condor

- Rolling A Married Put

- Conclusion

-

-

-

-

Today we are going to talk about rolling options.

Typically, we roll as a defensive adjustment to give us more time in the trade to be right.

But we can roll as an offensive adjustment, to bring in credits to reduce our cost basis or to lock in profits.

Let’s look at some examples.

Rolling Down A Covered Call

Suppose we have started a covered call on January 7, 2021, with 100 shares of Lululemon (LULU) plus a short put:

Date: Jan 7, 2021

Price: LULU @ $367.29

Buy 100 shares of LULU

Sell one Feb 19 LULU $420 call @ $5.10

Since this is a bullish strategy, we want the price of LULU to go up.

But unfortunately, it did the opposite.

As the price of LULU drops (a bad thing for us), the value of the $420 call also decreases (a good thing for us).

Until on January 15, the value of the call got down to $97 for one contract.

We had sold it for $510.

The delta on the call went far out-of-the-money from its original 18 delta down to the 5 delta.

We’ll buy to close the call whenever we can get it for 20% of what we sold it for.

Date: January 15

Price: LULU @ $344.50

Buy to close one Feb 19 LULU $420 call @ $0.97

We just made $413 from the short call.

This amount is more than 80% of the maximum profit available on this short call.

However, this will never be enough to offset our loss on the stock, which is –$2279.

The total P&L (profit and loss) on the entire position is –$1865.50.

We need to sell another call to try to recoup some of the losses.

Since there are still 35 days till the February 19th expiration, we sell another call for the same expiration.

Otherwise, we could sell the call for the following month’s expiration.

Date: February 15

Sell one Feb 19 LULU $380 call @ $4.25

We sold closer to the money to collect a premium of $425.

If we performed the two operations (buying back the call and selling another one) in the same transaction order, we are “rolling the call option.”

In this case, we are rolling down the $420 call to the $380 strike at the same expiration.

As we go forward, keep in mind that rolling always means closing one trade and entering a new trade.

Let’s see how the LULU trade turned out.

The price of LULU keeps dropping, which is not good.

On February 5, when the call has only 14 days till expiration, we roll it down in strike and roll it out in expiration.

Date: Feb 5

Buy to close one Feb 19 LULU $380 call @ $0.60

Sell to open one Mar 19 LULU $370 call @ $5.43

Credit: $483

We received a credit of $483 for the roll.

We say that we “rolled for a credit” because there can be times where the roll results in a debit.

Again, this credit does not compensate for the loss in the stock.

Our overall P&L is –$2542.

Did this trade ever become profitable?

If continuing to backtest in this fashion using OptionNet Explorer, we find that the trade does not become profitable until June 11, when the price of LULU comes back up to $338.30 after going through two earnings reports.

It became profitable on June 11 only because of the sales of the calls.

Because the share price of LULU is still below what we had bought them for it.

Rolling Up A Covered Call

Suppose that we got so fed up with LULU tying up our capital for half a year that we move that money into a covered call on Costco (COST).

Date: June 11, 2021

Price: COST @ $381.83

Buy 100 shares of COST

Sell one Jul 16 COST $405 call @ $1.19

Capital invested: $38064

This time the stock went up.

On July 8, the overall P&L was positive $2131, even though we were losing money on the short call.

When the price goes above the short call (as it did on this day), we can choose to roll up and out in time the call — preferably for a credit if possible.

Date: July 8

Price: COST @ $407.15

Buy to close one Jul 16 COST $405 call @ $5.20

Sell to open one Aug 20 COST $415 call @ $5.98

Credit: $77.50

This will give the stock room to move even higher.

