Rolling an options position for credit involves closing an existing position and opening a new one to collect additional premium.

This technique is primarily applied to short premium strategies such as the short put, selling credit spreads, iron condors, and butterflies.

The closing of the old and the opening of the new position can sometimes be done in a single transaction or in two separate transactions.

The two transactions can even be separated by a small amount of time.

When the credit received for opening the new position is larger than the debit paid for closing the old position, we are rolling for a credit.

Although it is possible to roll for a debit, we would ideally like to roll for a credit whenever possible.

Rolling, like any other adjustment, does not change the current P&L of the position, except for accounting of slippage, commissions, and fees.

Contents

-

-

-

- Rolling a Short Put Option for a Credit

- Rolling a Bull Put Credit Spread for Additional Credit

- Iron Condor – Rolling for a Credit

- Rolling Out in Time

- Rolling Butterflies for a Credit

- Rolling Legs of Calendars for a Credit

- Conclusion:

-

-

Rolling A Short Put Option For A Credit

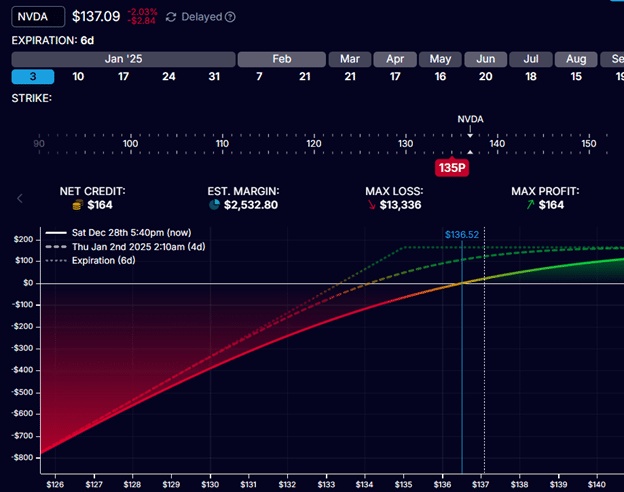

Suppose an investor has a short put on NVIDIA (NVDA) with less than a week till expiration.

Delta: 39

Theta: 18

Vega: -7

Gamma: -6

With the short put strike at $135 and NVDA trading at $137, the investor may decide to give the trade more time, hoping that the stock would move higher so that he can close the short put for a profit without needing to get assigned.

It would cost $164 to buy back this short put.

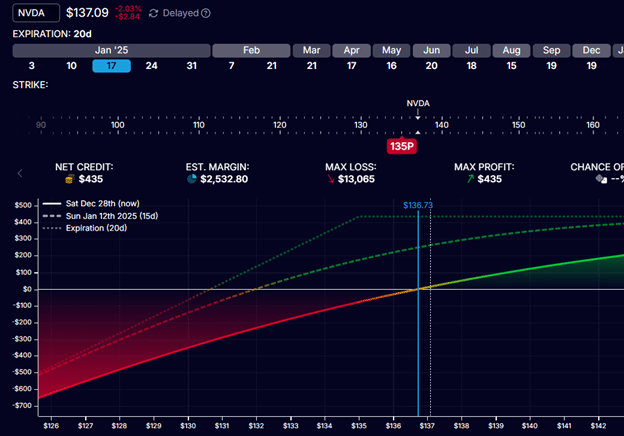

Selling the $135 strike put option that is two weeks further out in time would give the investor $435 credit.

Therefore, a net credit of $271 for performing the roll.

If you roll a short option further out in time with the same strike price, you will get a net credit because the further-out option takes more time and is, therefore, worth more.

The new position would look like this:

Delta: 43

Theta: 12

Vega: -13

Gamma: -3

The delta increased slightly, making the trade slightly more directional.

The theta decreased because there is less time decay with options further away from expiration.

The magnitude of the vega increased, meaning that short options further out in time are more sensitive to volatility changes.

The magnitude of gamma decreases as the position is farther away from expiration.

Rolling A Bull Put Credit Spread For Additional Credit

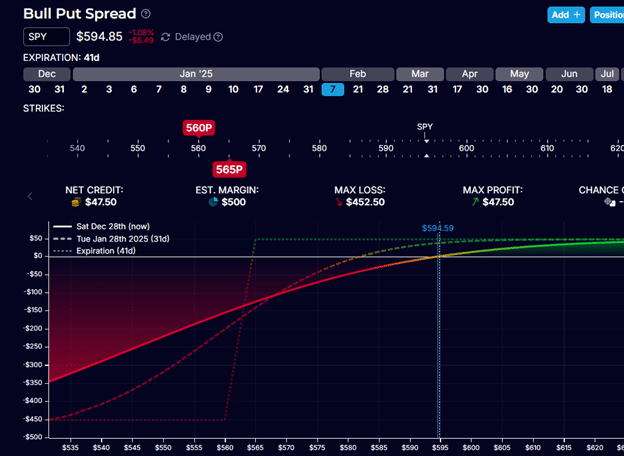

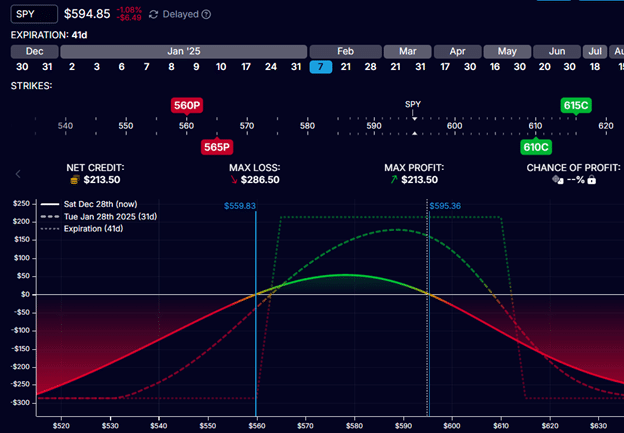

Now let’s look at out-of-the-money put credit spreads on SPY with 41 days till expiration.

Delta: 2.7

Theta: 0.66

Vega: -5.46

Gamma: -0.11

It would cost a debit of $47.50 to buy to close this spread.

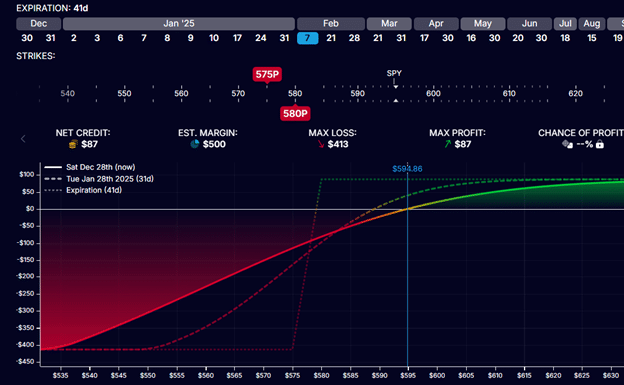

If the trader opens a new spread with the same width and expiration but closer to the current price of SPY, he would receive a credit of $87, giving him a net credit of $39.50 for the roll.

The new position would look like this:

Delta: 4.70

Theta: 0.40

Vega: -5.95

Gamma: -0.16

Moving the spread closer increased the delta and gamma.

The spread has more directional and gamma risks, which means that the delta changes more rapidly as the price of SPY moves.

This new spread has less time decay, as indicated by a smaller theta.

That doesn’t sound that good.

So, why would anyone roll a bull put spread closer to the money?

You can see a hint of the reason by looking at the max loss.

The max loss of the previous position is $452.50.

The max loss of the new position is $413.

The risk had decreased by $39.50 – by the exact amount of credit received from rolling.

The reason will become more evident if this spread is part of an iron condor.