Rolling A Short Put

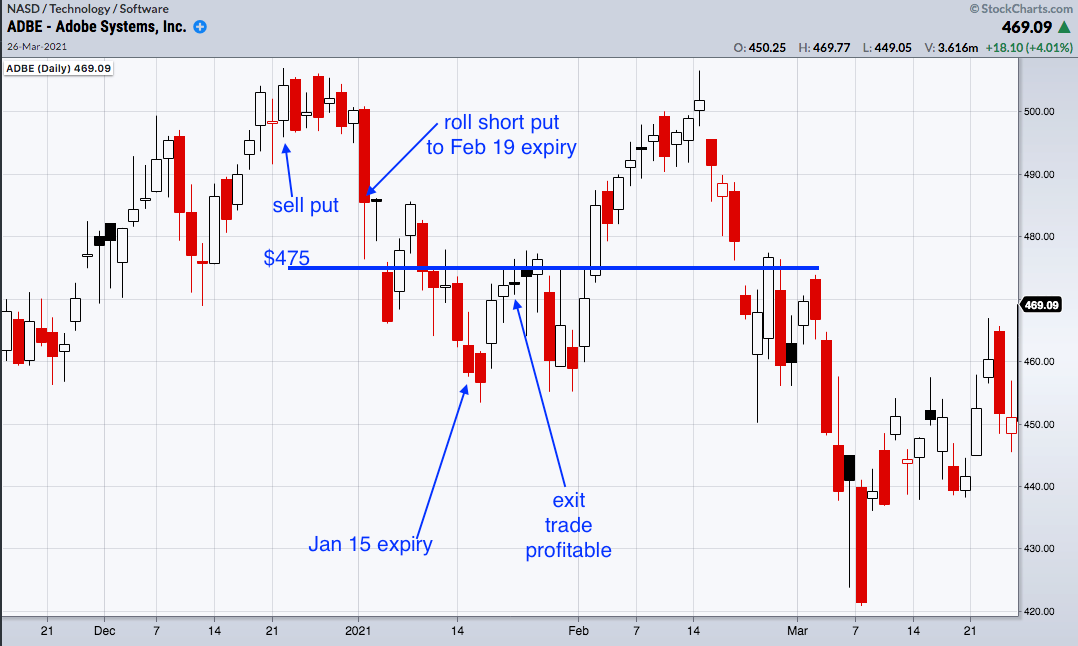

In the next hypothetical example, suppose we sell a short put on Adobe (ADBE), such as in a cash-secured put for a wheel strategy or something similar.

Date: Dec 22, 2020

Price: ADBE at $504.17

Sell one Jan 15, 2021 ADBE $475 put

Credit: $572.50

On January 4, 2021, ADBE had dropped to $485.34, which is within 3% of the short strike with only 11 more days till expiration.

ADBE may stay above $475 in those 11 days, and we would be fine.

Or it might drop below the strike.

It is quite a gamble, and we don’t like gambling.

Therefore, we roll out the short strike in time.

Date: Jan 4, 2021

Buy to close one Jan 15 ADBE $475 put @ $6.93

Sell to open one Feb 19 ADBE $475 put @ $17.33

Credit: $1040

We are essentially exchanging our short put for another short put (with the same strike) that has 30 more days till expiration.

Why not?

Especially when we get paid $1040 to perform the exchange.

This gives us more time in the trade, and we don’t have to lose sleep wondering if ADBE is going to stay above $475 within the next 11 days.

On January 6, ADBE made a down move.

And it made another downward push on January 19.

This trade is not behaving well.

When selling a put, we want the stock to go up.

Our current P&L is still negative.

So, on January 22, when the P&L of the overall trade came back to positive, we exited the trade.

Date: Jan 22, 2021

Buy to close one Feb 19 ADBE $475 put @ $15.75

Debit: $1575

The overall tally is $37.50 of profit — basically breakeven…

$572.50 + $1040 – $1575 = $37.50

When looking back at the chart, it is pretty remarkable that we could come out profitably even when the stock price dropped below the strike price.

If we had not performed the roll, the original short put would have expired in the money on January 15, and we would have been assigned 100 shares of ADBE at a loss.

Rolling out in time at the same strike can nearly always be done for a credit for single-leg options.

However, this may not be the case when rolling spreads, as we shall see in the next example.