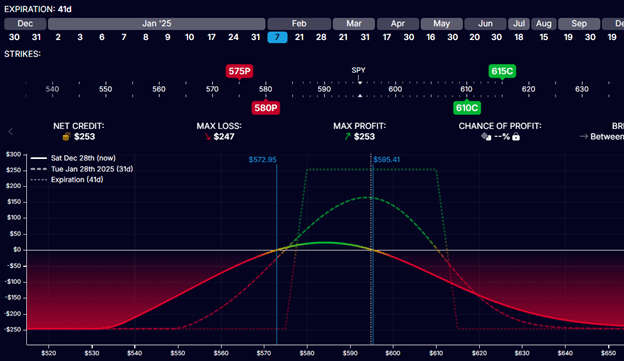

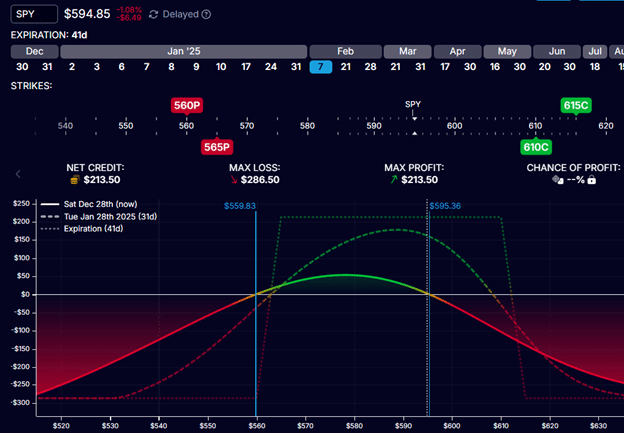

Iron Condor – Rolling For A Credit

Suppose we had the same original SPY put credit spread as the lower half of an iron condor.

We have a bear call credit spread for the upper half with the short call at $610 and the long call at $615.

Delta: -4.87

Theta: 2.73

Vega: -15.7

Gamma: -0.24

You can see that the max loss on this condor is $286.50, and the call side is being threatened.

If SPY moves up, the P&L will drop quite rapidly.

This is indicated by the downward-sloping T+0 line and the negative delta of -4.87

One adjustment technique is to roll the put credit spread up to obtain an additional credit.

As we saw, by rolling the 565/560 put spread to 580/575, we would get a credit of $39.50, resulting in the following new condor.

Delta: -2.85

Theta: 2.47

Vega: -16.2

Gamma: -0.29

We have decreased the magnitude of the delta.

I made the condor less directional, so we would lose less P&L if SPY goes up.

It is true that our theta dropped a little as a side effect.

What may be more important is that the max loss of the condor is now $247, down $39.50 from its previous max loss of $286.50.

Iron condor traders will complain that this condor is too narrow, decreasing the probability of profit.

By rolling the put spread closer, it is also more likely to get threatened by a whipsaw if SPY reverts down.

This is true and is one of the downsides of this adjustment that one needs to consider.

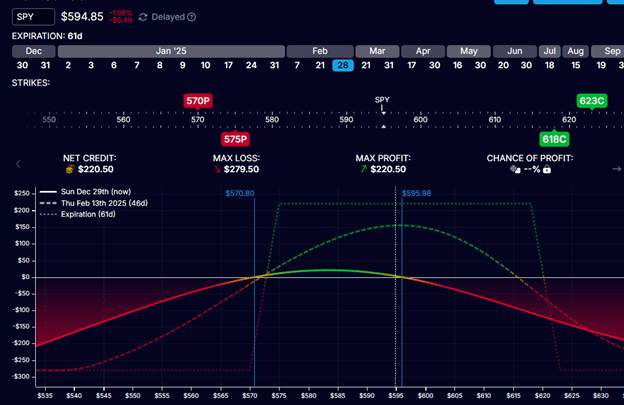

Rolling Out In Time

An alternative is to roll both the put and call spreads out in time and re-center the iron condor while still trying to get a credit for the adjustment.

Here is the original condor again:

Delta: -4.87

Theta: 2.73

Vega: -15.7

Gamma: -0.24

We roll two weeks out to the February 28th expiry with new strikes, as shown:

Paying $213.50 to close the existing condor and getting $220.50 for the new condor, we barely got a credit of $7 for the roll.

If unable to get a credit, a trader may need to roll even further out in time to be able to sell more premium.

The net effect is a more centered condor with a reduced delta at the cost of reduced theta.

Delta: -2.05

Theta: 1.66

Vega: -17.09

Gamma: -0.21

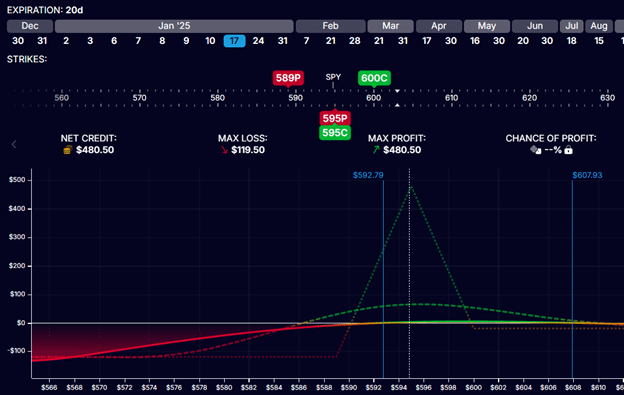

Rolling Butterflies For A Credit

Below is an iron butterfly, which is basically an iron condor with the put spread and call spread pressed very close to each other.

When you do that, the range of profit is narrow.

But the theoretical risk-to-reward is better.

Risking a max loss of $119.50 with a potential max profit of $480.50.

This butterfly has 20 days left till expiration – which some traders feel may be time to exit to avoid the higher gamma risk that occurs close to expiration.

And if the trade is profitable, they might.

But if the trade is not in profit, they may want to give the trade more time by rolling the entire butterfly to a later expiration.

The current Greeks are:

Delta: 2.42

Theta: 1.45

Vega: -5

Gamma: -0.26

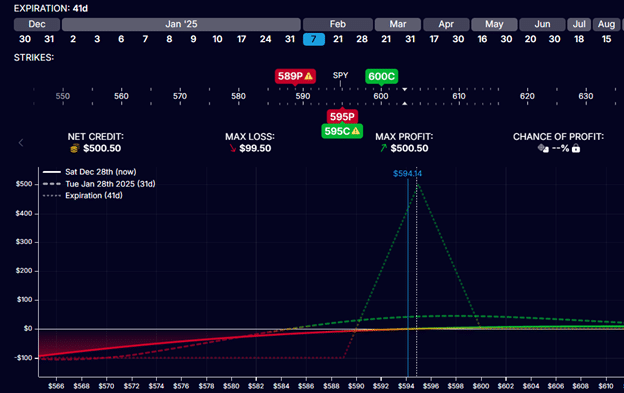

Let’s see how they change as we roll this fly to the February 7th expiration (three weeks further out).

It costs $480.50 debit to close the existing fly.

To initiate the new fly with the same strikes at the later expiration would give a credit of $500.50.

Therefore, we would receive a net credit of $20 to roll the fly out in time.

The resulting position would look like this:

Delta: 2.56

Theta: 0.484

Vega: -3

Gamma: -0.12

This roll’s main benefit is decreasing gamma and giving more time.

Gamma decreased by half.

The side effect is that our theta has also decreased.

Since we received a credit of $20 for the roll, the trade max loss decreased by $20 – from $119.50 down to $99.50.

While it is usually possible to roll iron condors and butterflies further out in time for a credit, it is not always the case.

However, short straddles and short strangles that are unencumbered by the friction of the protective leg can always be rolled out in time for a credit.

Rolling Legs Of Calendars For A Credit

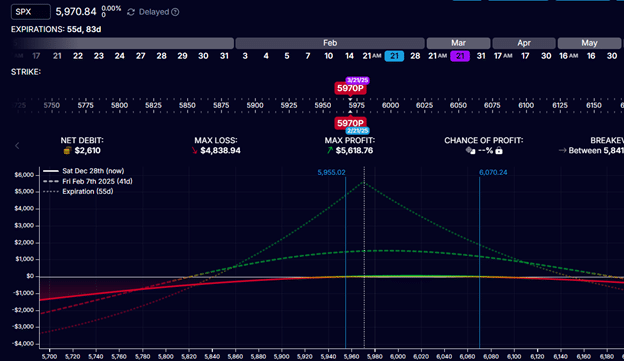

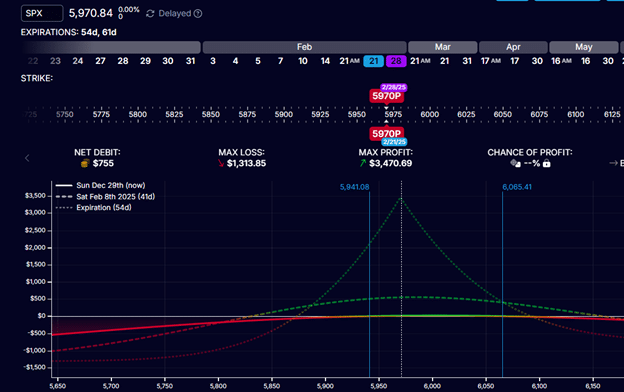

Using the SPX index, below is an at-the-money calendar with 55 days left on the short put option and 83 days left on the long put option.