Rolling A Put Spread

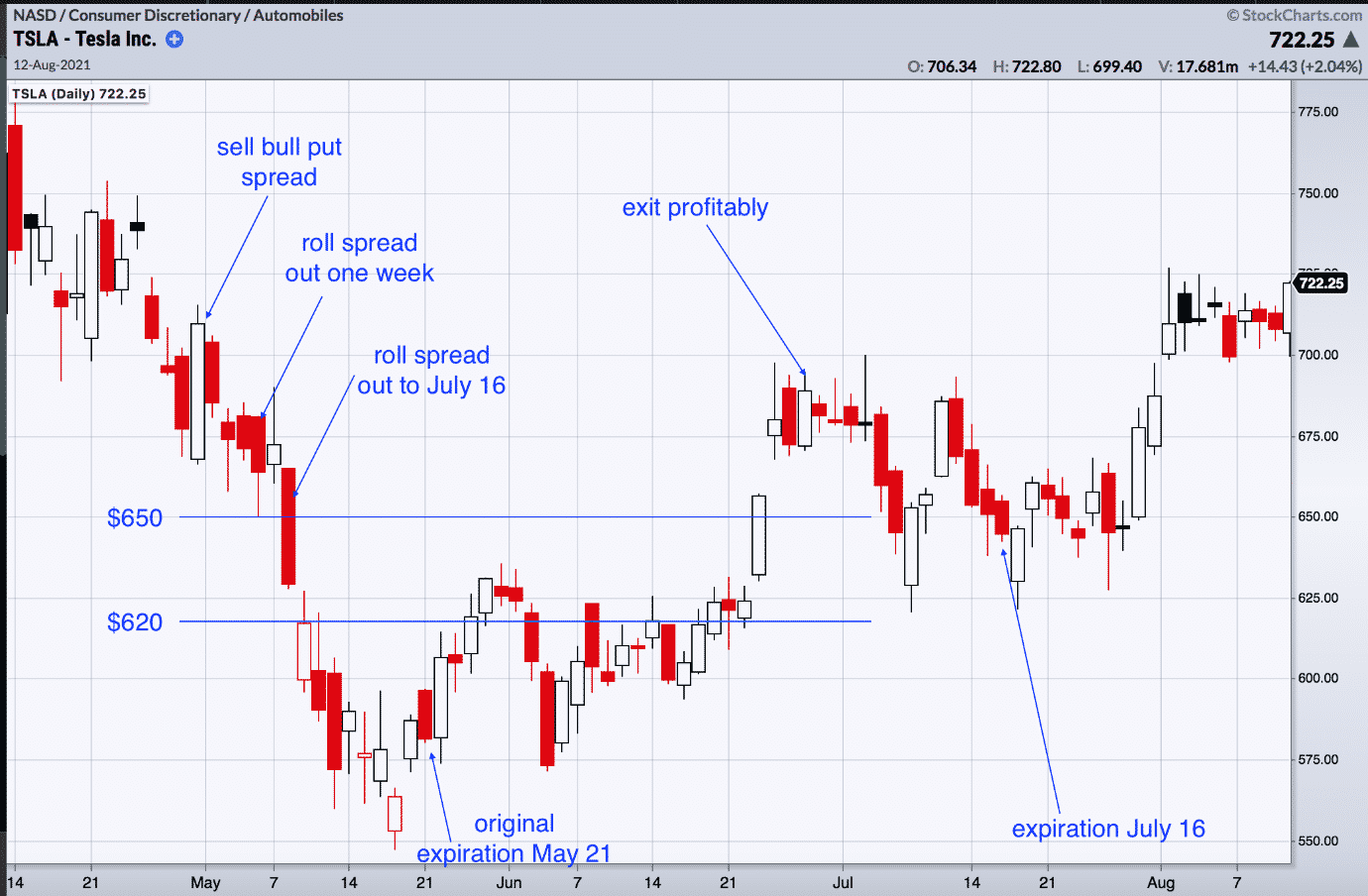

Suppose we sell a bull put spread on Tesla (TSLA) after seeing a bullish engulfing candle pattern:

Date: Apr 30, 2021

Price: TSLA @ $709.44

Buy one May 21 TSLA $620 put @ $8.18

Sell one May 21 TSLA $650 put @ $13.50

Credit: $532.50

Max risk: $2467.50

The trade didn’t go well from the start.

On May 6, the price was down to within 3% of the short strike.

We roll the spread one week out in time.

Date: May 6

Sell to close one May 21 TSLA $620 put @ $14.95

Buy to close one May 21 TSLA $650 put @ $24.58

Buy to open one May 28 TSLA $620 put @ $20.53

Sell to open one May 28 TSLA $650 put @ $31.05

Credit: $90

By performing this roll, we decreased the delta slightly from 13.26 to 11.44, which is good when the price is not going in our favor.

The tradeoff is that our theta also decreased (from 6.40 to 4.08).