Delta: 0.88

Theta: 14.21

Vega: 201

Gamma: -0.03

The max risk on this calendar is the initial debit paid for the calendar.

In this example, it is $2610.

If the trade has generated some profit, it is possible to take some partial profit out of the trade by performing a partial roll.

We will roll only the short leg to a later expiration.

But ensure its expiration date is still earlier than the long leg. We don’t touch the long option.

For example, we:

Buy to close February 21st SPX 5970 put

Sell to open February 28th SPX 5970 put

Net credit: $755

By doing so, we have just pulled out $755 from the trade and returned that money to our account.

The resulting position will be a smaller calendar with a lower max risk of $1855.

Delta: 0.66

Theta: 10.21

Vega: 146

Gamma: -0.02

The time difference between the expiration of the long and short options has dropped from 30 days to 21 days.

The tradeoff is that the smaller calendar will have less theta.

This type of “thinning of the calendar” can also be done if the trade is not profitable and the trader wants to reduce the risk in the trade.

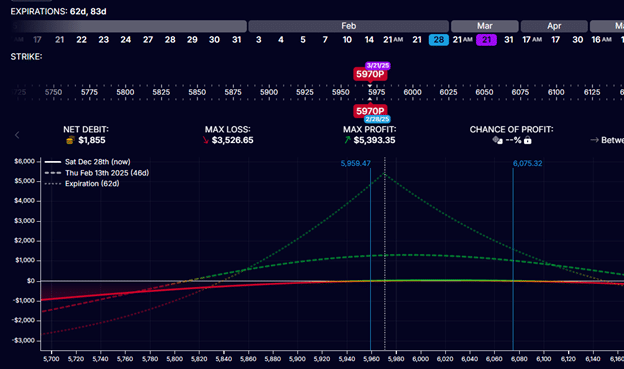

As an alternative, we can similarly thin the calendar by rolling the long option closer to expiration without touching the short option.

Selling the longer-dated option expiring on March 21st and buying the shorter-dated option expiring on February 28th would always result in a credit.

In this case, it gave us a net credit of $1855 with the following result:

This calendar now only has $755 of capital in it.

It is even smaller than the previous one because the time between the long and the short options has now dropped to 7 days.

Conclusion:

Rolling for a credit is generally good because it can reduce risk and/or give us more time to be right.

If we roll in the course of a trade to get credits back, we are reducing the capital in the trade. Sizing down the trade reduces risk.

The market is not going to give us a “good thing” without taking back something in return.

Usually, it takes back theta, leaving us with a weaker time decay.

Since getting credits means a reduction in theta, and getting credit means a risk reduction.

Then, it follows that theta is a proxy for risk.

The more theta you have, the more risk you have in the trade.

It may not always be obvious, but somewhere in the trade, there is risk.

The only reason the market is giving you theta is that you agree to take on some risk.

Is there such a thing as too much theta?

Yes, because there is such a thing as too much risk.

If you feel that the trade has too much risk, you need to decrease your theta.

To decrease your theta, you roll for credits.

If you feel that the trade has too much gamma and the P&L is swinging too much for you to monitor that frequently, you can roll the trade out in time (also for credits).

It is important not to over-generalize the concepts in this article.

They apply to many of the examples as shown under the conditions specified.

However, the diversity of option structures means that it does apply to all imaginable cases.

There are instances where you roll one option leg of an option structure for a credit, which does not decrease risk or theta.

In fact, it does the opposite by increasing risk and theta.

So, we have to know when it applies and when it does not.

We hope you enjoyed this article on rolling options positions for credit.

If you have any questions, please send an email or leave a comment below.

Trade safe!

Disclaimer: The information above is for educational purposes only and should not be treated as investment advice. The strategy presented would not be suitable for investors who are not familiar with exchange traded options. Any readers interested in this strategy should do their own research and seek advice from a licensed financial adviser.

Original source: https://optionstradingiq.com/rolling-options-for-a-credit/