The most significant effect is that we reduced our maximum risk on the trade from $2467.50 to $2377.50 due to the additional $90 credit for the roll.

We prefer to roll for a credit whenever possible.

Because, in this scenario, rolling for a debit would increase the trade’s risk.

We are not saying that you should never roll a debit.

Occasionally, it is necessary.

Later in the last example, we’ll demonstrate why rolling for a debit is actually beneficial.

On May 10, TSLA made a big move down, breaching the short strike.

Price is now in between the short and long strikes the spread.

When we try to roll the spread out another one or two weeks, we find that we are not able to roll the spread out in time for a credit.

The further that price breaches into the spread, the more difficult it is to roll for a credit.

The tighter the spread (meaning the strikes of the long and short puts are close together), the more difficult it is to roll for a credit.

The further out in time that we roll the spread, the more likely it is to collect a credit.

In this case, we had to roll all the way out to July 16 expiry (with 67 days to expiration) to collect a $15 credit.

This is about the limit of how far we’ll roll out.

But let’s make this one last roll before we give up on this trade.

Date: May 10

Buy to close one May 28 TSLA $650 put @ $44.48

Sell to close one May 28 TSLA $620 put @ $29.23

Sell to open one July 16 TSLA $650 put @ $73.93

Buy to open one July 16 TSLA $620 put @ $58.53

Credit: $15

It turns out that the roll served us well. We had to wait for a long time.

But eventually, the cyclicality of stock prices took TSLA price back up enough for us to exit with a profit of $57.50 on June 28 — basically, breakeven.

After making one or two defensive rolls, we know that the trade is not going as expected.

So we no longer look for the original profit target.

We will be happy to get out without a loss.

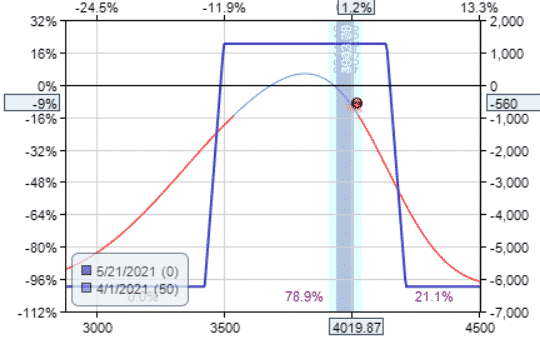

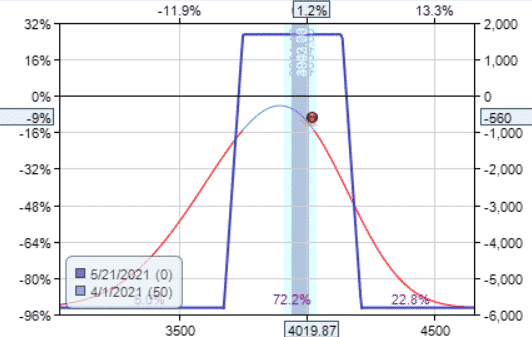

Rolling An Iron Condor

An iron condor is just two credit spreads together.

Here is an iron condor on the SPX index…

Date: Mar 25, 2021

Price: SPX at $3909.52

Buy one May 21 SPX $3425 put @ $21.05

Sell one May 21 SPX $3500 put @ $26.15

Sell one May 21 SPX $4135 call @ $14.35

Buy one May 21 SPX $4210 call @ $6.80

Credit: $1265

Max Risk: $6235

Take profit: $632

Stop loss: $2530

Breakevens: $3487 and $4148

SPX is going up.

On April 1, the short call hit 25 delta, which means we need to make an adjustment.

The overall trade has a delta of -12.16.

The short put spread has lost value with short put at the 7.6 delta.

This is a good thing because it means we can buy to close this spread for less.

Because the put spread is in profits, a standard adjustment is to roll the unchallenged spread up for a credit.

Date: Apr 1

Price: SPX at $4019.87

Sell to close one May 21 SPX $3425 put @ $9.80

Buy to close one May 21 SPX $3500 put @ $12.30

Buy to open one May 21 SPX $3675 put @ $22.20

Sell to open one May 21 SPX $3750 put @ $28.90

Credit: $420

Due to the extra credit collected, the max risk has been reduced by that exact amount.

Our new max risk is now $5815.

Another good thing is that the new delta of -9.45 is a reduction of 22% of the delta.

However, the adjustment narrows the iron condor and therefore reduces the probability of profit.

Before adjustment:

After adjustment:

Note the reduction in max risk after the adjustment.

Note the closer breakeven points in the narrower condor.

Rolling A Married Put

So far, we have only looked at rolling short options or spreads.

Now we will look at rolling a long option.

Supposed we have 100 shares of Home Depot (HD) plus a put option:

Date: March 12, 2021

Buy 100 shares of HD @ $273.10

Buy one Aug 20, 2021 HD $270 put @ $17.68

Capital Invested: $29077.50

Max loss at expiration: $310 + $1768 = $2078 (or 7% of capital invested)

On March 24, HD had gone up to $292.75, and overall P&L was $1042.50.

We want to lock in some of those gains by rolling up the long put.

Note that this roll results in an overall debit.

Date: Mar 24

Price: HD @ $292.75

Sell to close one Aug 20 HD $270 put @ $8.45

Buy to open one Aug 20 HD $285 put @ $15.13

Debit: –$667.50

As the price of the stock goes up, the put’s protective power decreases.

We restore its protective power by rolling it up closer to the price.

Because our new protective put increased the protection on the stock from $270 to $285, we are in effect paying $667.50 to lock in a $1500 gain.

Whether that is worth it or not is up to the individual investor and the stock’s price action.

Some investors might wait until it is possible to pay 25% or less of the locked-in gain.

Rolling the put up in a married put strategy decreases the max risk.

At expiration, the new max risk is now $1246, or 4% of the original capital invested.

Calculated by: $1246 = $2078 – $1500 + $667.5 $1246/$29077.50 = 4%

At this point, even if Home Depot stock drops to $1, we can not lose more than $1246.

Home Depot keeps going up.

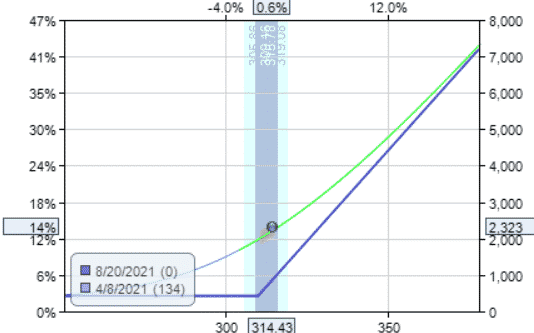

On April 8, we roll the put up again to lock in more profits:

Date: Apr 8

Price: HD @ $314.43

Sell to close one Aug 20 HD $285 put @ $6.25

Buy to open one Aug 20 HD $310 put @ $14.55

Debit: –$830

We paid $830 to lock in a $2500 gain.

At this point, the trade has become a risk-less trade.

In the worst-case scenario, even if HD drops to $1, we will come out with a profit of $424.

To see this, lets look at all our debits:

Buy 100 shares: –$27310

Buy $270 put: –$1768

Roll up $270 put to $285: –$667.50

Roll up $285 put to $310: –$830

Total Debits: –$30576

We have a protective put that enables us to sell HD at $310 anytime before August 20 regardless of HD stock price.

Therefore $31000 – $30576 = $424 is the profit we will get in the worst-case scenario.

If HD continues up, our profits will increase.

The payoff diagram at this point looks like this:

Note that the graph never goes below the zero P&L horizontal line.

Another example of rolling to lock in profits is converting a broken wing butterfly to a standard butterfly, which you can read more about here.

Conclusion

We’ve seen numerous examples of rolling options, sometimes for a credit and sometimes for a debit.

It can be done as a defensive action or as a profit-taking move.

Yes, we are closing one trade (sometimes for a loss) and opening another trade on the same underlying.

But that is not necessarily a bad thing.

Due to the cyclic nature of stock price movements, sometimes this is a good thing.

Trade safe!

Disclaimer: The information above is for educational purposes only and should not be treated as investment advice. The strategy presented would not be suitable for investors who are not familiar with exchange traded options. Any readers interested in this strategy should do their own research and seek advice from a licensed financial adviser.

The post Rolling Options – Complete Guide for 2022 : OTIQ first appeared on Options Trading IQ.

Original source: https://optionstradingiq.com/rolling-options/